This version of the form is not currently in use and is provided for reference only. Download this version of

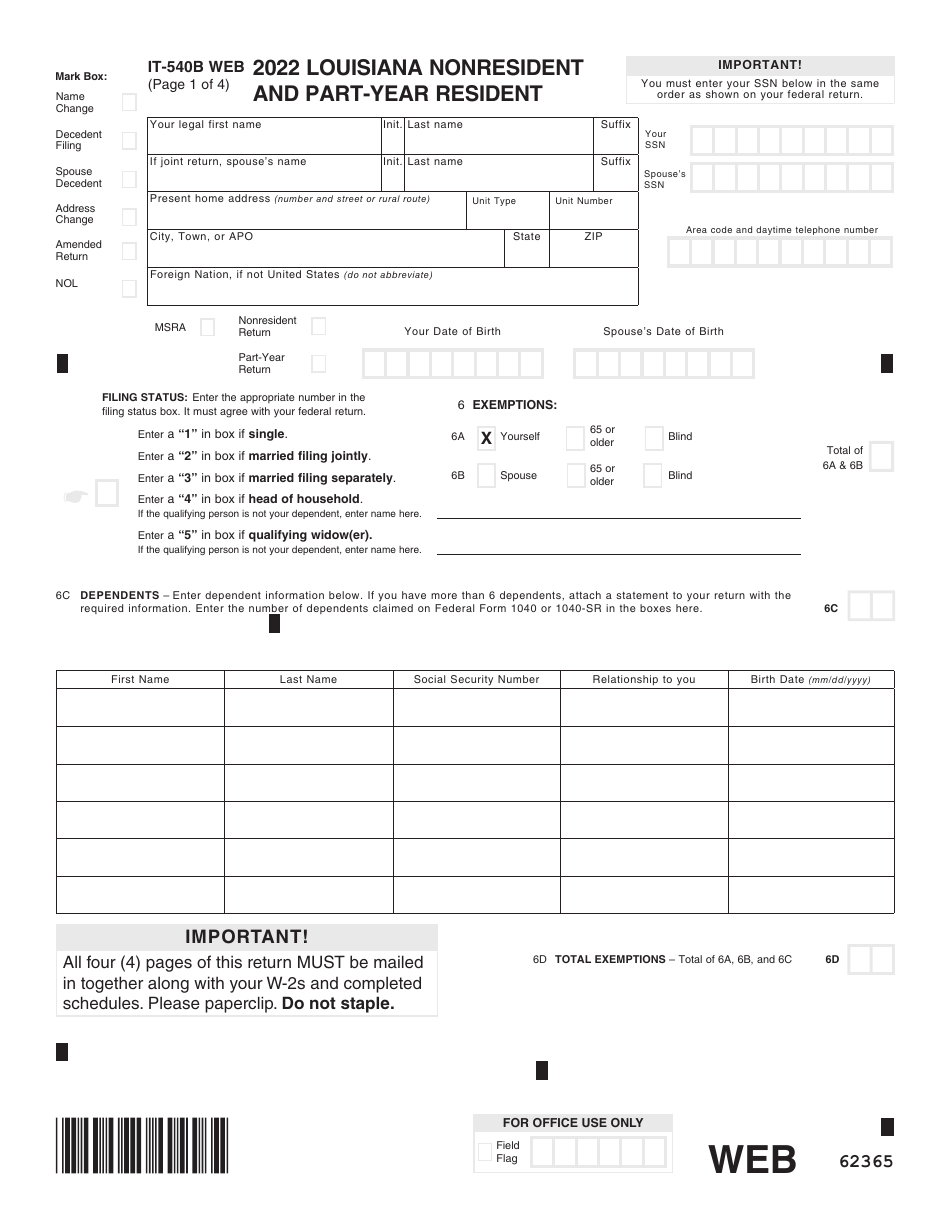

Form IT-540B

for the current year.

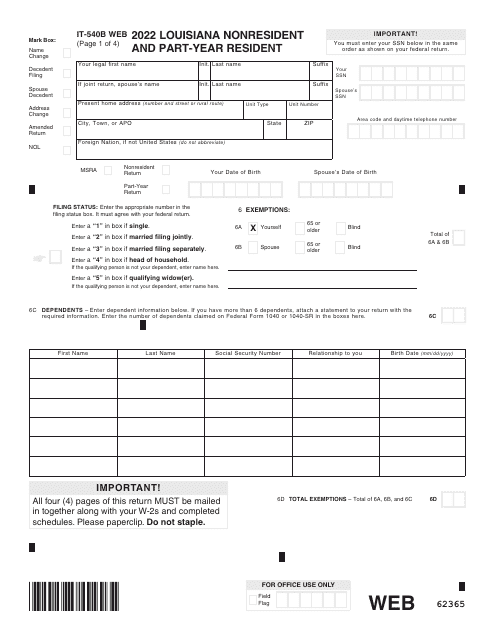

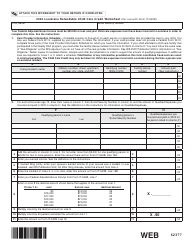

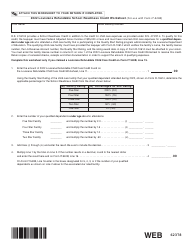

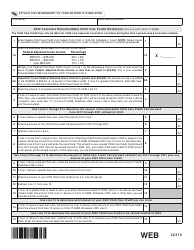

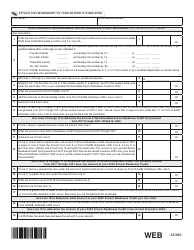

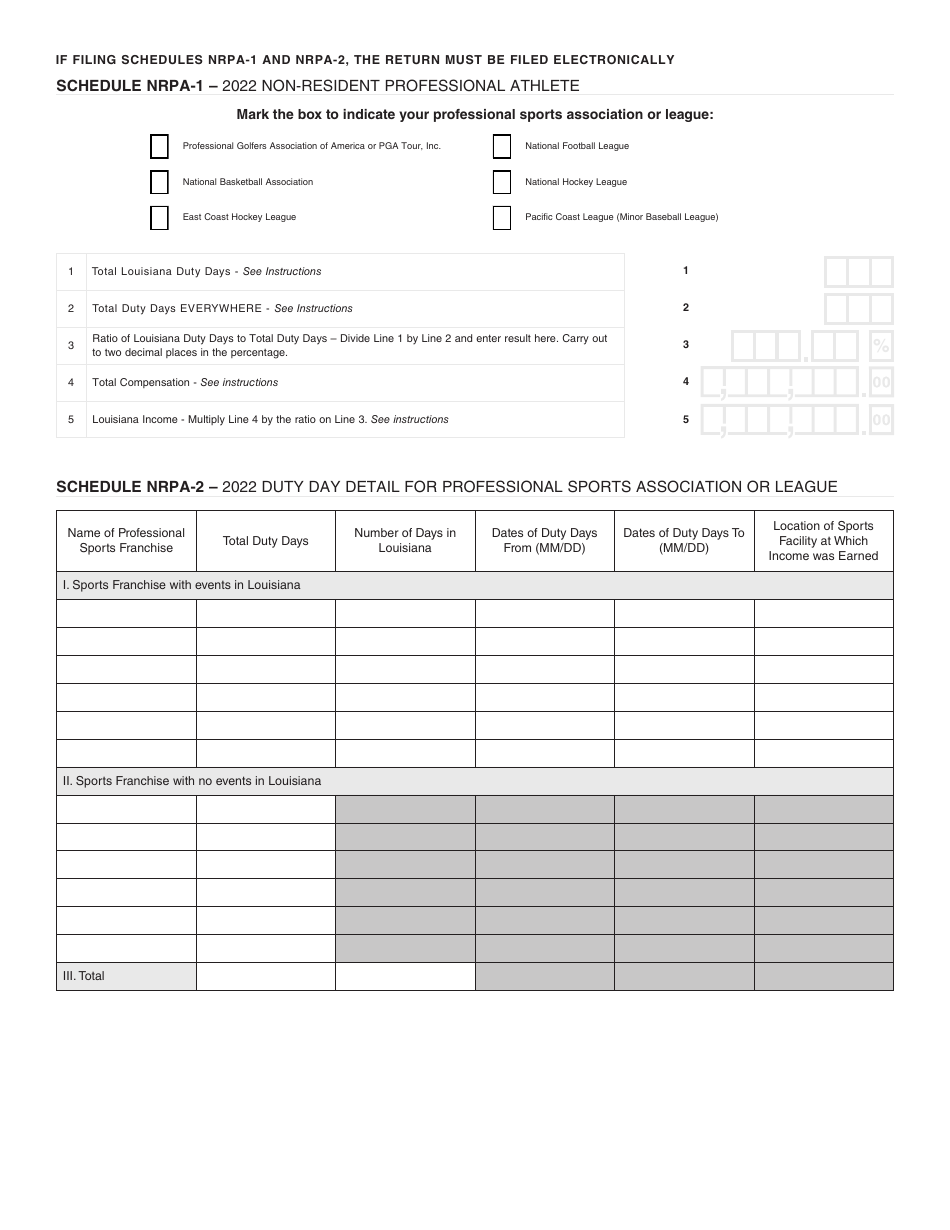

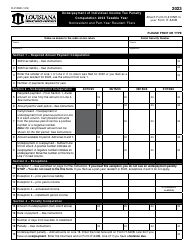

Form IT-540B Louisiana Nonresident Income Tax Return - Louisiana

What Is Form IT-540B?

This is a legal form that was released by the Louisiana Department of Revenue - a government authority operating within Louisiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IT-540B?

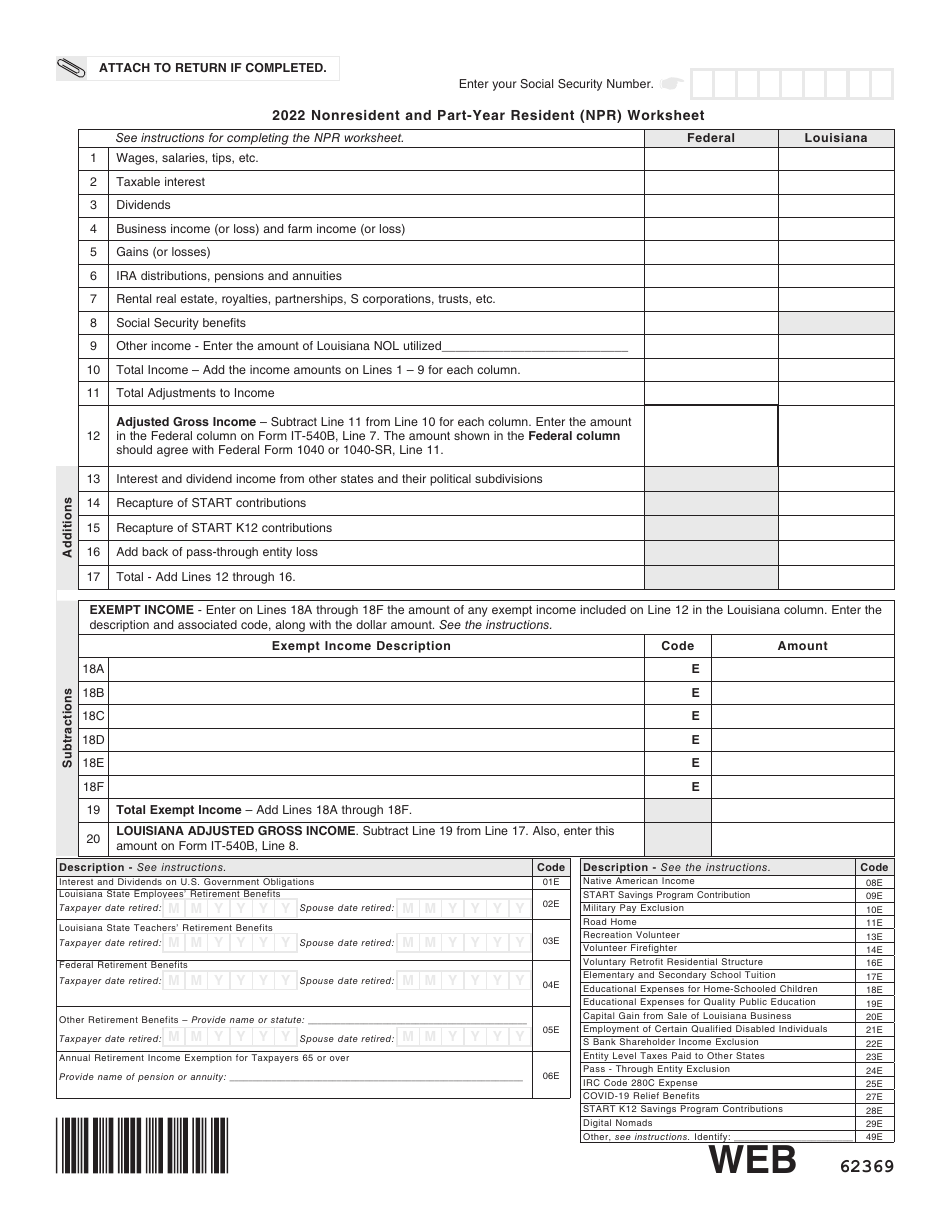

A: Form IT-540B is the Louisiana Nonresident Income Tax Return.

Q: Who should file Form IT-540B?

A: Nonresidents of Louisiana who have income from Louisiana sources should file Form IT-540B.

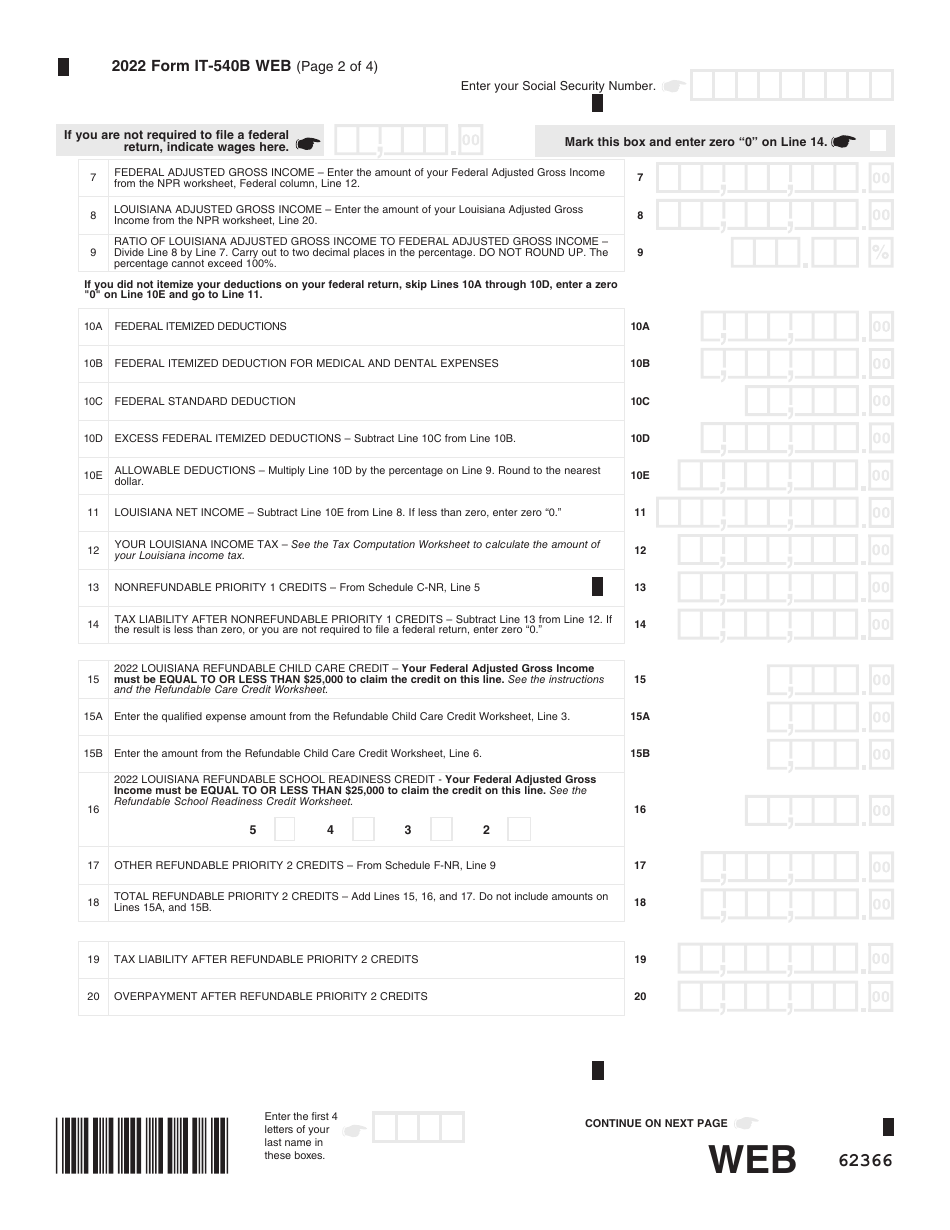

Q: What is the purpose of Form IT-540B?

A: The purpose of Form IT-540B is to report and calculate the amount of Louisiana income tax owed by nonresidents.

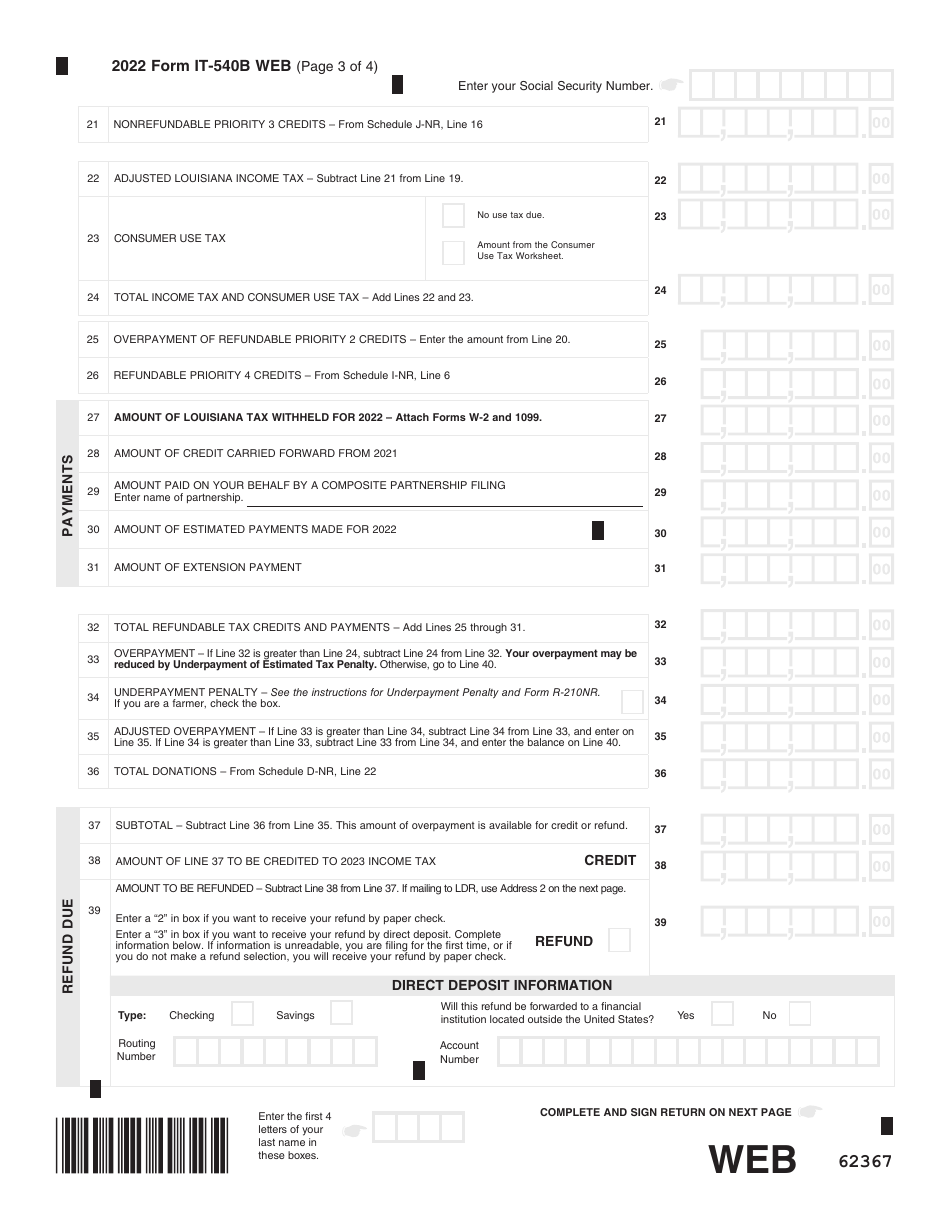

Q: When is the deadline for filing Form IT-540B?

A: The deadline for filing Form IT-540B is the same as the federal income tax deadline, which is typically April 15th.

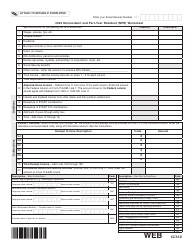

Q: What types of income should be reported on Form IT-540B?

A: Any income earned from Louisiana sources, such as wages, salaries, or income from rental properties in Louisiana, should be reported on Form IT-540B.

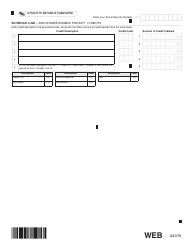

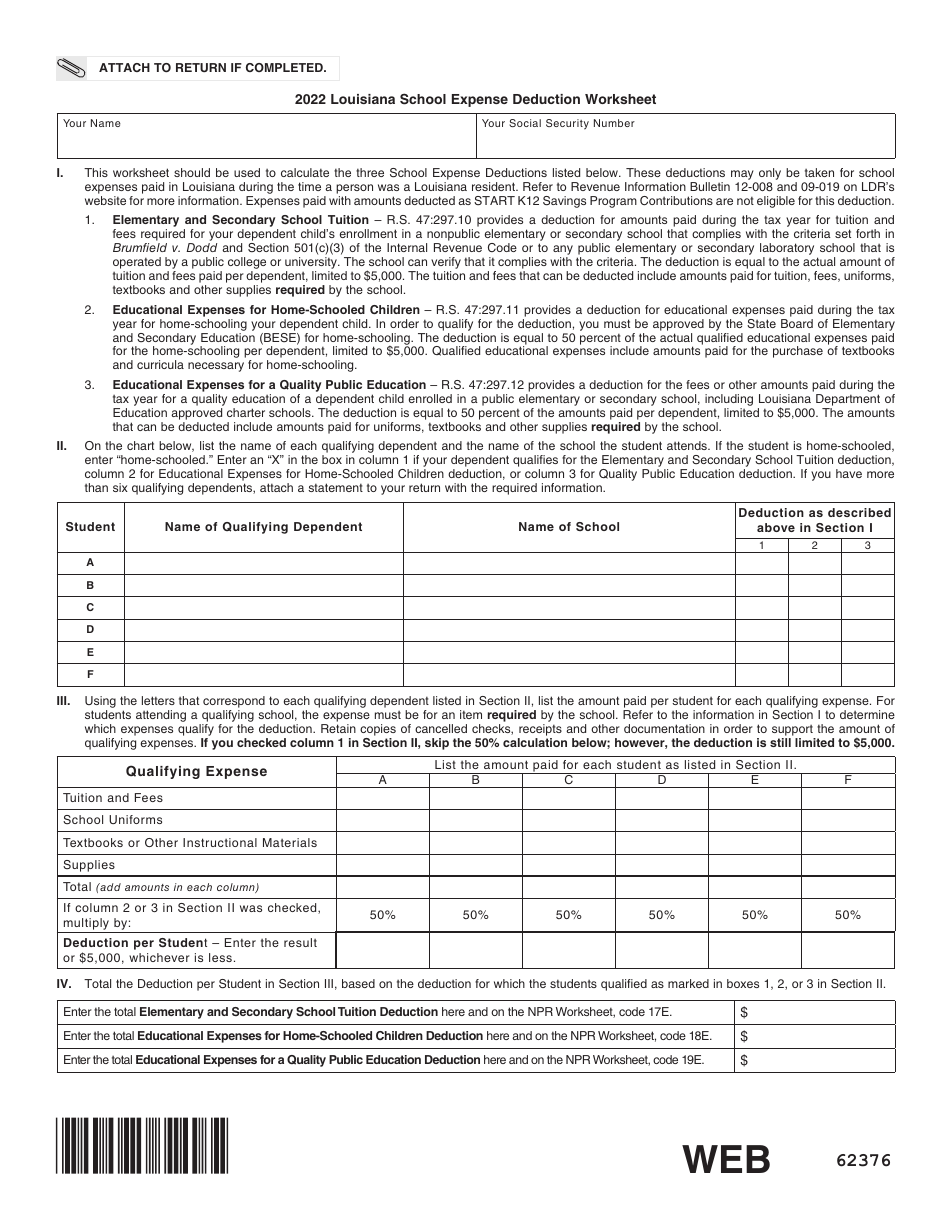

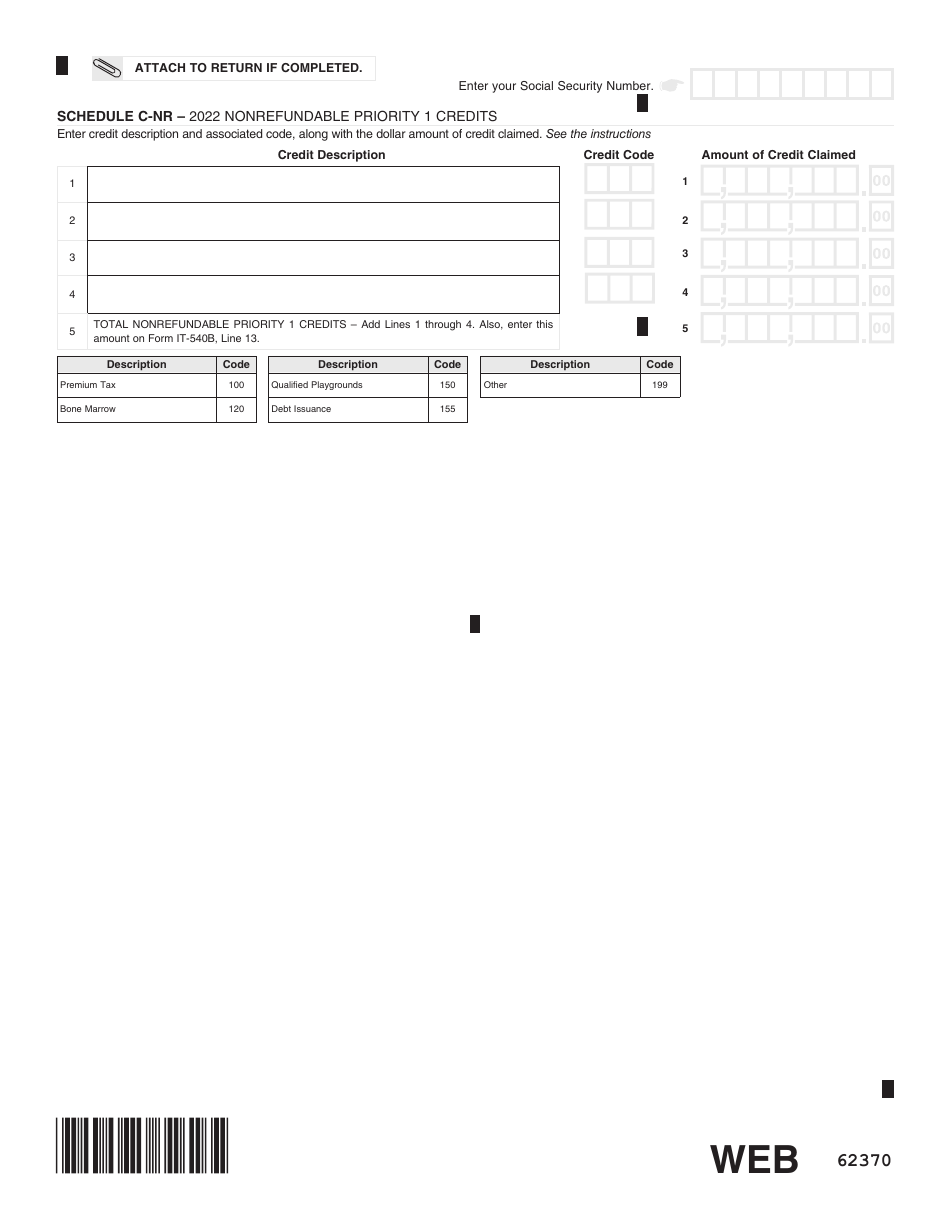

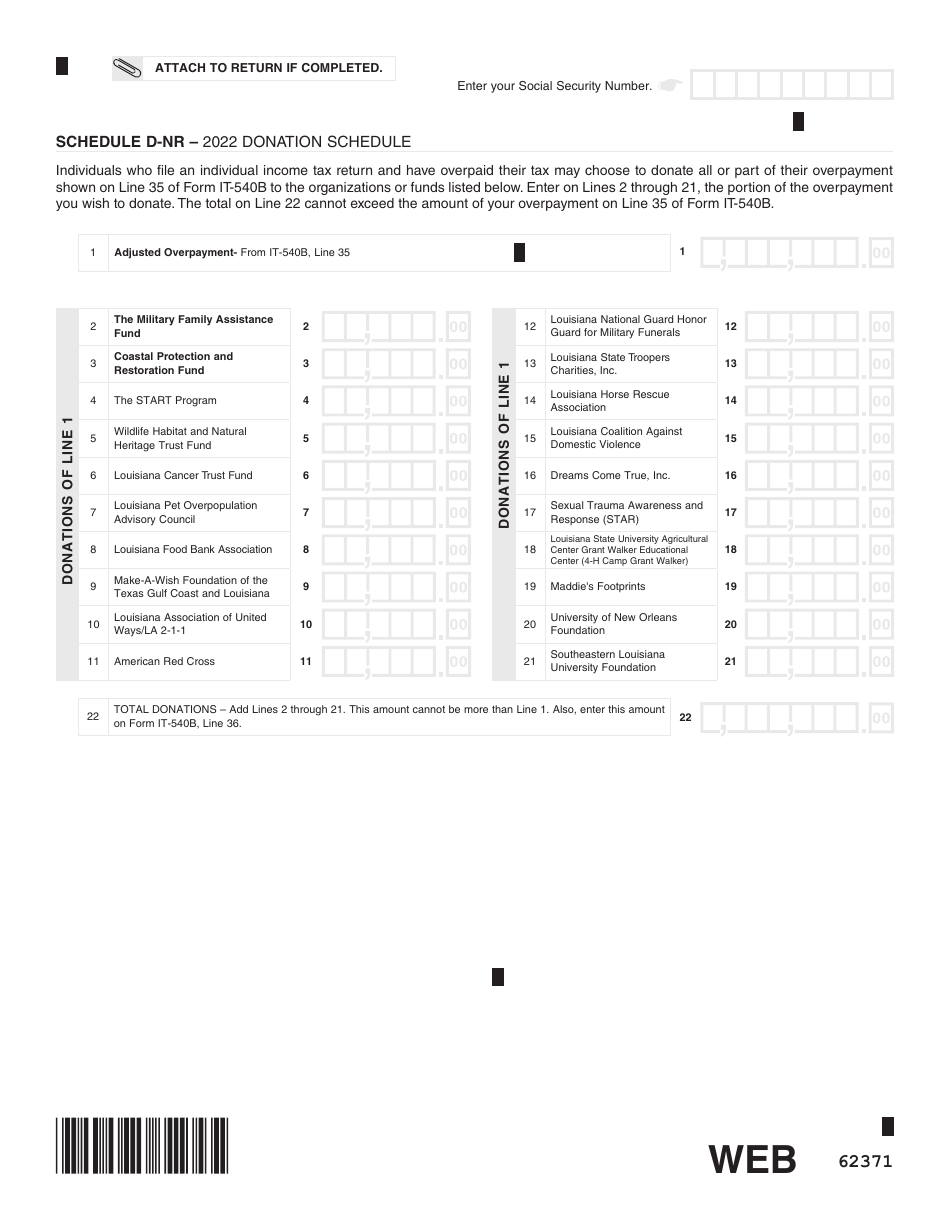

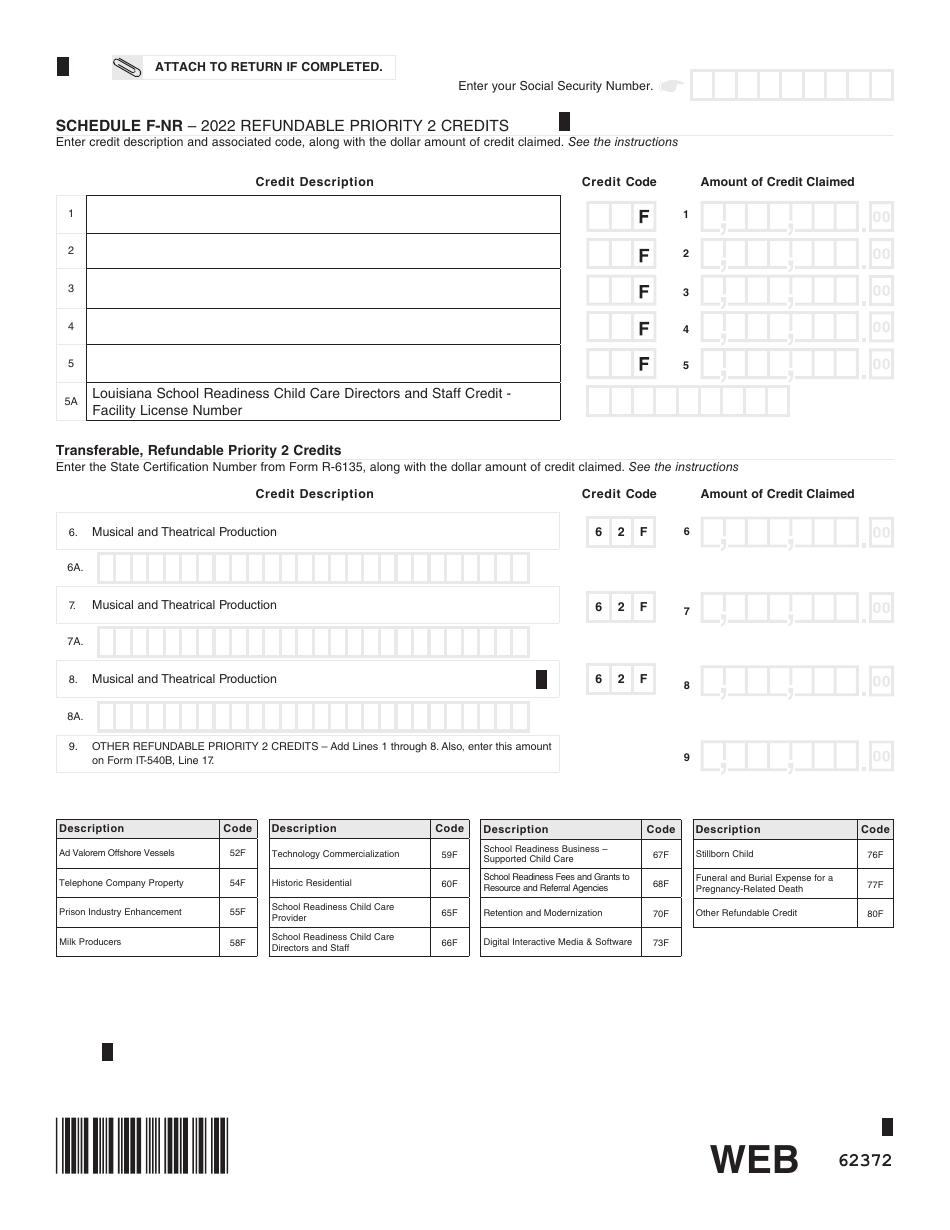

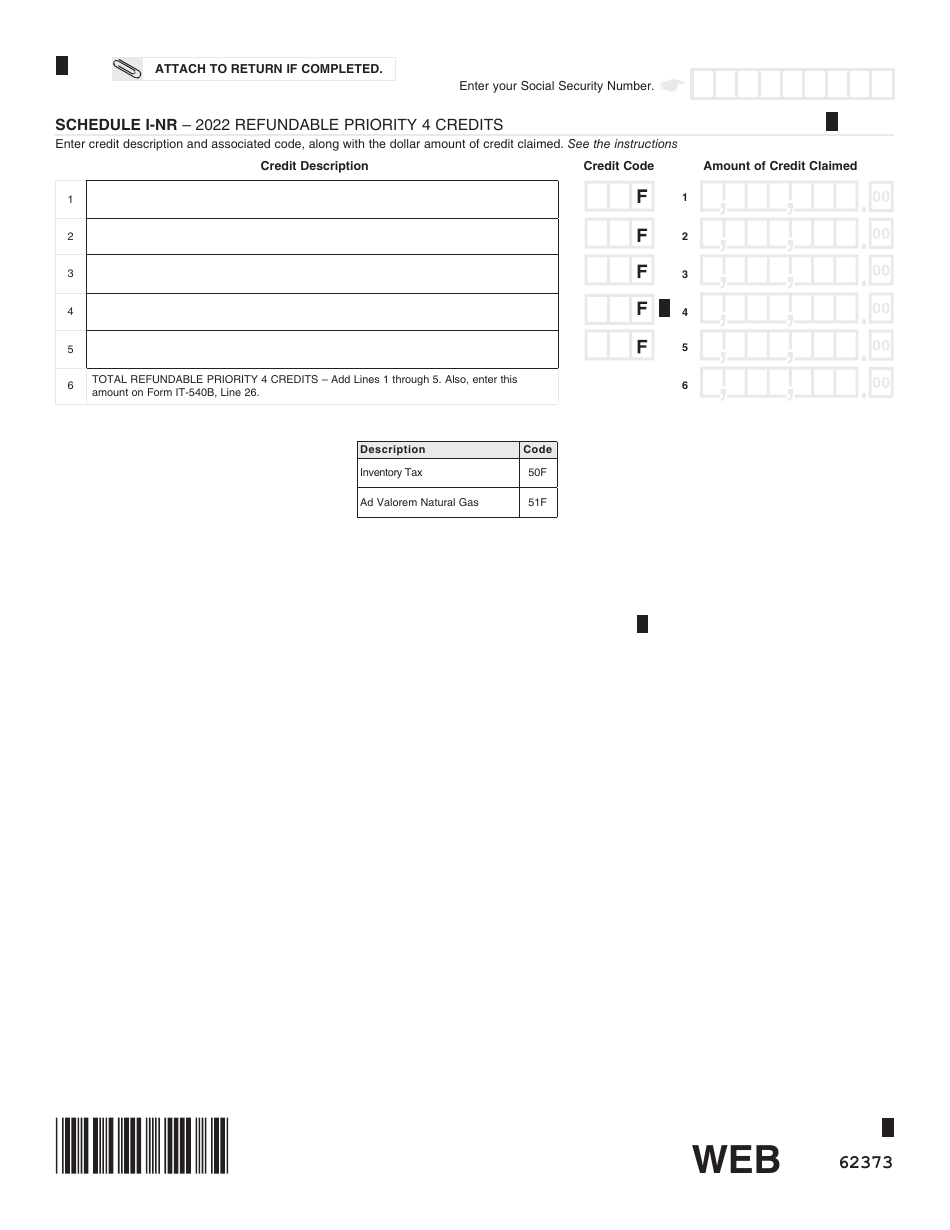

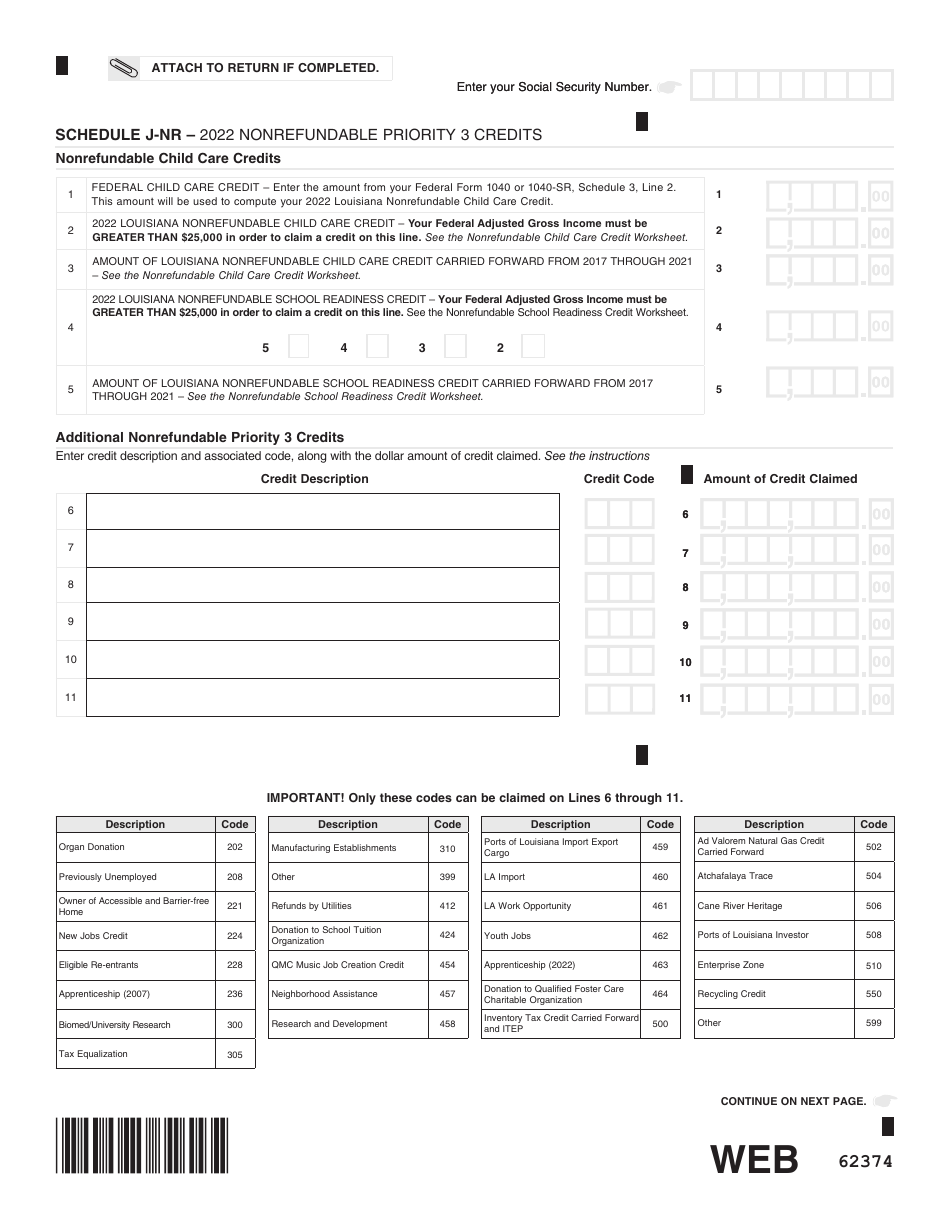

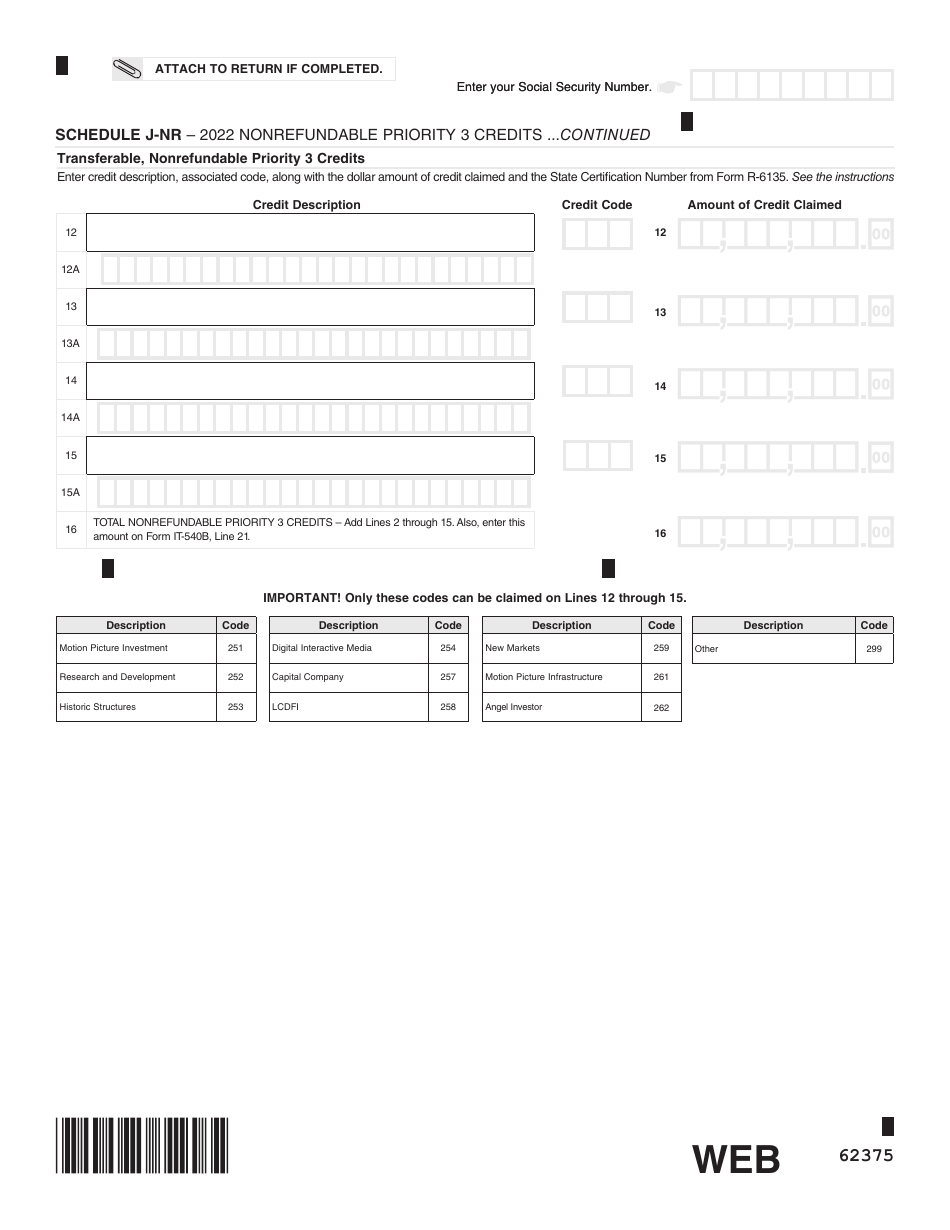

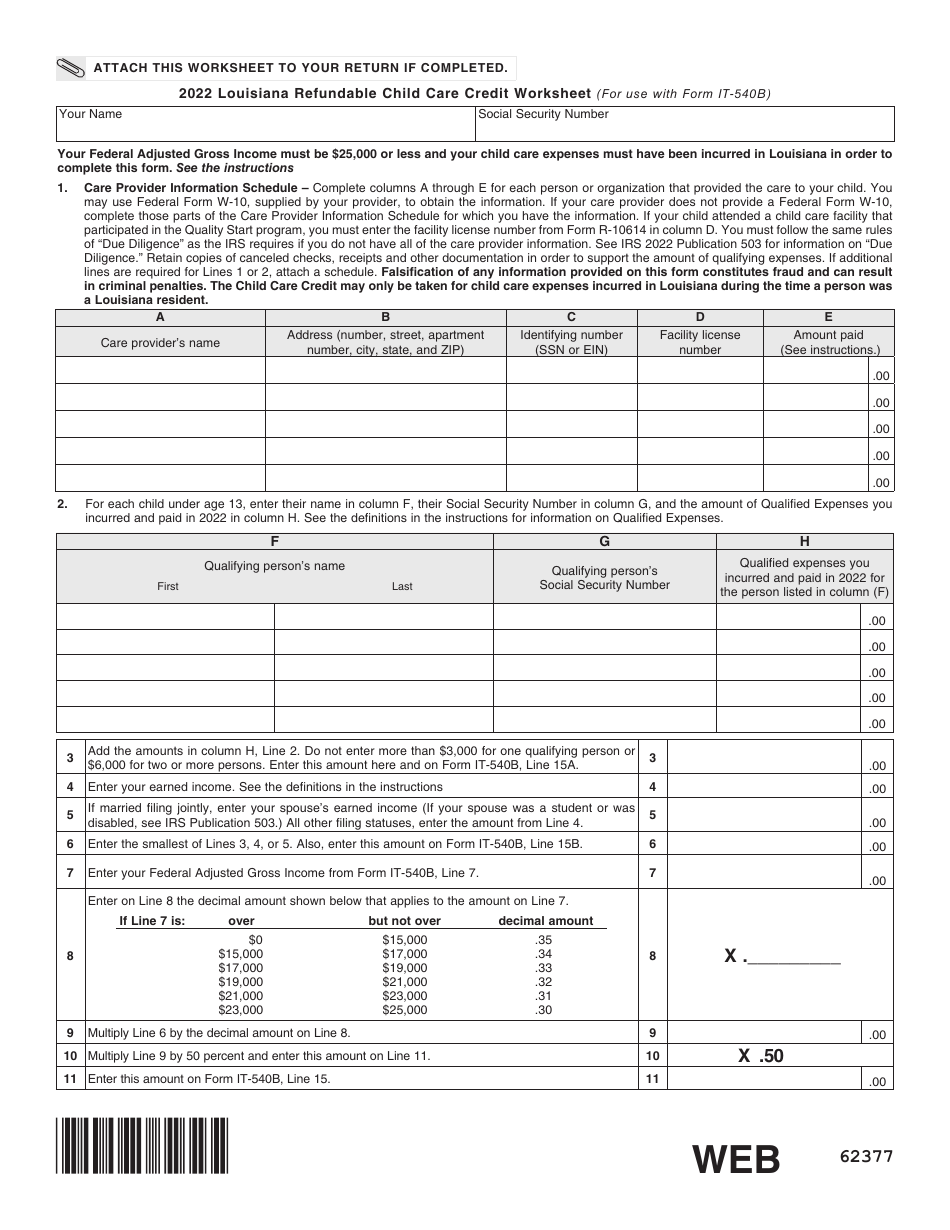

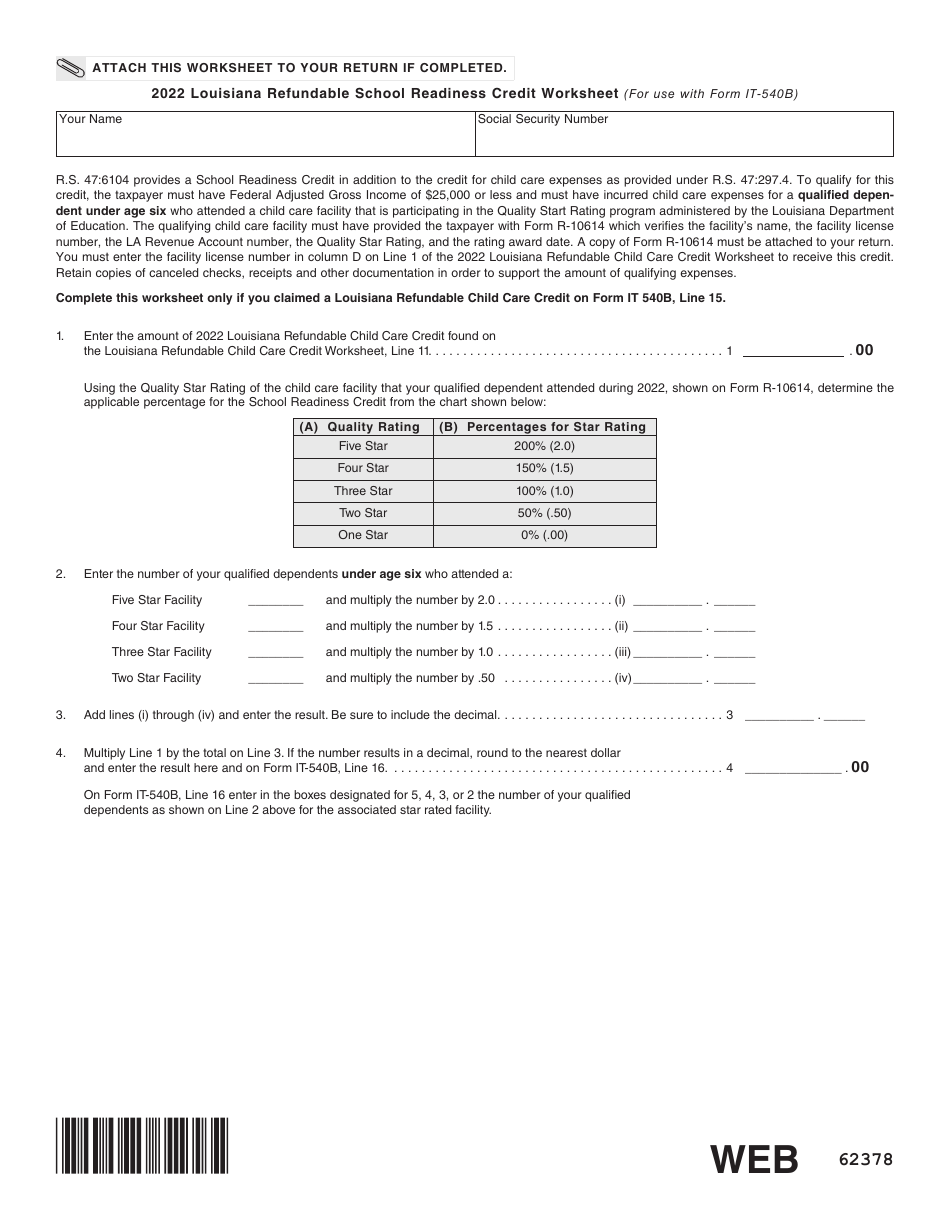

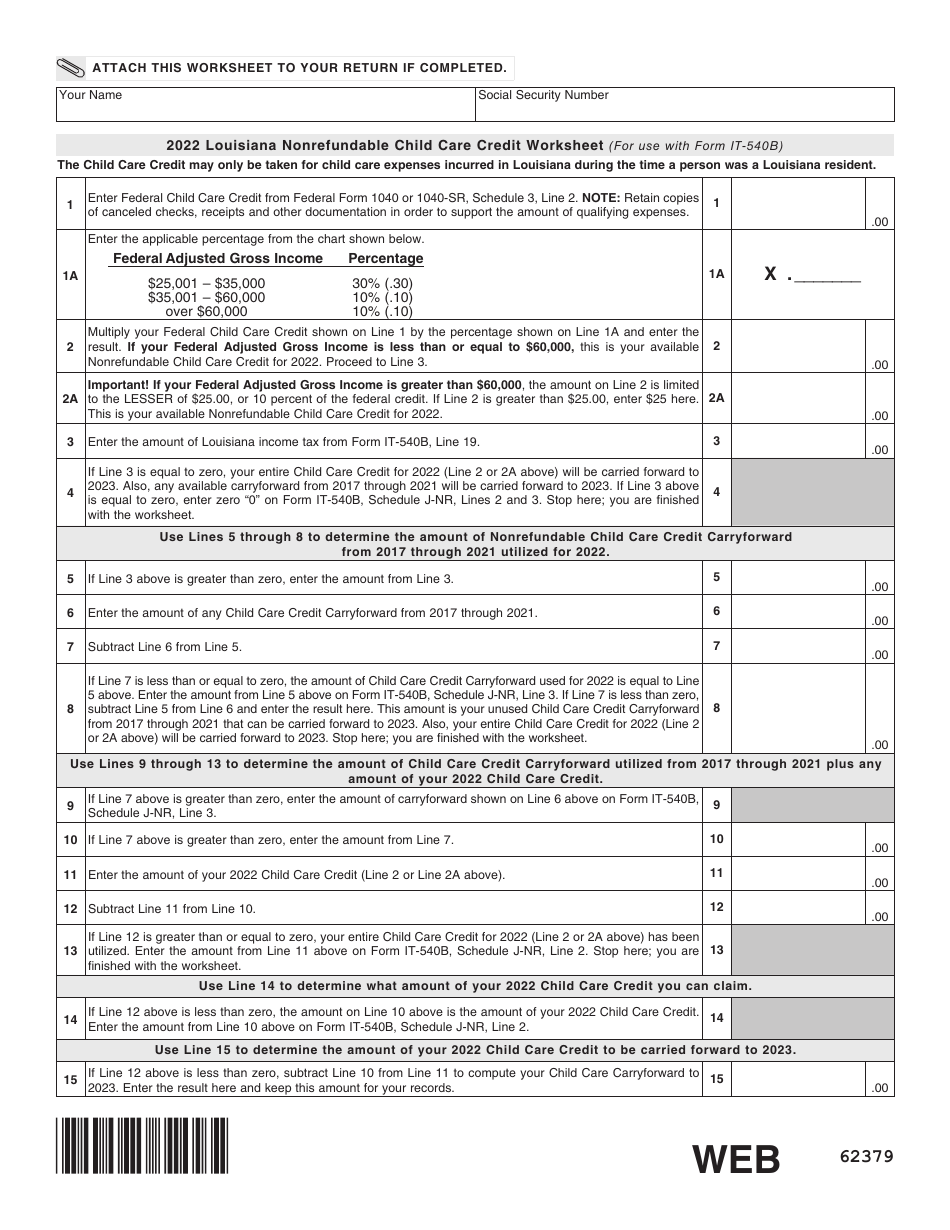

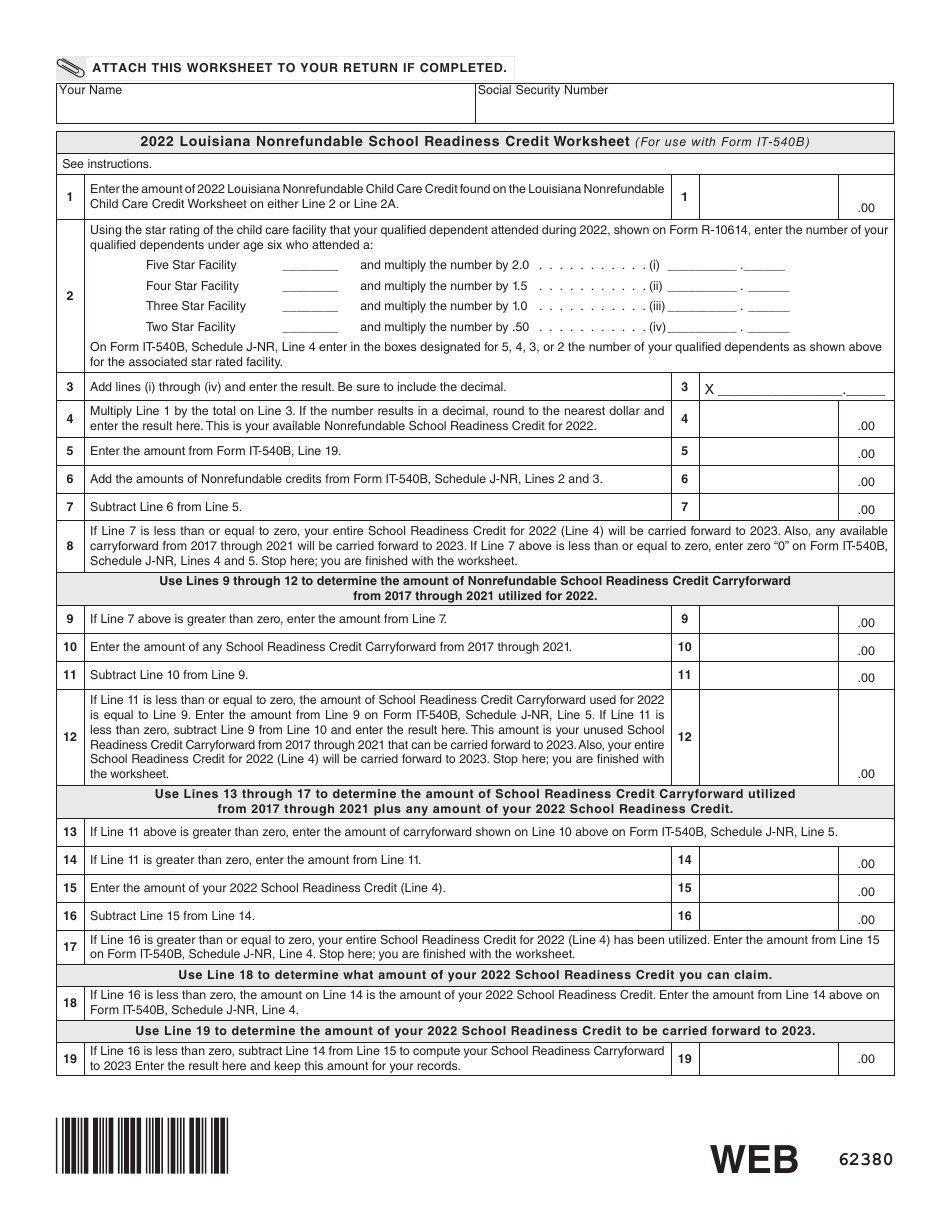

Q: Are there any deductions or credits available for nonresidents on Form IT-540B?

A: Yes, nonresidents may be eligible for certain deductions or credits on Form IT-540B. Consult the instructions for Form IT-540B or seek professional tax advice for more information.

Q: What happens if I don't file Form IT-540B?

A: If you are required to file Form IT-540B and fail to do so, you may be subject to penalties and interest on any unpaid taxes.

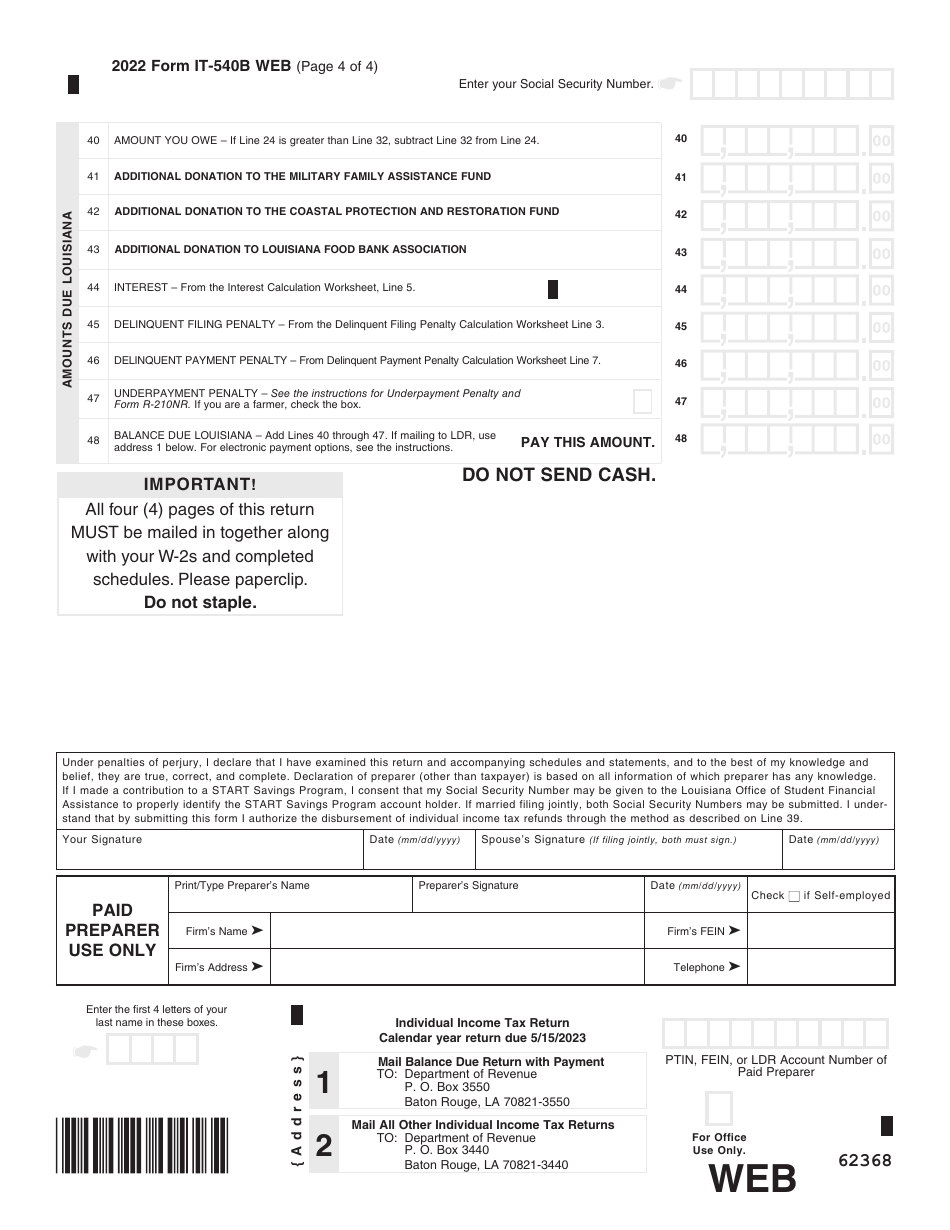

Q: Can I file Form IT-540B if I am a resident of Louisiana?

A: No, Form IT-540B is specifically for nonresidents of Louisiana. Residents of Louisiana should file Form IT-540, the Louisiana Resident Income Tax Return.

Form Details:

- The latest edition provided by the Louisiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-540B by clicking the link below or browse more documents and templates provided by the Louisiana Department of Revenue.