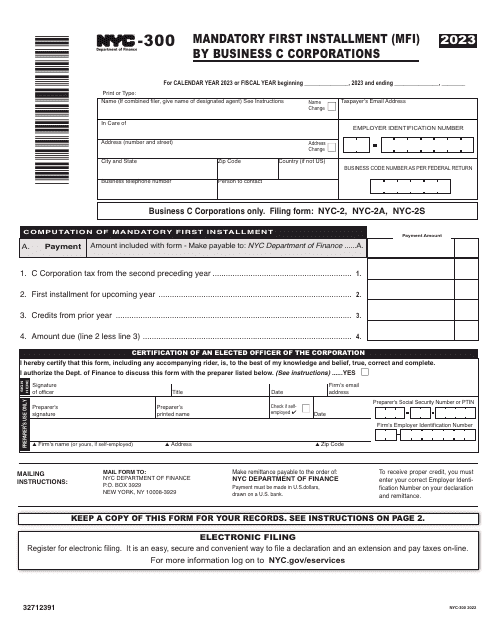

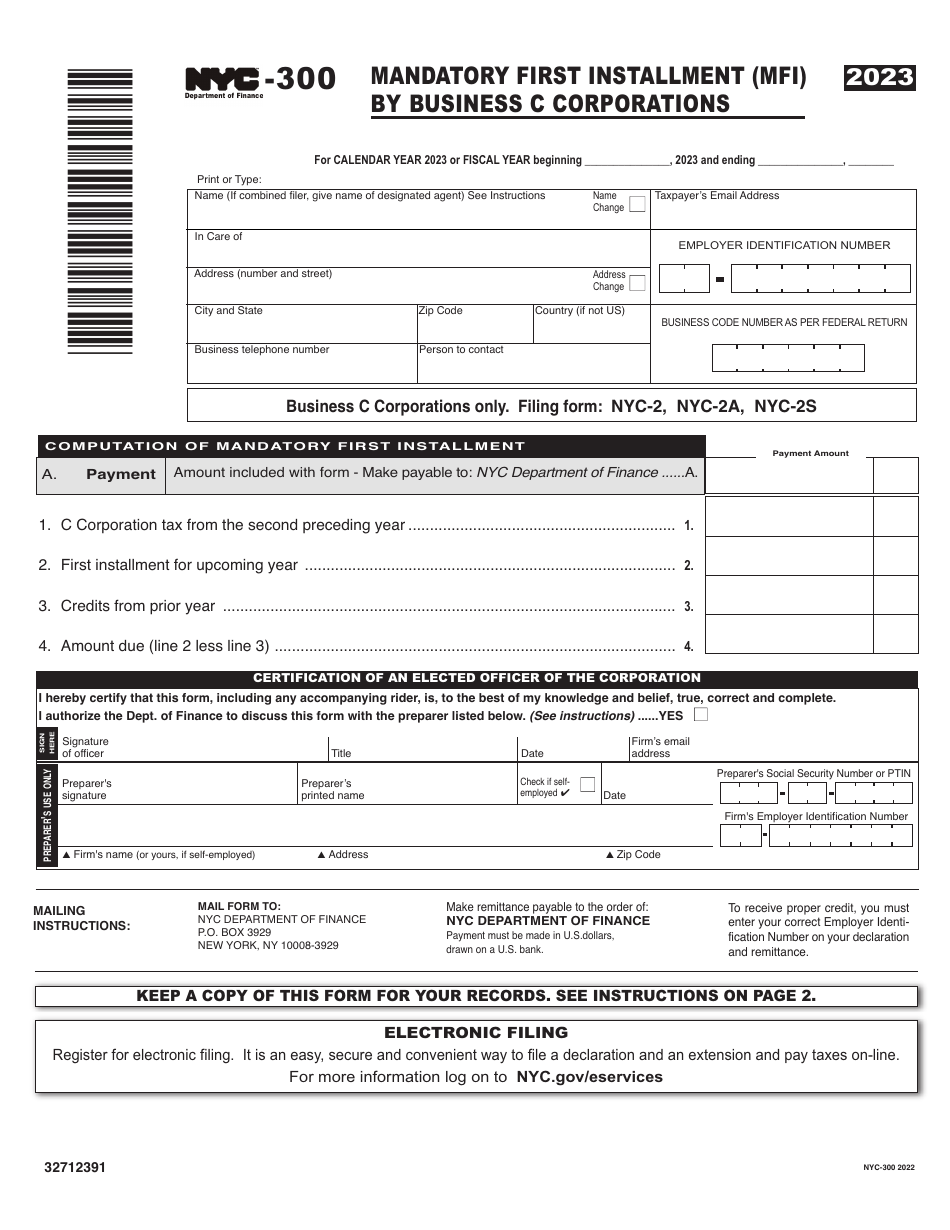

Form NYC-300 Mandatory First Installment (Mfi) by Business C Corporations - New York City

What Is Form NYC-300?

This is a legal form that was released by the New York City Department of Finance - a government authority operating within New York City. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the NYC-300 form?

A: The NYC-300 form is a mandatory first installment (Mfi) form for business C corporations in New York City.

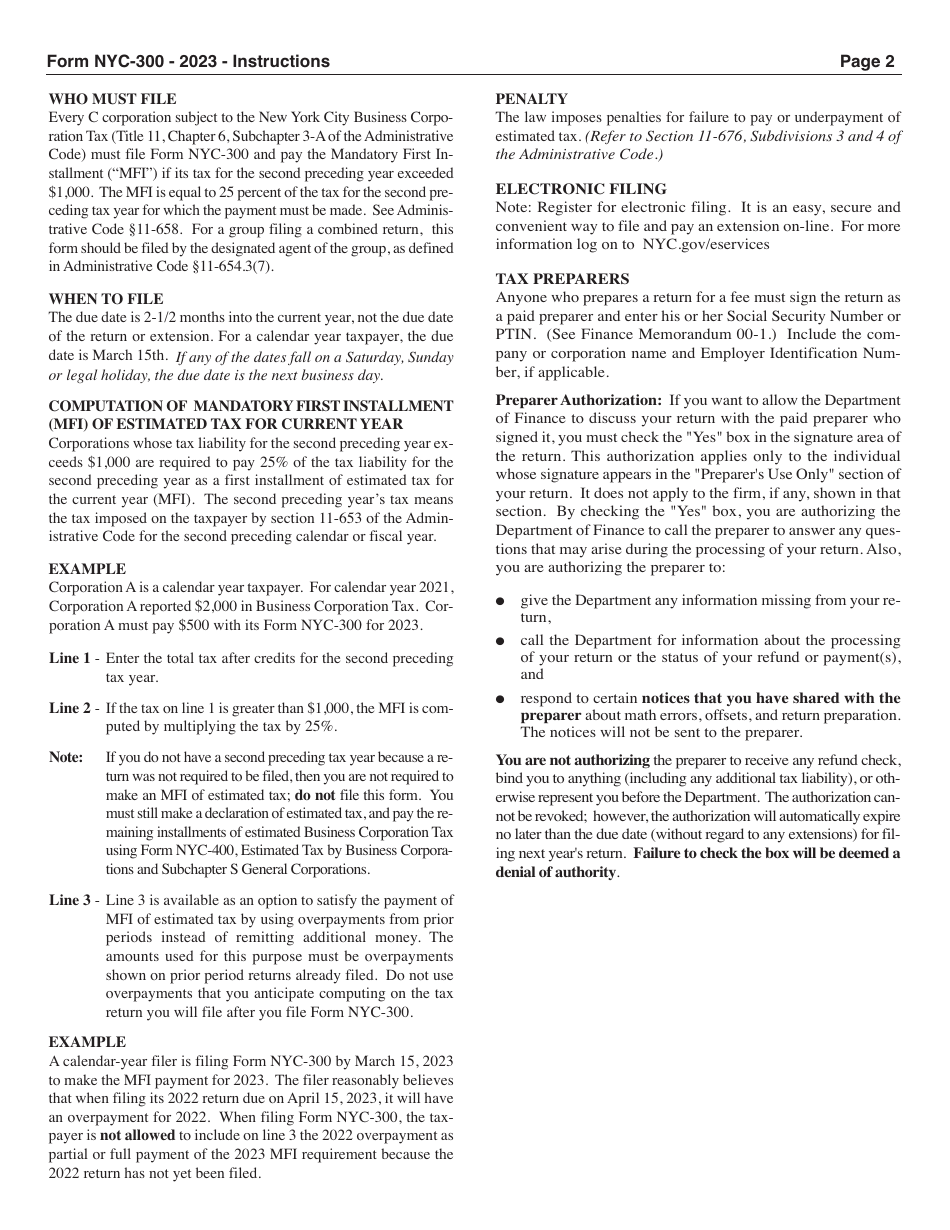

Q: Who needs to file the NYC-300 form?

A: Business C corporations in New York City need to file the NYC-300 form.

Q: What is the purpose of the NYC-300 form?

A: The purpose of the NYC-300 form is to report and pay the first installment of the Business Corporation Tax (BCT) liability.

Q: When is the deadline to file the NYC-300 form?

A: The deadline to file the NYC-300 form is determined by the taxpayer's accounting period. It is generally due on or before the 15th day of the third month following the close of the period.

Q: What happens if the NYC-300 form is not filed on time?

A: If the NYC-300 form is not filed on time, penalties and interest may be assessed.

Form Details:

- The latest edition provided by the New York City Department of Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form NYC-300 by clicking the link below or browse more documents and templates provided by the New York City Department of Finance.