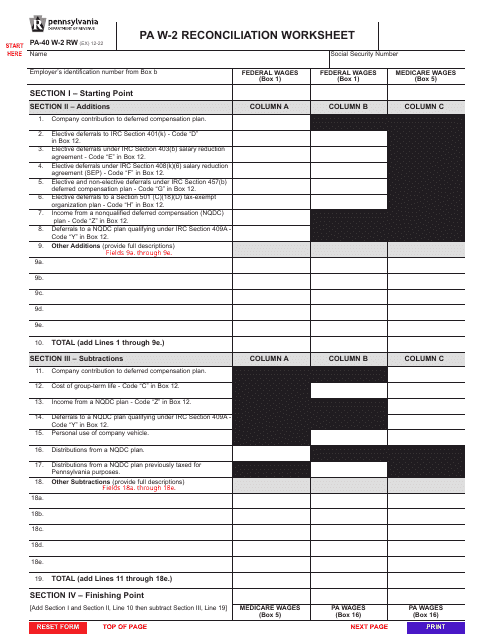

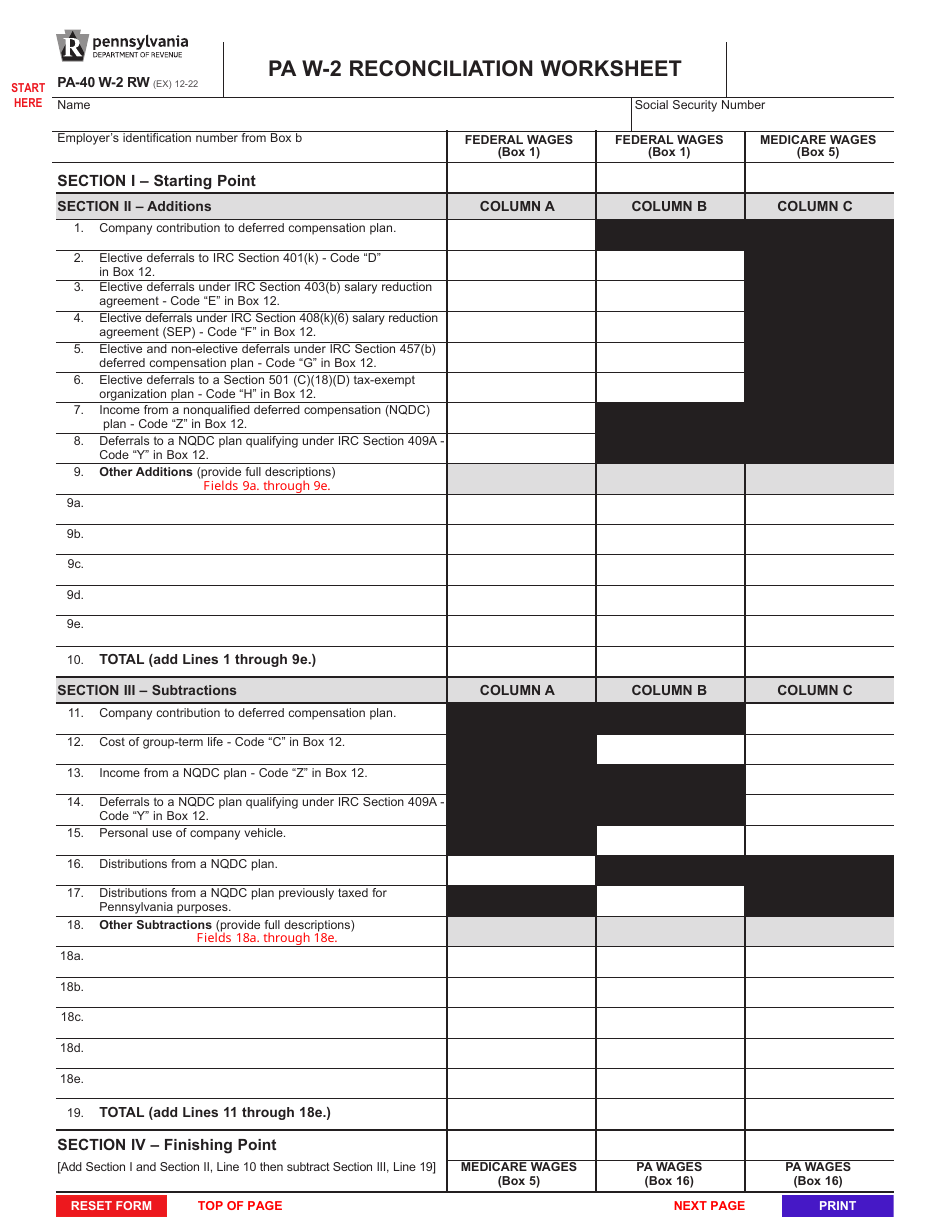

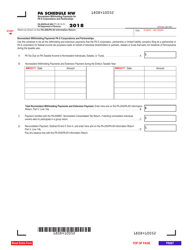

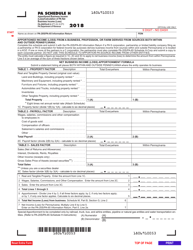

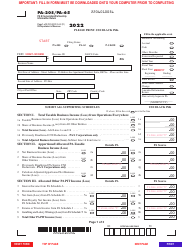

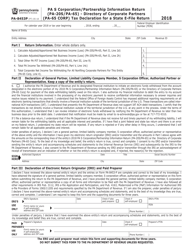

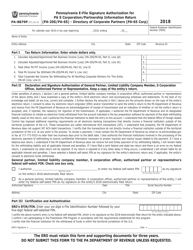

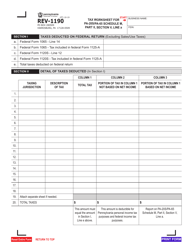

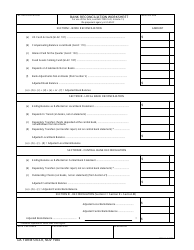

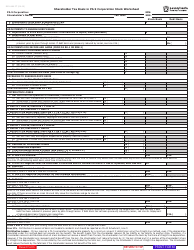

Form PA-40 W-2 RW Pa W-2 Reconciliation Worksheet - Pennsylvania

What Is Form PA-40 W-2 RW?

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PA-40 W-2 RW?

A: Form PA-40 W-2 RW is the Pennsylvania W-2 Reconciliation Worksheet.

Q: What is the purpose of Form PA-40 W-2 RW?

A: Form PA-40 W-2 RW is used to reconcile the information reported on your federal W-2 forms and the Pennsylvania state withholding tax returns.

Q: Who needs to file Form PA-40 W-2 RW?

A: If you are an employer who has filed or is required to file 250 or more W-2 forms with Pennsylvania, you must file Form PA-40 W-2 RW.

Q: When is Form PA-40 W-2 RW due?

A: Form PA-40 W-2 RW is due on or before February 28th each year.

Q: What information do I need to complete Form PA-40 W-2 RW?

A: You will need the information from your federal W-2 forms, including employee wages, withholding amounts, and employer information.

Q: Can I e-file Form PA-40 W-2 RW?

A: No, you cannot e-file Form PA-40 W-2 RW. It must be filed by mail.

Q: Are there any penalties for not filing Form PA-40 W-2 RW?

A: Yes, failure to file Form PA-40 W-2 RW may result in penalties and interest.

Q: Can I request an extension to file Form PA-40 W-2 RW?

A: No, there is no extension available for filing Form PA-40 W-2 RW. It must be filed on time.

Q: Who should I contact if I have questions about Form PA-40 W-2 RW?

A: If you have questions about Form PA-40 W-2 RW, you can contact the Pennsylvania Department of Revenue.

Form Details:

- Released on December 1, 2022;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PA-40 W-2 RW by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.