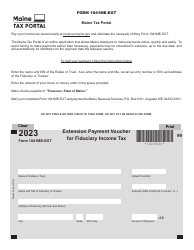

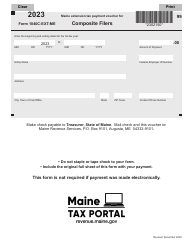

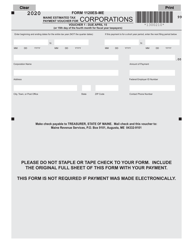

This version of the form is not currently in use and is provided for reference only. Download this version of

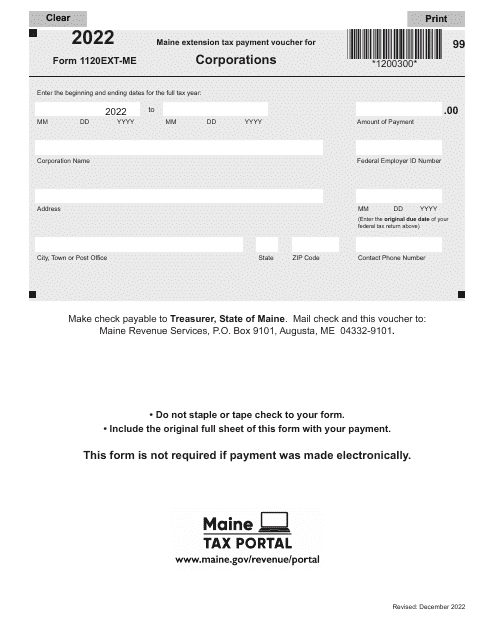

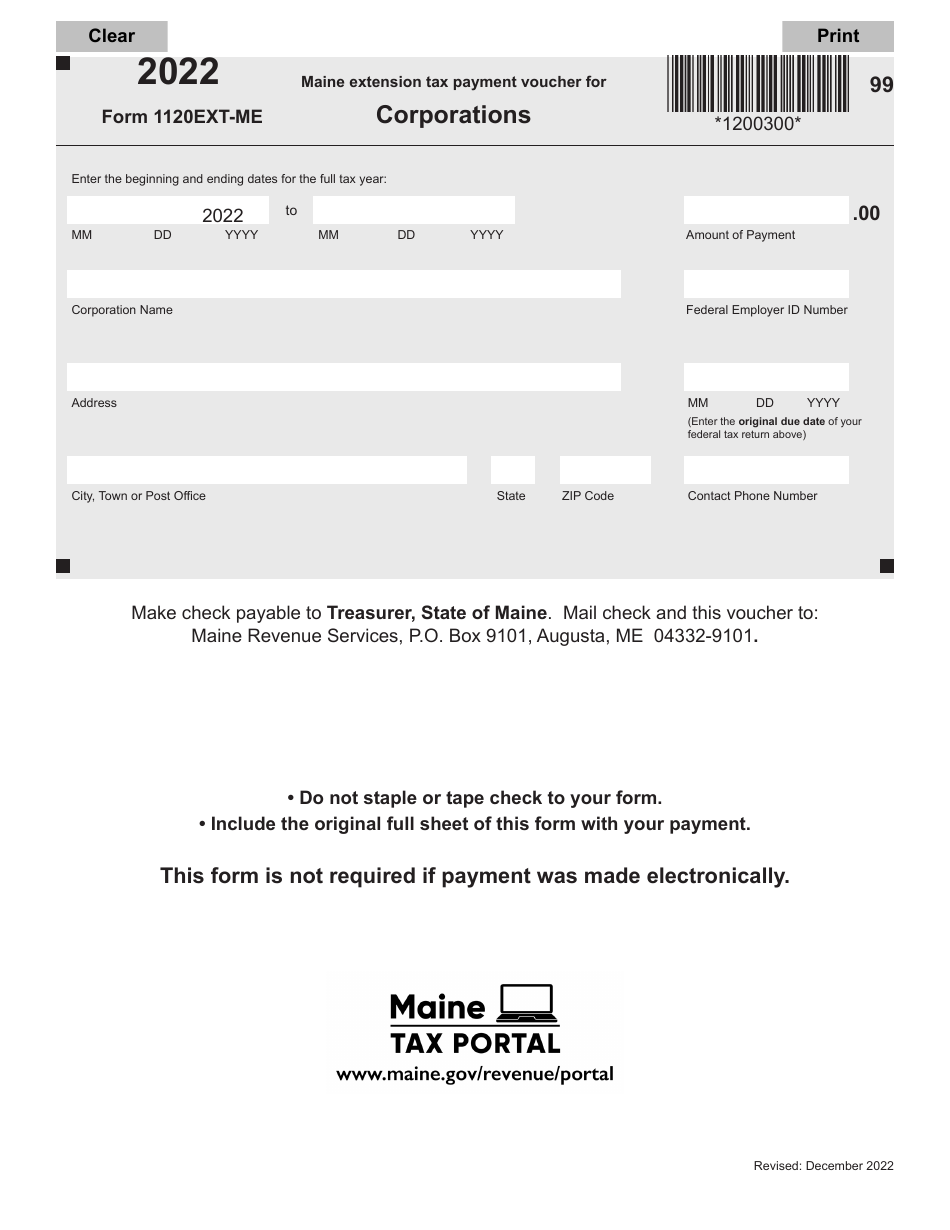

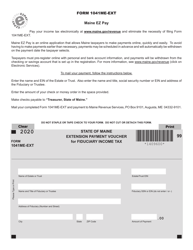

Form 1120EXT-ME

for the current year.

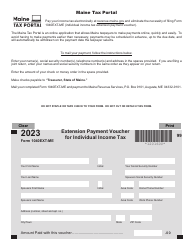

Form 1120EXT-ME Maine Extension Tax Payment Voucher for Corporations - Maine

What Is Form 1120EXT-ME?

This is a legal form that was released by the Maine Revenue Services - a government authority operating within Maine. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

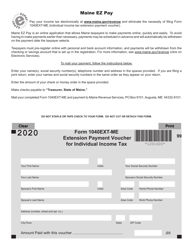

Q: What is Form 1120EXT-ME?

A: Form 1120EXT-ME is the Maine Extension Tax Payment Voucher for Corporations.

Q: Who needs to use Form 1120EXT-ME?

A: Corporations that are requesting an extension of time to file their Maine tax return.

Q: What is the purpose of Form 1120EXT-ME?

A: The purpose of this form is to submit the payment of any tax due for a Maine corporation that is filing for an extension.

Q: Is Form 1120EXT-ME used for federal taxes?

A: No, this form is specific to the state of Maine and is not used for federal taxes.

Q: When is Form 1120EXT-ME due?

A: Form 1120EXT-ME is due on the original due date of the Maine corporation tax return, which is typically March 15th.

Q: Is there a penalty for not filing Form 1120EXT-ME?

A: Yes, there may be penalties for failing to file Form 1120EXT-ME, so it is important to submit it by the due date if an extension is needed.

Form Details:

- Released on December 1, 2022;

- The latest edition provided by the Maine Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 1120EXT-ME by clicking the link below or browse more documents and templates provided by the Maine Revenue Services.