This version of the form is not currently in use and is provided for reference only. Download this version of

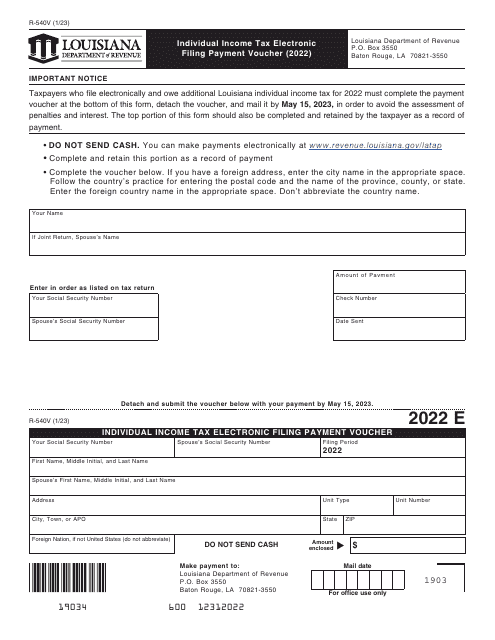

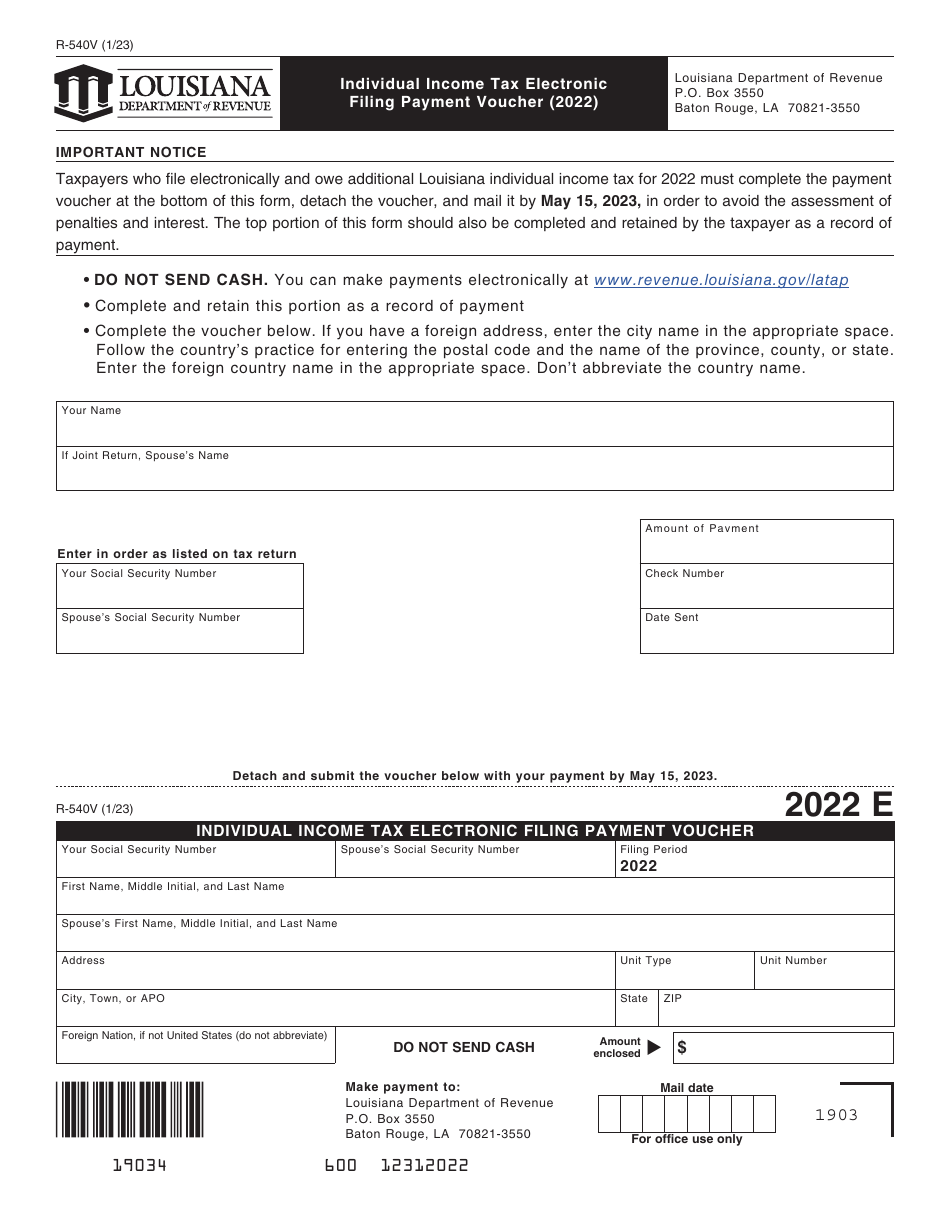

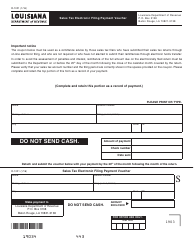

Form R-540V

for the current year.

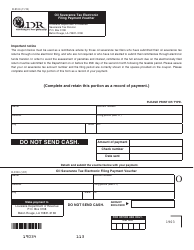

Form R-540V Individual Income Tax Electronic Filing Payment Voucher - Louisiana

What Is Form R-540V?

This is a legal form that was released by the Louisiana Department of Revenue - a government authority operating within Louisiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form R-540V?

A: Form R-540V is the Individual Income Tax Electronic Filing Payment Voucher for Louisiana.

Q: Who needs to use Form R-540V?

A: This form is used by individuals who are filing their Louisiana income taxes electronically.

Q: What is the purpose of Form R-540V?

A: The purpose of Form R-540V is to make a payment towards the individual's income tax liability when filing electronically.

Q: How do I use Form R-540V?

A: Fill out the form with your payment information, including the Taxpayer Identification Number, payment amount, payment type, and contact information.

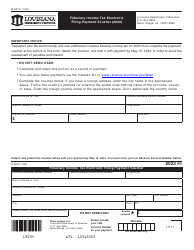

Q: Are there any deadlines for using Form R-540V?

A: Yes, the payment must be made on or before the due date of the individual's income tax return.

Q: Can I file my Louisiana income tax return electronically without using Form R-540V?

A: Yes, you can file your tax return electronically without using Form R-540V if you have already made your payment.

Q: What payment types are accepted on Form R-540V?

A: Form R-540V accepts payments made by electronic funds transfer, credit/debit card, or check.

Q: Is there a fee for using certain payment types on Form R-540V?

A: Yes, there may be fees associated with certain payment types, such as credit/debit card payments.

Q: Can I mail Form R-540V along with my paper tax return?

A: No, Form R-540V is specifically for electronic filing of income tax returns. If you are mailing a paper return, you do not need to use this form.

Form Details:

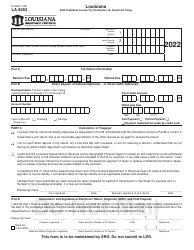

- Released on January 1, 2023;

- The latest edition provided by the Louisiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form R-540V by clicking the link below or browse more documents and templates provided by the Louisiana Department of Revenue.