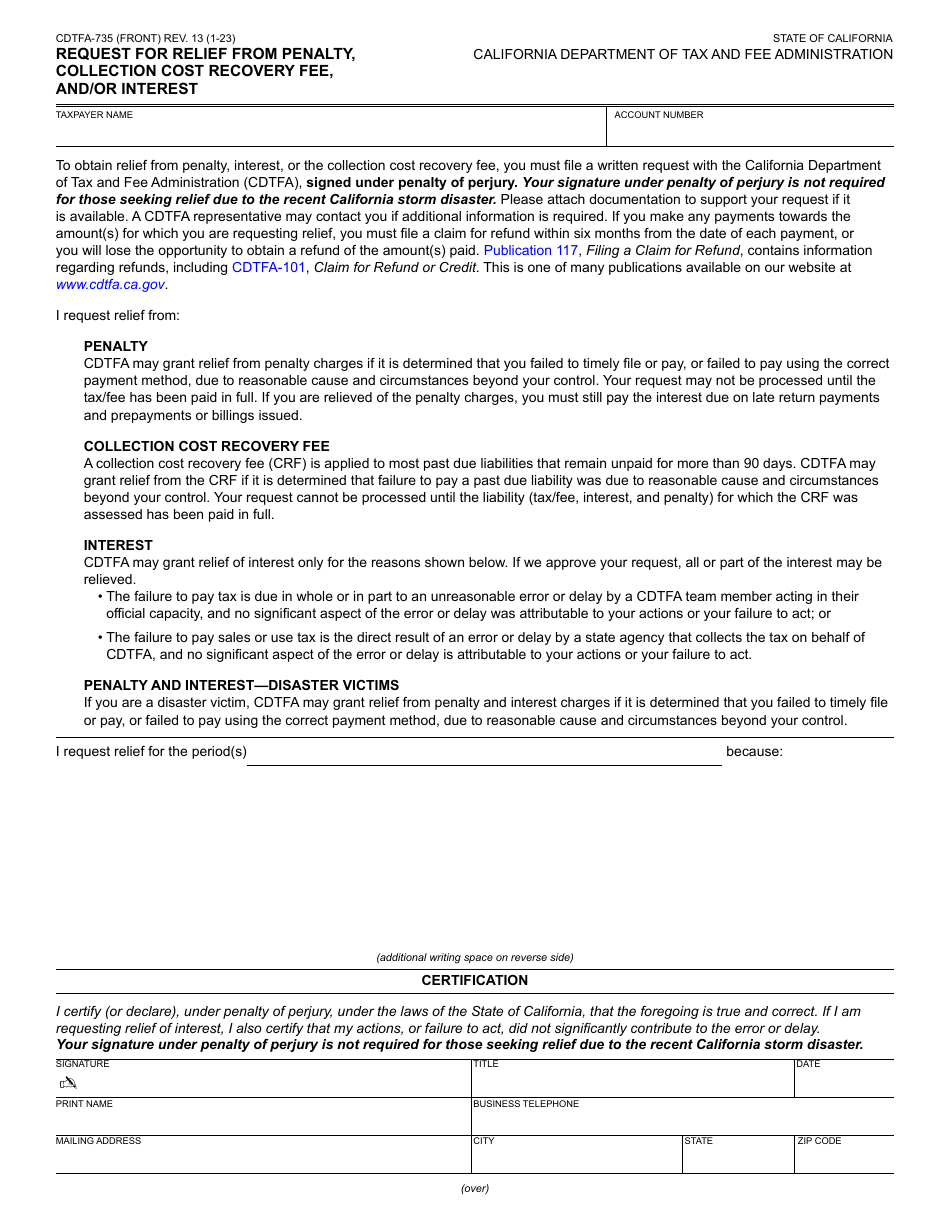

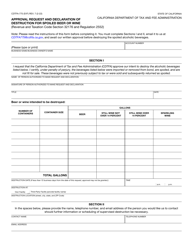

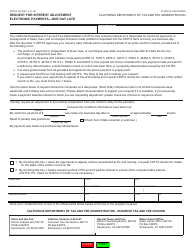

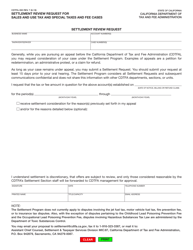

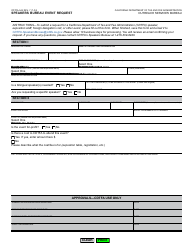

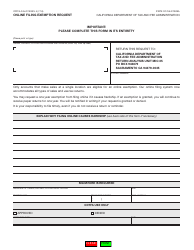

Form CDTFA-735 Request for Relief From Penalty, Collection Cost Recovery Fee, and / or Interest - California

What Is Form CDTFA-735?

This is a legal form that was released by the California Department of Tax and Fee Administration - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CDTFA-735?

A: Form CDTFA-735 is a request for relief from penalty, collection cost recovery fee, and/or interest in the state of California.

Q: What can I request relief from using Form CDTFA-735?

A: You can request relief from penalties, collection cost recovery fees, and/or interest.

Q: Who can use Form CDTFA-735?

A: Any taxpayer who has incurred penalties, collection cost recovery fees, and/or interest in the state of California can use Form CDTFA-735.

Q: Is there a deadline for submitting Form CDTFA-735?

A: Yes, there is a deadline for submitting Form CDTFA-735. The deadline is typically within three years from the date the tax or fee liability was due.

Q: Are there any fees associated with filing Form CDTFA-735?

A: No, there are no fees associated with filing Form CDTFA-735.

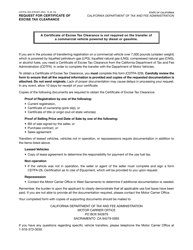

Q: What supporting documents do I need to include with Form CDTFA-735?

A: You should include any supporting documents that provide evidence or justification for your request for relief.

Q: How long does it take to receive a decision on a request for relief?

A: The processing time for a request for relief can vary, but you should receive a decision within a reasonable amount of time.

Q: What should I do if my request for relief is denied?

A: If your request for relief is denied, you may have the option to appeal the decision. You should follow the instructions provided in the denial notice for further steps.

Form Details:

- Released on January 1, 2023;

- The latest edition provided by the California Department of Tax and Fee Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CDTFA-735 by clicking the link below or browse more documents and templates provided by the California Department of Tax and Fee Administration.