This version of the form is not currently in use and is provided for reference only. Download this version of

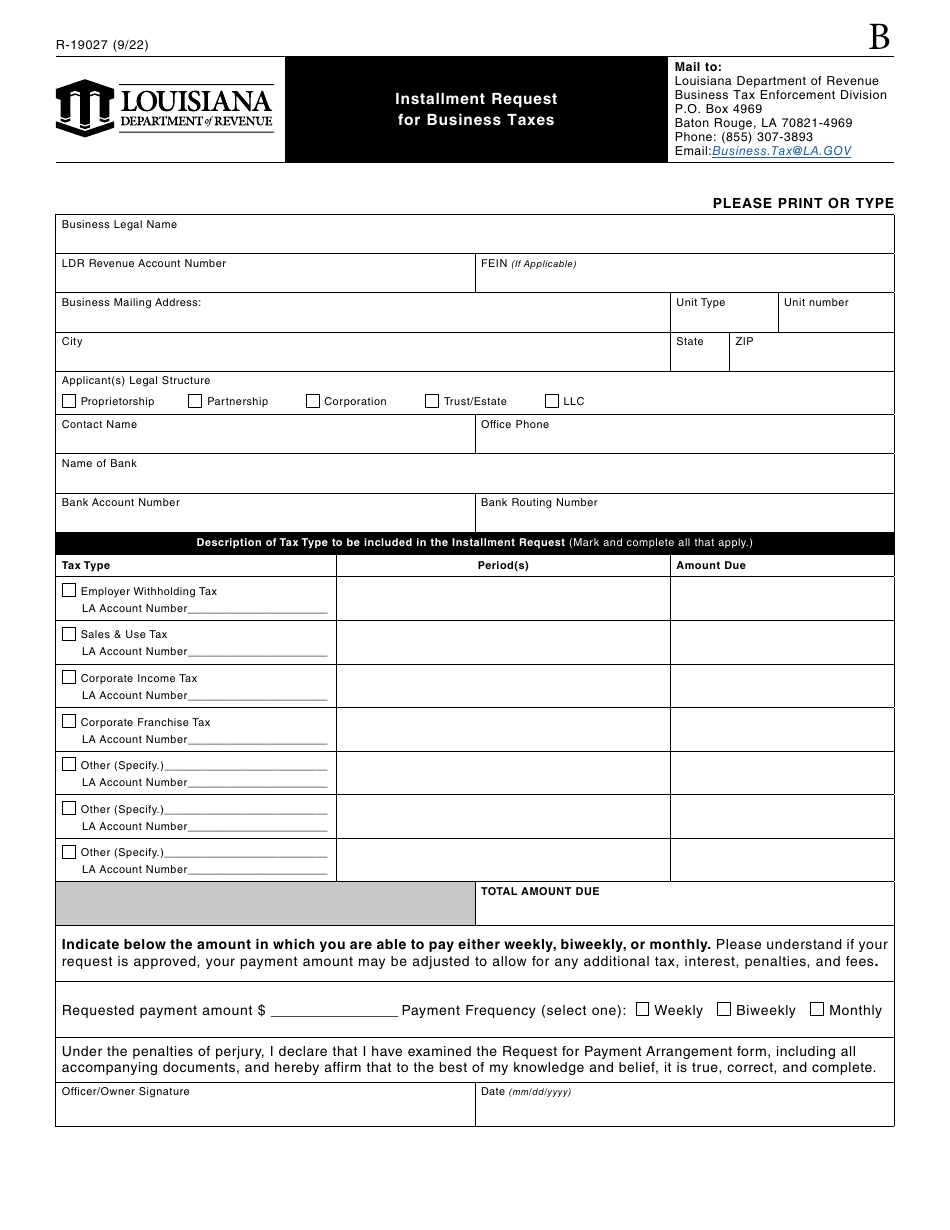

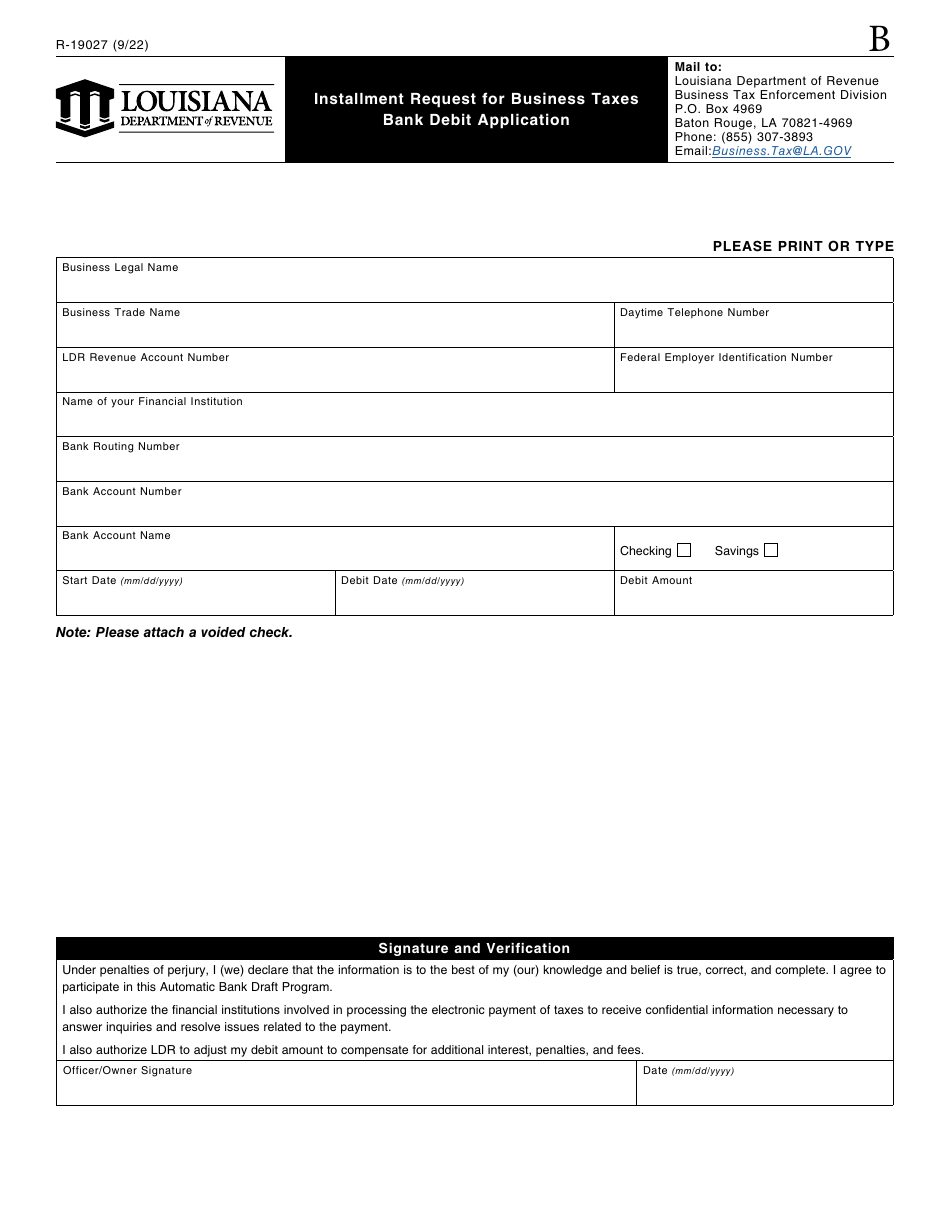

Form R-19027

for the current year.

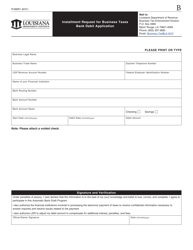

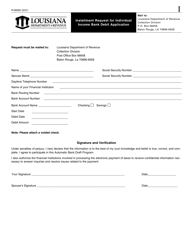

Form R-19027 Installment Request for Business Tax - Louisiana

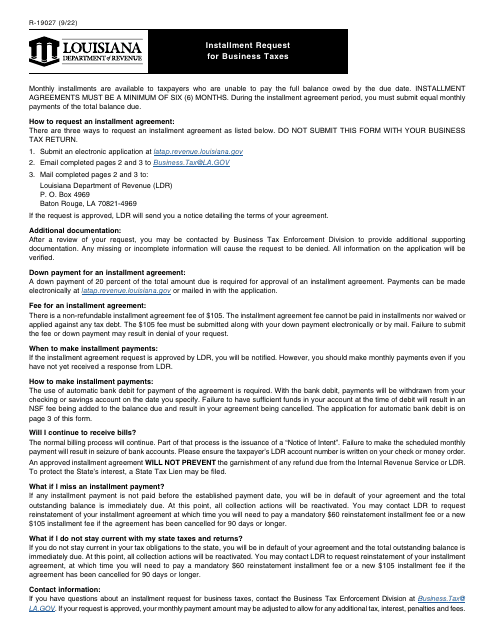

What Is Form R-19027?

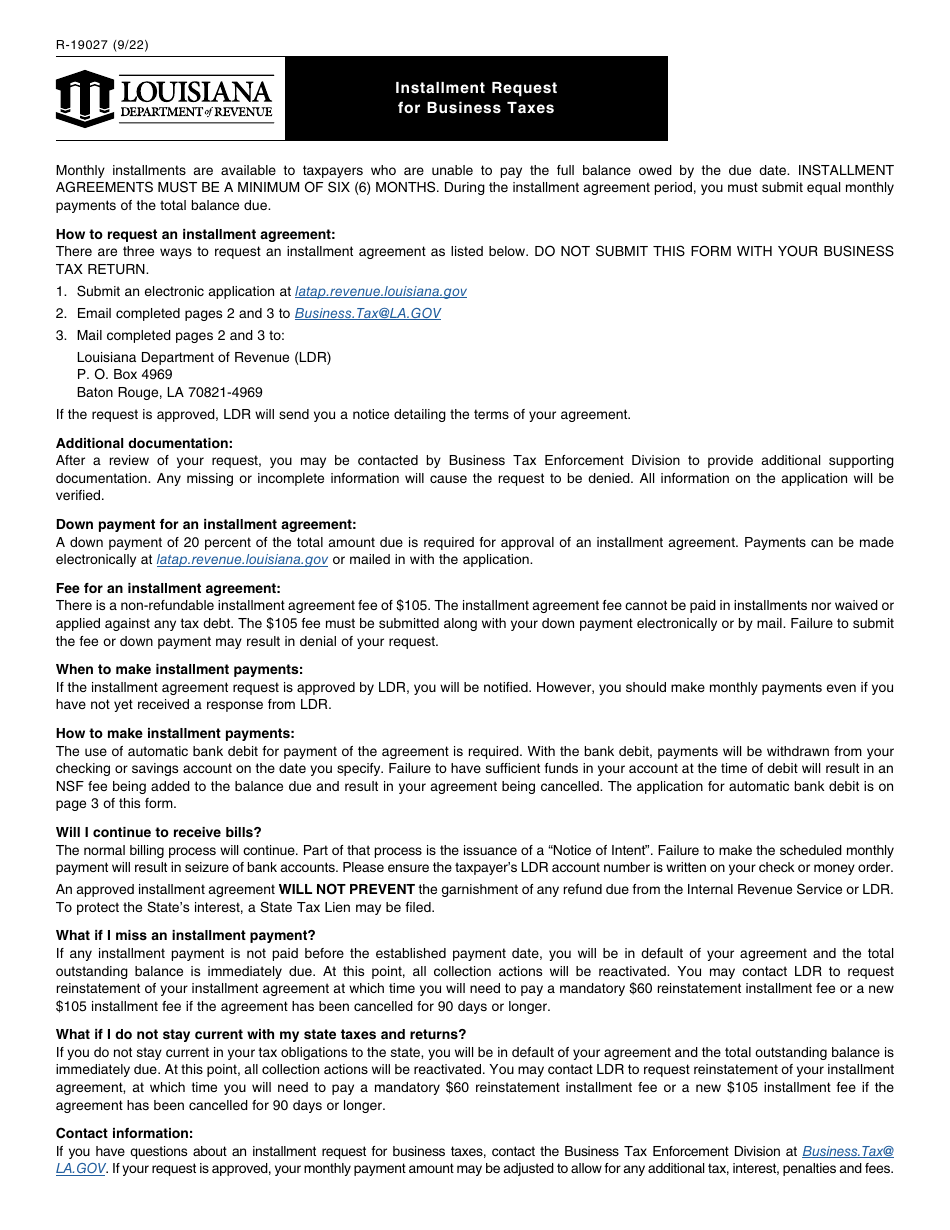

This is a legal form that was released by the Louisiana Department of Revenue - a government authority operating within Louisiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form R-19027?

A: Form R-19027 is an Installment Request form for Business Tax in Louisiana.

Q: Who can use Form R-19027?

A: This form can be used by businesses in Louisiana to request an installment plan for paying their taxes.

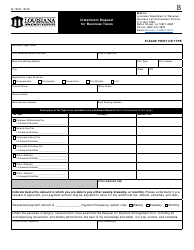

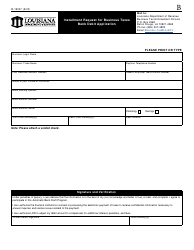

Q: What information is required on Form R-19027?

A: The form requires information such as the business's name, tax account number, and details of the requested installment plan.

Q: Can I request an installment plan for past due taxes?

A: Yes, you can use Form R-19027 to request an installment plan for past due taxes.

Q: Is there a fee for requesting an installment plan?

A: No, there is no fee for requesting an installment plan using Form R-19027.

Q: How long does it take to process the installment request?

A: The processing time for the installment request can vary, but it generally takes several weeks to receive a decision.

Q: What happens if I fail to make payments according to the installment plan?

A: If you fail to make payments according to the installment plan, the Louisiana Department of Revenue may take further enforcement actions, such as placing a lien on your business.

Q: Can I modify or cancel my installment plan?

A: Yes, you can request modifications or cancellations of your installment plan by contacting the Louisiana Department of Revenue.

Form Details:

- Released on September 1, 2022;

- The latest edition provided by the Louisiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form R-19027 by clicking the link below or browse more documents and templates provided by the Louisiana Department of Revenue.