This version of the form is not currently in use and is provided for reference only. Download this version of

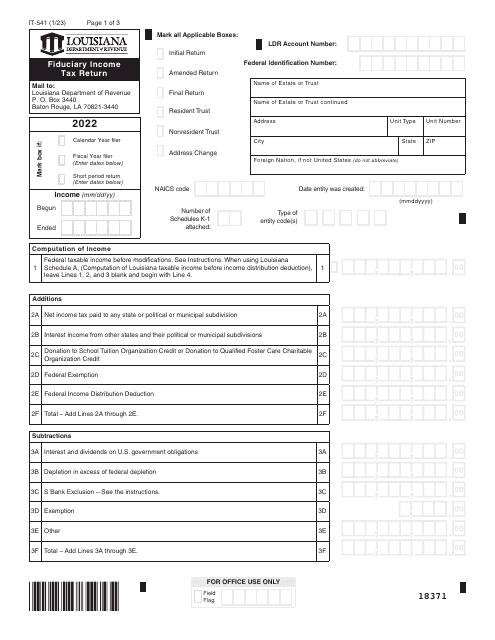

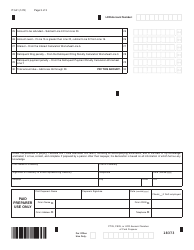

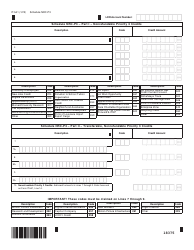

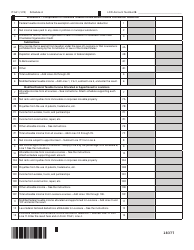

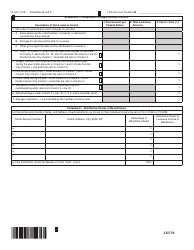

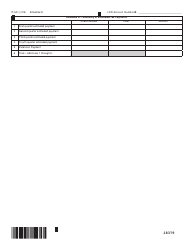

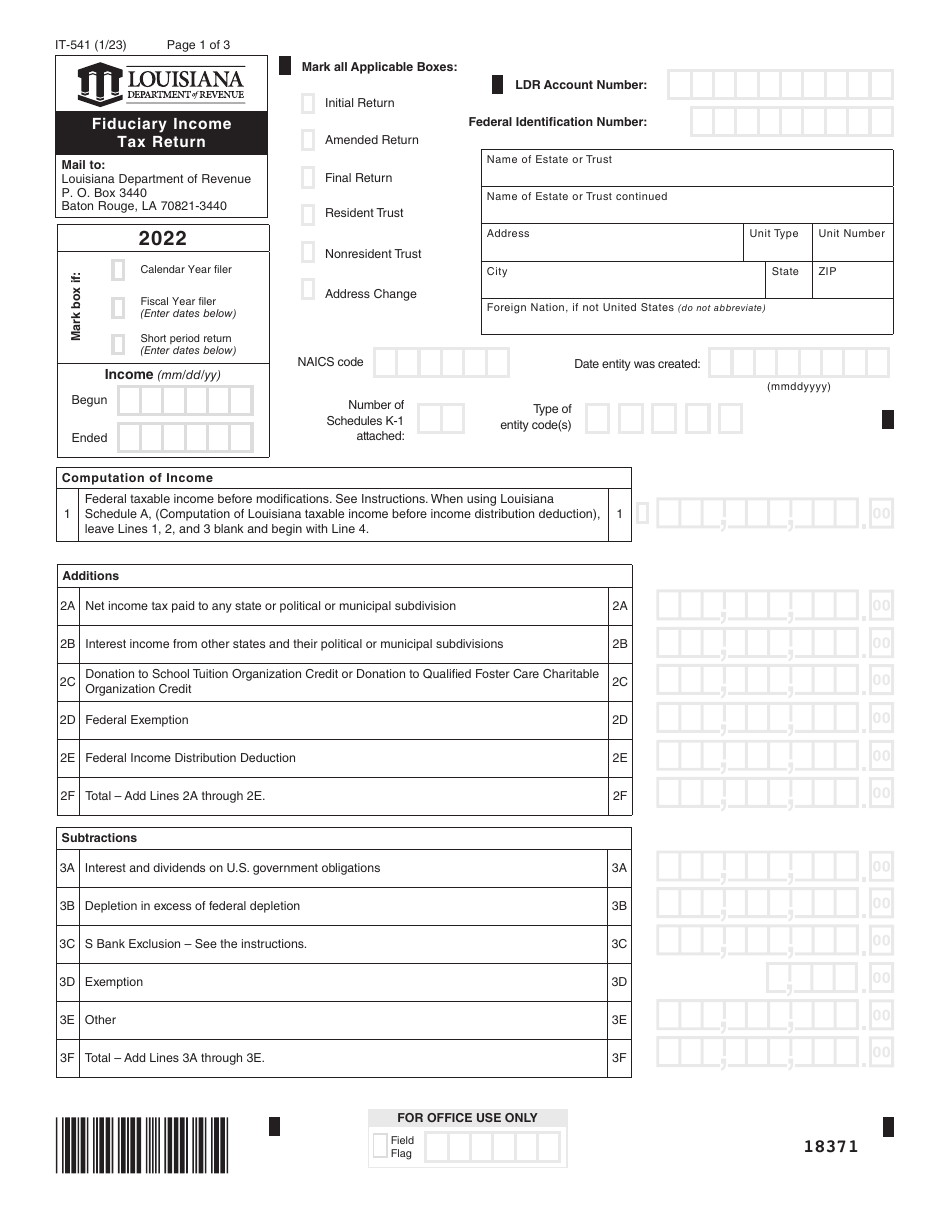

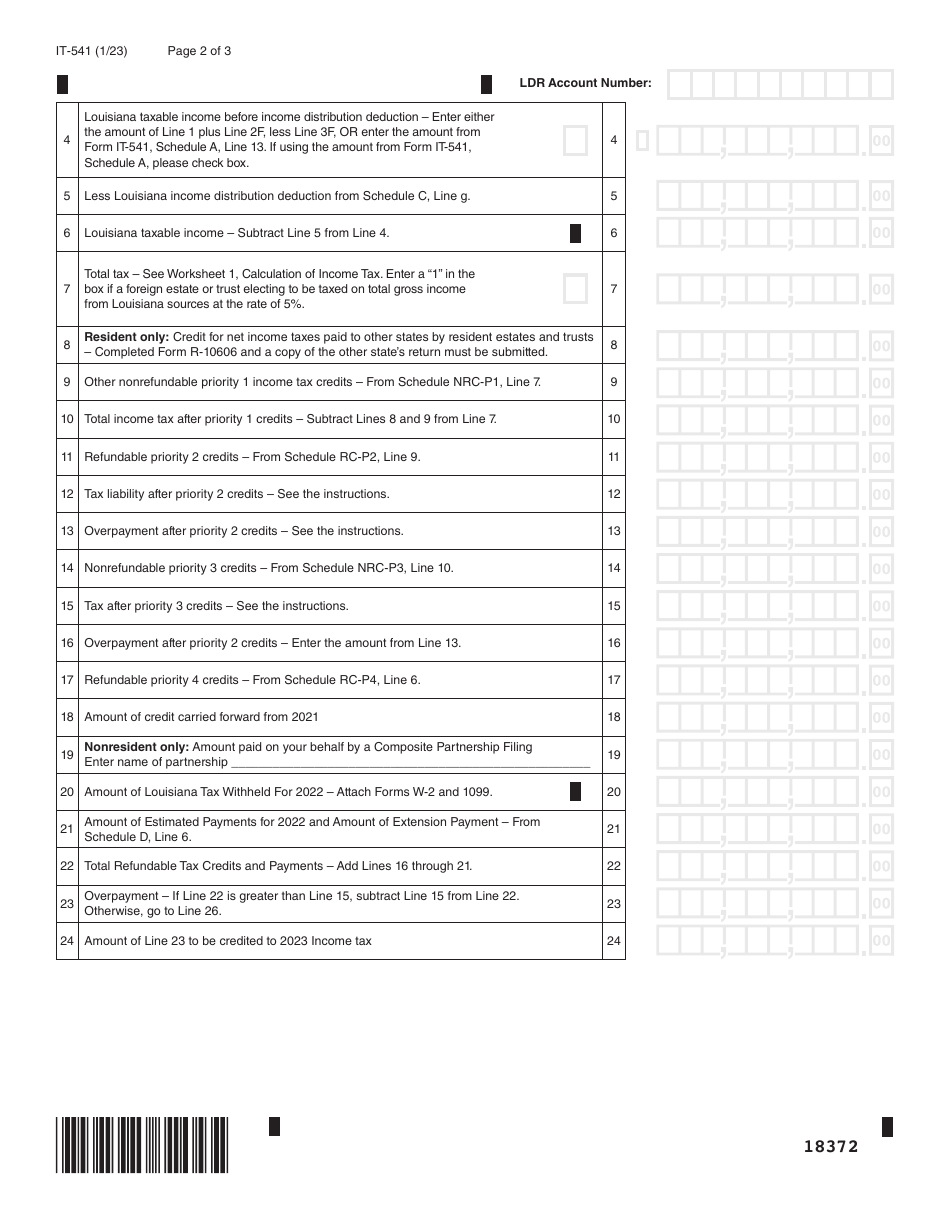

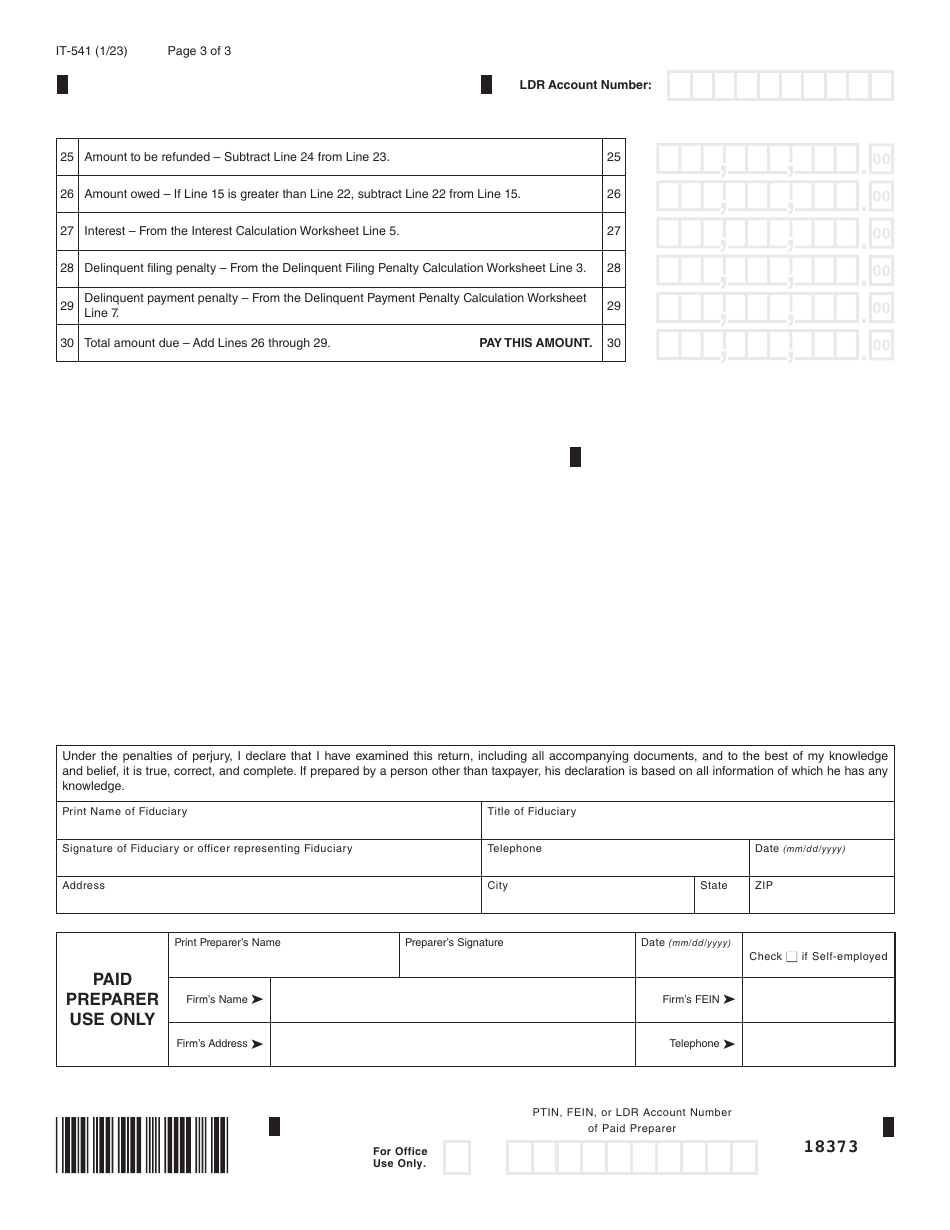

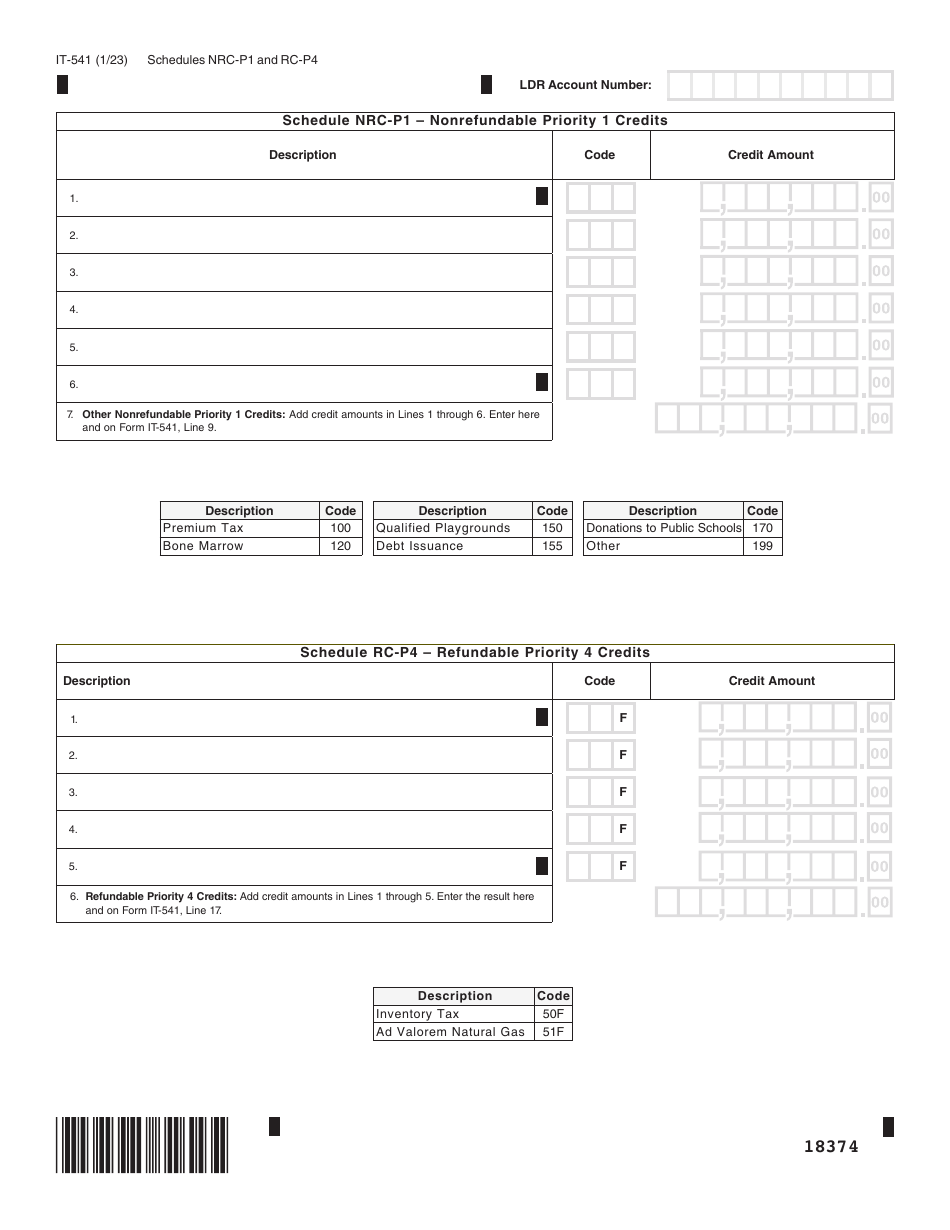

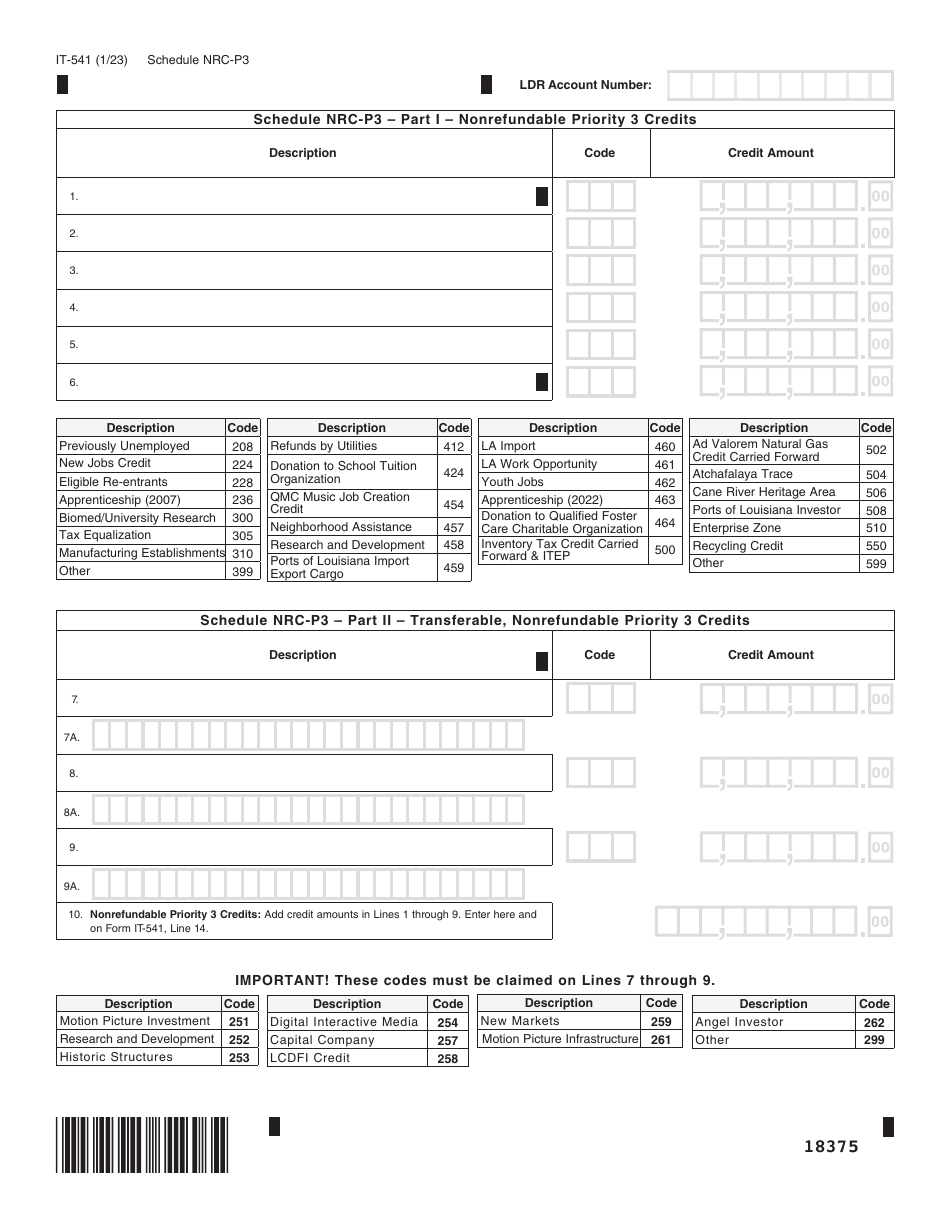

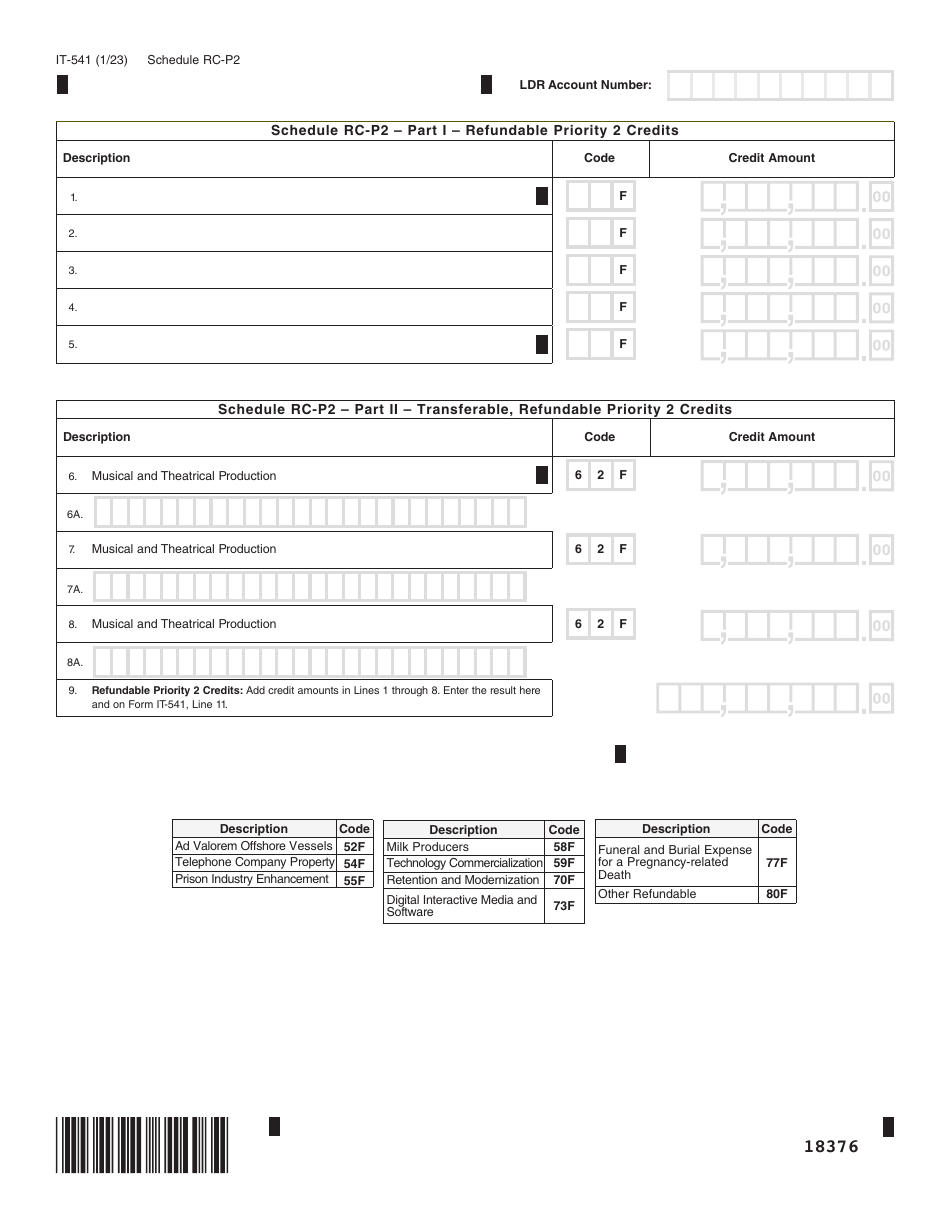

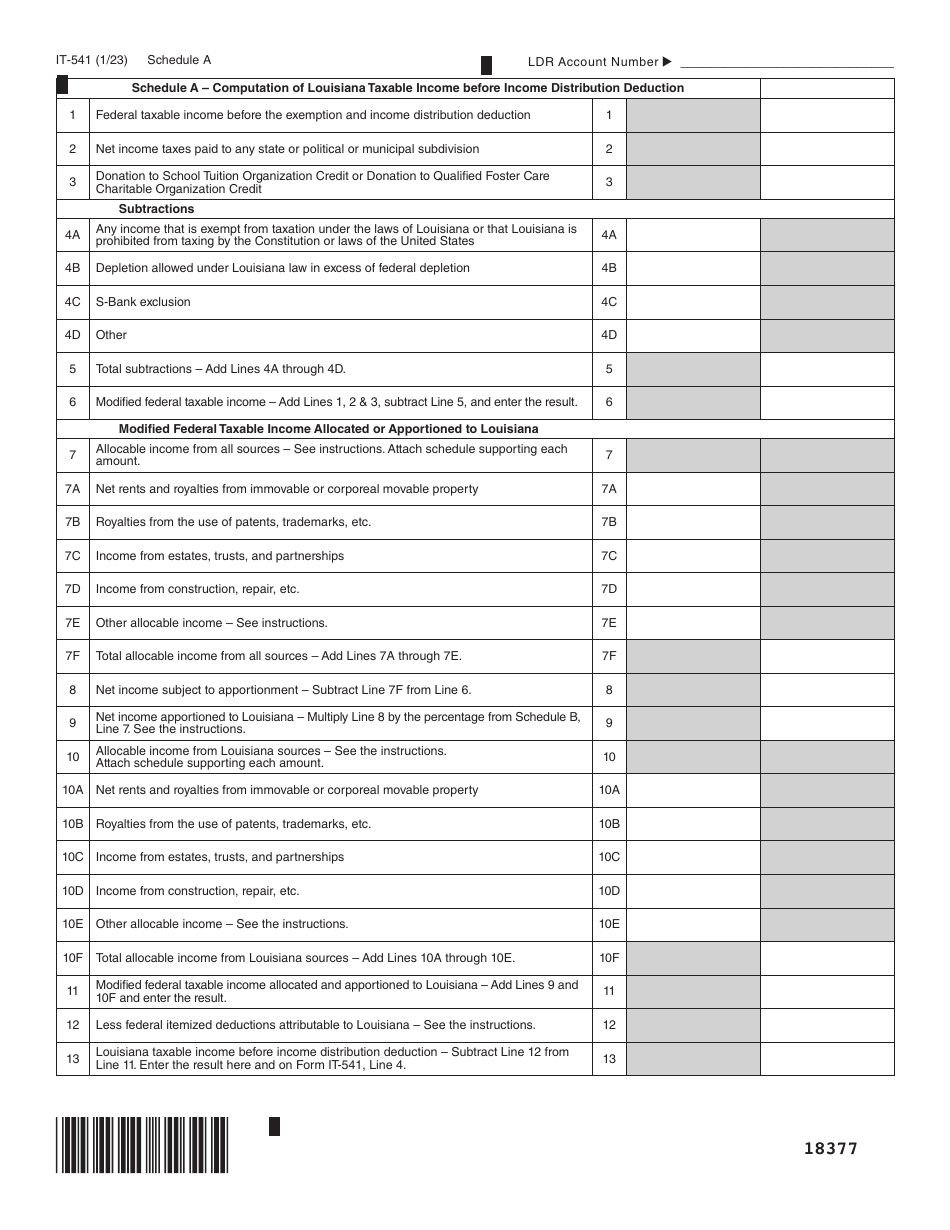

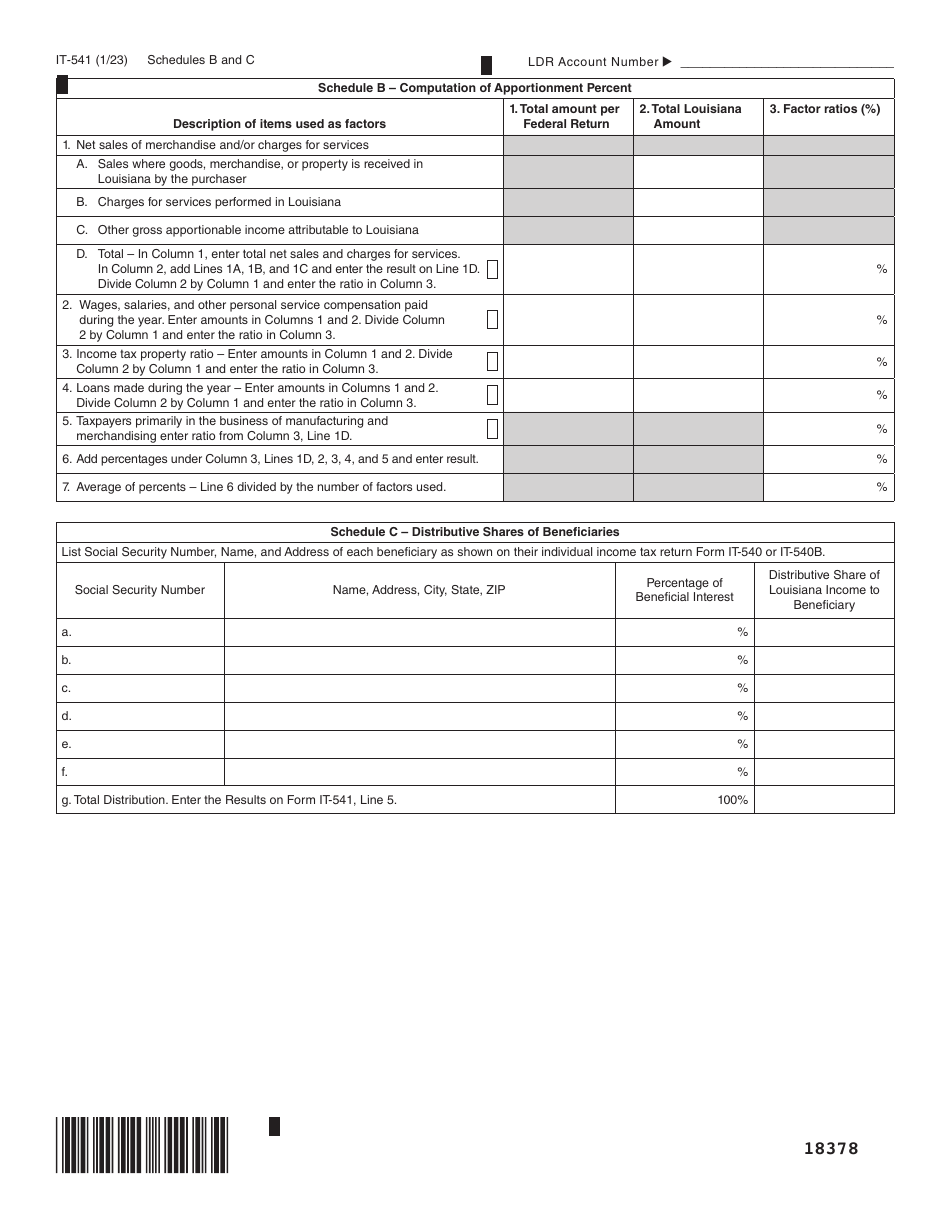

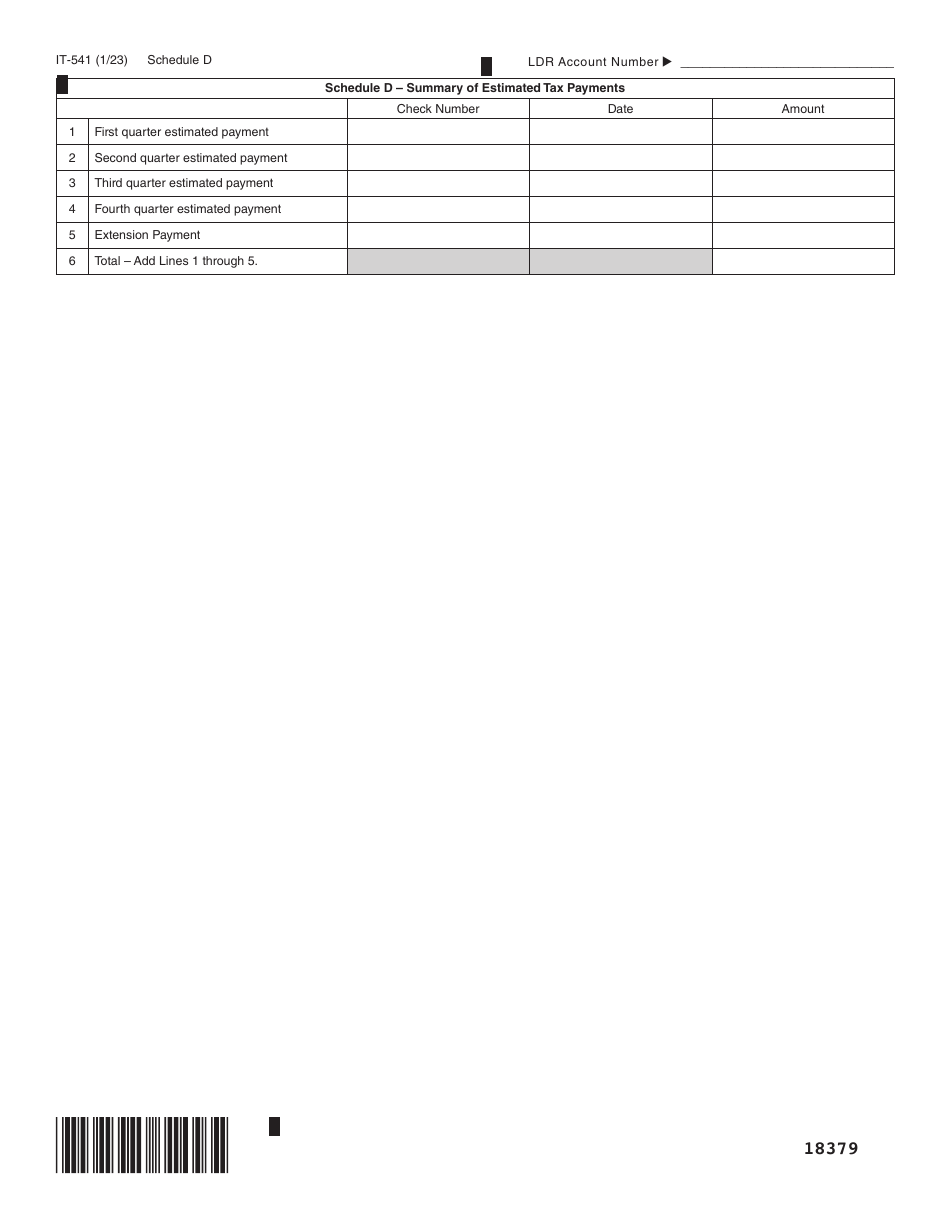

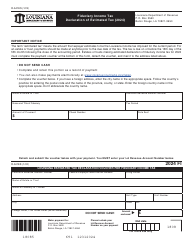

Form IT-541

for the current year.

Form IT-541 Fiduciary Income Tax Return - Louisiana

What Is Form IT-541?

This is a legal form that was released by the Louisiana Department of Revenue - a government authority operating within Louisiana. Check the official instructions before completing and submitting the form.

FAQ

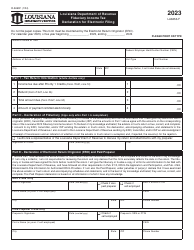

Q: What is Form IT-541?

A: Form IT-541 is the Fiduciary Income Tax Return for the state of Louisiana.

Q: Who needs to file Form IT-541?

A: Individuals or entities that are acting as fiduciaries for a Louisiana estate or trust need to file Form IT-541.

Q: When is Form IT-541 due?

A: Form IT-541 is due on the 15th day of the 4th month following the close of the tax year.

Q: Are there any filing fees for Form IT-541?

A: There are no filing fees associated with Form IT-541.

Q: What information is required to complete Form IT-541?

A: You will need information such as income, deductions, and details about the estate or trust in order to complete Form IT-541.

Q: Can I e-file Form IT-541?

A: Yes, you can e-file Form IT-541 if you prefer.

Q: Are there any penalties for late filing of Form IT-541?

A: Yes, there are penalties for late filing of Form IT-541. It is important to file on time to avoid any penalties.

Q: What if I need an extension to file Form IT-541?

A: You can request an extension to file Form IT-541 using Form R-2868. The extension request must be submitted by the original due date of the return.

Form Details:

- Released on January 1, 2023;

- The latest edition provided by the Louisiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-541 by clicking the link below or browse more documents and templates provided by the Louisiana Department of Revenue.