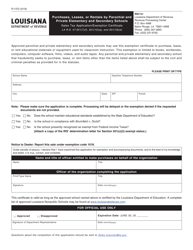

This version of the form is not currently in use and is provided for reference only. Download this version of

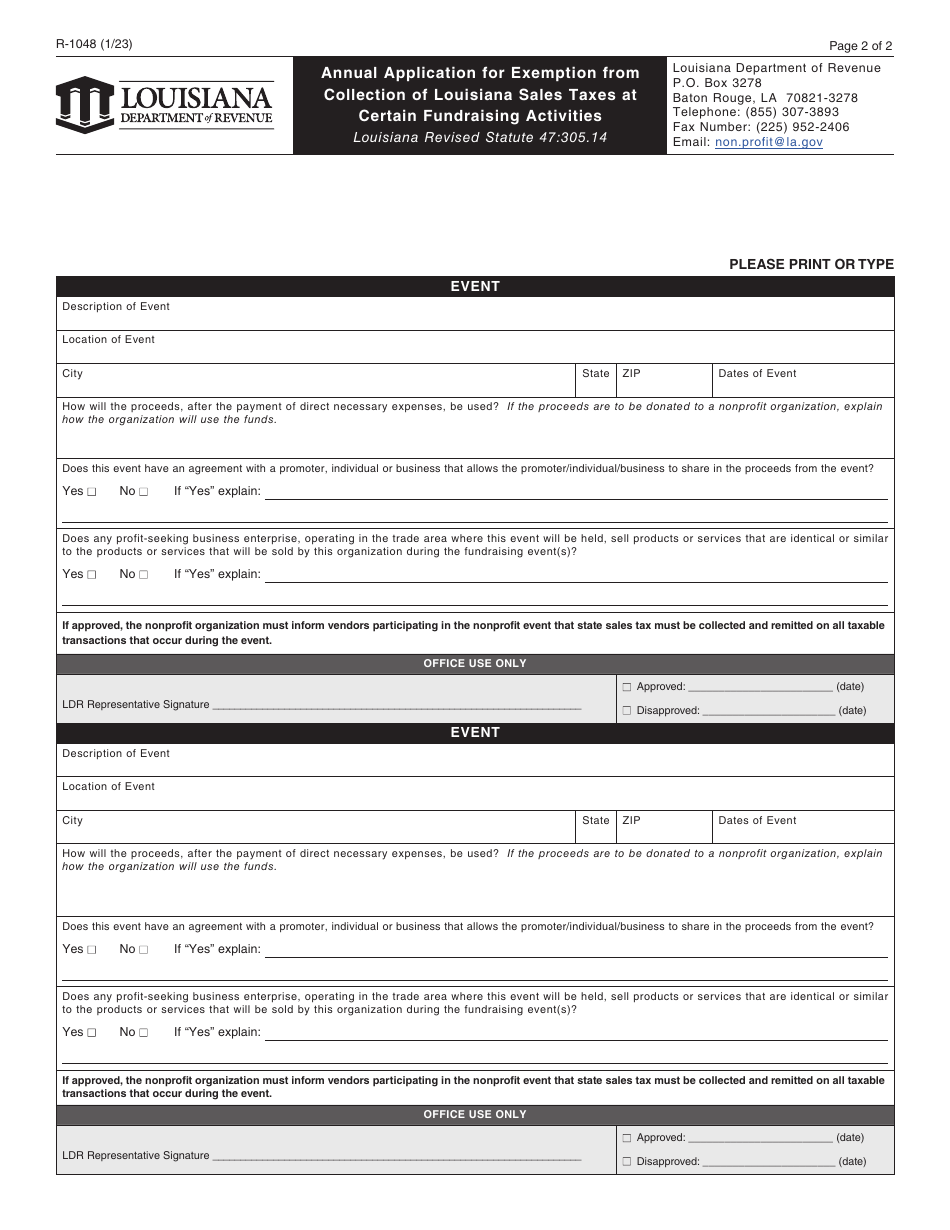

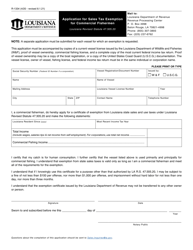

Form R-1048

for the current year.

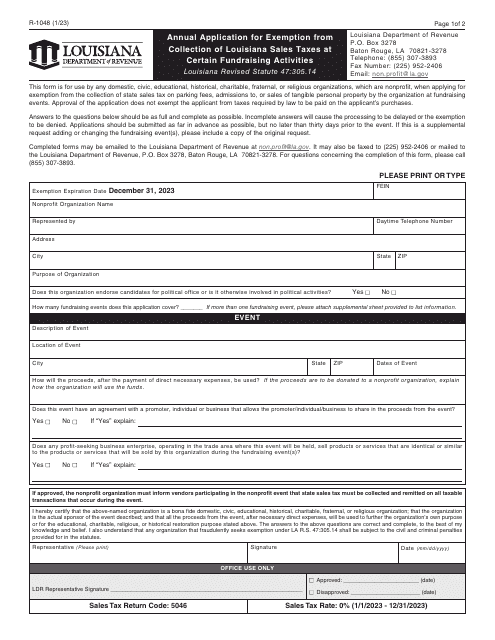

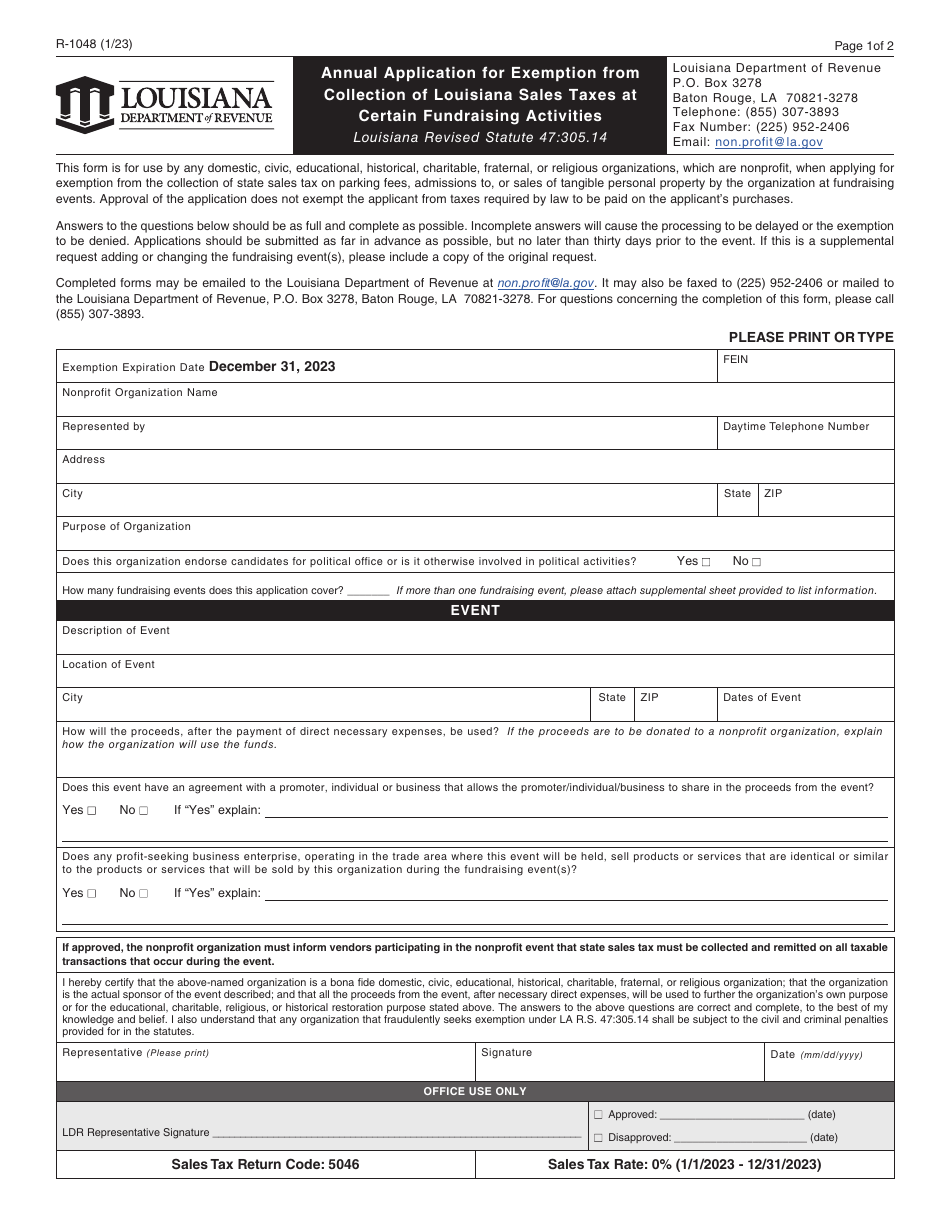

Form R-1048 Annual Application for Exemption From Collection of Louisiana Sales Taxes at Certain Fundraising Activities - Louisiana

What Is Form R-1048?

This is a legal form that was released by the Louisiana Department of Revenue - a government authority operating within Louisiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form R-1048?

A: Form R-1048 is the Annual Application for Exemption From Collection of Louisiana Sales Taxes at Certain Fundraising Activities.

Q: What is the purpose of Form R-1048?

A: The purpose of Form R-1048 is to apply for an exemption from collecting Louisiana sales taxes for certain fundraising activities.

Q: Who needs to file Form R-1048?

A: Organizations that are engaged in fundraising activities in Louisiana and meet the eligibility requirements need to file Form R-1048.

Q: How often do organizations need to file Form R-1048?

A: Organizations need to file Form R-1048 annually.

Q: What are the eligibility requirements for exemption?

A: The eligibility requirements for exemption include being a non-profit, charitable, religious, or educational organization, and not conducting more than three fundraising activities during the calendar year.

Form Details:

- Released on January 1, 2023;

- The latest edition provided by the Louisiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form R-1048 by clicking the link below or browse more documents and templates provided by the Louisiana Department of Revenue.