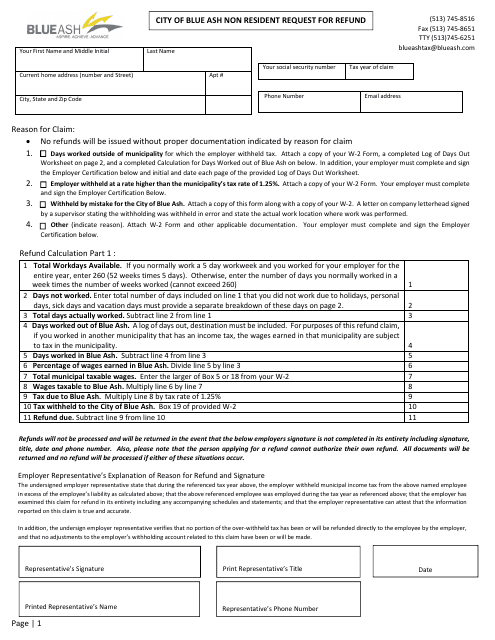

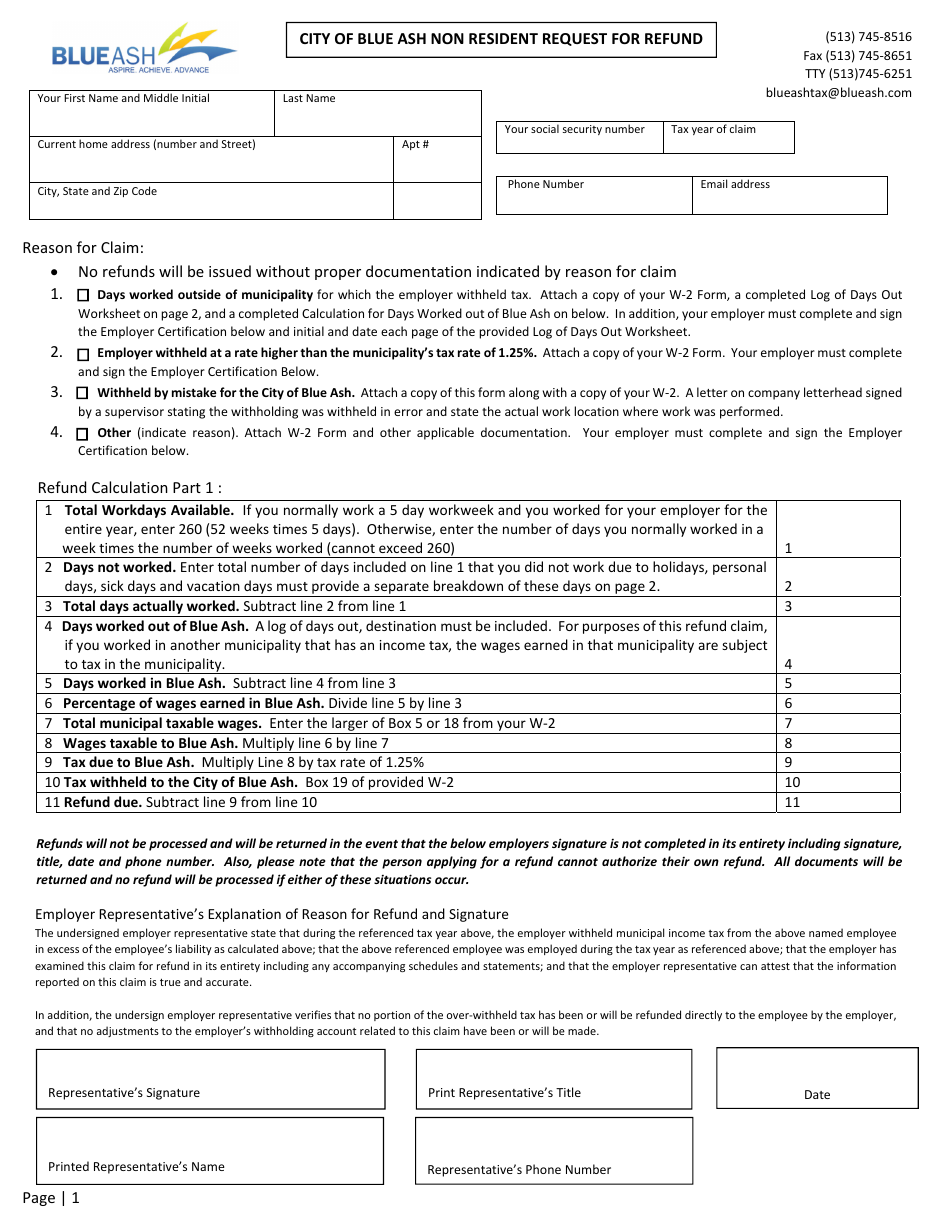

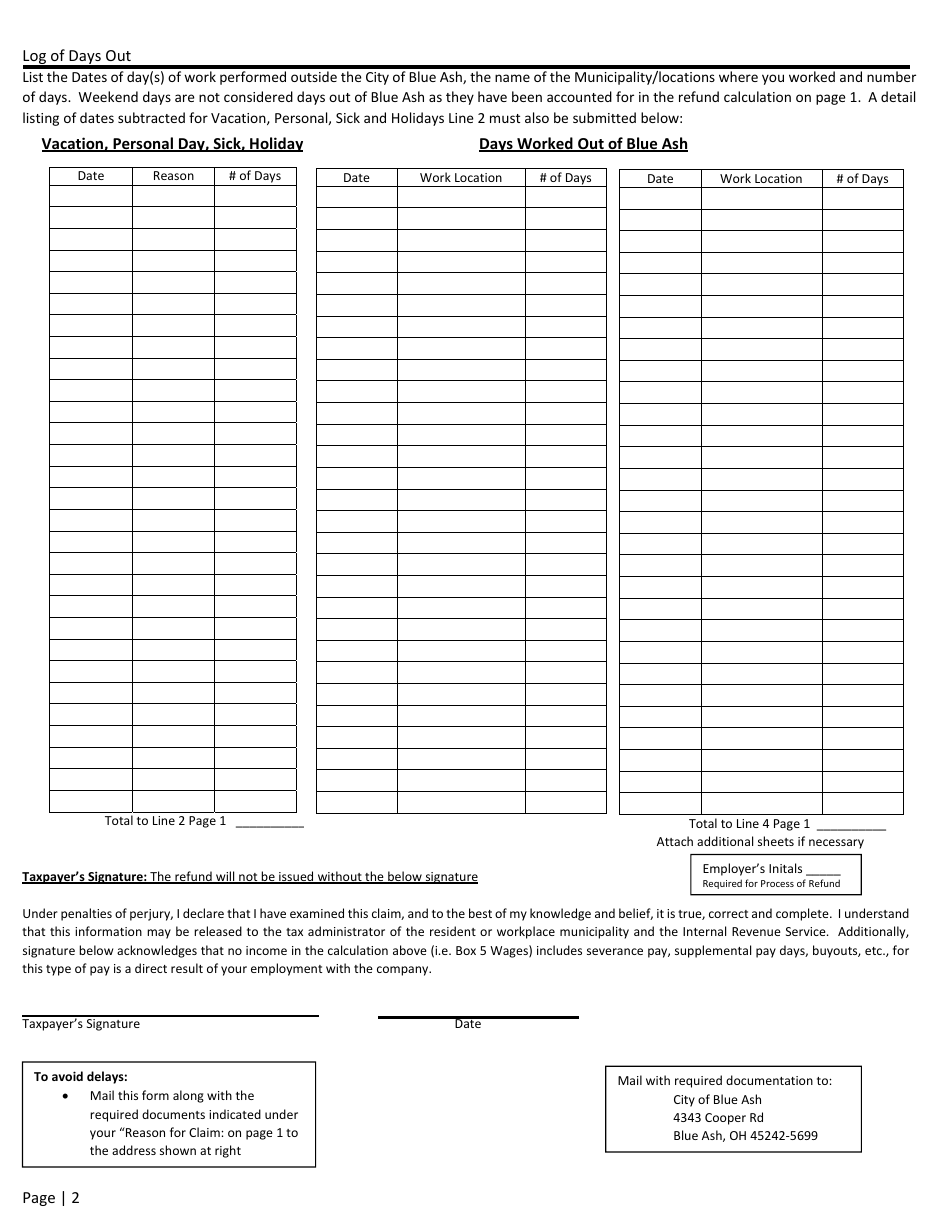

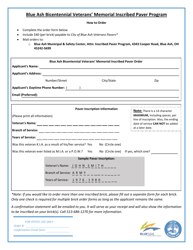

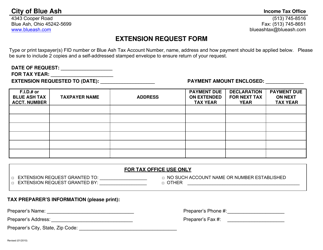

Non-resident Request for Refund - City of Blue Ash, Ohio

Non-resident Request for Refund is a legal document that was released by the Tax Office - City of Blue Ash, Ohio - a government authority operating within Ohio. The form may be used strictly within City of Blue Ash.

FAQ

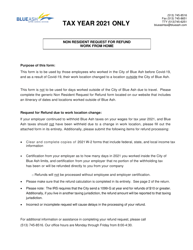

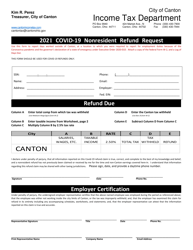

Q: What is a non-resident request for refund?

A: A non-resident request for refund is a request made by someone who does not live in the city of Blue Ash, Ohio to receive a refund.

Q: Why would someone submit a non-resident request for refund?

A: Someone may submit a non-resident request for refund if they have overpaid taxes or fees to the city of Blue Ash, Ohio.

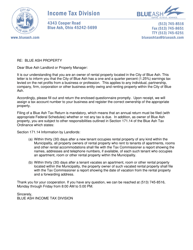

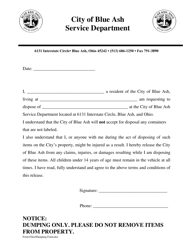

Q: How can someone submit a non-resident request for refund?

A: To submit a non-resident request for refund, you will need to contact the City of Blue Ash's finance department and follow their instructions.

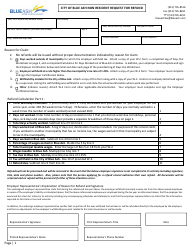

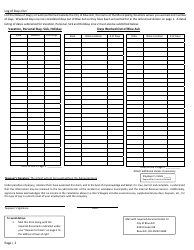

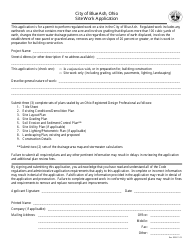

Q: What documents or information may be required for a non-resident request for refund?

A: The City of Blue Ash's finance department may require documentation such as proof of payment, proof of non-residency, and a completed refund request form.

Q: How long does it take to process a non-resident request for refund?

A: The processing time for a non-resident request for refund can vary, but it typically takes several weeks to be processed and for the refund to be issued.

Form Details:

- The latest edition currently provided by the Tax Office - City of Blue Ash, Ohio;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Tax Office - City of Blue Ash, Ohio.