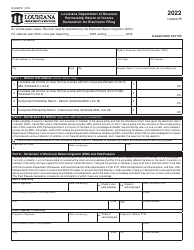

This version of the form is not currently in use and is provided for reference only. Download this version of

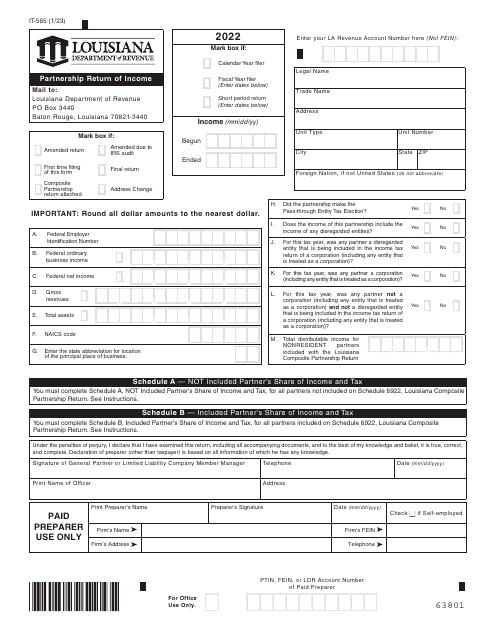

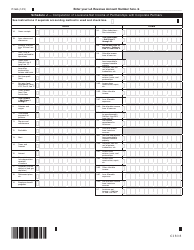

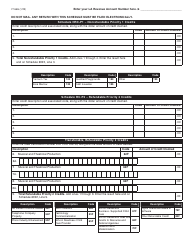

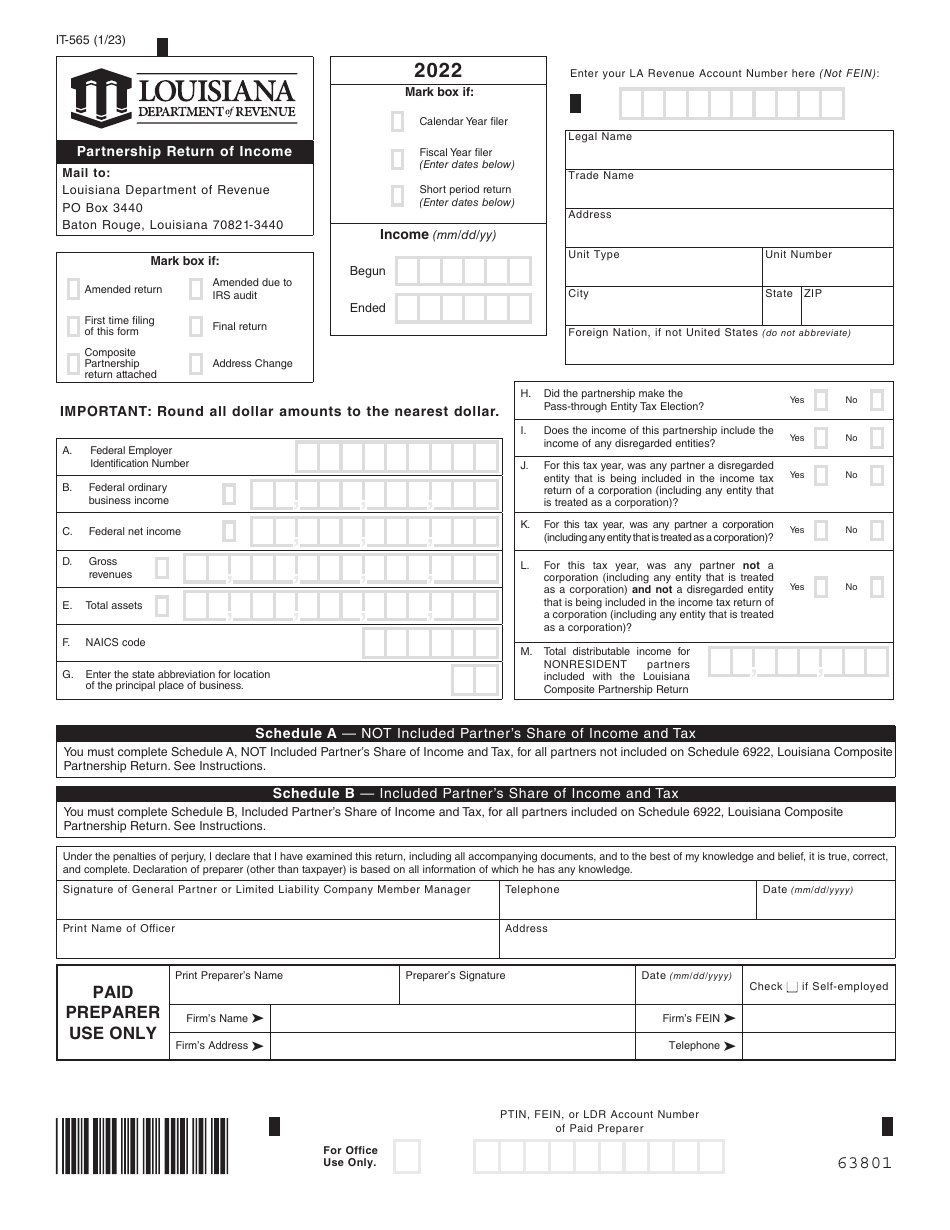

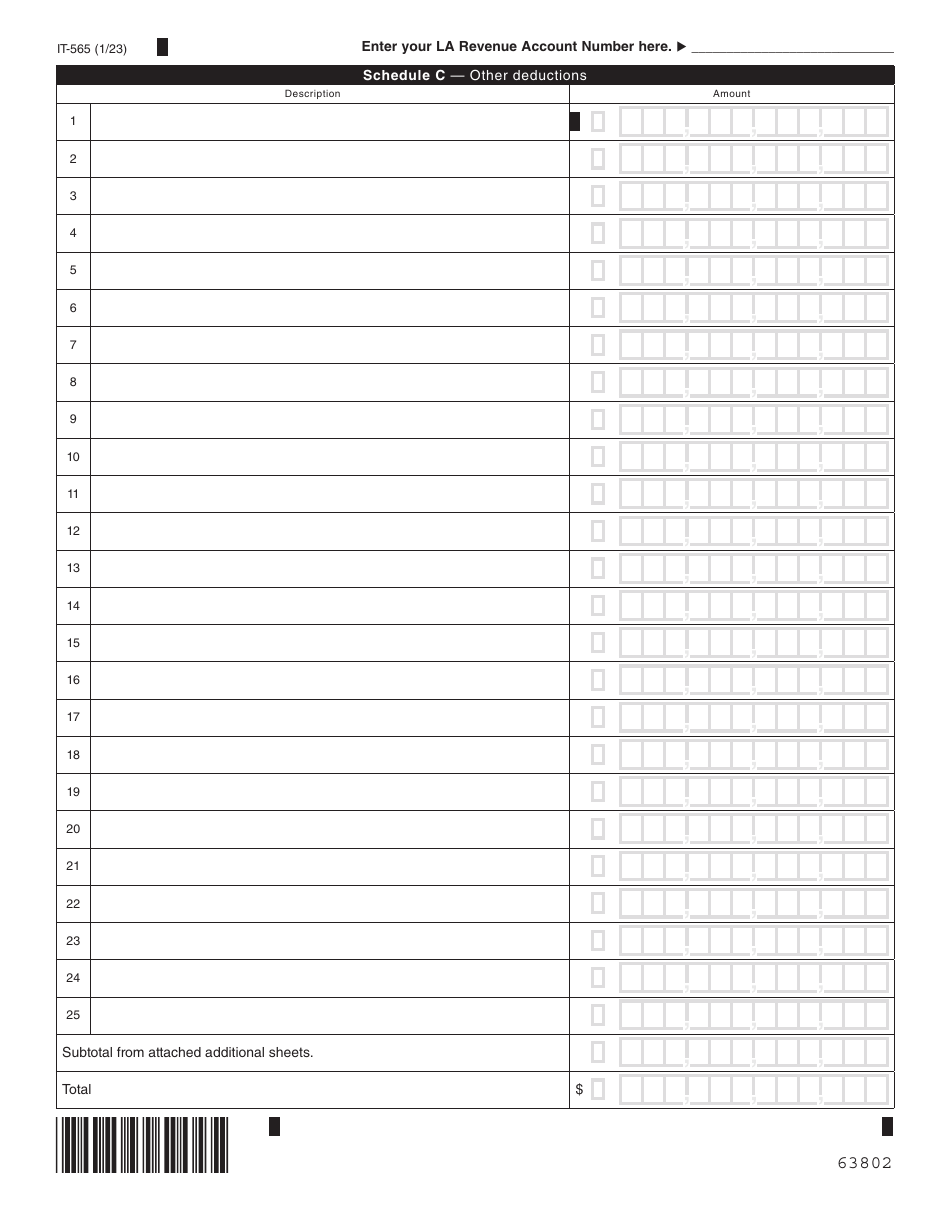

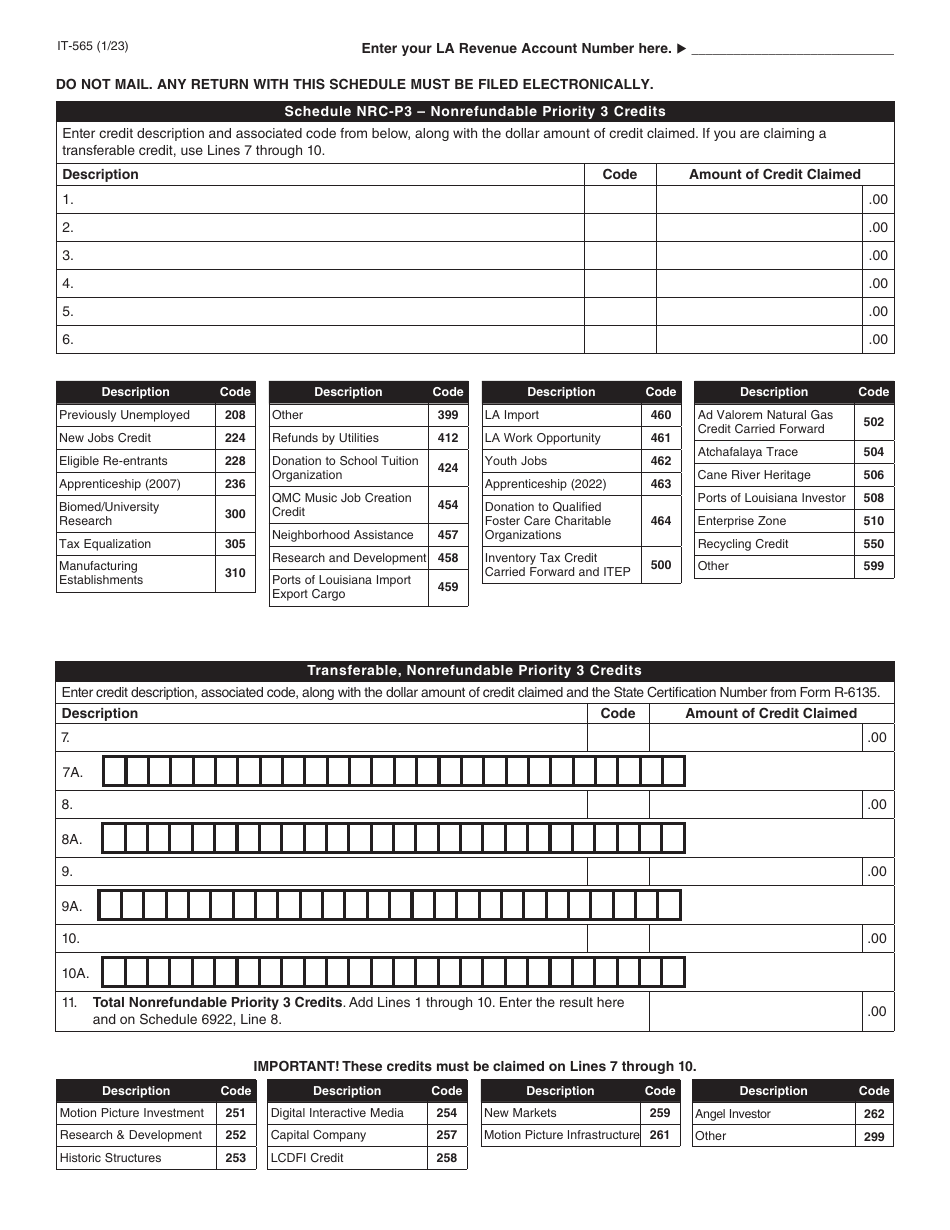

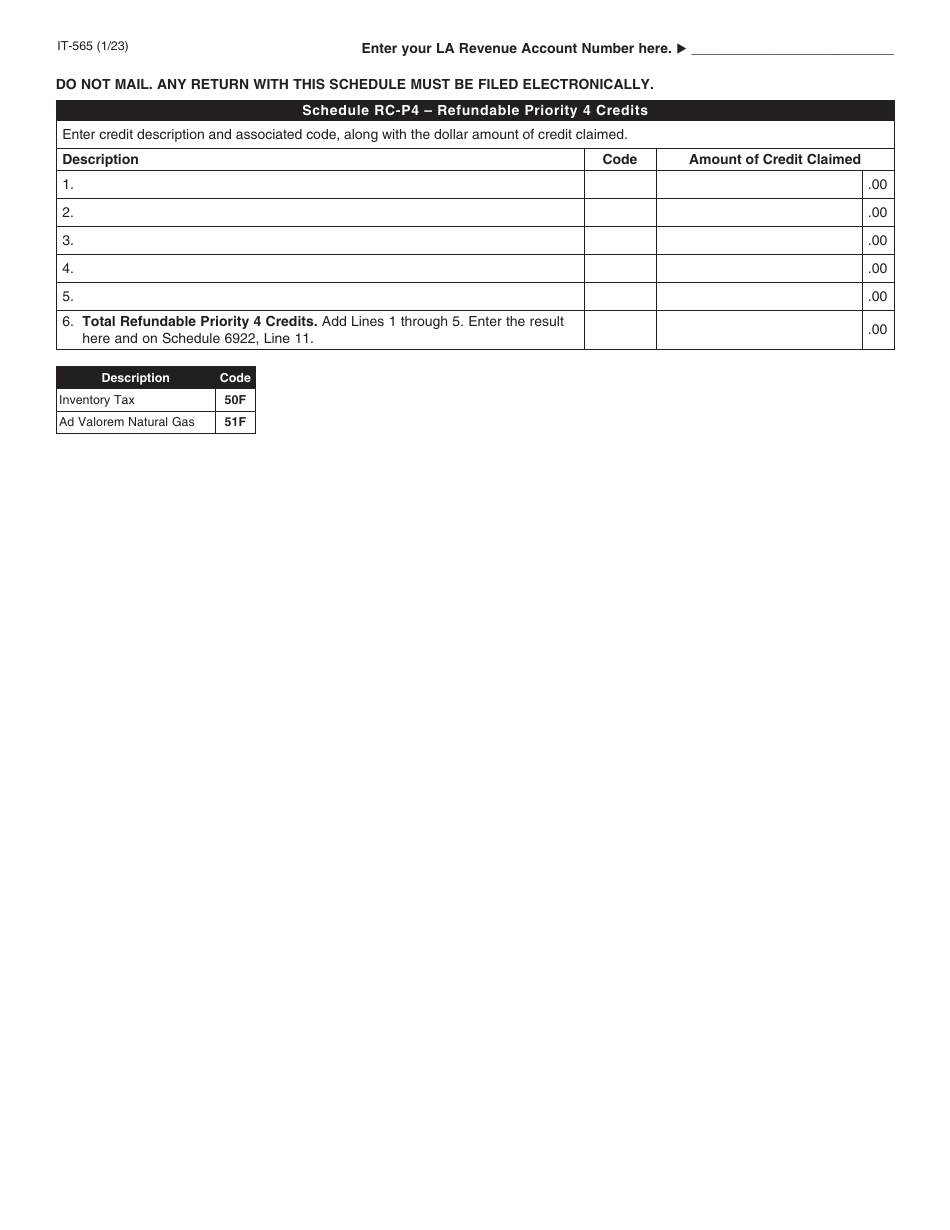

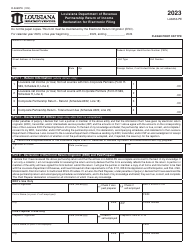

Form IT-565

for the current year.

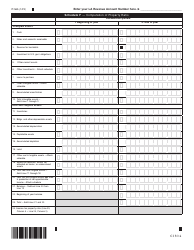

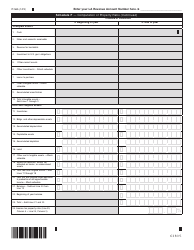

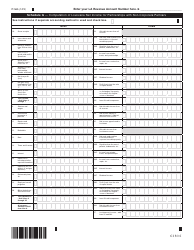

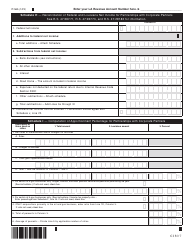

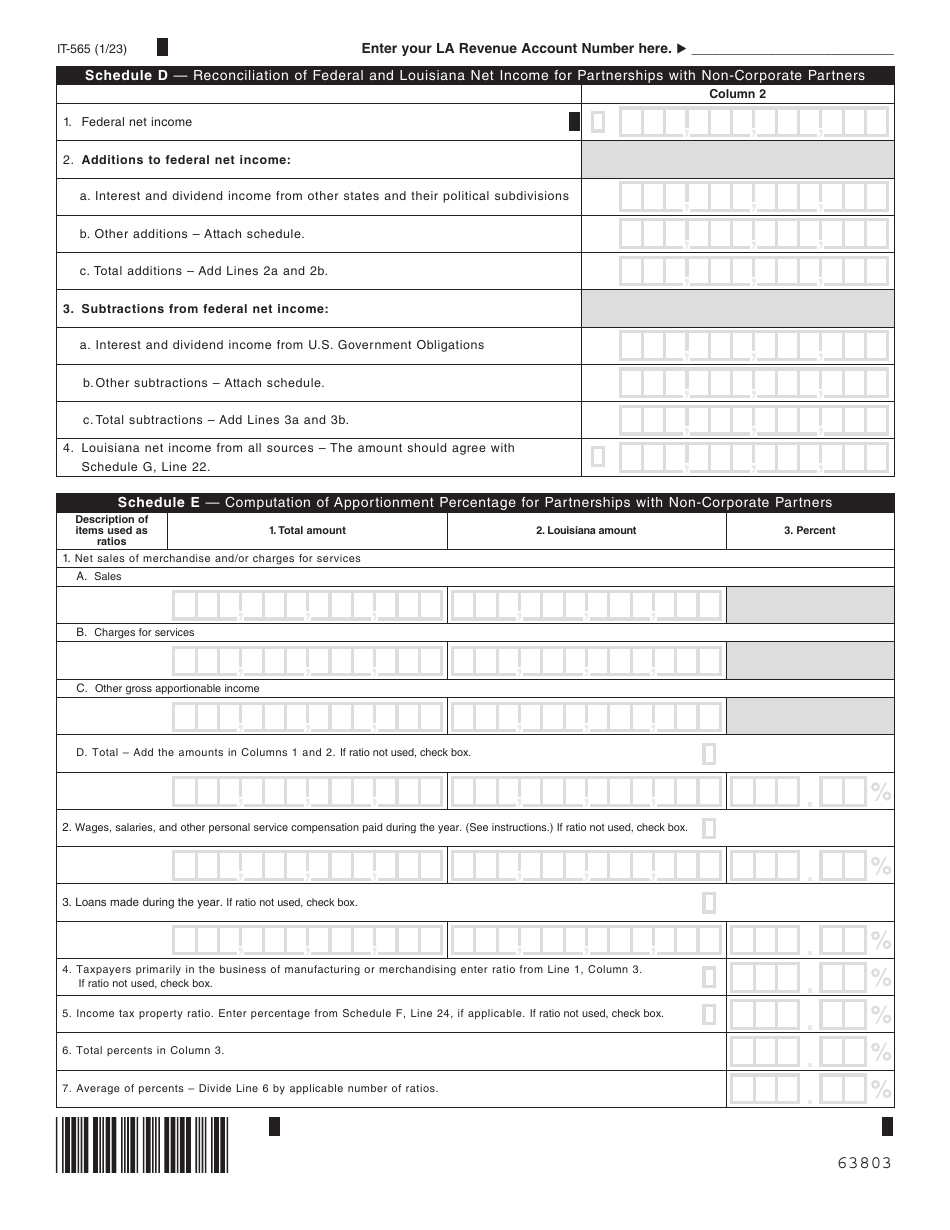

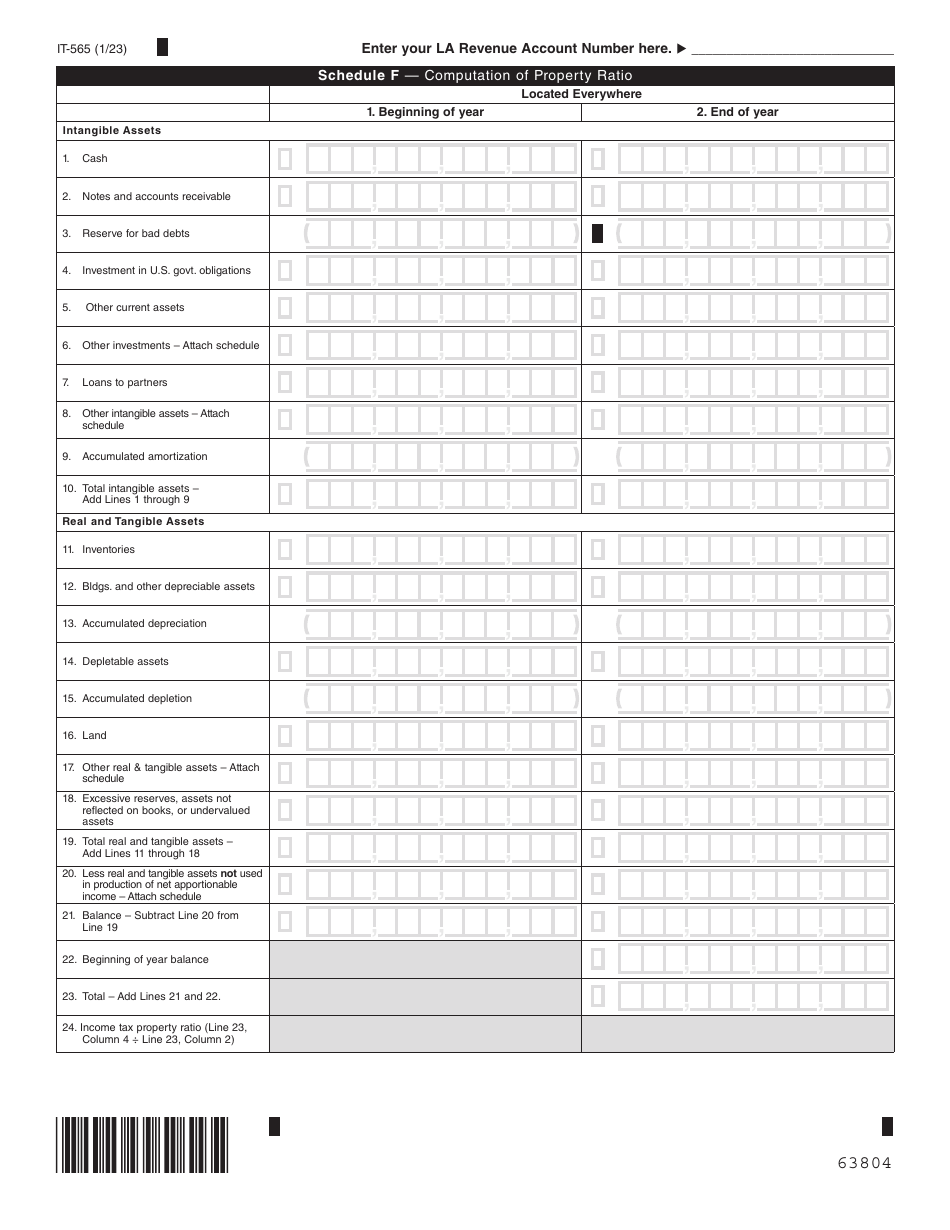

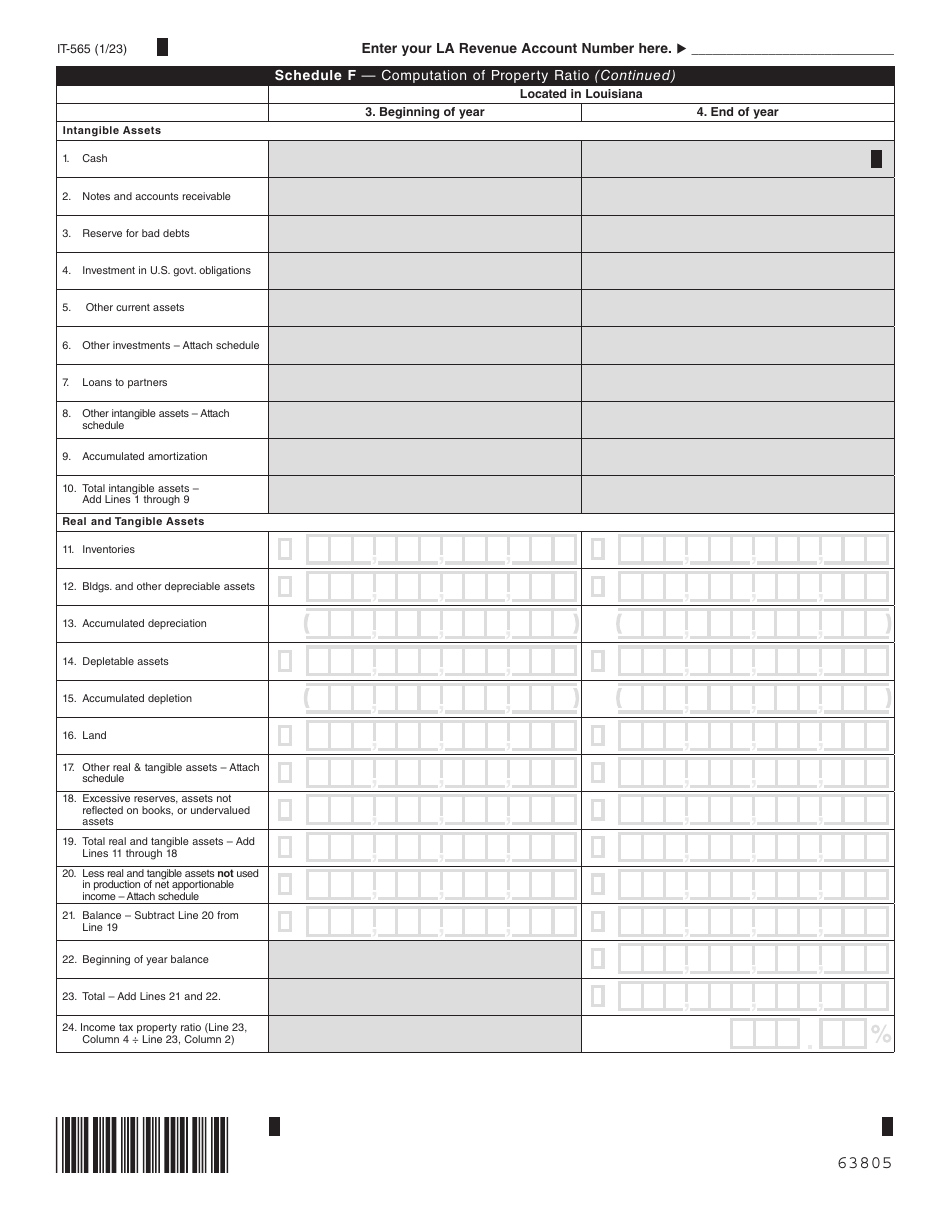

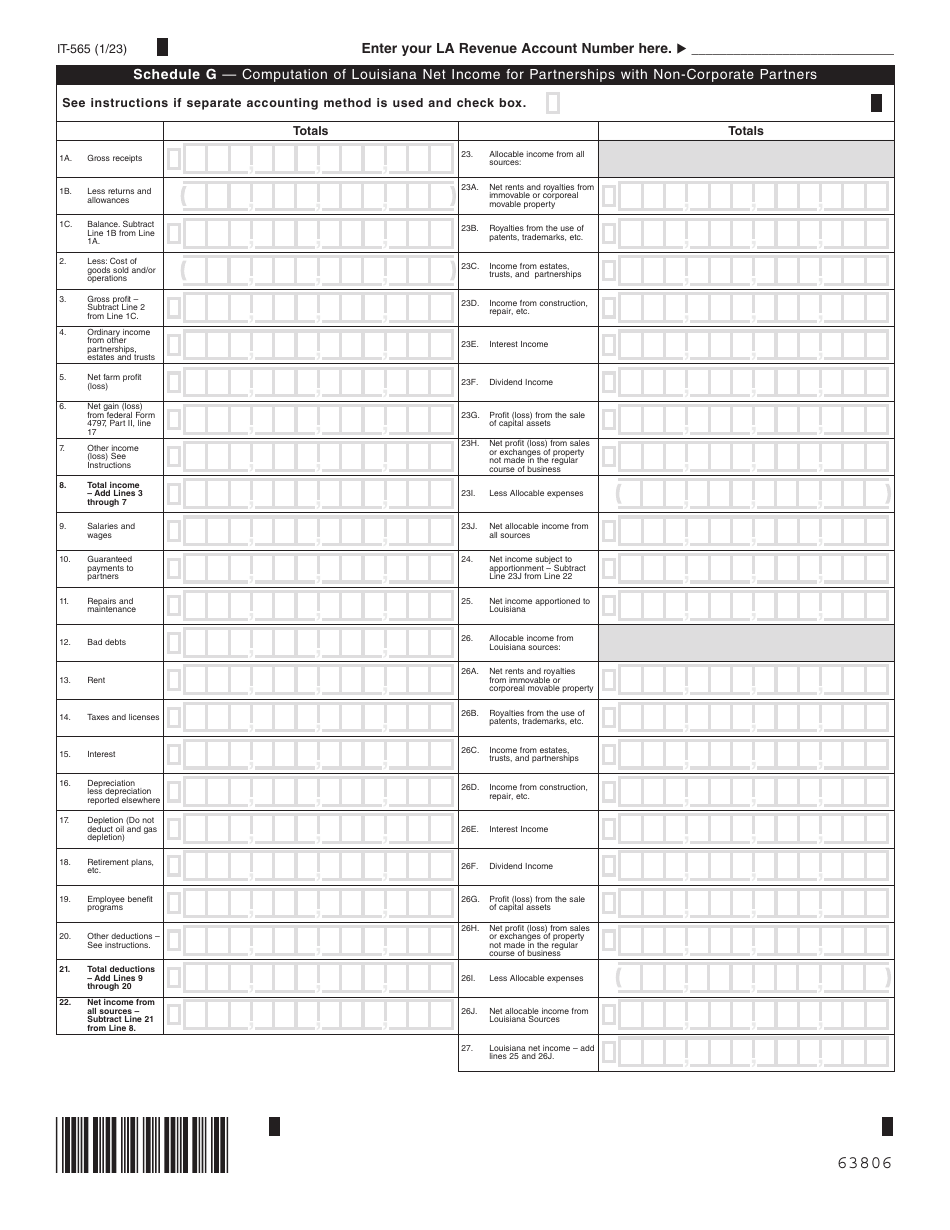

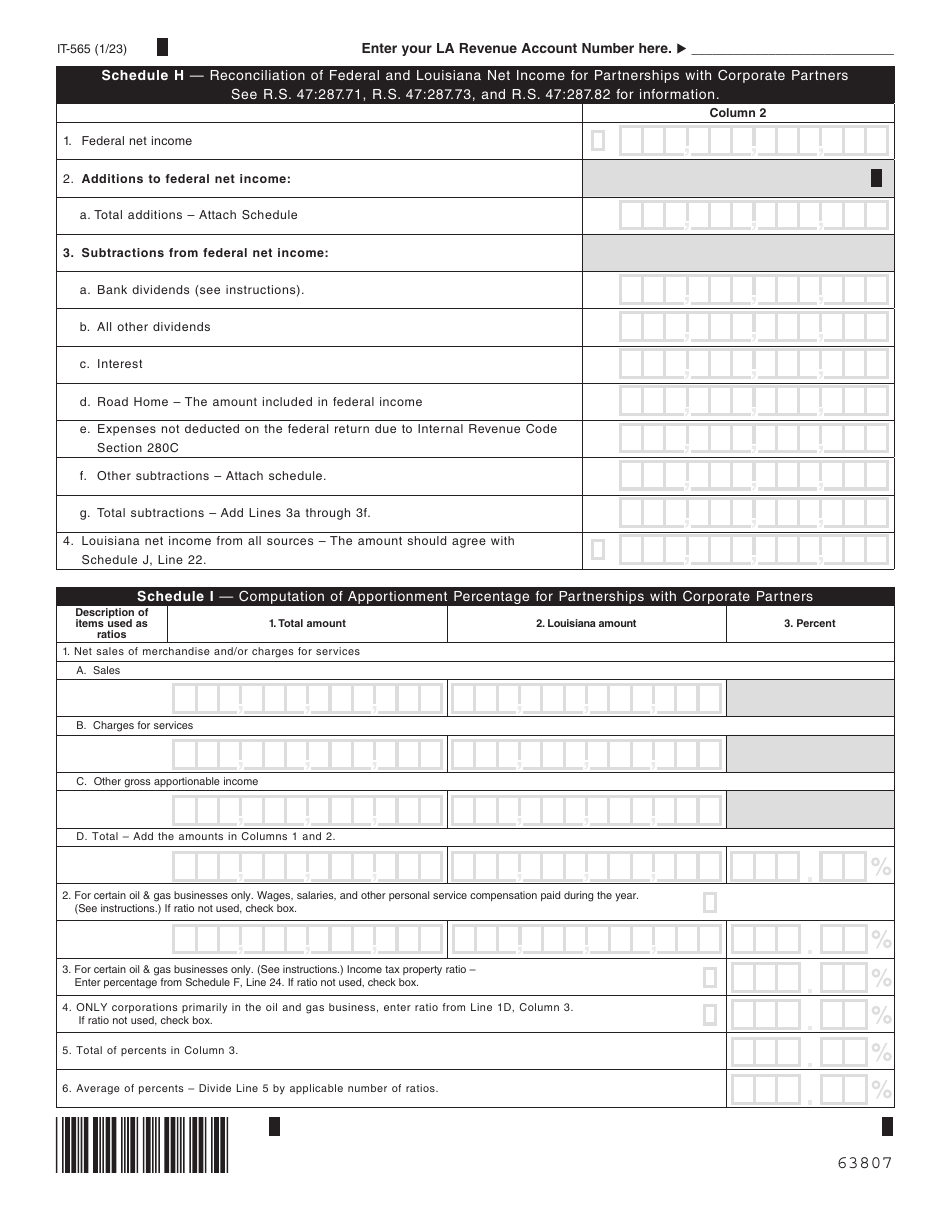

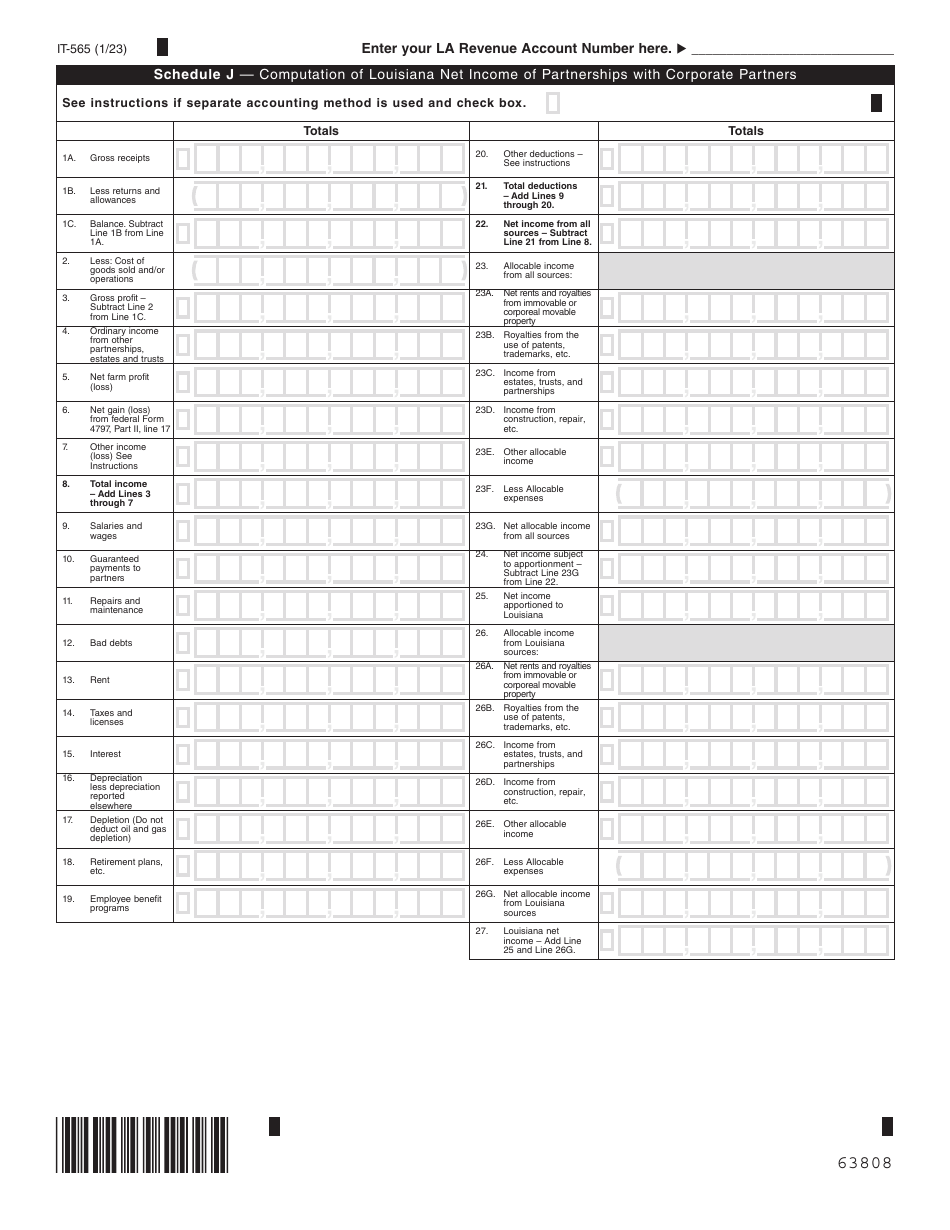

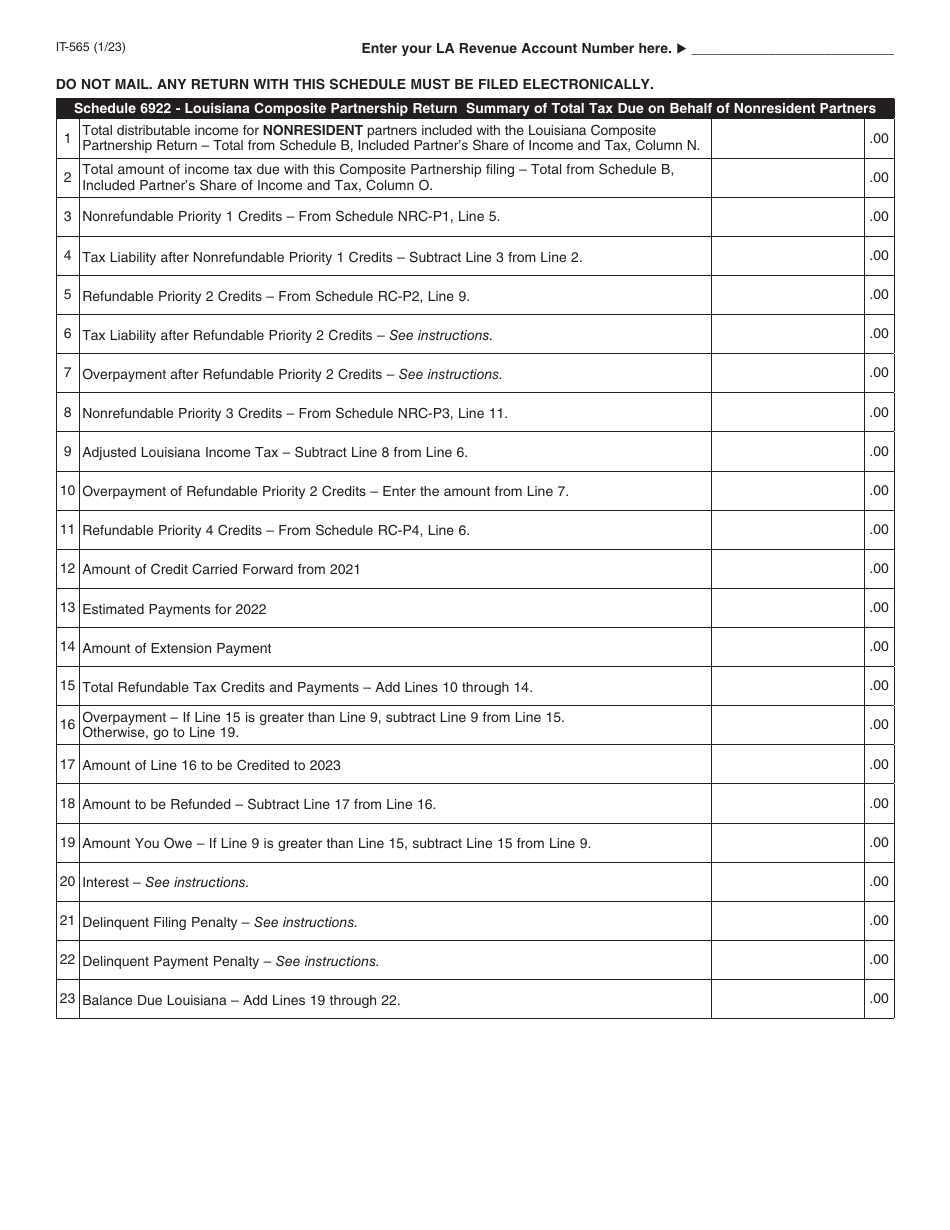

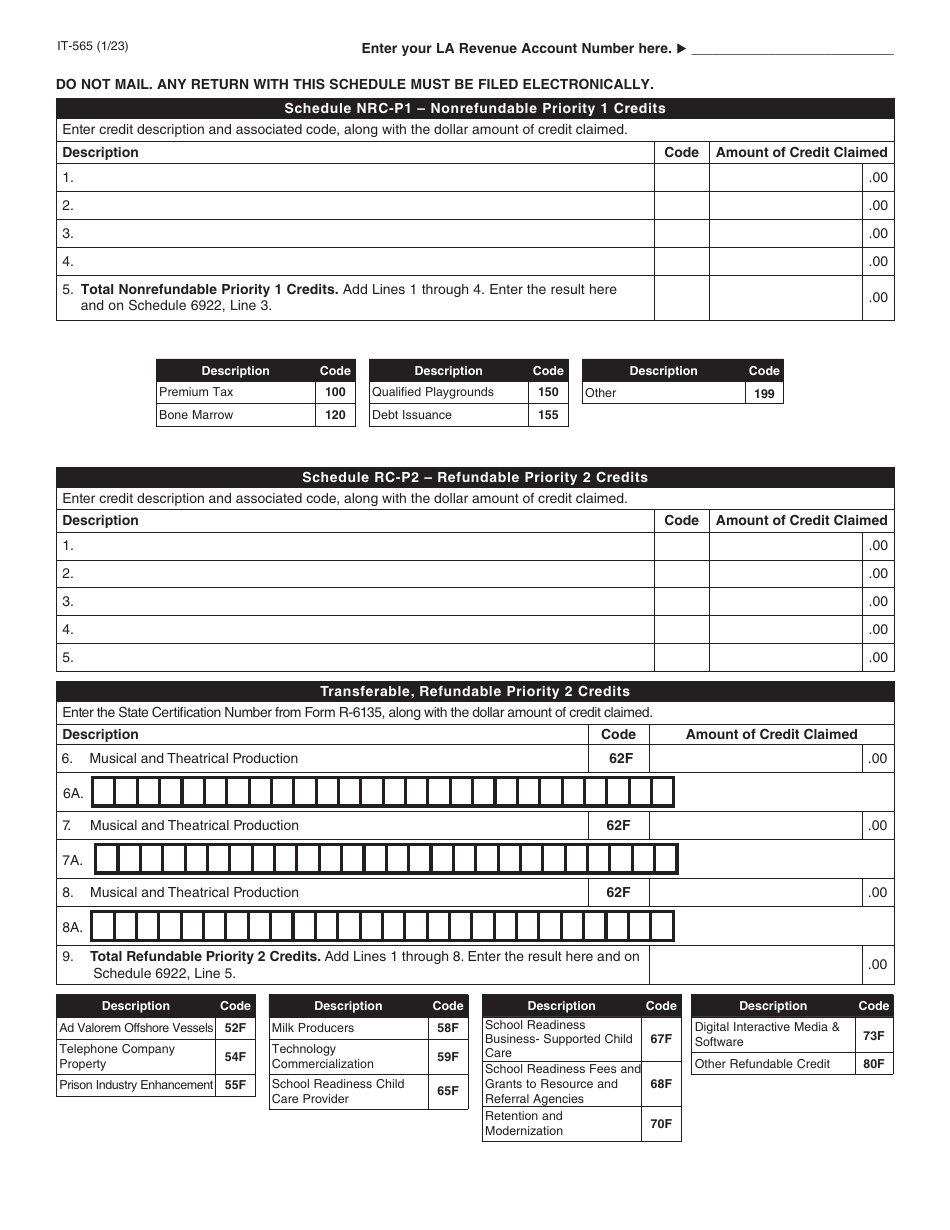

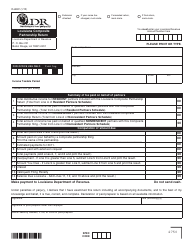

Form IT-565 Partnership Return of Income - Louisiana

What Is Form IT-565?

This is a legal form that was released by the Louisiana Department of Revenue - a government authority operating within Louisiana. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form IT-565 Partnership Return of Income?

A: Form IT-565 is the official tax form used in Louisiana for partnership entities to report their income and deductions.

Q: Who needs to file Form IT-565?

A: Partnerships that are doing business in Louisiana or have income derived from Louisiana sources are required to file Form IT-565.

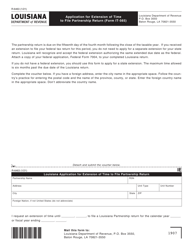

Q: When is the deadline for filing Form IT-565?

A: Form IT-565 is due on the 15th day of the fourth month following the close of the partnership's tax year (usually April 15th for calendar year partnerships).

Q: Are there any penalties for late filing or non-compliance?

A: Yes, penalties may apply for late filing, failure to pay taxes owed, or inaccurate reporting. It is important to file and pay on time to avoid these penalties.

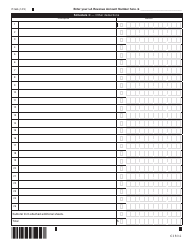

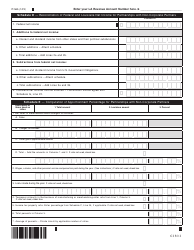

Q: What information is required to complete Form IT-565?

A: You will need to provide details about the partnership, its partners, income, expenses, deductions, and any other relevant financial information.

Q: Is there a minimum income threshold for filing Form IT-565?

A: There is no minimum income threshold for filing Form IT-565. All partnerships meeting the filing requirements are required to file the form.

Q: Can I amend my partnership return if I made an error?

A: Yes, you can file an amended return using Form IT-565 if you need to correct any errors or make changes to previously reported information.

Form Details:

- Released on January 1, 2023;

- The latest edition provided by the Louisiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-565 by clicking the link below or browse more documents and templates provided by the Louisiana Department of Revenue.