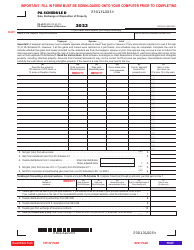

This version of the form is not currently in use and is provided for reference only. Download this version of

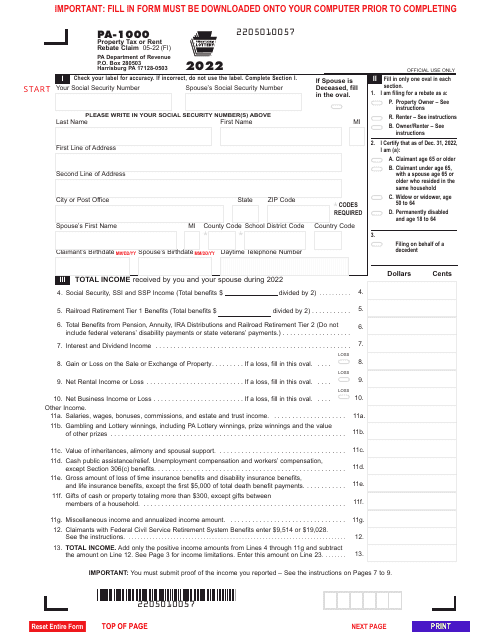

Form PA-1000

for the current year.

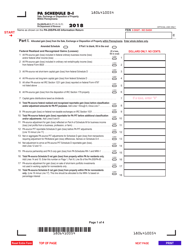

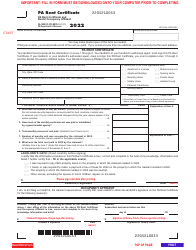

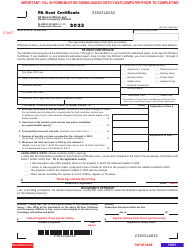

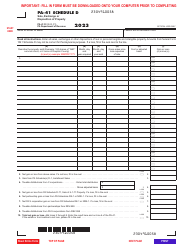

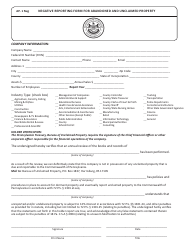

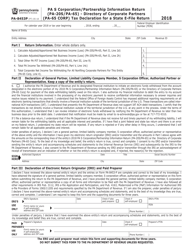

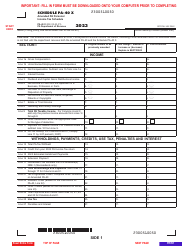

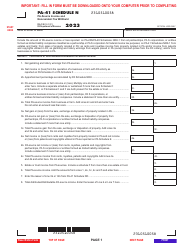

Form PA-1000 Property Tax or Rent Rebate Claim - Pennsylvania

What Is Form PA-1000?

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the PA-1000 Property Tax or Rent Rebate Claim?

A: PA-1000 is a form used in Pennsylvania to apply for property tax or rent rebates.

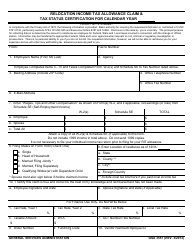

Q: Who is eligible to file a PA-1000 claim?

A: Eligibility for the PA-1000 depends on age, income, and disability status. It is primarily for low-income senior citizens and individuals with disabilities.

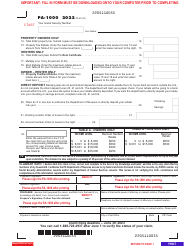

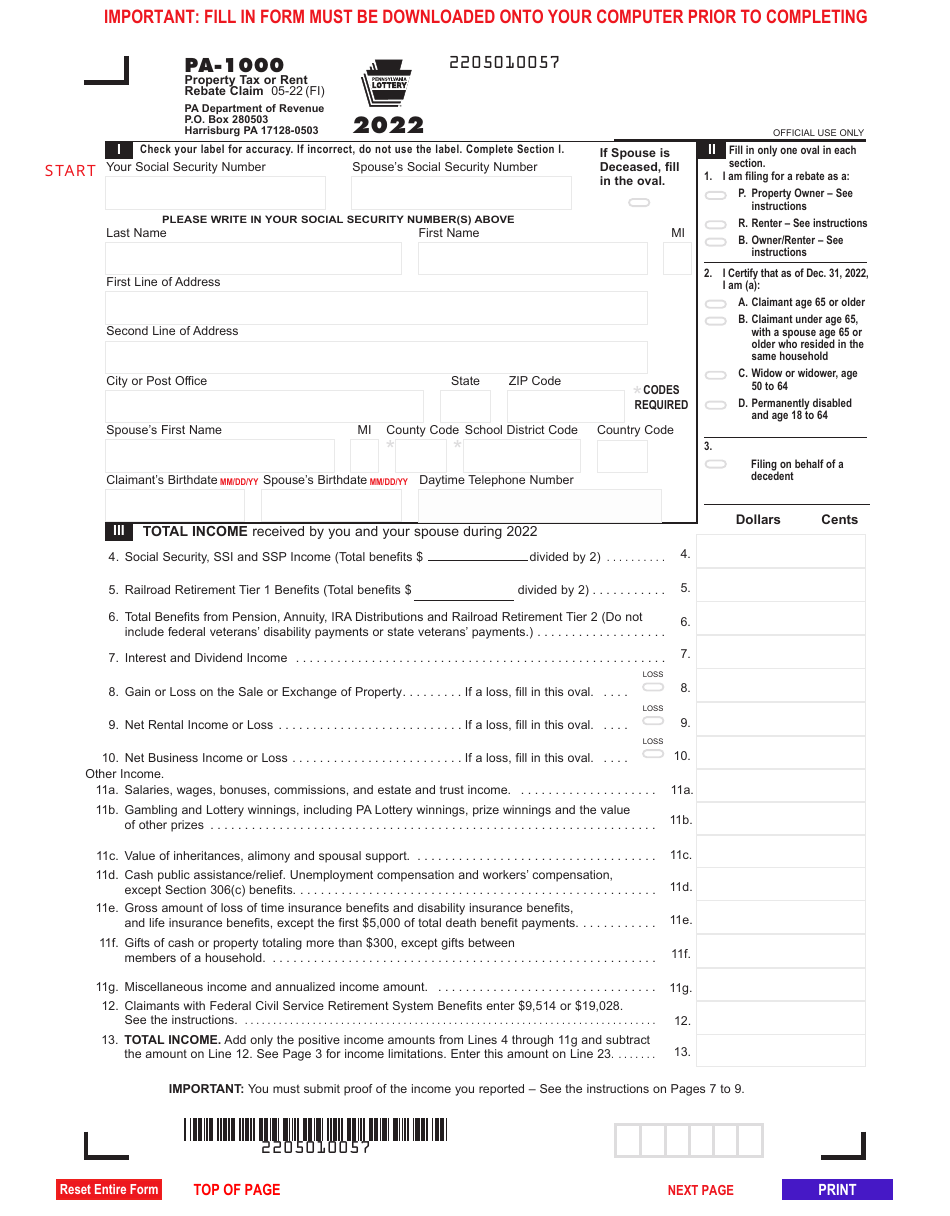

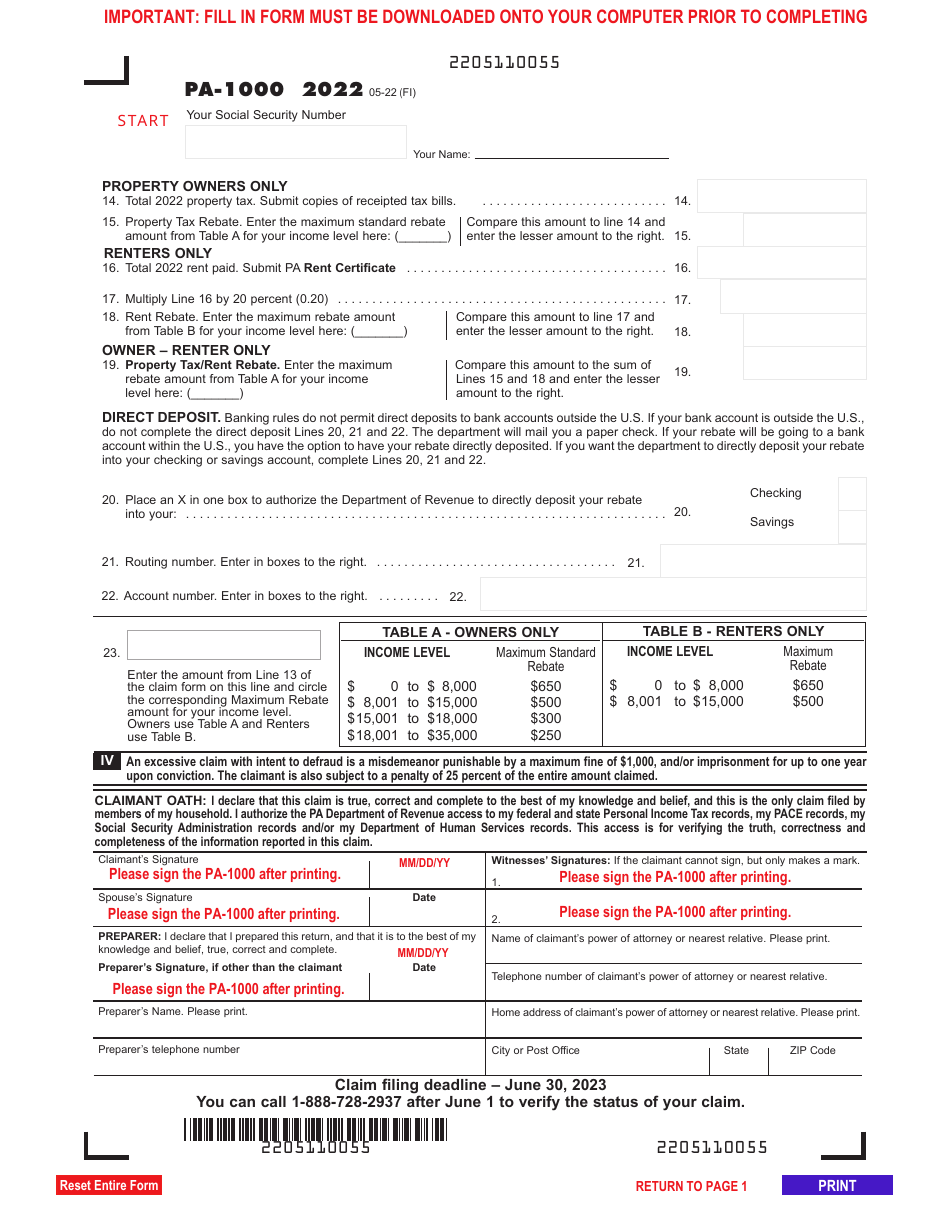

Q: How do I apply for a property tax or rent rebate in Pennsylvania?

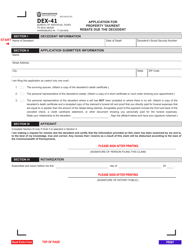

A: You can apply for the rebate by completing the PA-1000 form and submitting it to the Pennsylvania Department of Revenue.

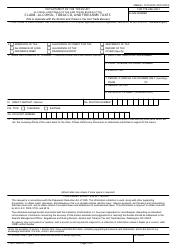

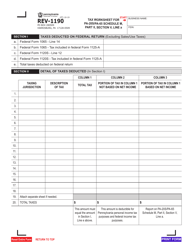

Q: What documents do I need to include with my PA-1000 claim?

A: You will need to provide proof of income, such as copies of your tax returns or other income documents, as well as documentation of your property tax or rent payments.

Q: When is the deadline to submit a PA-1000 claim?

A: The deadline to submit a PA-1000 claim is usually June 30th of the following year.

Q: How much can I receive in property tax or rent rebates in Pennsylvania?

A: The amount of the rebate depends on your income and the amount of property tax or rent you paid. The maximum rebate amount is $650.

Q: How long does it take to receive a property tax or rent rebate in Pennsylvania?

A: Typically, it takes 4-6 weeks to process a PA-1000 claim.

Q: Are there any fees associated with filing a PA-1000 claim?

A: No, there are no fees to file a PA-1000 claim. It is free to apply for the property tax or rent rebate.

Q: What if I need help completing the PA-1000 form?

A: If you need assistance completing the form, you can reach out to the Pennsylvania Department of Revenue or your local Area Agency on Aging for guidance.

Form Details:

- Released on May 1, 2022;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PA-1000 by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.