This version of the form is not currently in use and is provided for reference only. Download this version of

Form R-6467V

for the current year.

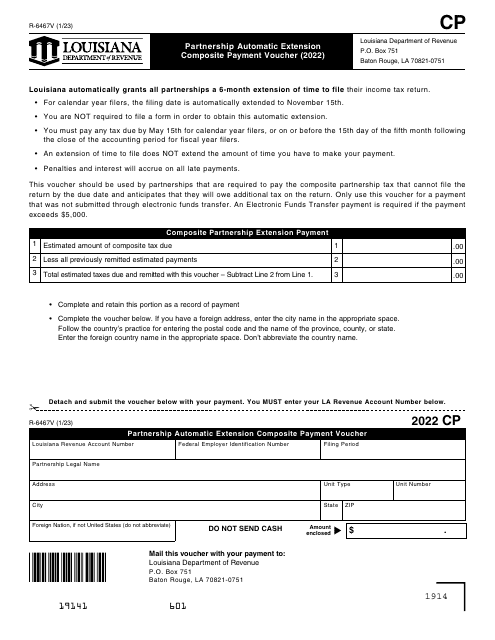

Form R-6467V Partnership Automatic Extension Composite Payment Voucher - Louisiana

What Is Form R-6467V?

This is a legal form that was released by the Louisiana Department of Revenue - a government authority operating within Louisiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form R-6467V?

A: Form R-6467V is the Partnership Automatic Extension Composite Payment Voucher in Louisiana.

Q: What is the purpose of Form R-6467V?

A: The purpose of Form R-6467V is to make a composite payment for a partnership's automatic extension in Louisiana.

Q: Who needs to use Form R-6467V?

A: Partnerships in Louisiana who have filed for an automatic extension and need to make a composite payment should use Form R-6467V.

Q: What information is required on Form R-6467V?

A: Form R-6467V requires you to provide your partnership's name, address, FEIN, and the amount of the composite payment.

Q: When is the deadline to file Form R-6467V?

A: The deadline to file Form R-6467V is the same as the partnership's extended deadline, usually September 15th.

Q: Can I file Form R-6467V electronically?

A: No, Form R-6467V must be filed by mail along with the composite payment.

Q: What happens if I don't file Form R-6467V?

A: If you don't file Form R-6467V, you may be subject to penalties and interest on the unpaid amount of the composite payment.

Form Details:

- Released on January 1, 2023;

- The latest edition provided by the Louisiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form R-6467V by clicking the link below or browse more documents and templates provided by the Louisiana Department of Revenue.