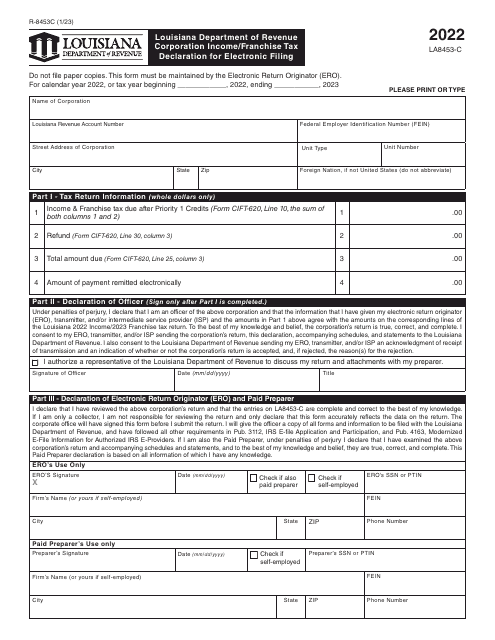

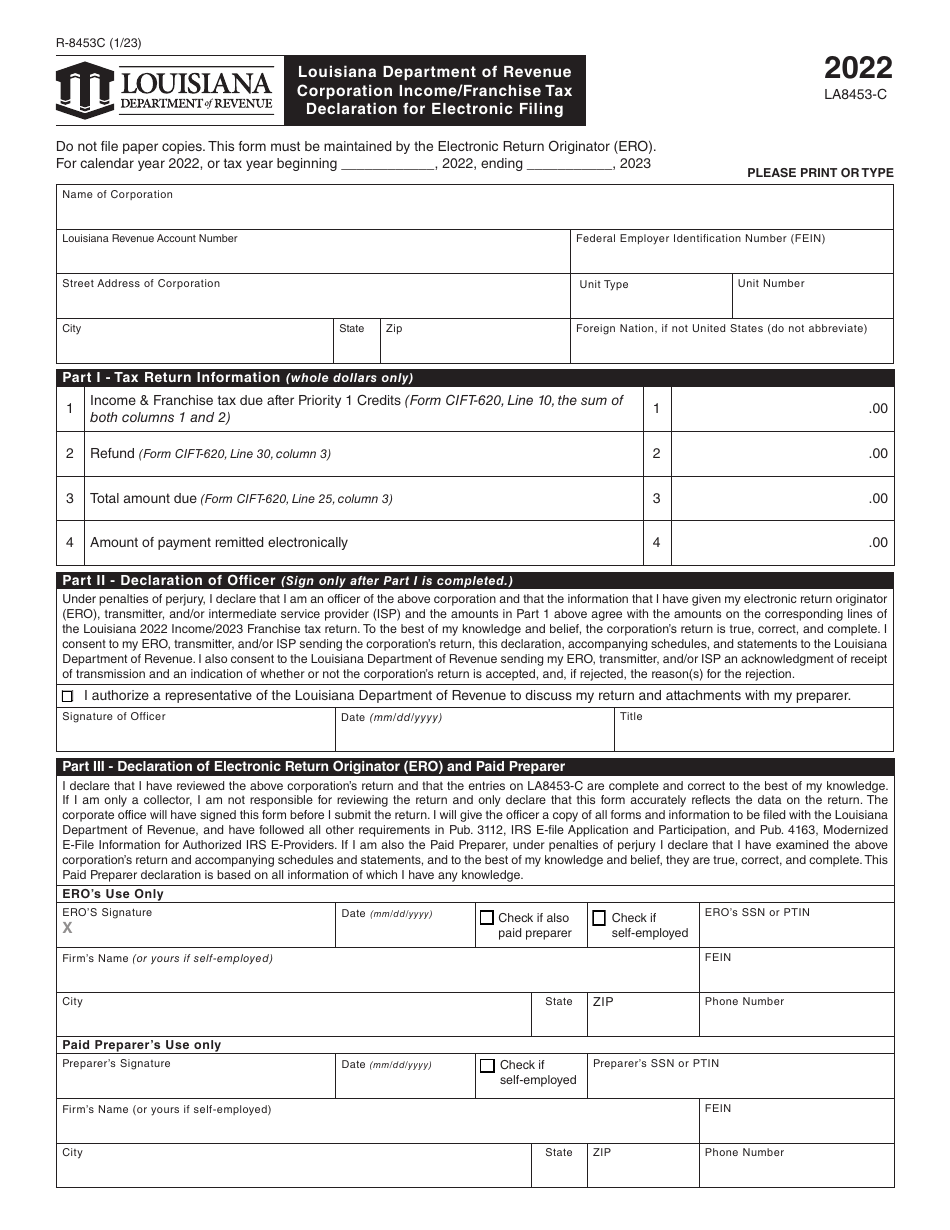

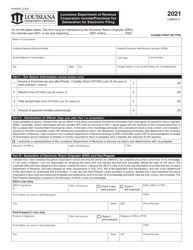

Form R-8453C (LA8453-C) Corporation Income / Franchise Tax Declaration for Electronic Filing - Louisiana

What Is Form R-8453C (LA8453-C)?

This is a legal form that was released by the Louisiana Department of Revenue - a government authority operating within Louisiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form R-8453C?

A: Form R-8453C is the Corporation Income/Franchise Tax Declaration for Electronic Filing specifically designed for Louisiana.

Q: Who should file Form R-8453C?

A: Corporations who are filing their income or franchise tax returns electronically in Louisiana should file Form R-8453C.

Q: What is the purpose of Form R-8453C?

A: Form R-8453C is used to declare and authorize the electronic filing of a corporation's income or franchise tax return in Louisiana.

Q: Is Form R-8453C mandatory for electronic filing?

A: Yes, Form R-8453C is mandatory for corporations choosing to electronically file their income or franchise tax returns in Louisiana.

Q: Are there any fees associated with filing Form R-8453C?

A: No, there are no fees associated with filing Form R-8453C. However, there may be fees associated with electronic filing services provided by third-party software providers.

Q: What information is required on Form R-8453C?

A: Form R-8453C requires the corporation's name, address, employer identification number, tax year, and electronic filing identification number, among other information.

Q: When should Form R-8453C be filed?

A: Form R-8453C should be filed along with the corporation's electronically filed income or franchise tax return on or before the due date.

Q: Can Form R-8453C be filed separately from the electronic tax return?

A: No, Form R-8453C cannot be filed separately from the electronic tax return. It should be filed together with the tax return.

Q: Can I sign Form R-8453C electronically?

A: Yes, Form R-8453C can be signed electronically using a self-selected Personal Identification Number (PIN) if authorized by the electronic filing software.

Form Details:

- Released on January 1, 2023;

- The latest edition provided by the Louisiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form R-8453C (LA8453-C) by clicking the link below or browse more documents and templates provided by the Louisiana Department of Revenue.