This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for Form R-210NR

for the current year.

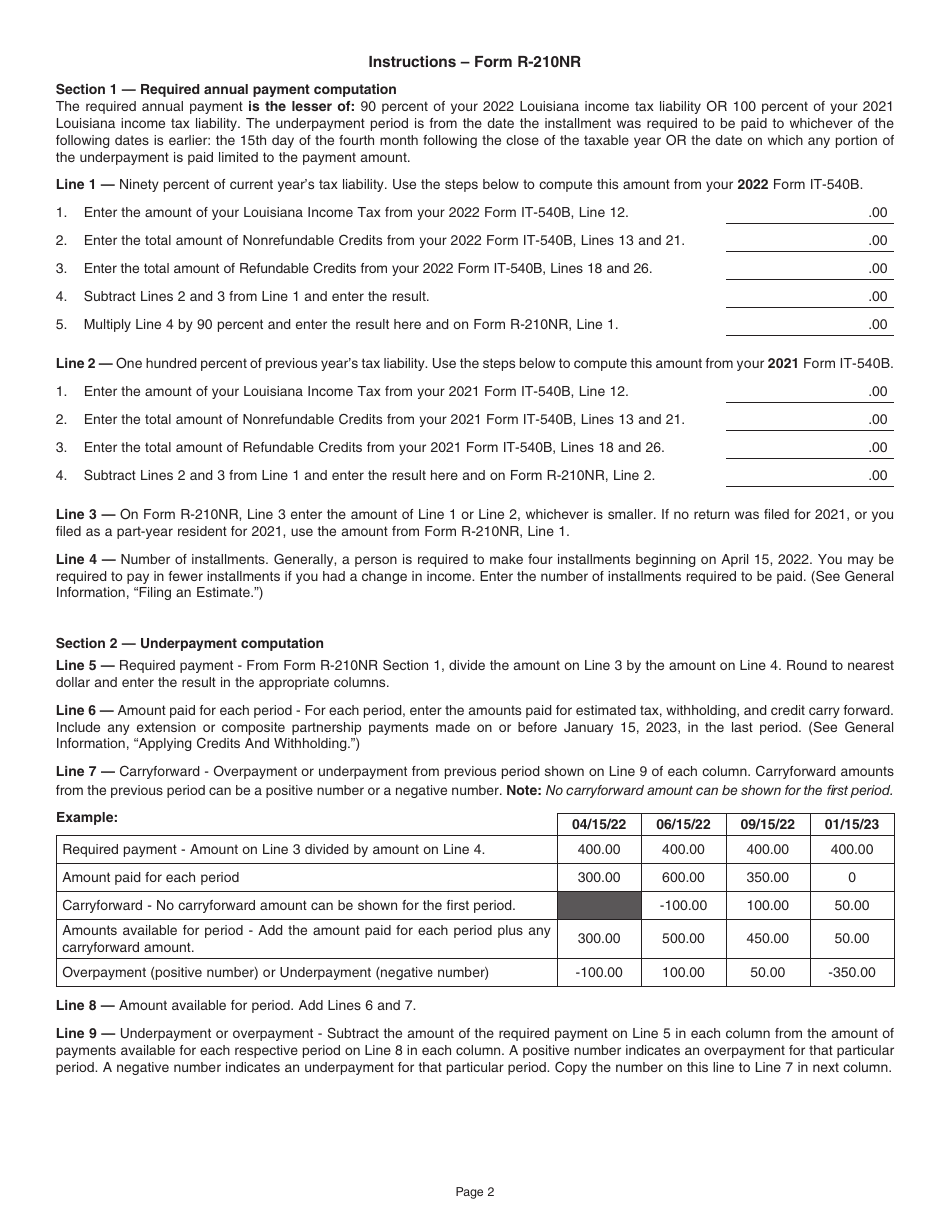

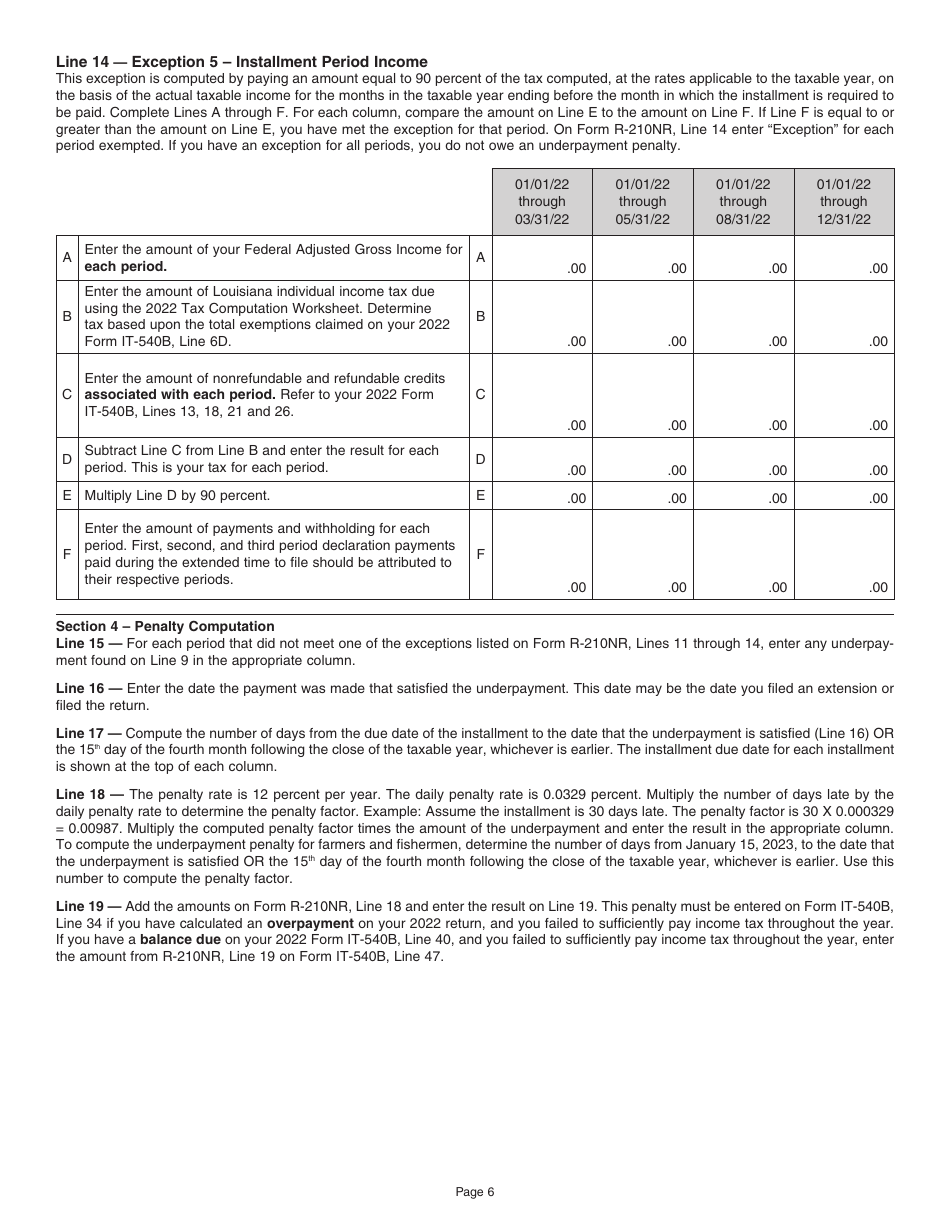

Instructions for Form R-210NR Underpayment of Individual Income Tax Penalty Computation - Nonresident and Part-Year Resident Filers - Louisiana

This document contains official instructions for Form R-210NR , Underpayment of Tax Penalty Computation - Nonresident and Part-Year Resident Filers - a form released and collected by the Louisiana Department of Revenue. An up-to-date fillable Form R-210NR is available for download through this link.

FAQ

Q: Who needs to file Form R-210NR?

A: Nonresidents and part-year residents who owe underpayment of individual income tax penalty in Louisiana.

Q: What is Form R-210NR?

A: Form R-210NR is a form used for computing the underpayment of individual income tax penalty for nonresidents and part-year residents in Louisiana.

Q: What is the purpose of Form R-210NR?

A: Form R-210NR is used to calculate the penalty for underpayment of individual income tax by nonresidents and part-year residents in Louisiana.

Q: When is Form R-210NR due?

A: Form R-210NR is due on the same date as your Louisiana individual income tax return.

Q: What is the penalty for underpayment of individual income tax in Louisiana?

A: The penalty for underpayment of individual income tax in Louisiana is 1% per month or fraction of a month.

Q: How do I calculate the underpayment of individual income tax penalty?

A: To calculate the penalty, you need to complete Form R-210NR using the instructions provided by the Louisiana Department of Revenue.

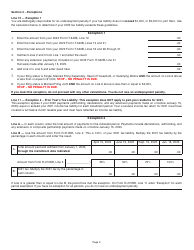

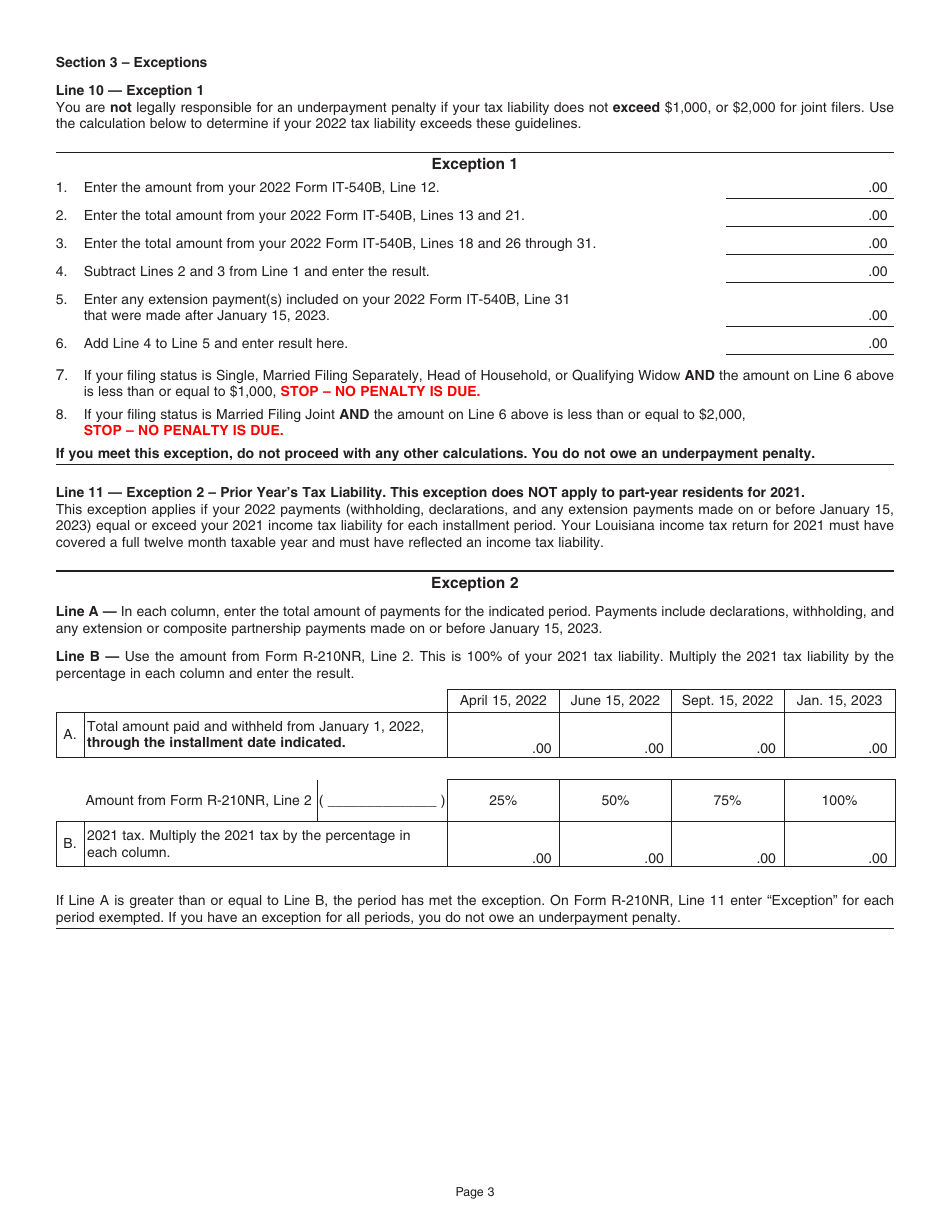

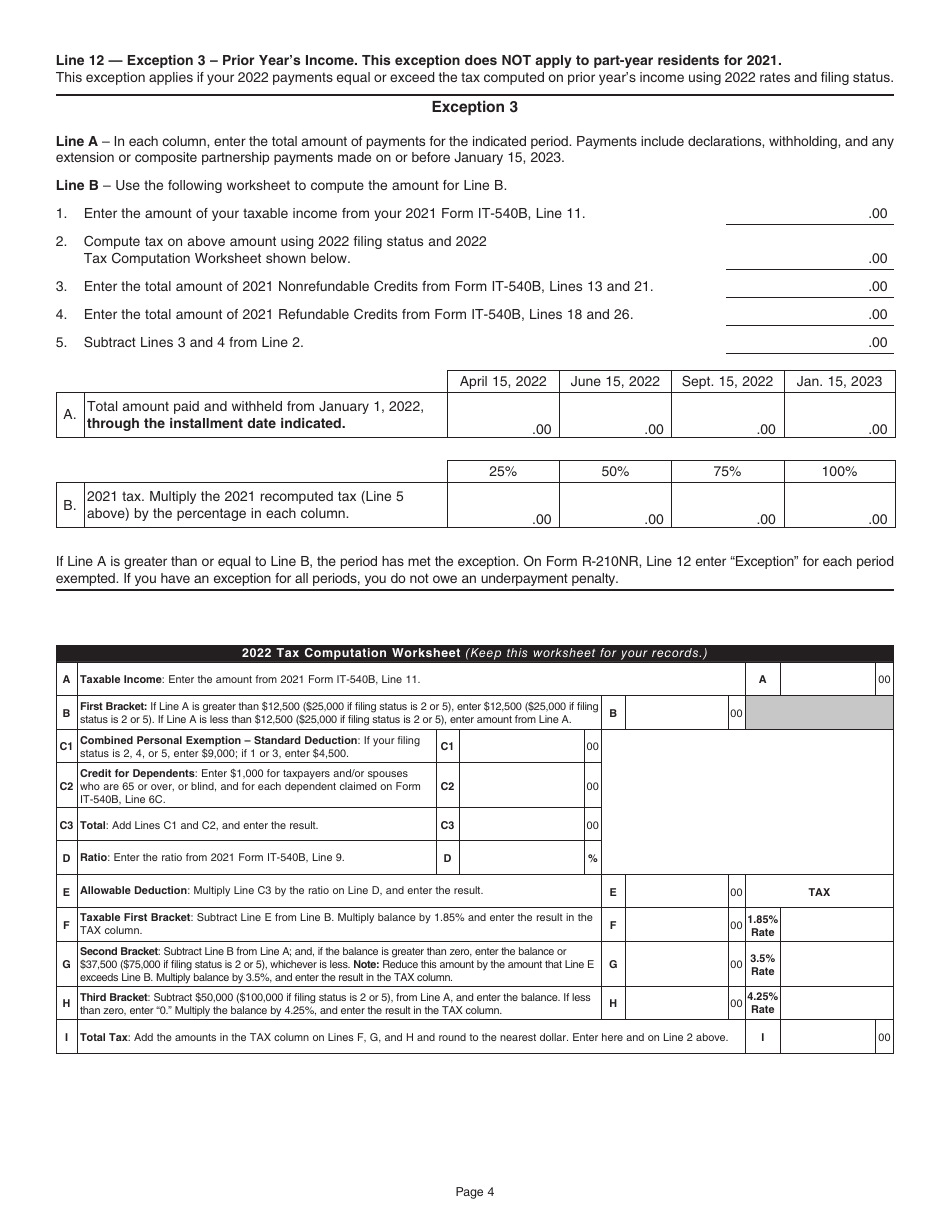

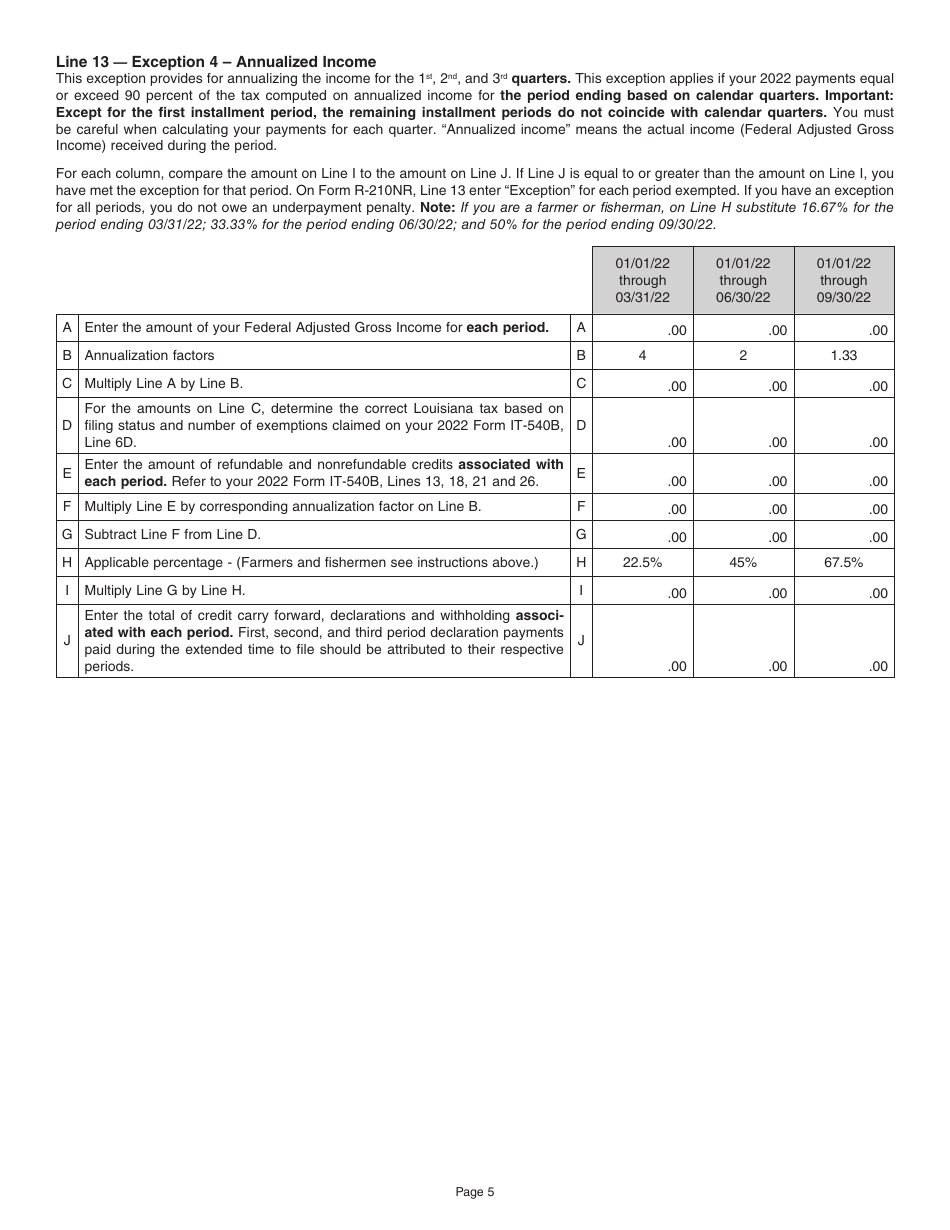

Q: Are there any exemptions to the underpayment penalty?

A: There are exceptions to the underpayment penalty, which are listed in the instructions for Form R-210NR.

Q: Can I e-file Form R-210NR?

A: No, Form R-210NR cannot be e-filed. It must be mailed to the Louisiana Department of Revenue.

Instruction Details:

- This 6-page document is available for download in PDF;

- Actual and applicable for this year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Louisiana Department of Revenue.