This version of the form is not currently in use and is provided for reference only. Download this version of

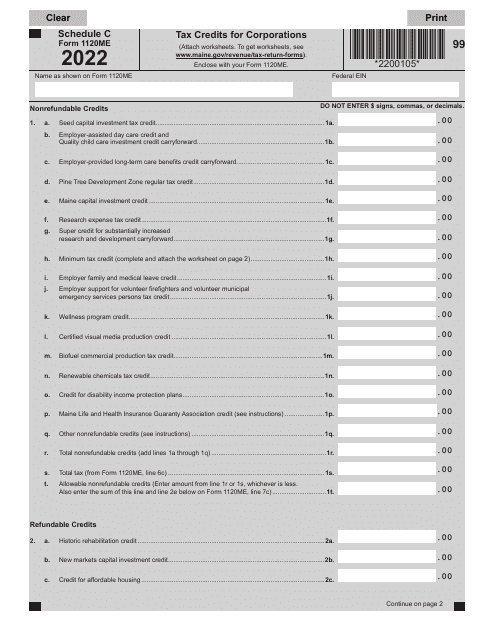

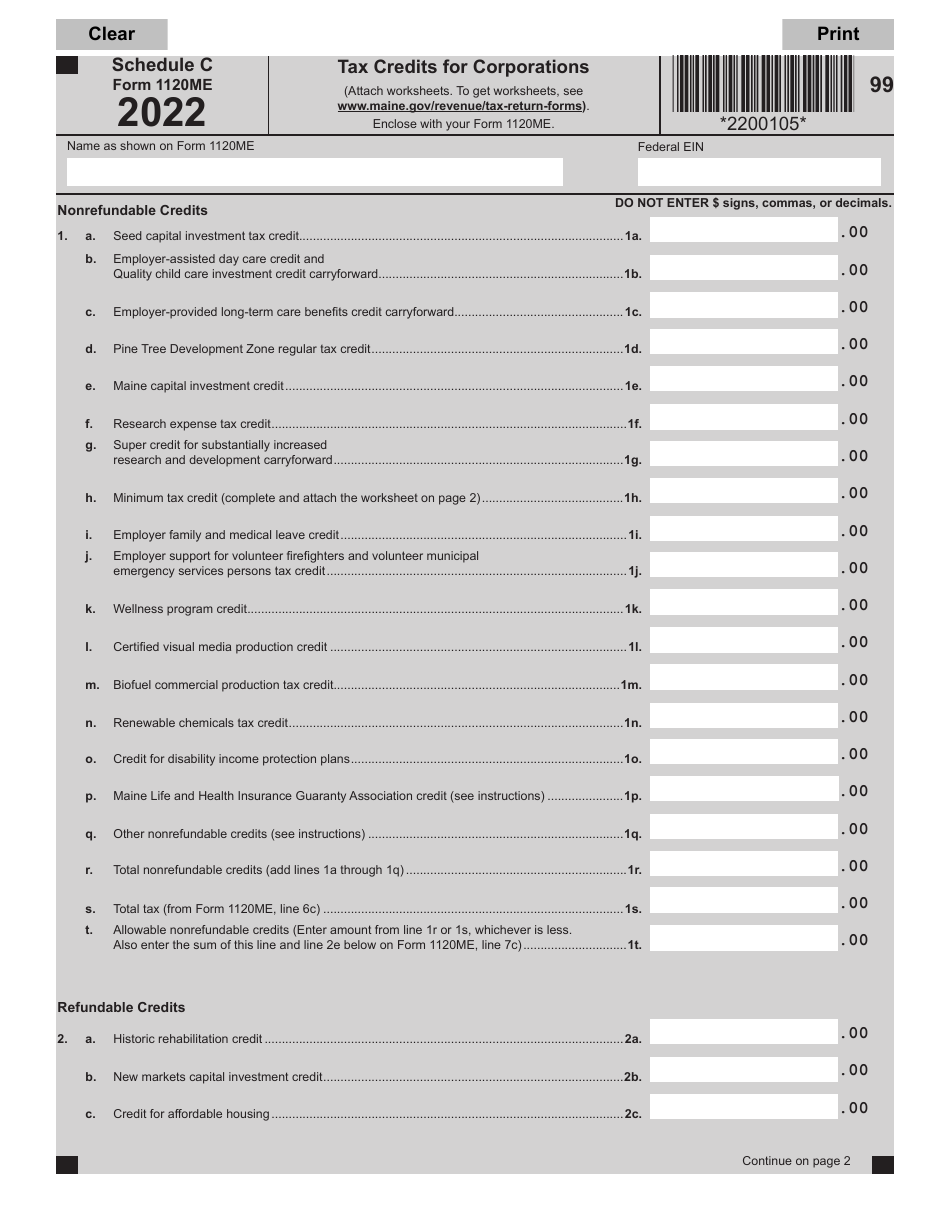

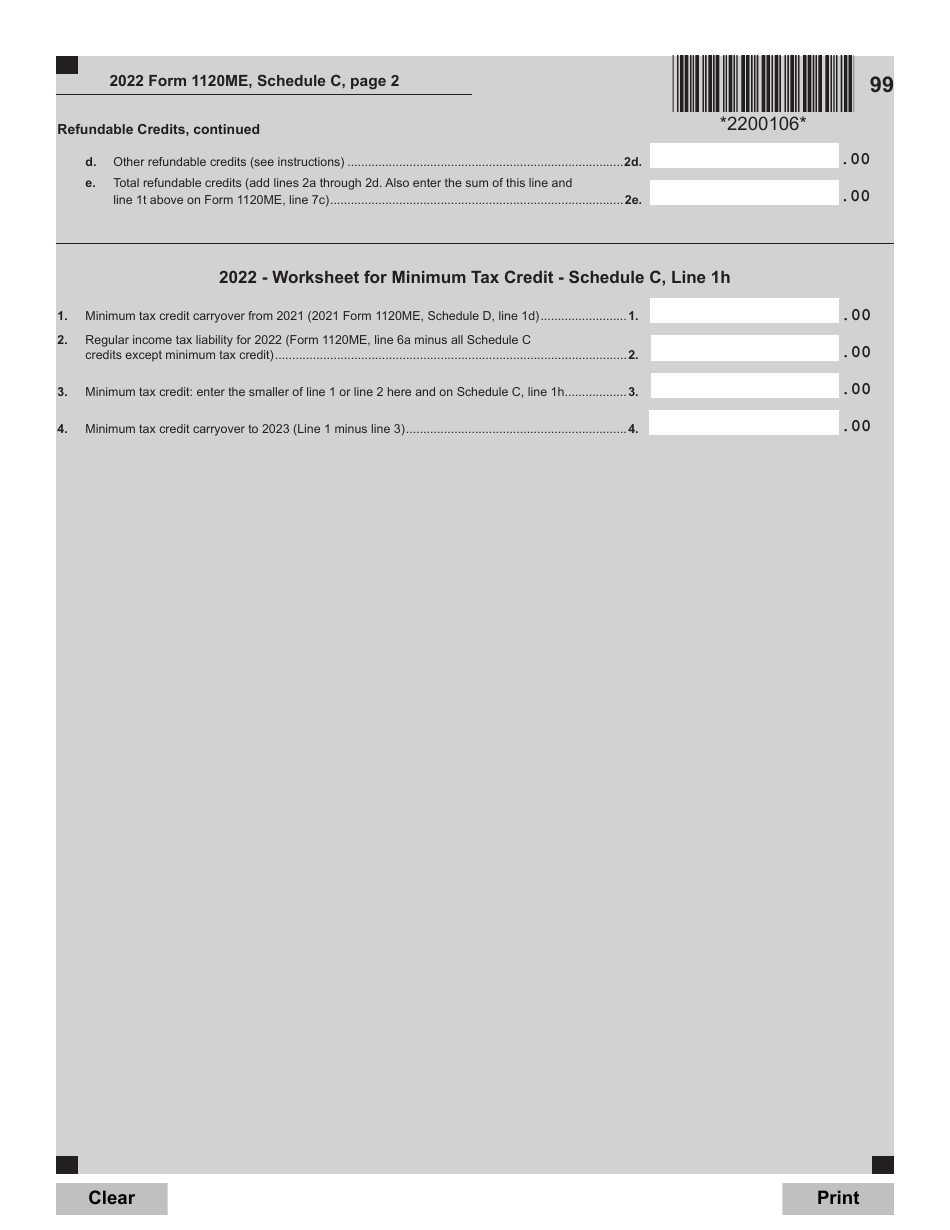

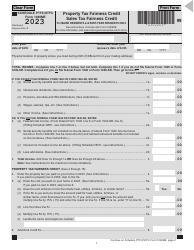

Form 1120ME Schedule C

for the current year.

Form 1120ME Schedule C Tax Credits for Corporations - Maine

What Is Form 1120ME Schedule C?

This is a legal form that was released by the Maine Revenue Services - a government authority operating within Maine.The document is a supplement to Form 1120ME, Maine Corporate Income Tax Return. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 1120ME?

A: Form 1120ME is a tax form used by corporations in Maine to report their income, deductions, credits, and tax liability.

Q: What is Schedule C?

A: Schedule C is a supplementary form to Form 1120ME that is used to report tax credits for corporations in Maine.

Q: What are tax credits?

A: Tax credits are incentives provided by the government that reduce the amount of tax owed by a corporation.

Q: Who is eligible to claim tax credits on Form 1120ME Schedule C?

A: Corporations in Maine that meet certain criteria are eligible to claim tax credits on Form 1120ME Schedule C.

Q: What types of tax credits can be claimed on Form 1120ME Schedule C?

A: Form 1120ME Schedule C allows corporations to claim various tax credits, such as the Research Expense Credit, the Investment Credit, and the Rural Job Tax Credit.

Q: How does Form 1120ME Schedule C affect a corporation's tax liability?

A: By claiming tax credits on Form 1120ME Schedule C, a corporation can reduce its tax liability, potentially resulting in a lower tax bill.

Q: Is it mandatory for corporations in Maine to file Form 1120ME and Schedule C?

A: Yes, it is mandatory for corporations in Maine to file Form 1120ME and Schedule C if they meet the filing requirements.

Q: Are there any penalties for not filing Form 1120ME and Schedule C?

A: Yes, corporations that fail to file Form 1120ME and Schedule C or file them late may be subject to penalties imposed by the Maine Revenue Services.

Q: Can I claim tax credits for previous years on Form 1120ME Schedule C?

A: No, Form 1120ME Schedule C is used to claim tax credits for the current tax year only. Credits for previous years must be claimed on the appropriate forms for those years.

Form Details:

- The latest edition provided by the Maine Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 1120ME Schedule C by clicking the link below or browse more documents and templates provided by the Maine Revenue Services.