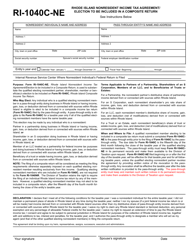

This version of the form is not currently in use and is provided for reference only. Download this version of

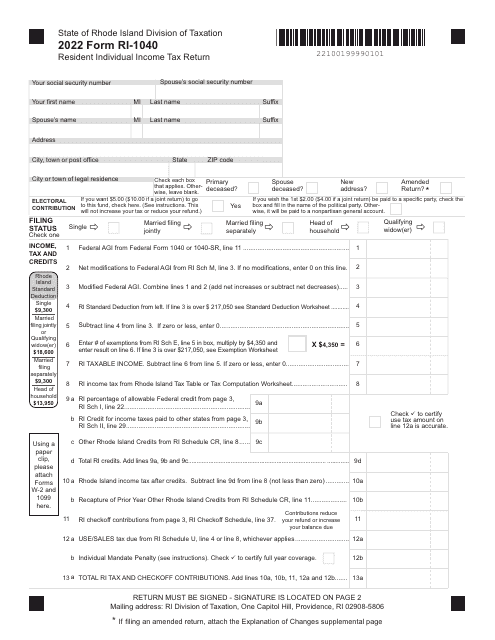

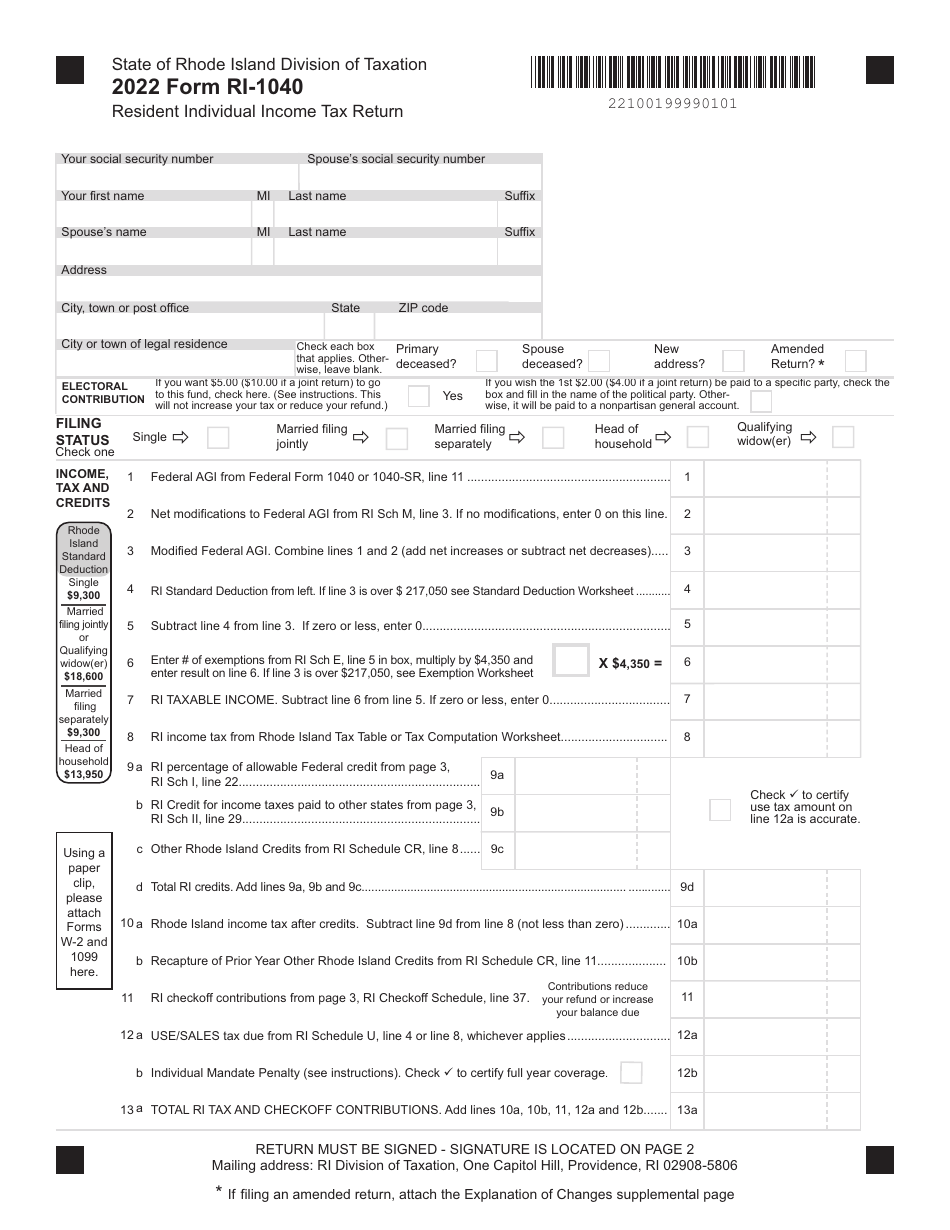

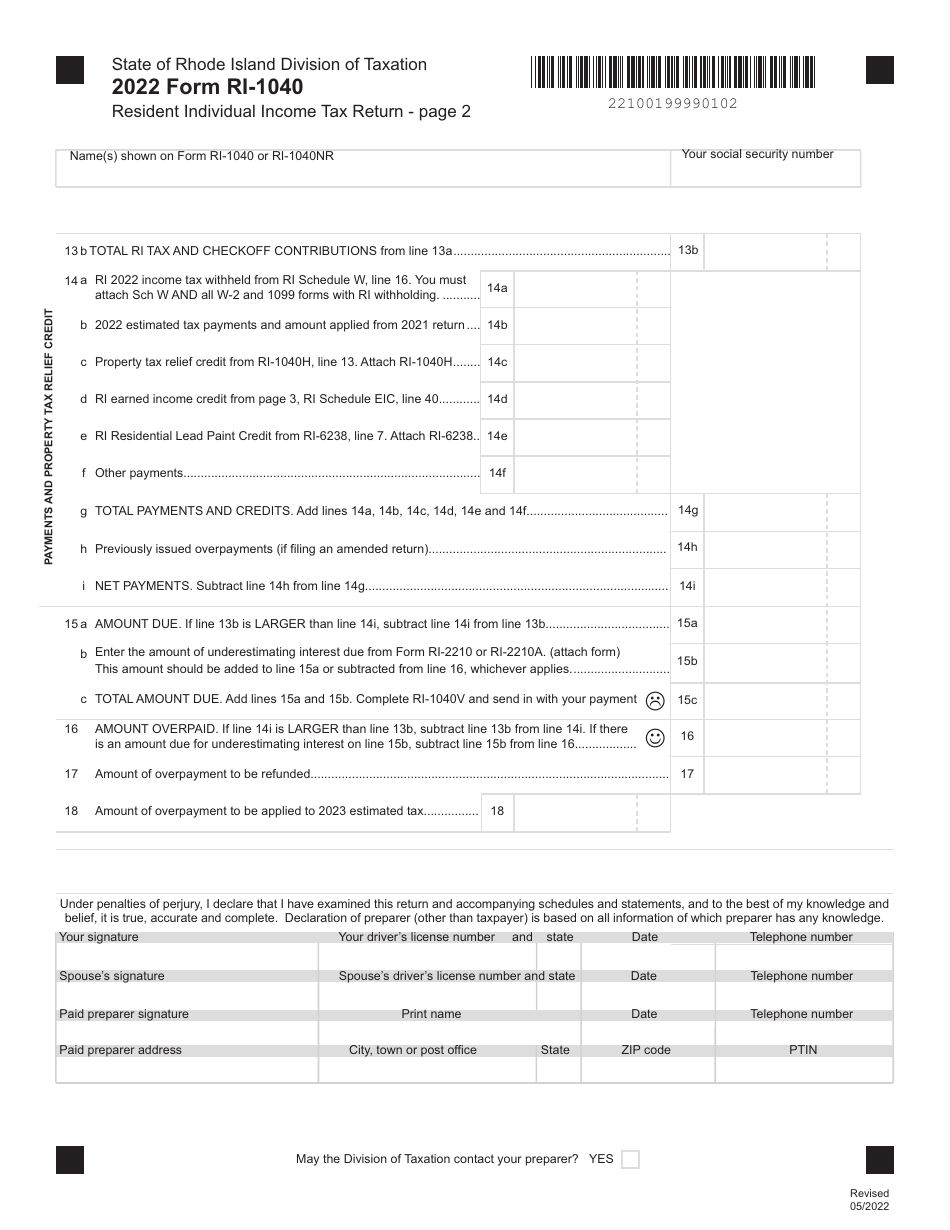

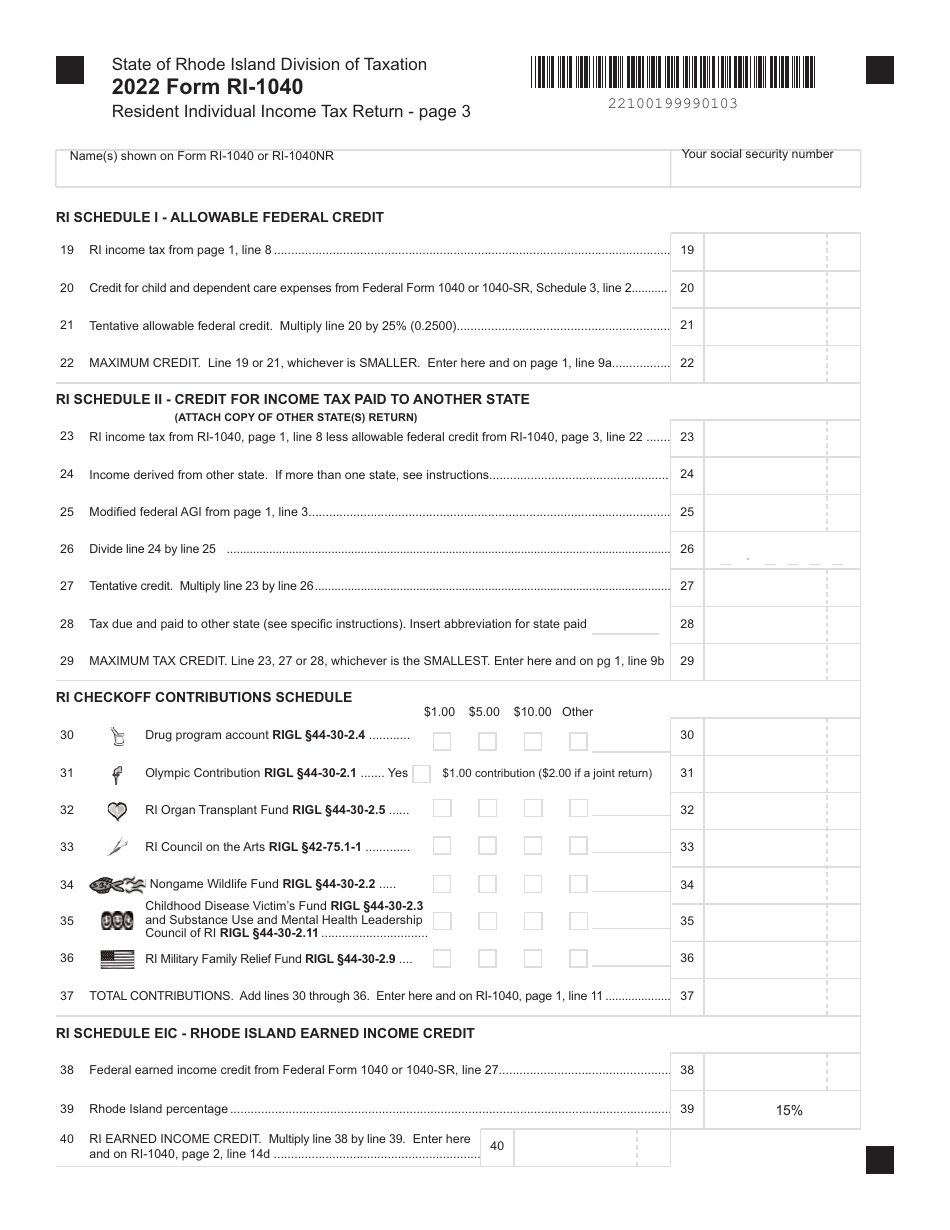

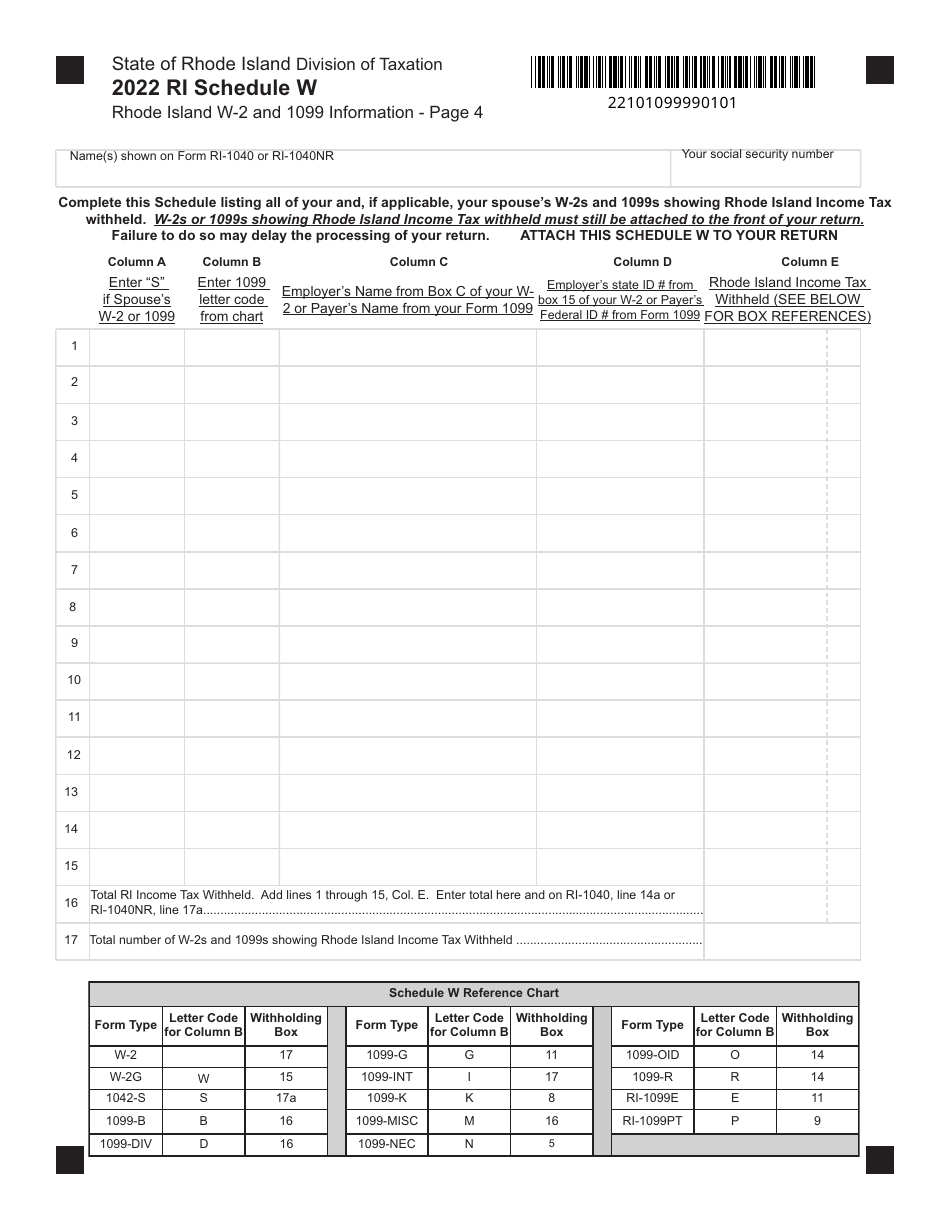

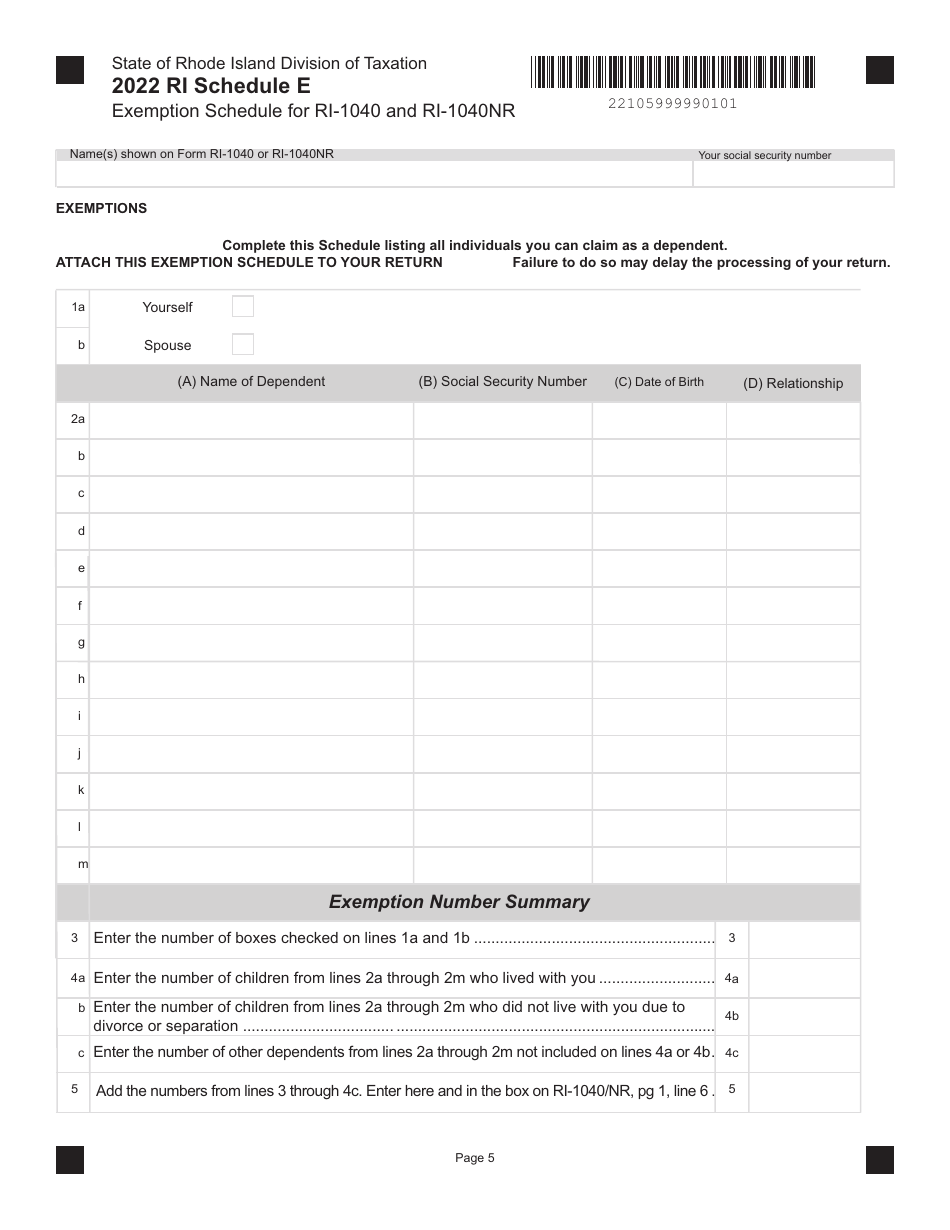

Form RI-1040

for the current year.

Form RI-1040 Resident Individual Income Tax Return - Rhode Island

What Is Form RI-1040?

This is a legal form that was released by the Rhode Island Department of Revenue - Division of Taxation - a government authority operating within Rhode Island. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form RI-1040?

A: Form RI-1040 is the Resident Individual Income Tax Return for Rhode Island residents.

Q: Who needs to file Form RI-1040?

A: Rhode Island residents who have taxable income need to file Form RI-1040.

Q: What is taxable income?

A: Taxable income is the total income you earn during the year that is subject to taxation.

Q: What information is required to complete Form RI-1040?

A: To complete Form RI-1040, you will need to provide information about your income, deductions, and tax credits.

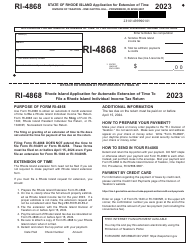

Q: When is the deadline to file Form RI-1040?

A: The deadline to file Form RI-1040 is typically April 15th, but it may vary depending on the tax year.

Q: Are there any penalties for not filing Form RI-1040 on time?

A: Yes, if you fail to file Form RI-1040 on time, you may be subject to penalties and interest on any taxes owed.

Q: Can I e-file Form RI-1040?

A: Yes, you can e-file Form RI-1040 using approved software or through a tax professional.

Q: What if I can't pay the taxes I owe?

A: If you can't pay the taxes you owe, you should still file Form RI-1040 and arrange a payment plan with the Rhode Island Division of Taxation.

Q: Can I claim a refund on Form RI-1040?

A: Yes, if you overpaid your taxes, you can claim a refund on Form RI-1040.

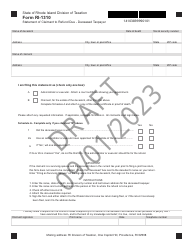

Form Details:

- Released on May 1, 2022;

- The latest edition provided by the Rhode Island Department of Revenue - Division of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RI-1040 by clicking the link below or browse more documents and templates provided by the Rhode Island Department of Revenue - Division of Taxation.