This version of the form is not currently in use and is provided for reference only. Download this version of

the document

for the current year.

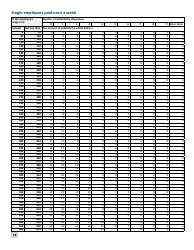

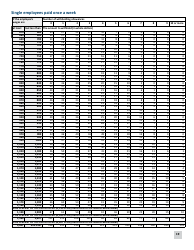

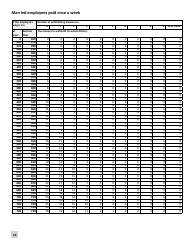

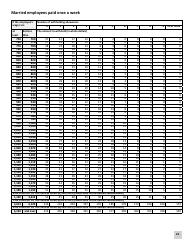

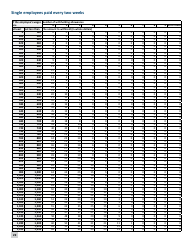

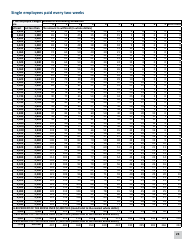

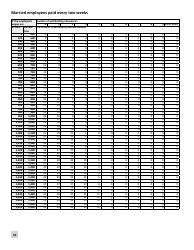

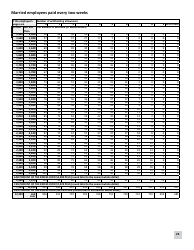

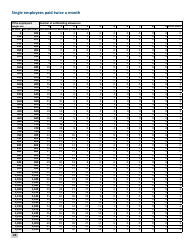

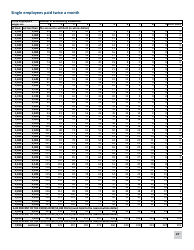

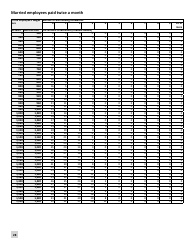

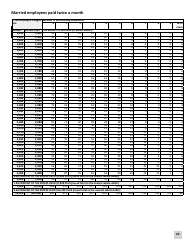

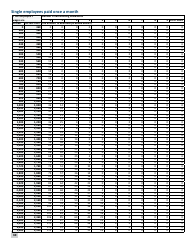

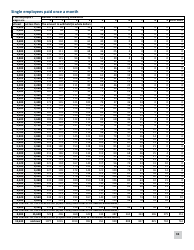

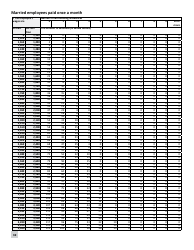

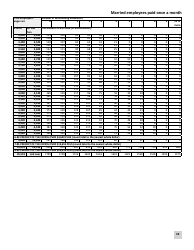

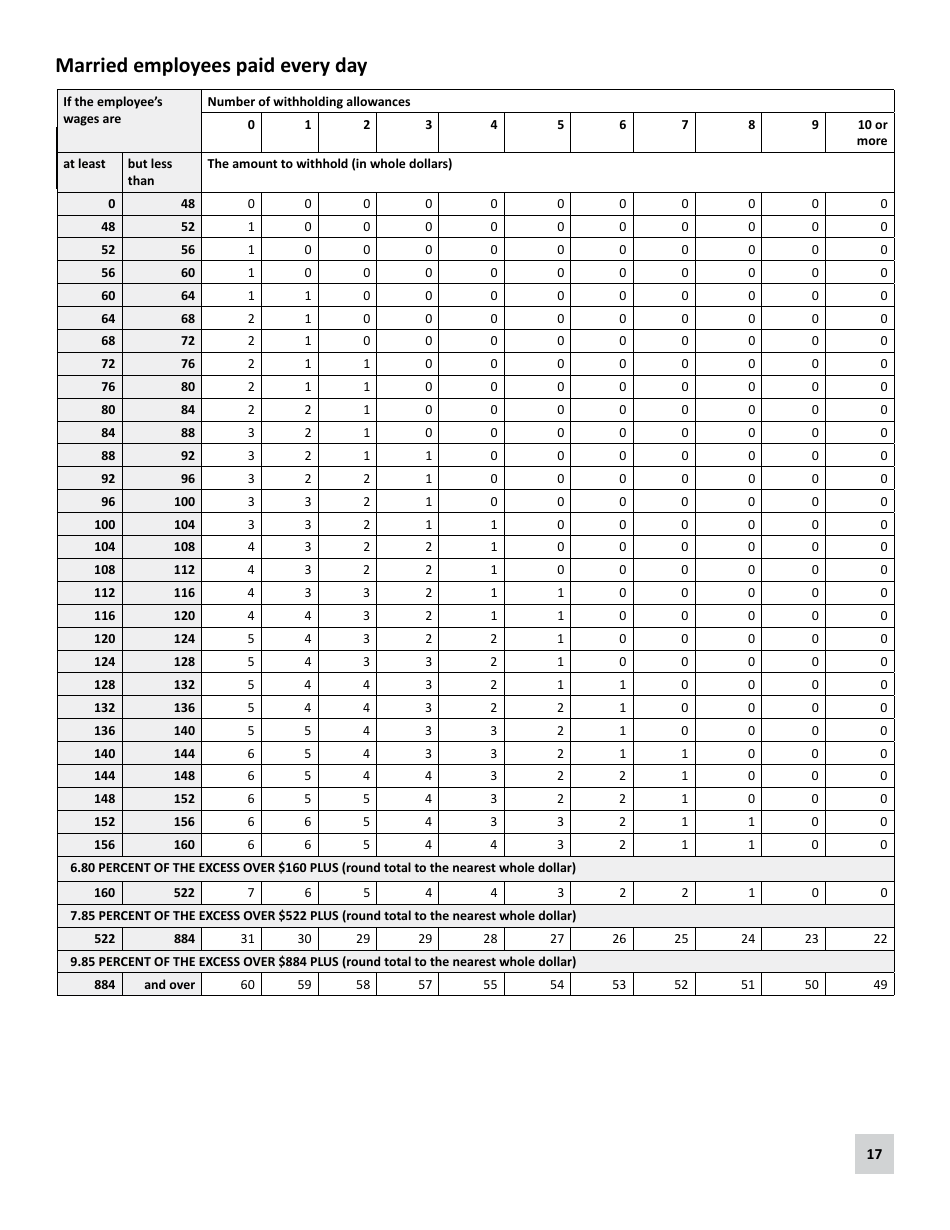

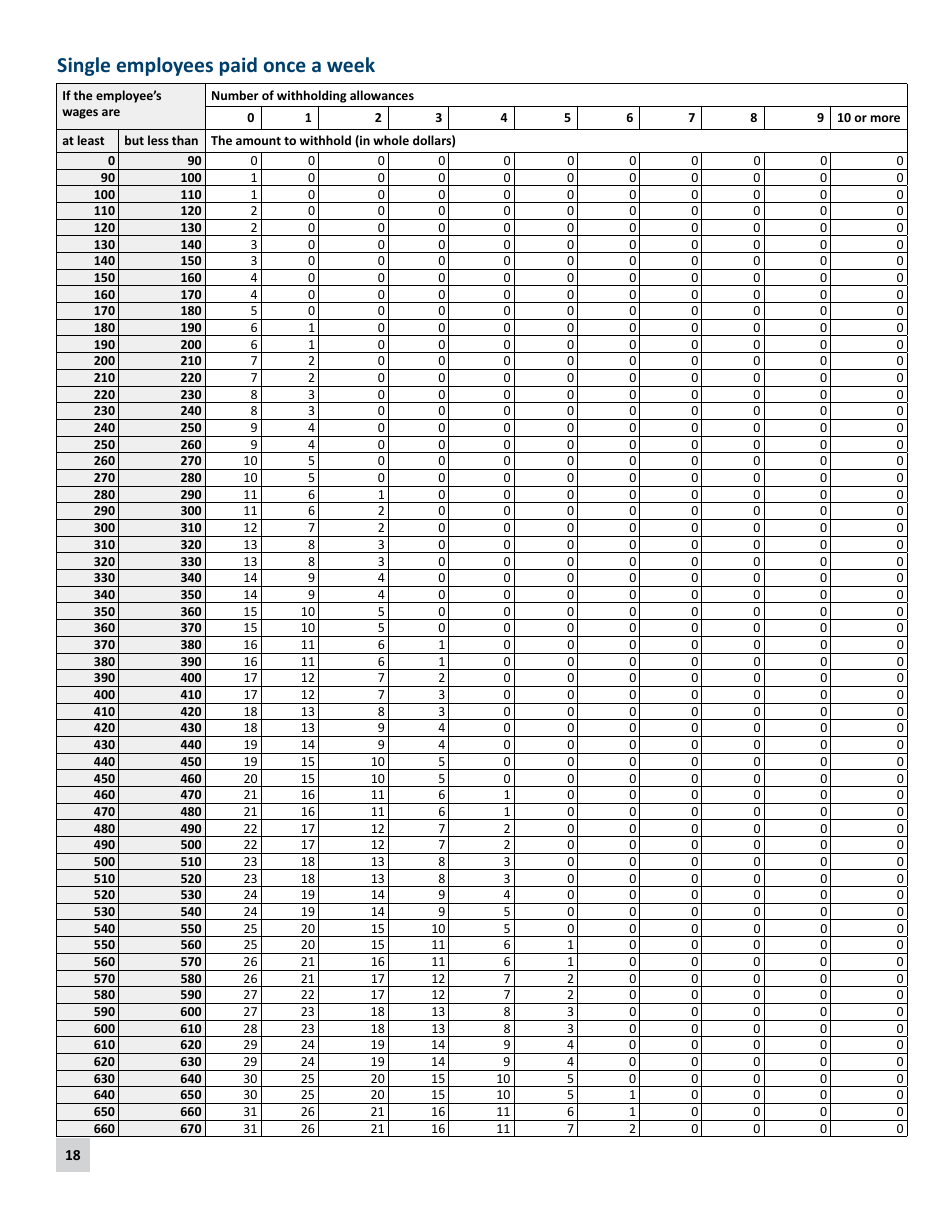

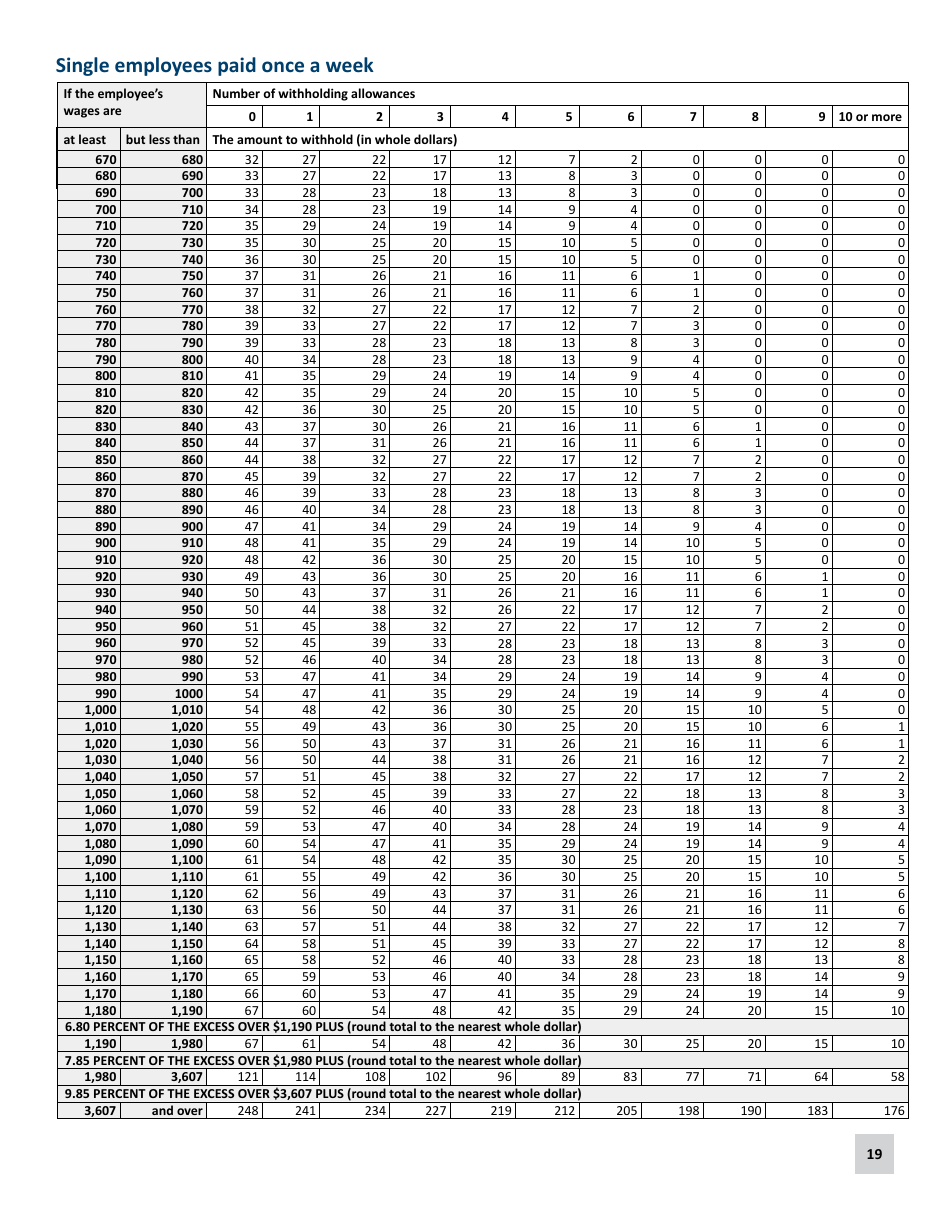

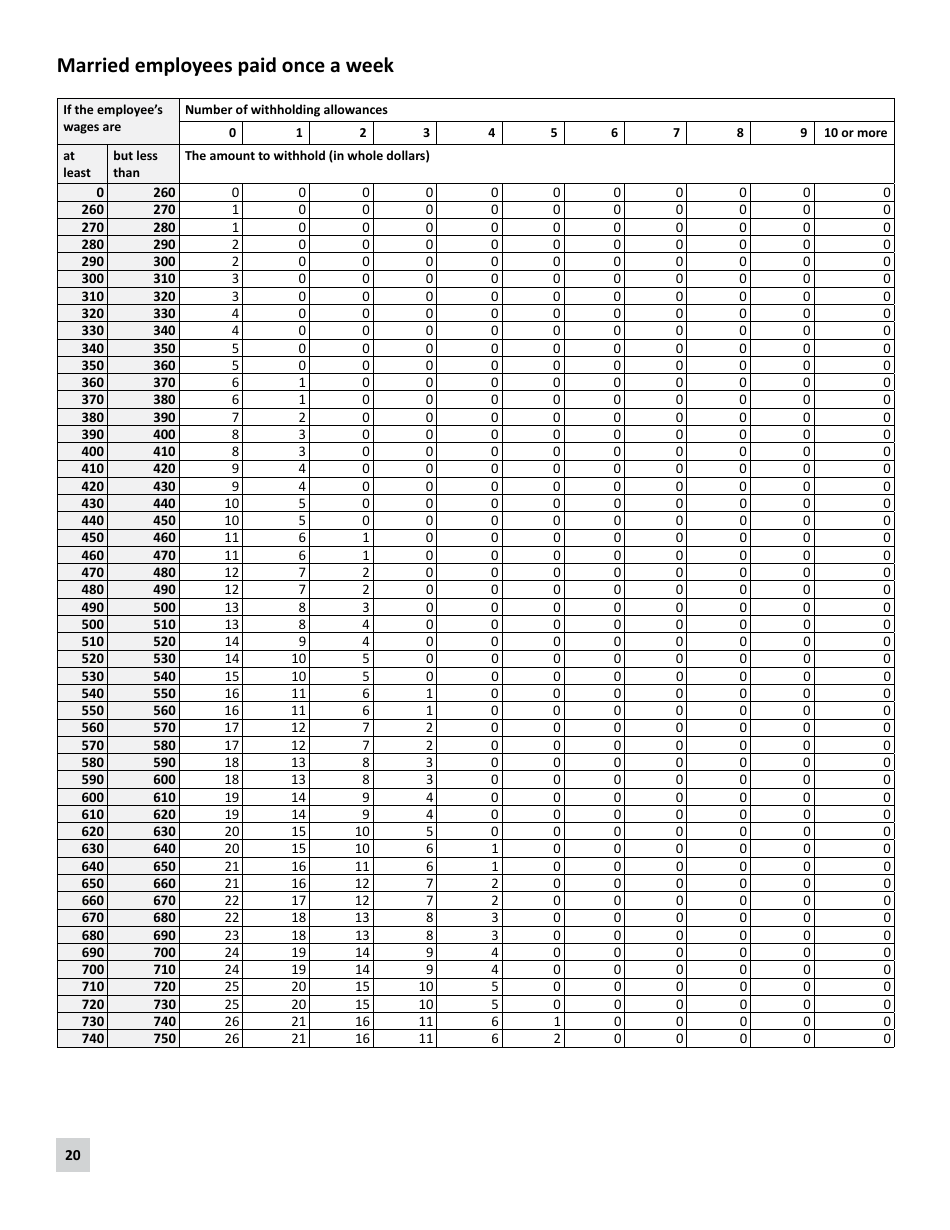

Minnesota Income Tax Withholding Instruction Booklet - Minnesota

Minnesota Income Tax Withholding Instruction Booklet is a legal document that was released by the Minnesota Department of Revenue - a government authority operating within Minnesota.

FAQ

Q: What is the Minnesota Income Tax Withholding Instruction Booklet?

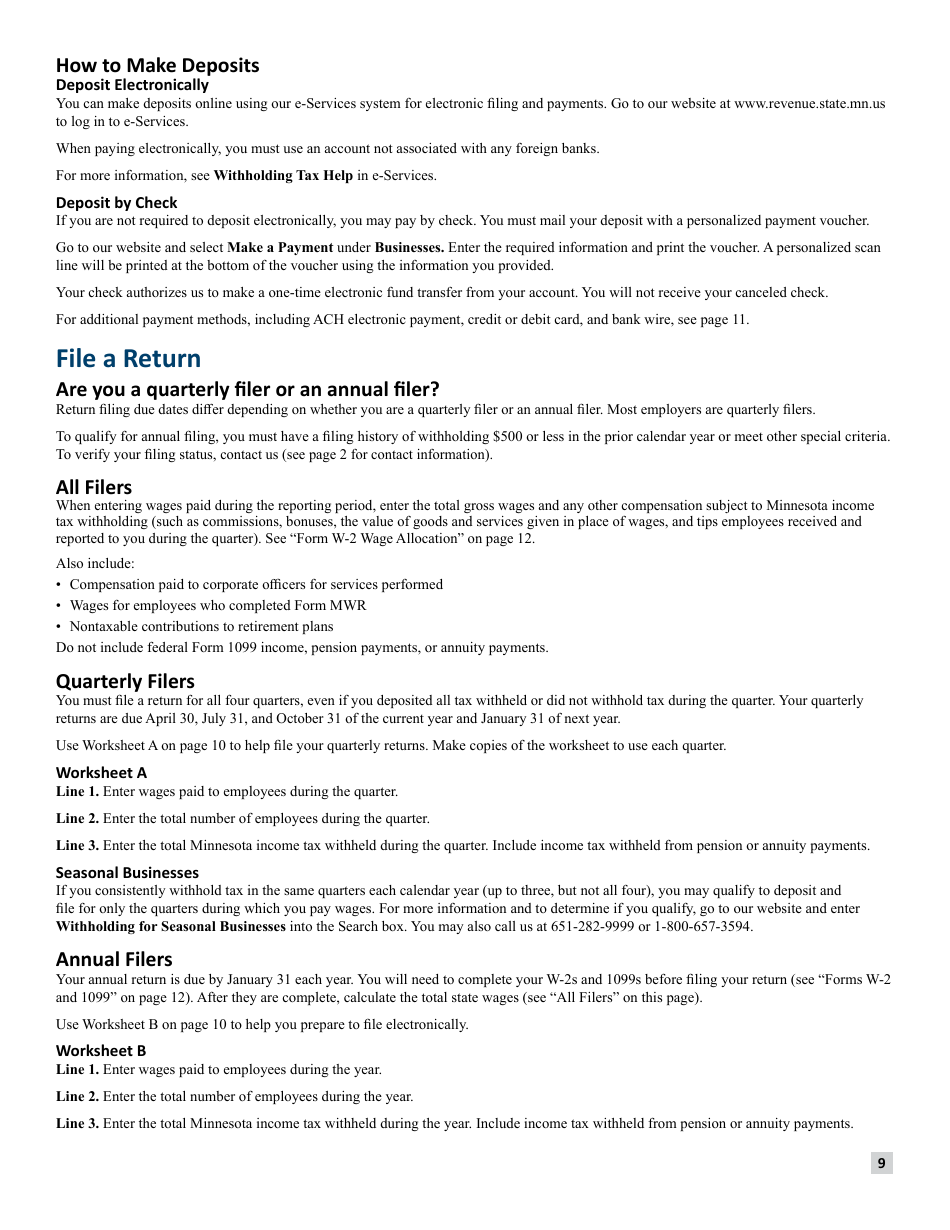

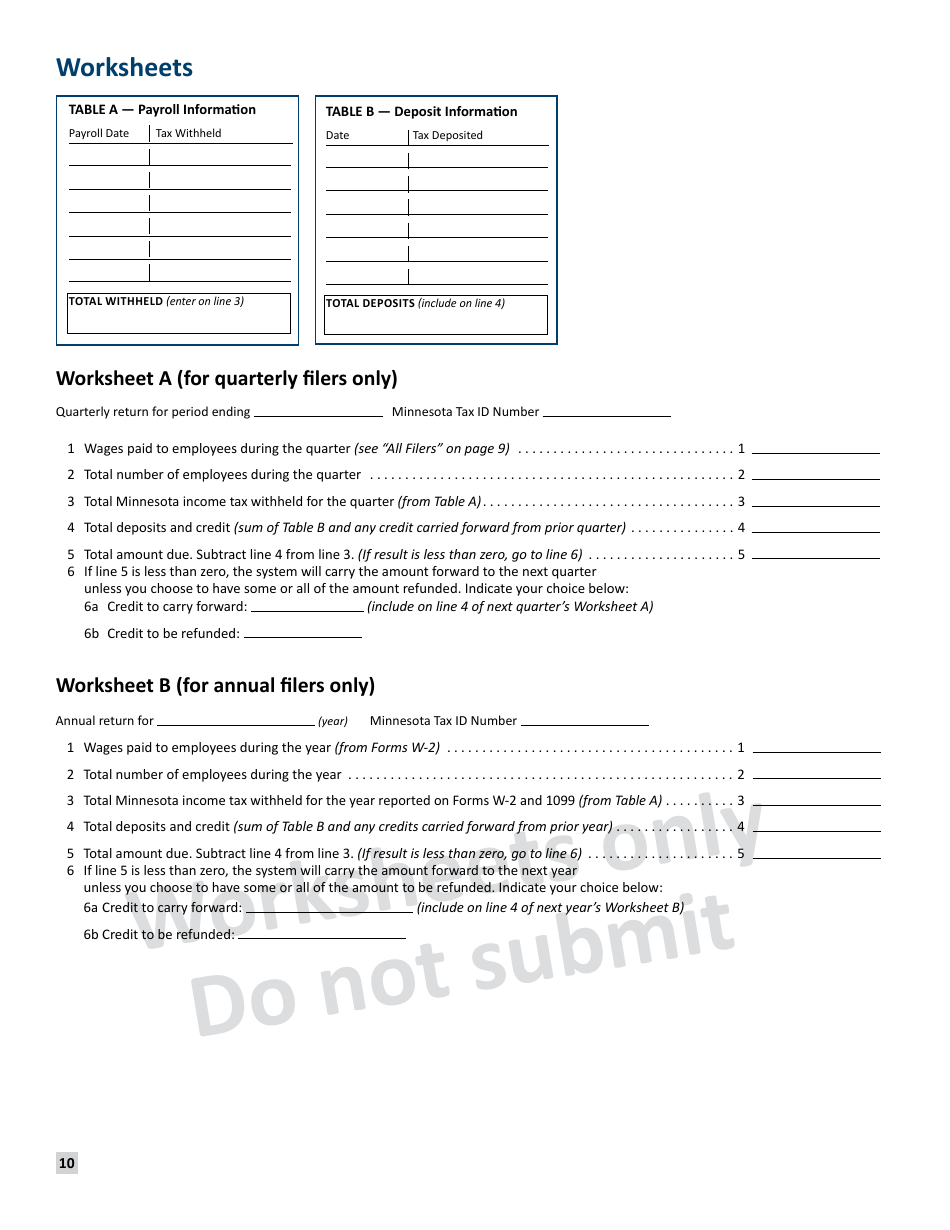

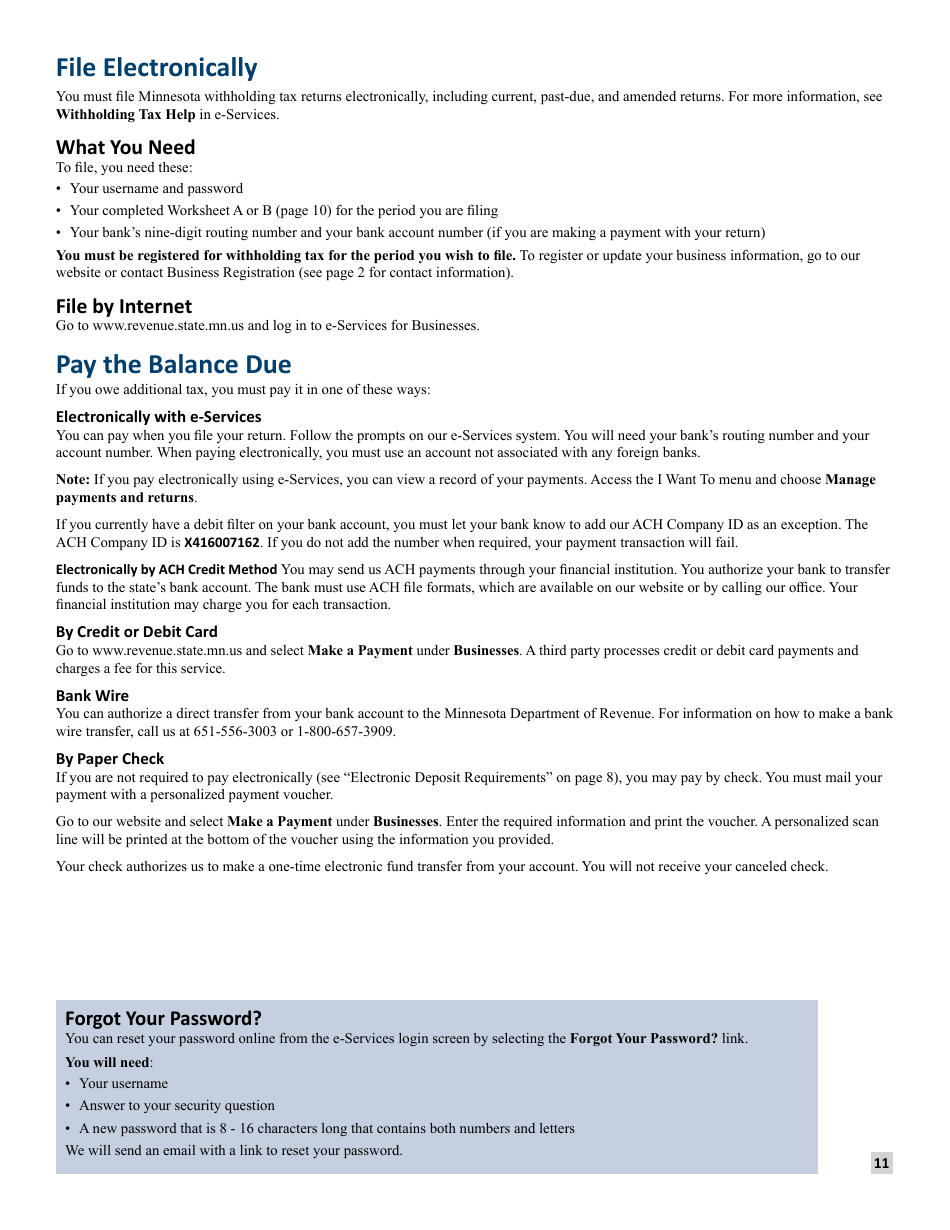

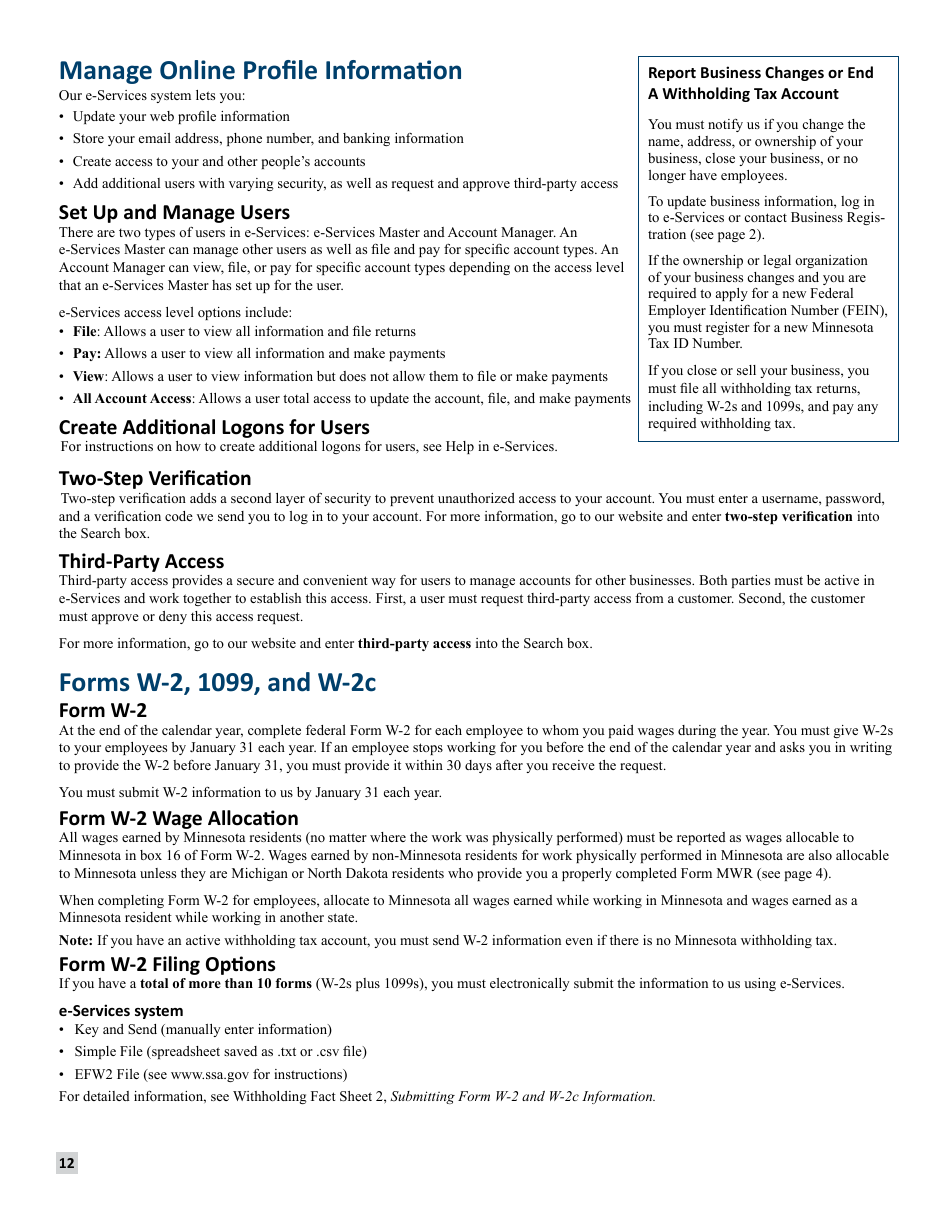

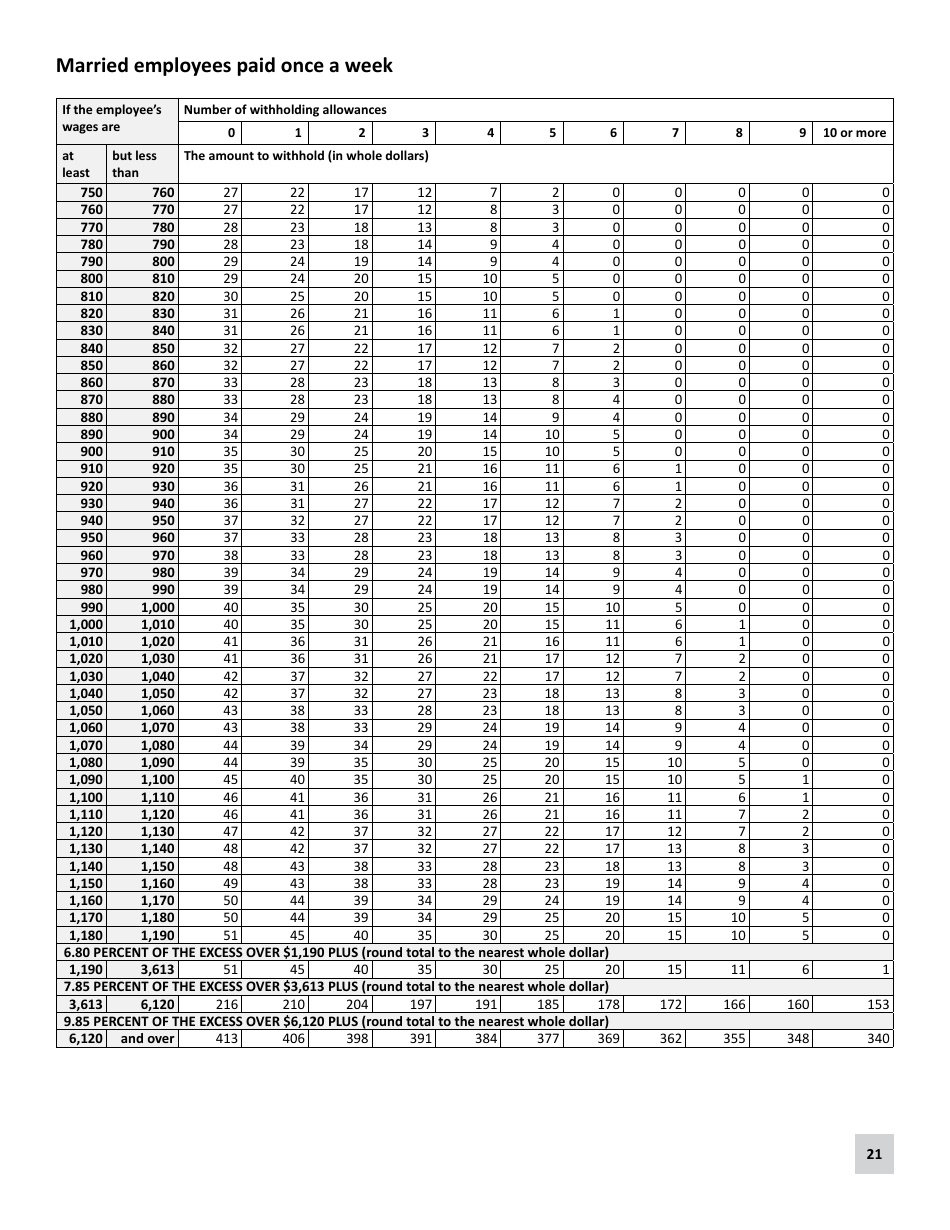

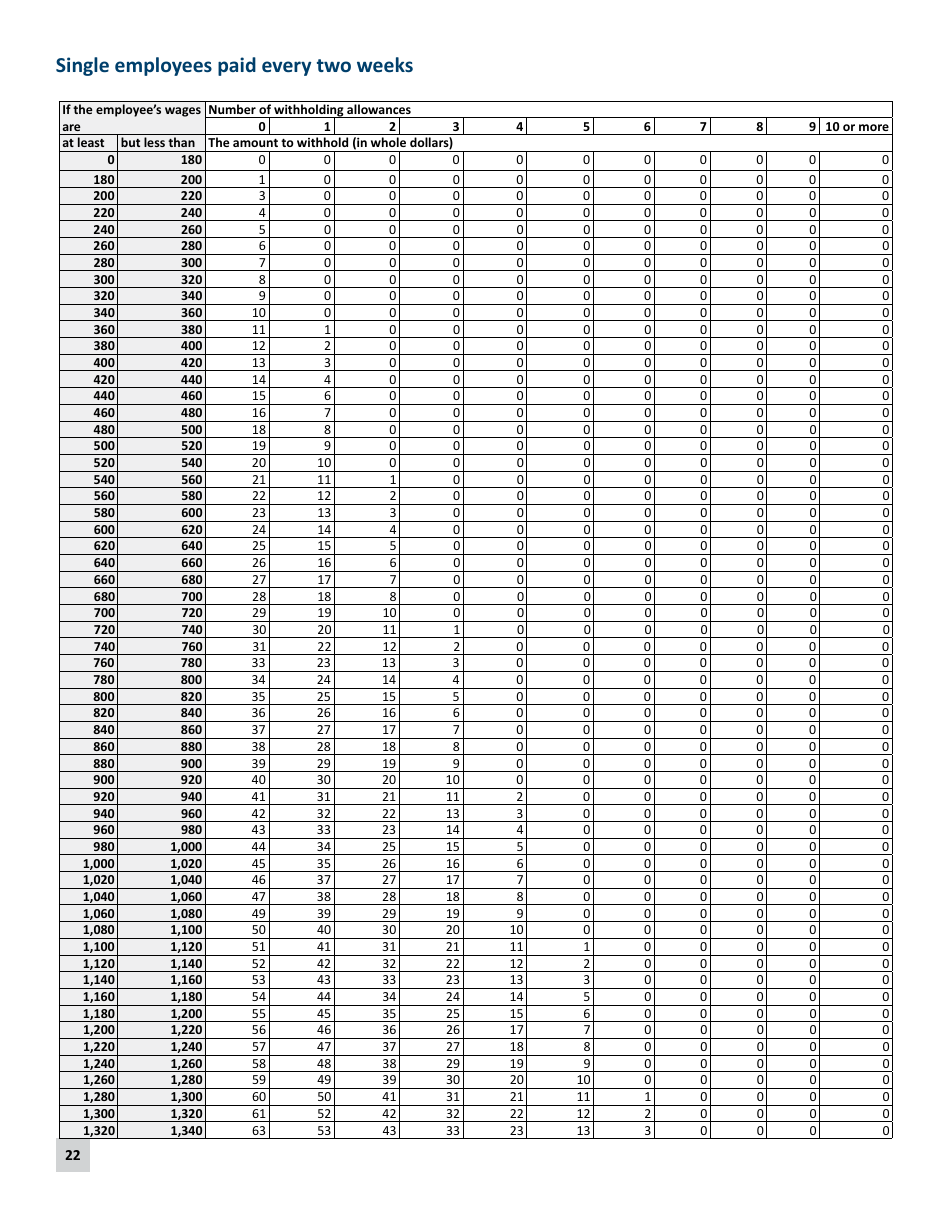

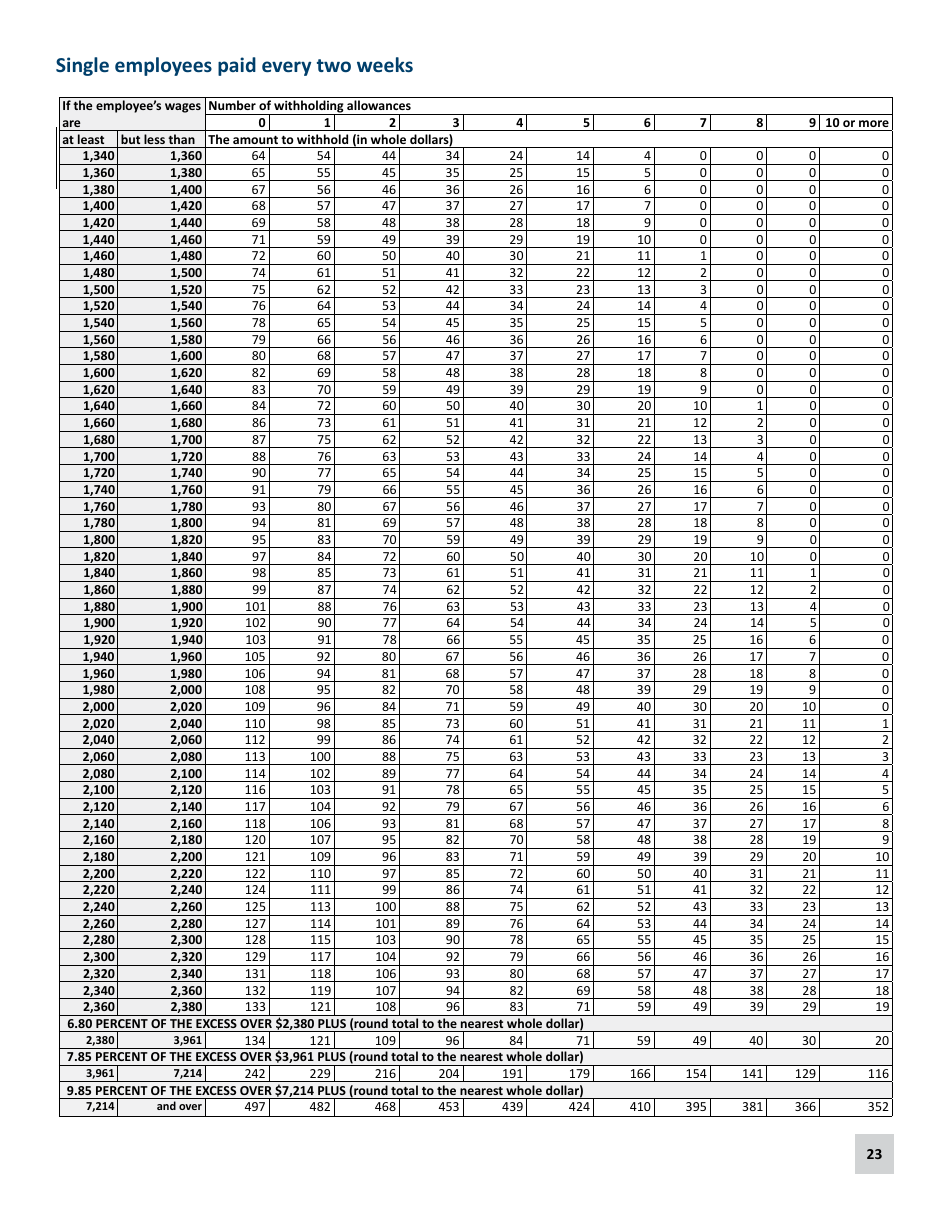

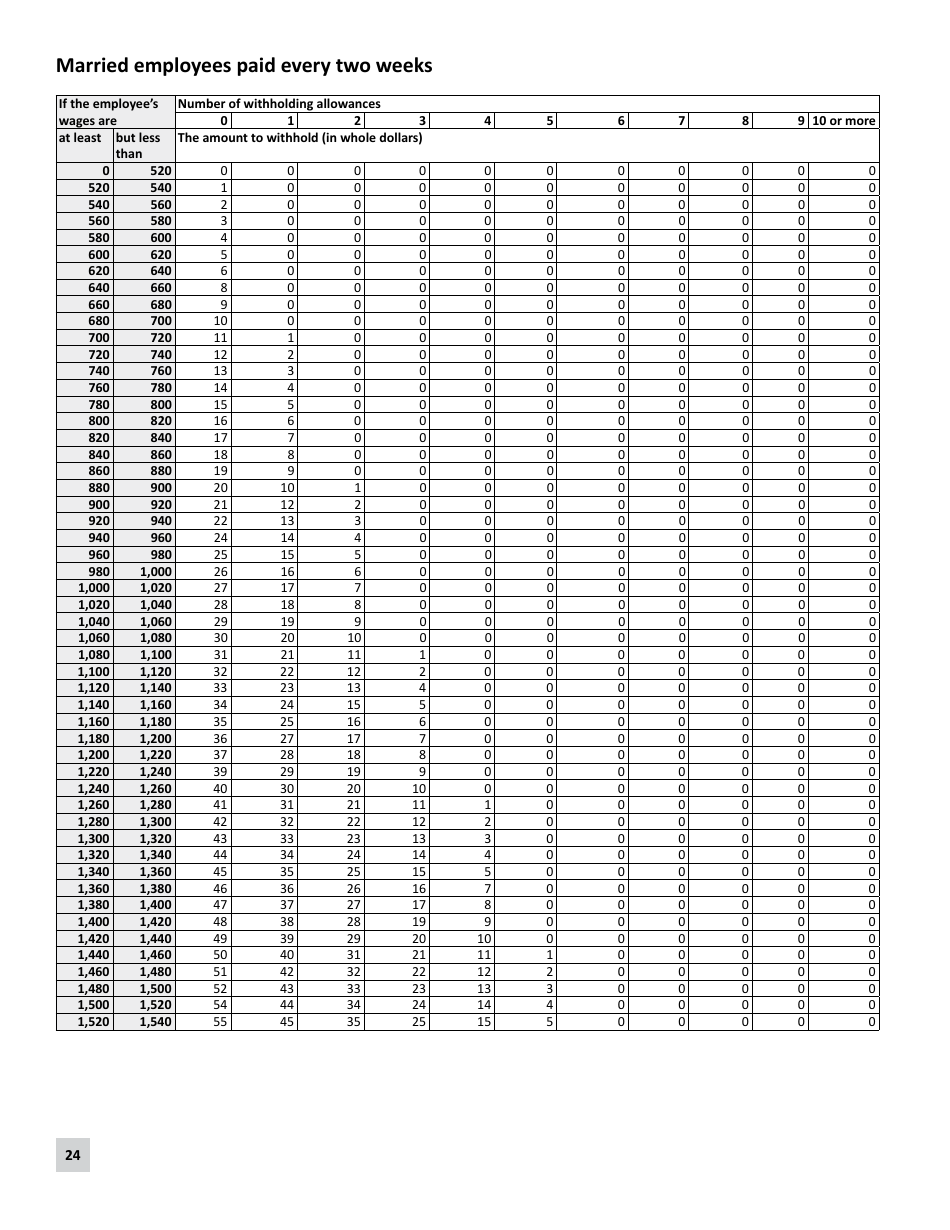

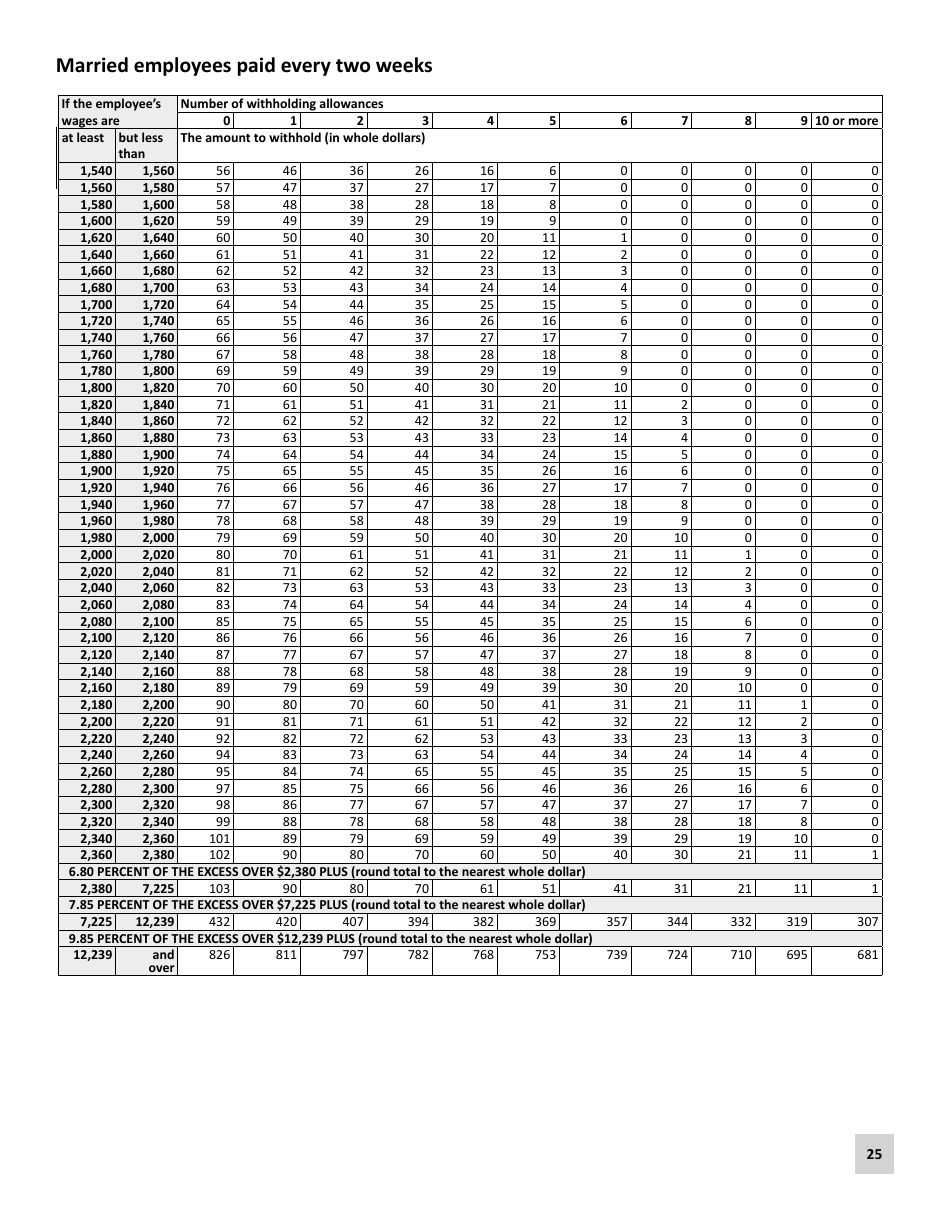

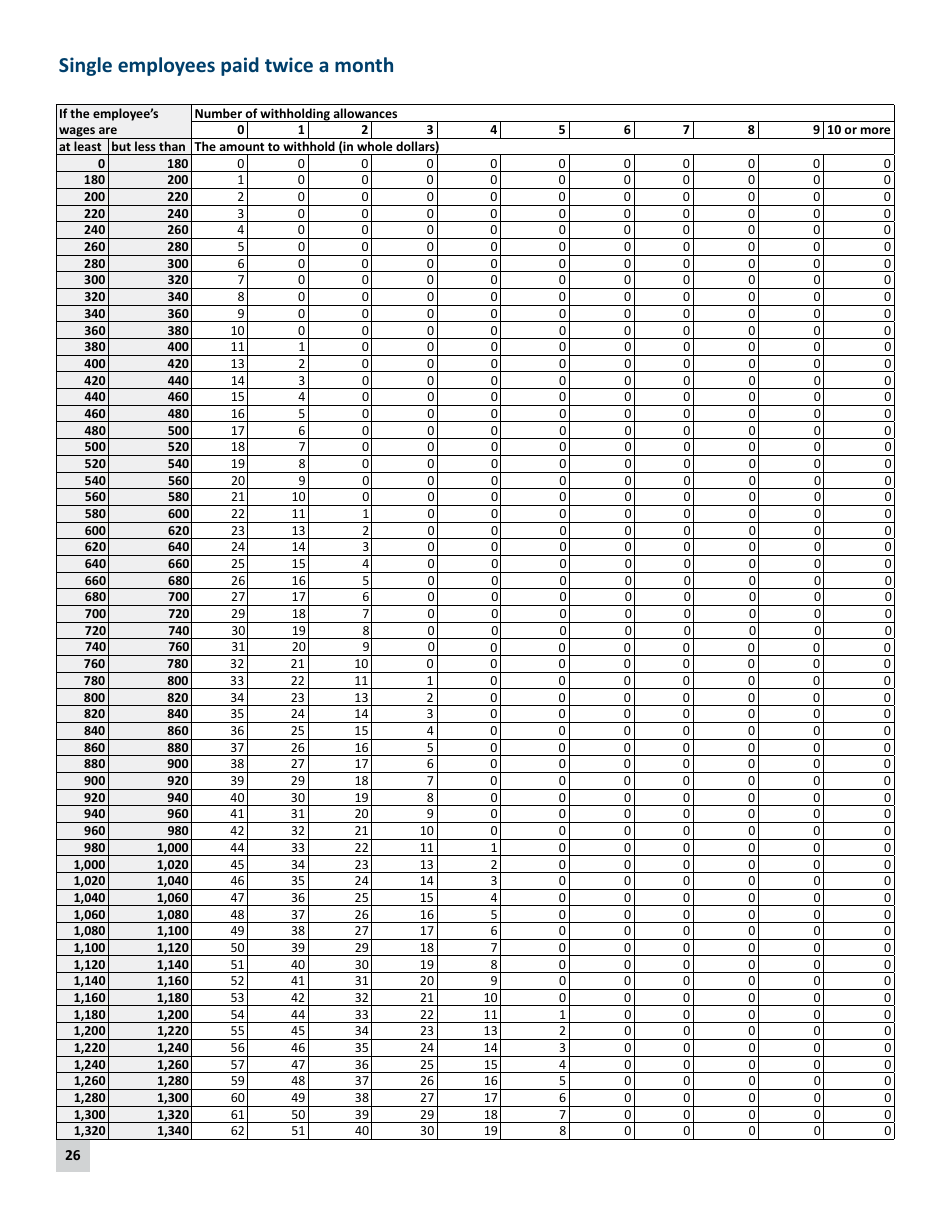

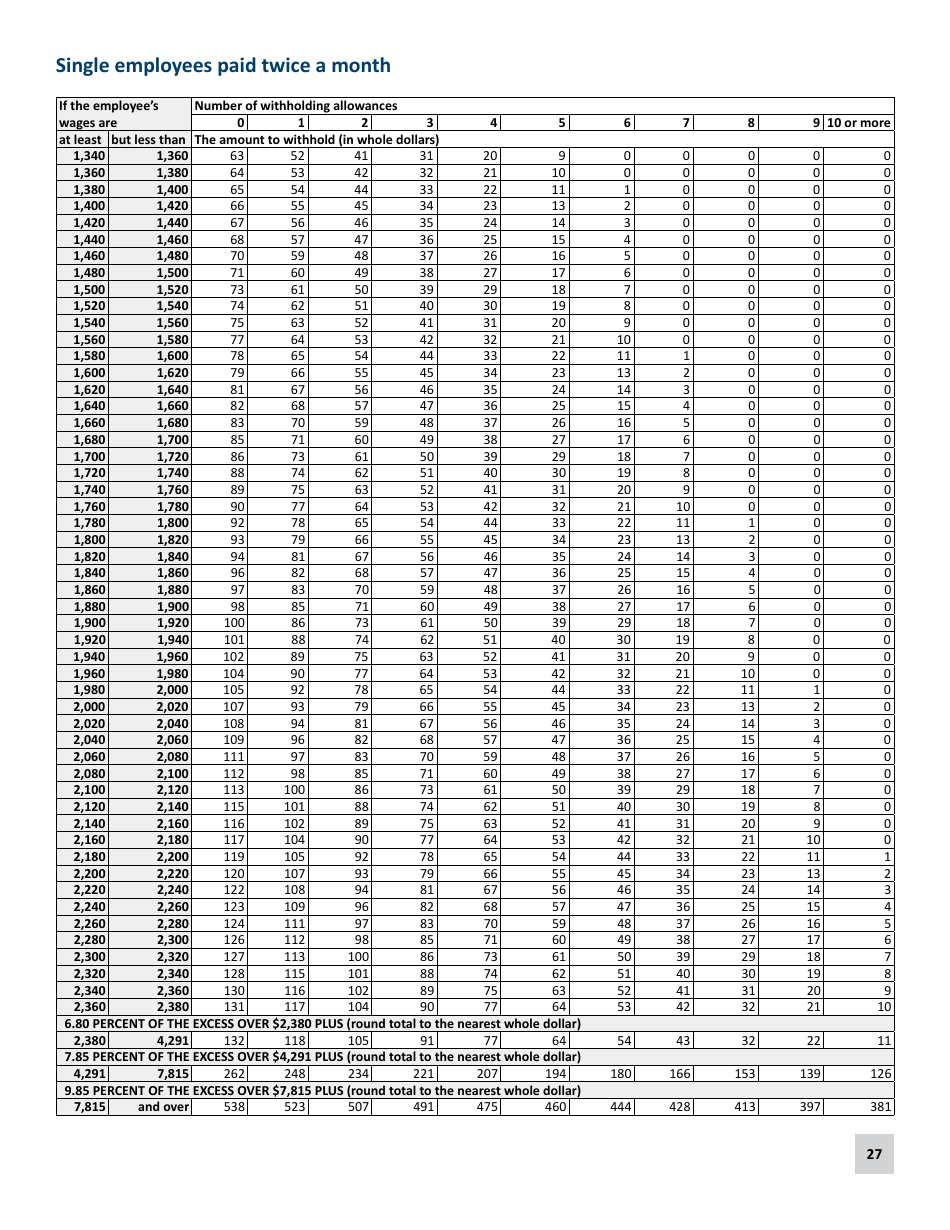

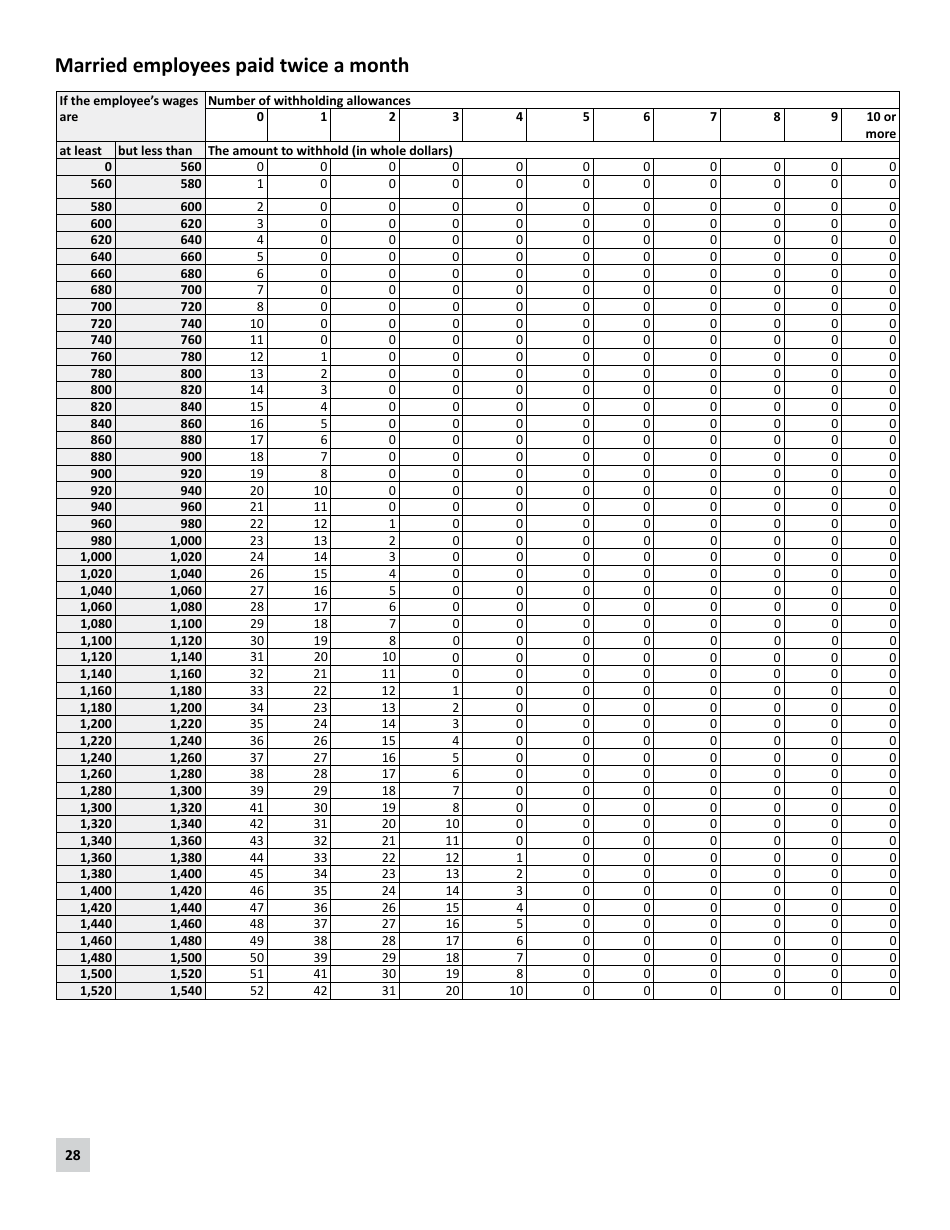

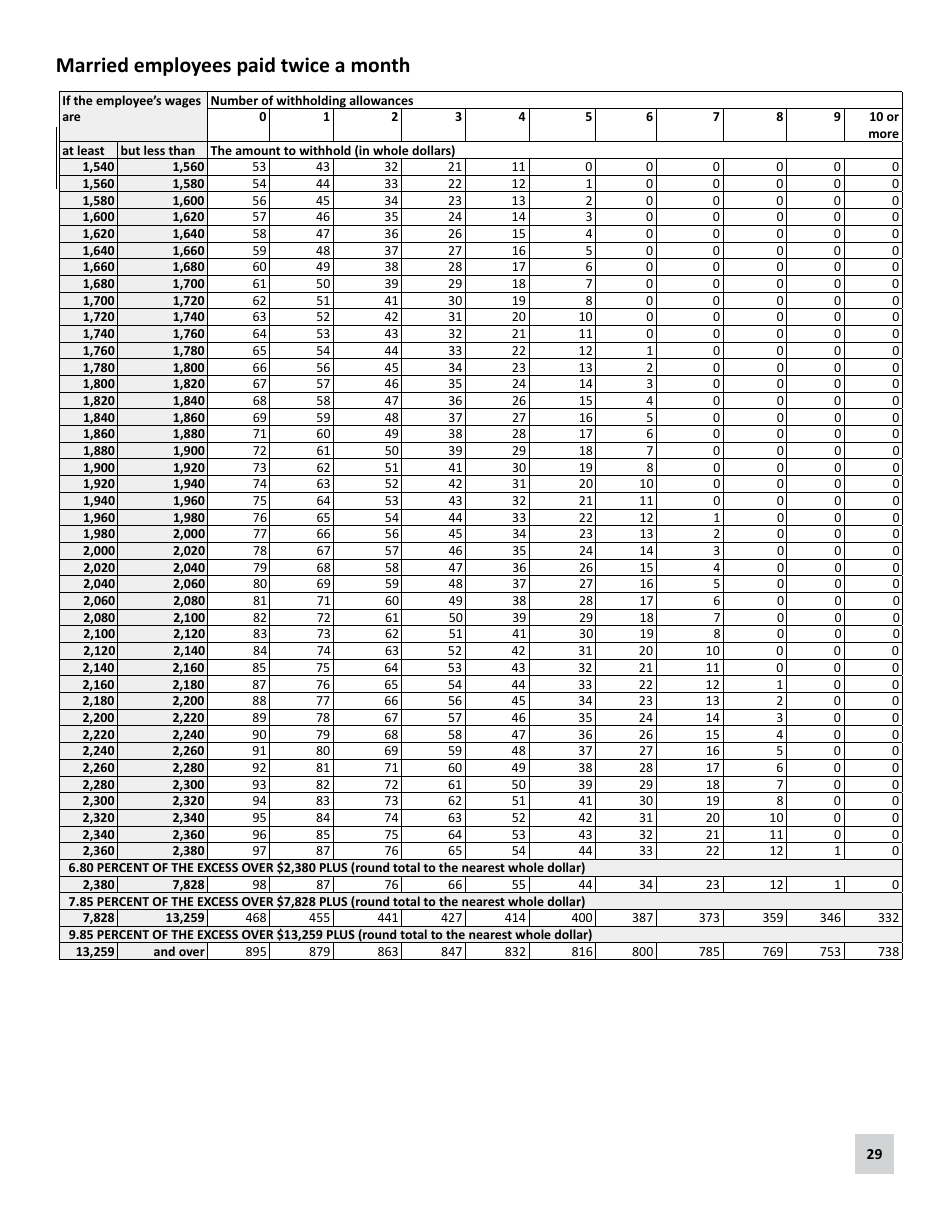

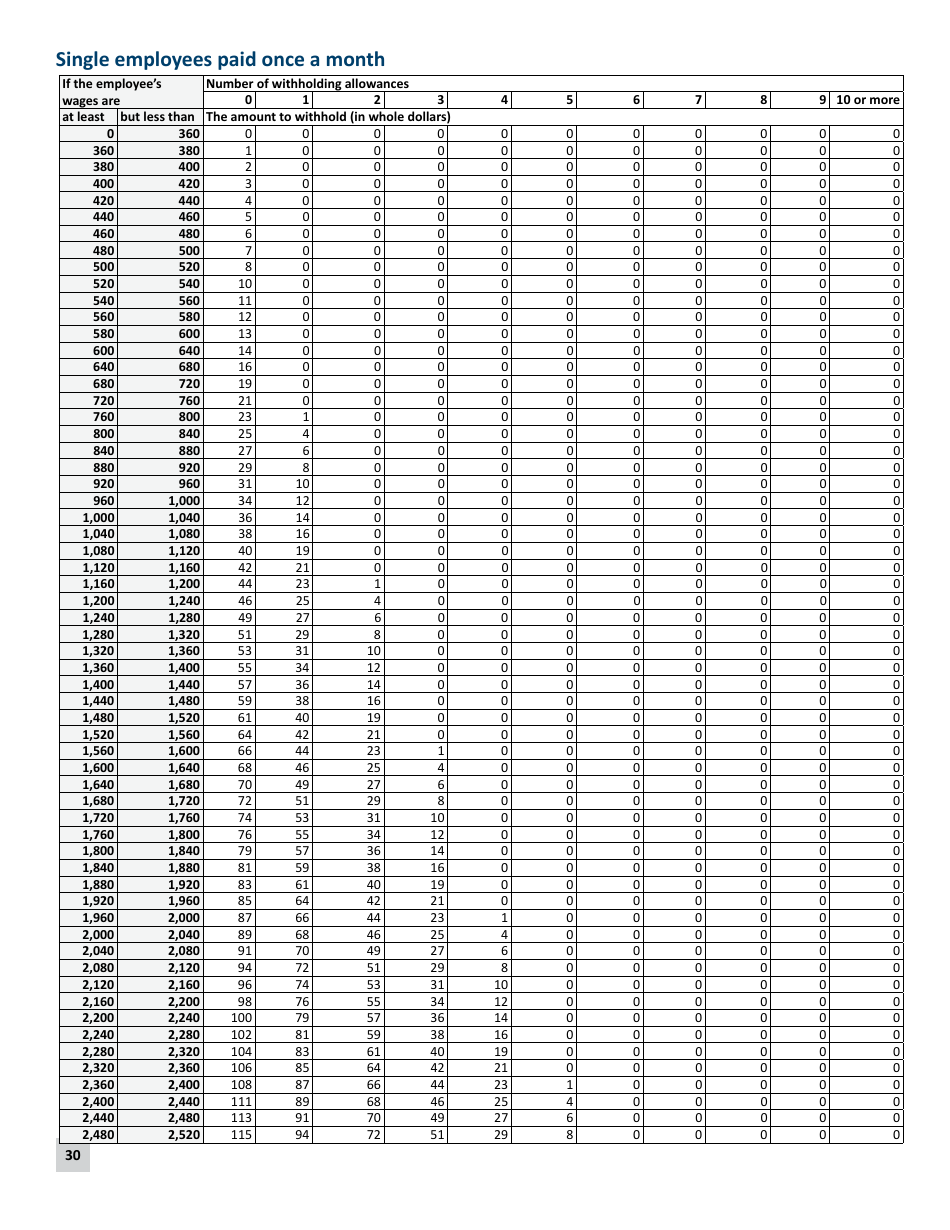

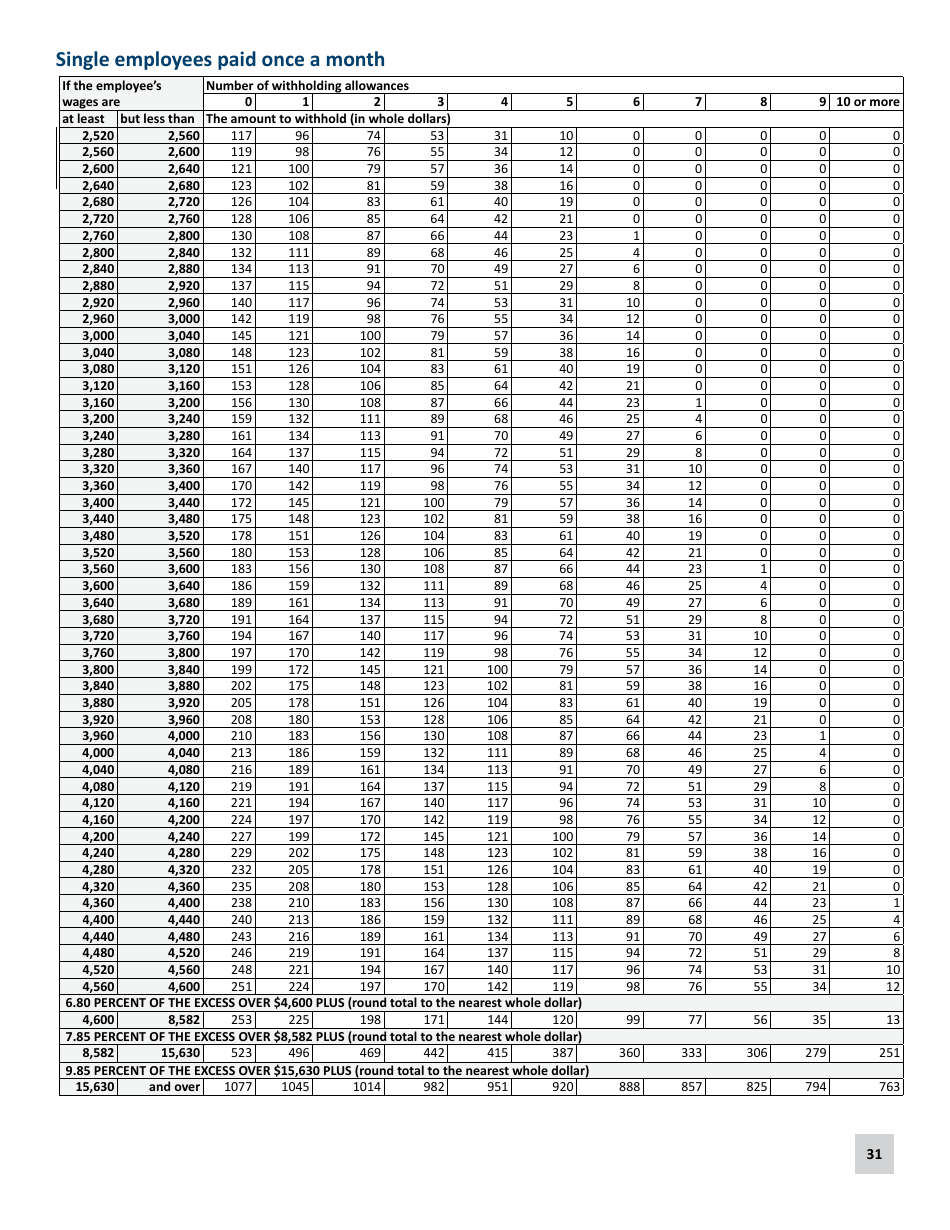

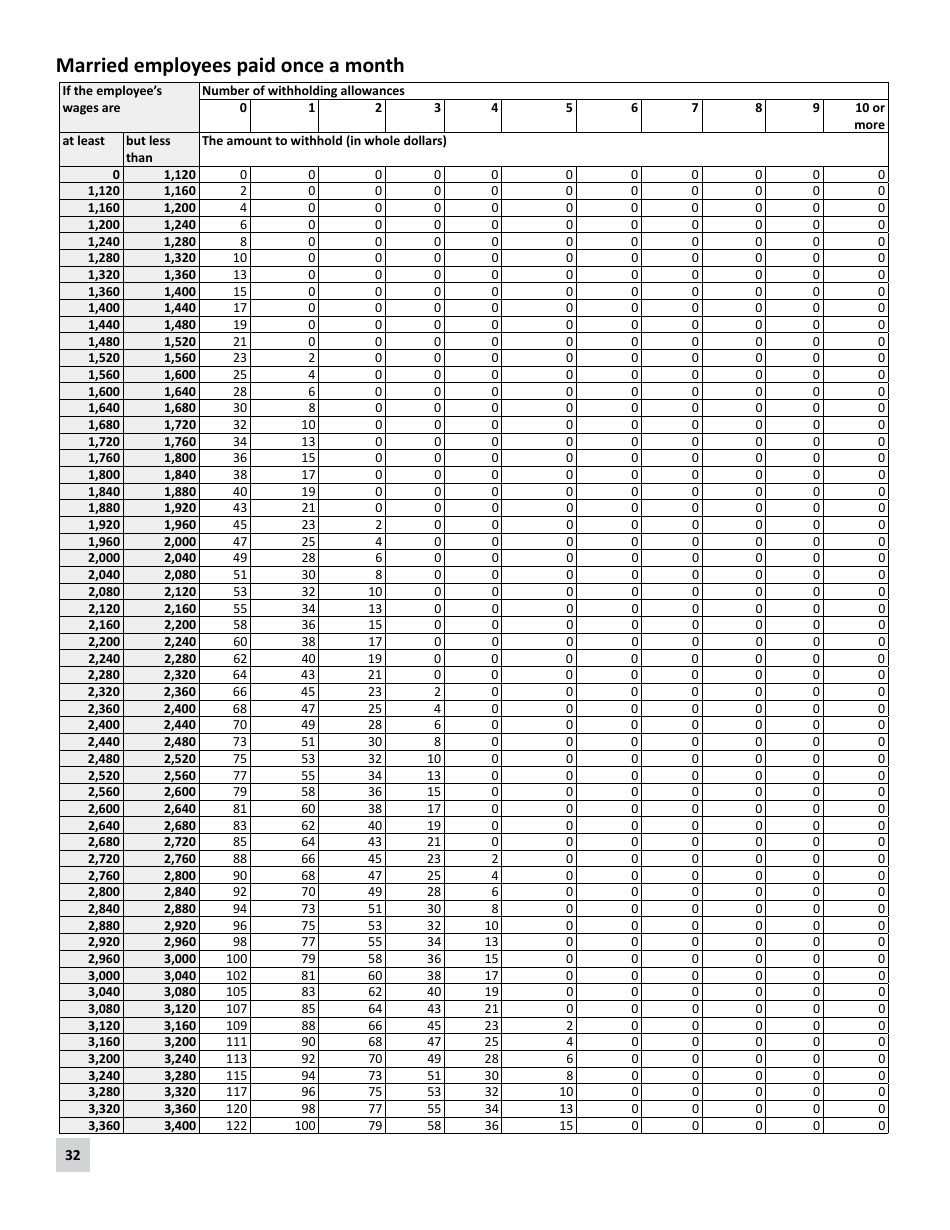

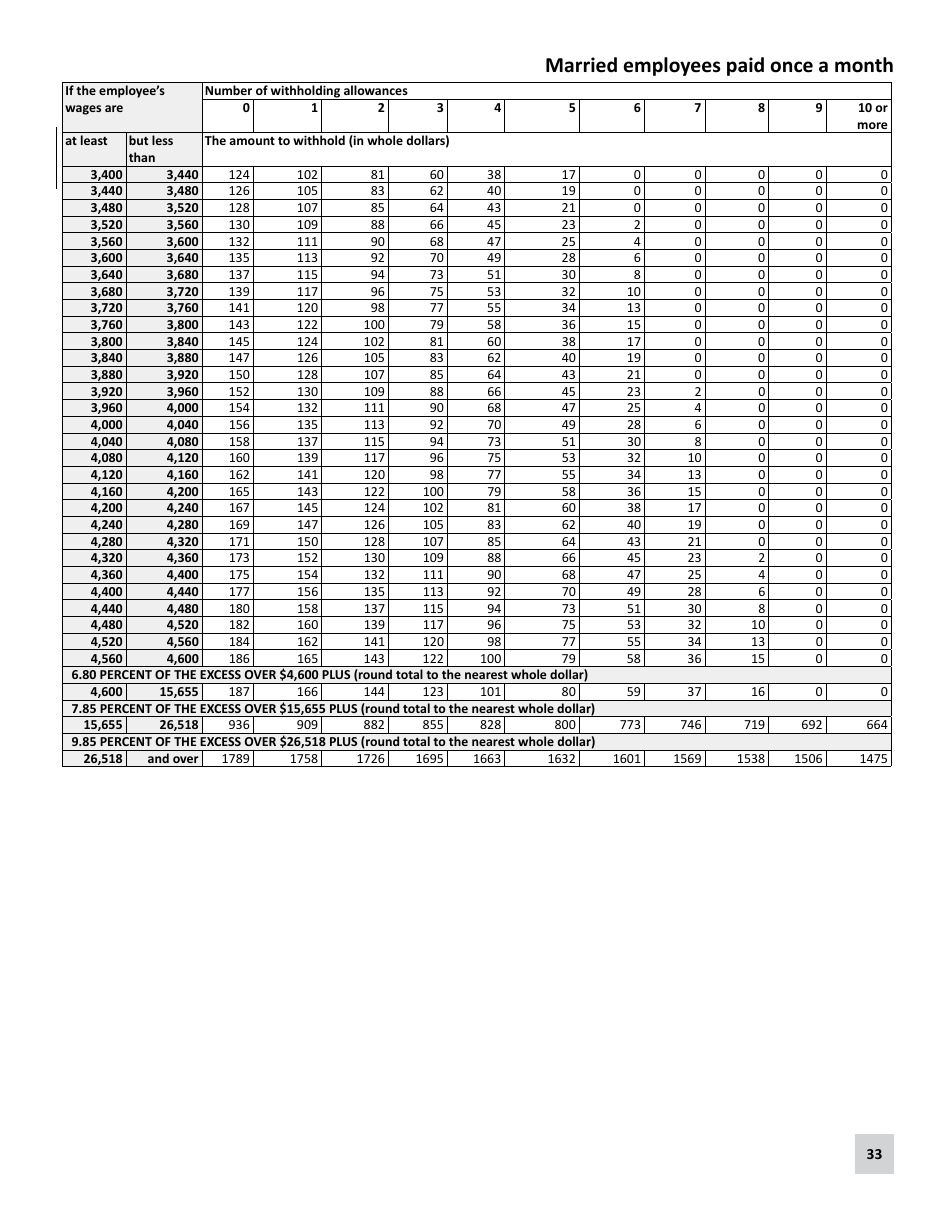

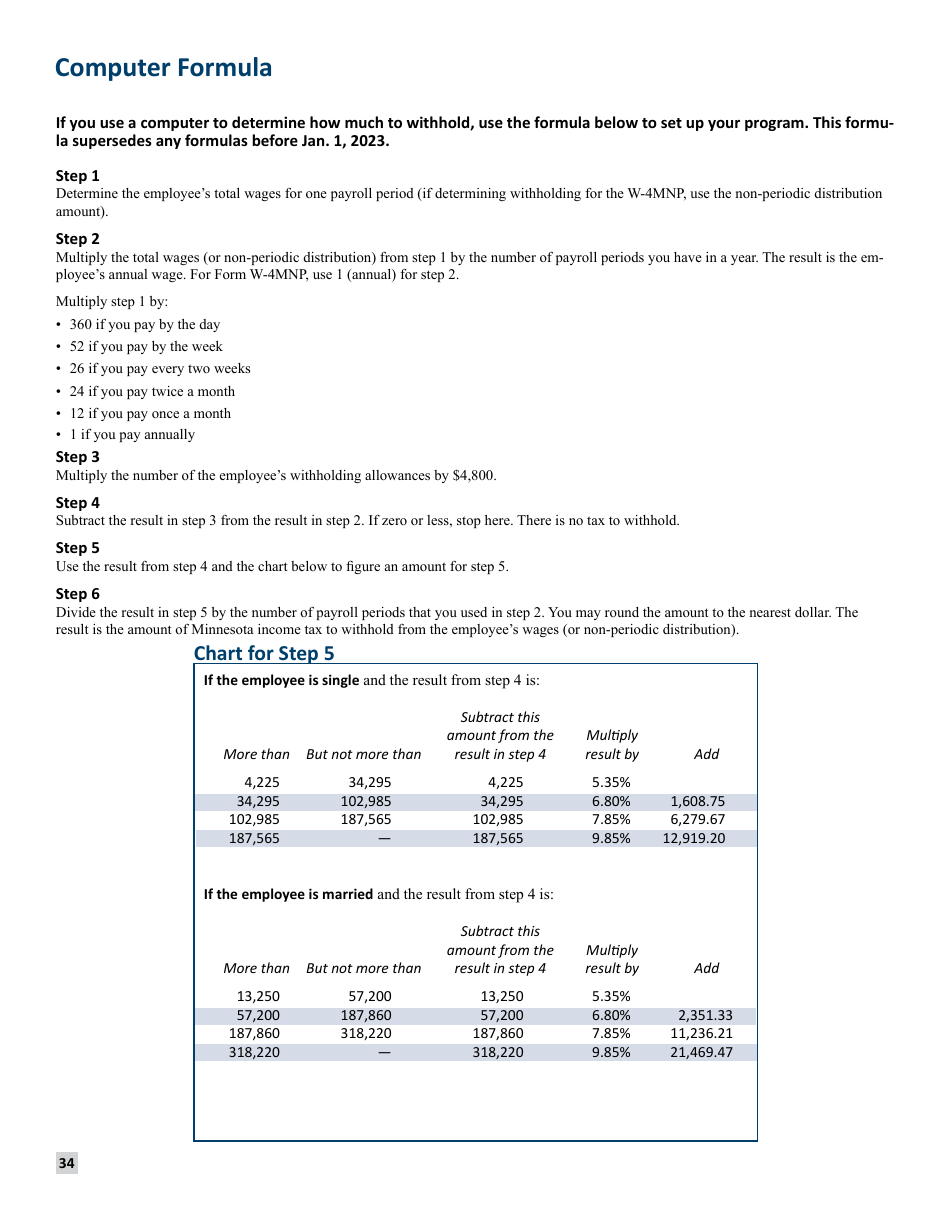

A: The Minnesota Income Tax Withholding Instruction Booklet is a guide provided by the Minnesota Department of Revenue that helps employers understand and comply with the state's income tax withholding requirements.

Q: Who needs to use the Minnesota Income Tax Withholding Instruction Booklet?

A: Employers in Minnesota who have employees subject to state income tax withholding need to use this booklet.

Q: What information does the booklet provide?

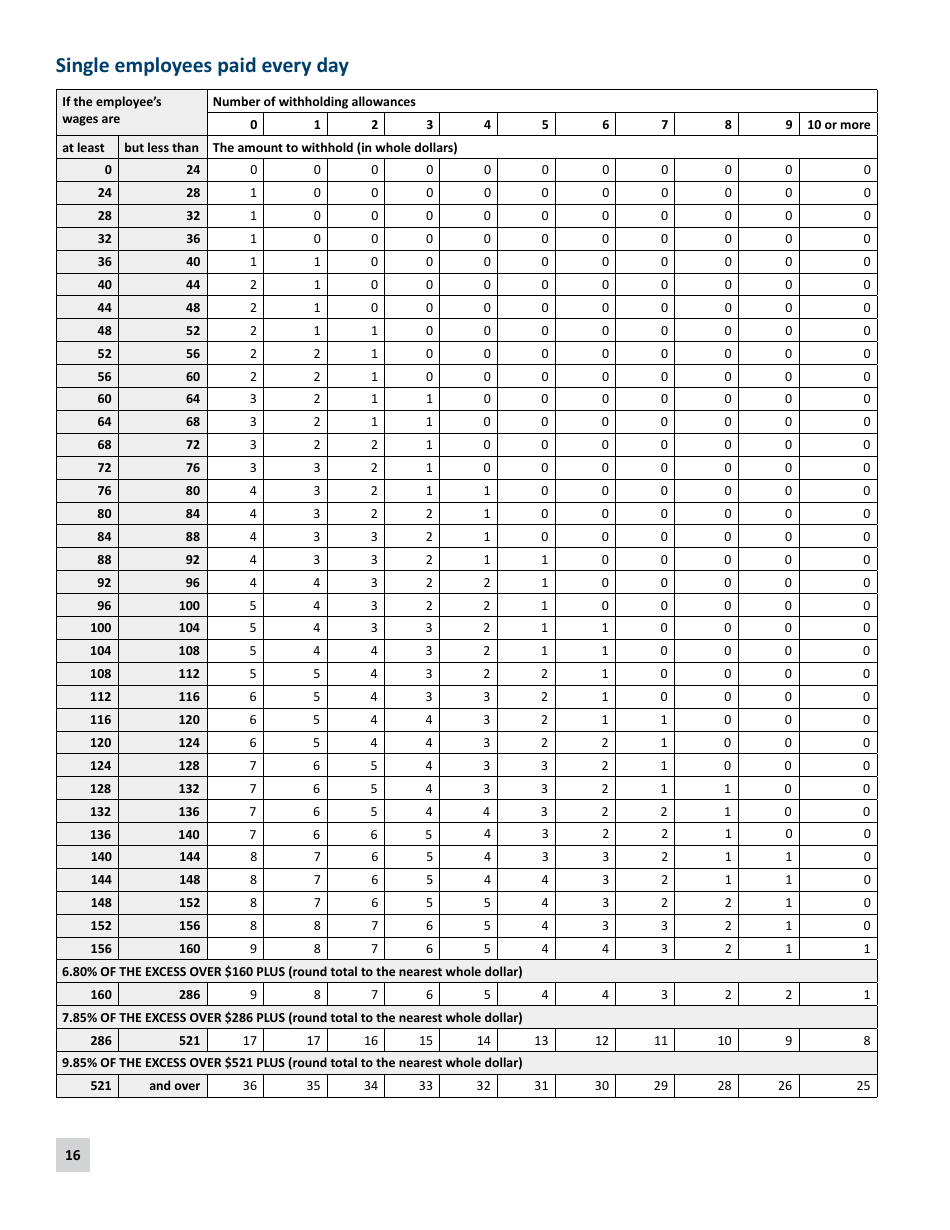

A: The booklet provides instructions on how to calculate and withhold state income taxes from employees' wages, as well as filing requirements and due dates for submitting withheld taxes.

Q: Is the booklet applicable for individuals who are self-employed?

A: No, this booklet is primarily for employers who have employees. Self-employed individuals generally pay state income tax through estimated quarterly tax payments.

Form Details:

- The latest edition currently provided by the Minnesota Department of Revenue;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Minnesota Department of Revenue.