This version of the form is not currently in use and is provided for reference only. Download this version of

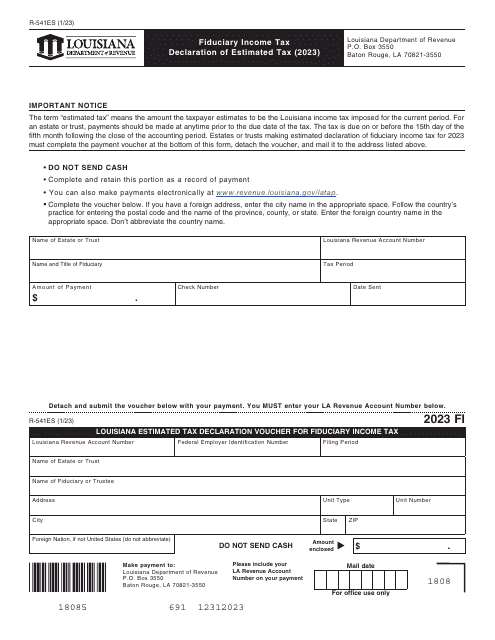

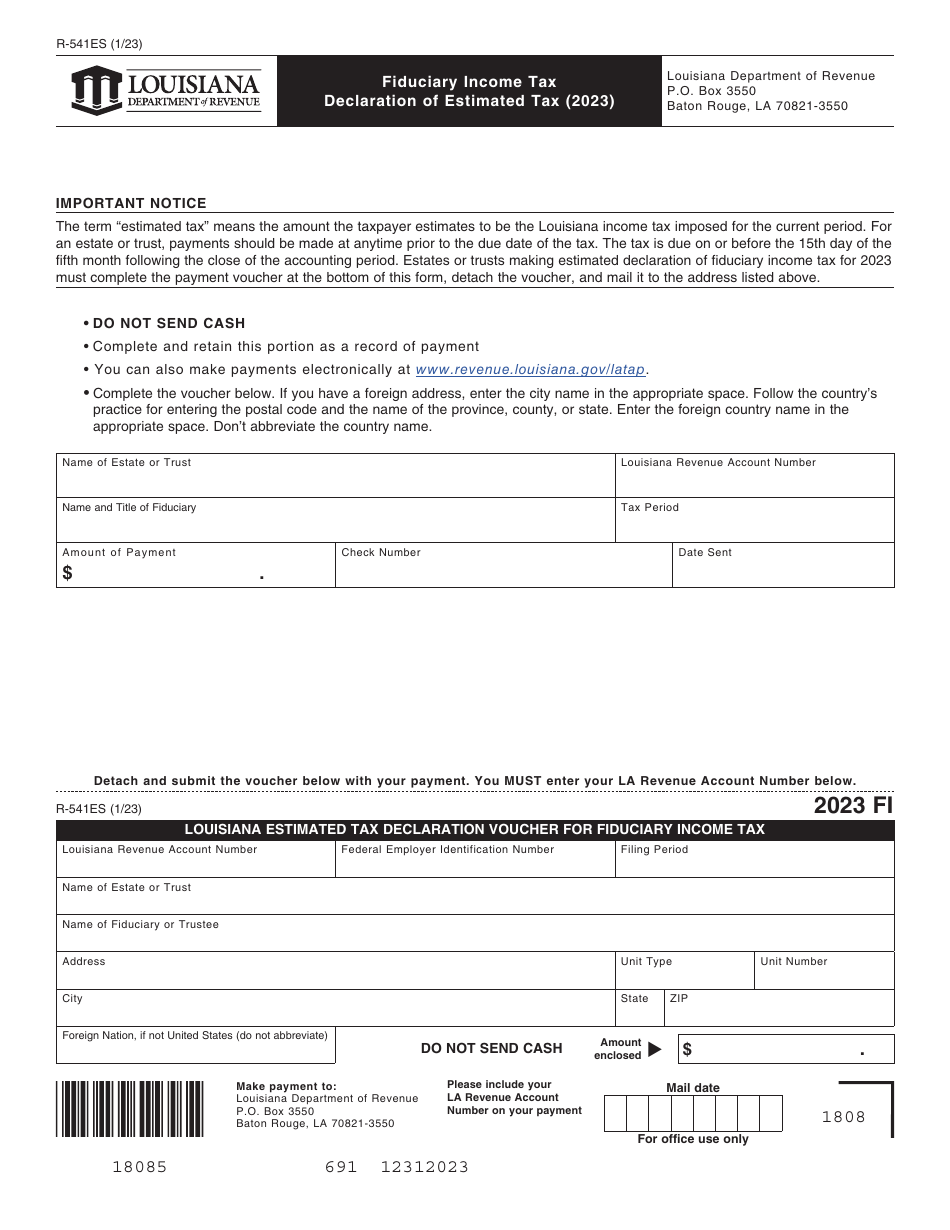

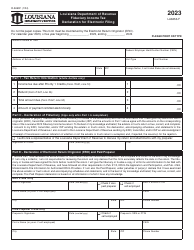

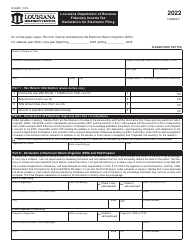

Form R-541ES

for the current year.

Form R-541ES Fiduciary Income Tax Declaration of Estimated Tax - Louisiana

What Is Form R-541ES?

This is a legal form that was released by the Louisiana Department of Revenue - a government authority operating within Louisiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form R-541ES?

A: Form R-541ES is the Fiduciary Income Tax Declaration of Estimated Tax specifically for Louisiana.

Q: Who should use Form R-541ES?

A: Form R-541ES should be used by fiduciaries in Louisiana who need to make estimated tax payments.

Q: What is the purpose of Form R-541ES?

A: The purpose of Form R-541ES is to declare and pay estimated income tax for fiduciaries in Louisiana.

Q: When is Form R-541ES due?

A: Form R-541ES is due on the 15th day of the fourth month following the close of the tax year.

Form Details:

- Released on January 1, 2023;

- The latest edition provided by the Louisiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form R-541ES by clicking the link below or browse more documents and templates provided by the Louisiana Department of Revenue.