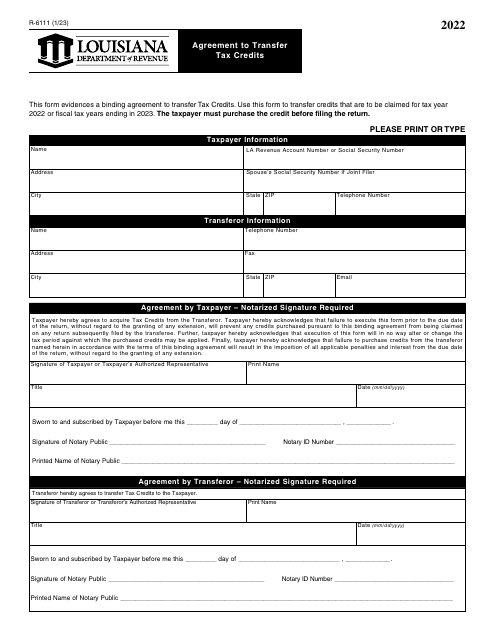

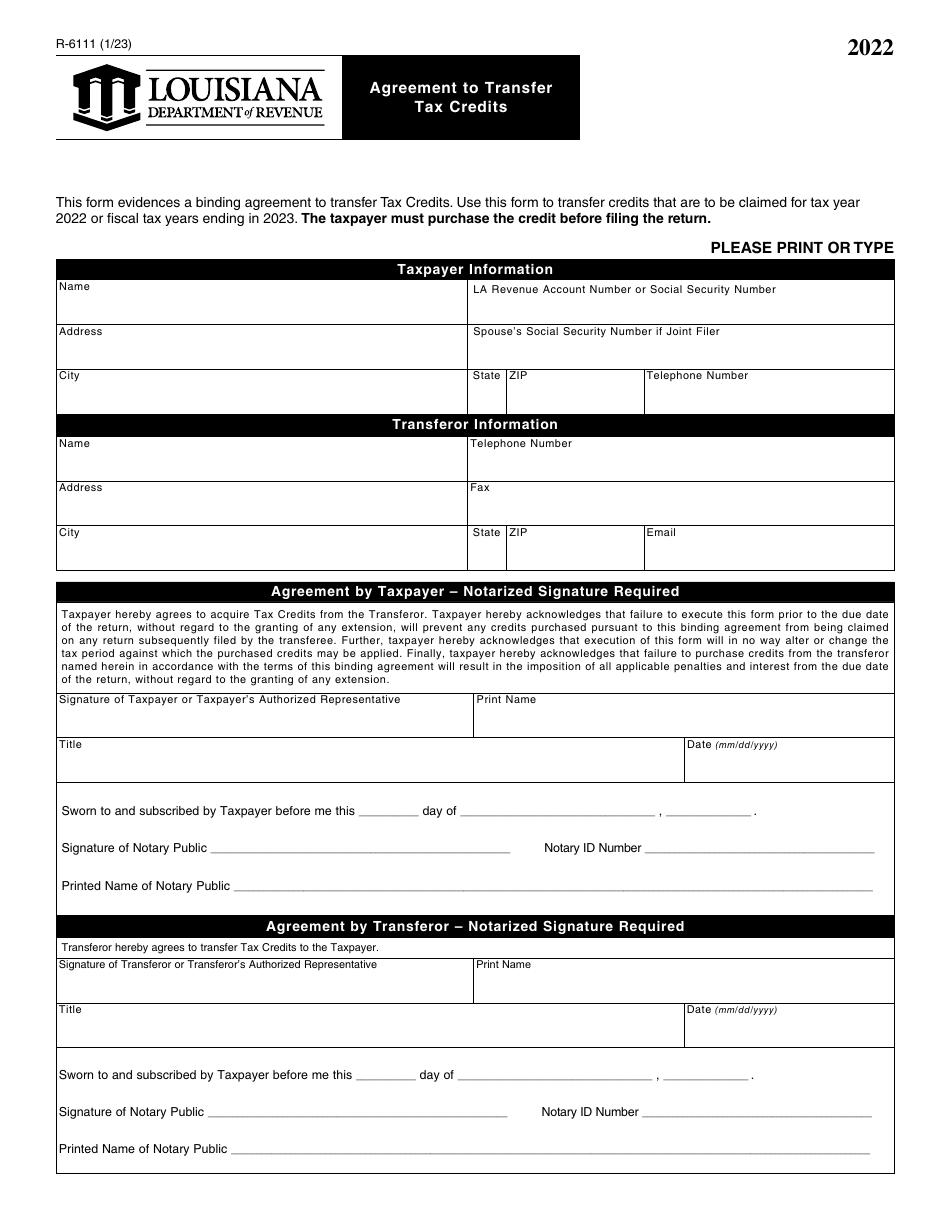

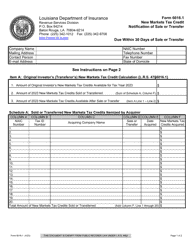

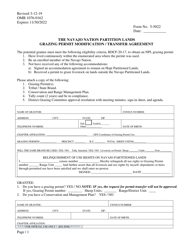

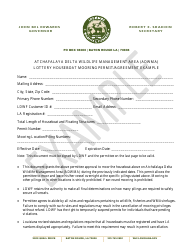

Form RI-6111 Agreement to Transfer Tax Credits - Louisiana

What Is Form RI-6111?

This is a legal form that was released by the Louisiana Department of Revenue - a government authority operating within Louisiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form RI-6111?

A: Form RI-6111 is the Agreement to Transfer Tax Credits in the state of Louisiana.

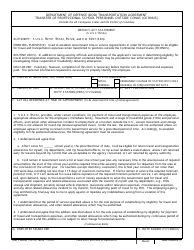

Q: Who needs to fill out Form RI-6111?

A: Form RI-6111 is filled out by taxpayers in Louisiana who want to transfer tax credits to another party.

Q: What is the purpose of Form RI-6111?

A: The purpose of Form RI-6111 is to authorize the transfer of tax credits from one party to another in Louisiana.

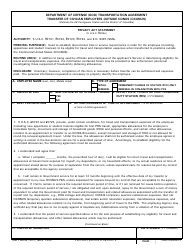

Q: Is there a deadline for submitting Form RI-6111?

A: Yes, the deadline for submitting Form RI-6111 is typically determined by the Louisiana Department of Revenue.

Q: Are there any fees associated with Form RI-6111?

A: There may be fees associated with the transfer of tax credits, as determined by the Louisiana Department of Revenue.

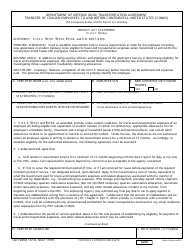

Q: Can I transfer tax credits to multiple parties with Form RI-6111?

A: Yes, Form RI-6111 allows taxpayers to transfer tax credits to multiple parties in Louisiana.

Q: What supporting documents are required with Form RI-6111?

A: The specific supporting documents required with Form RI-6111 may vary depending on the type of tax credit being transferred.

Form Details:

- Released on January 1, 2023;

- The latest edition provided by the Louisiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RI-6111 by clicking the link below or browse more documents and templates provided by the Louisiana Department of Revenue.