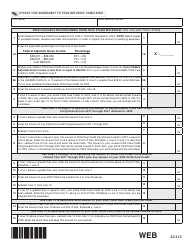

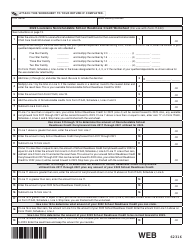

This version of the form is not currently in use and is provided for reference only. Download this version of

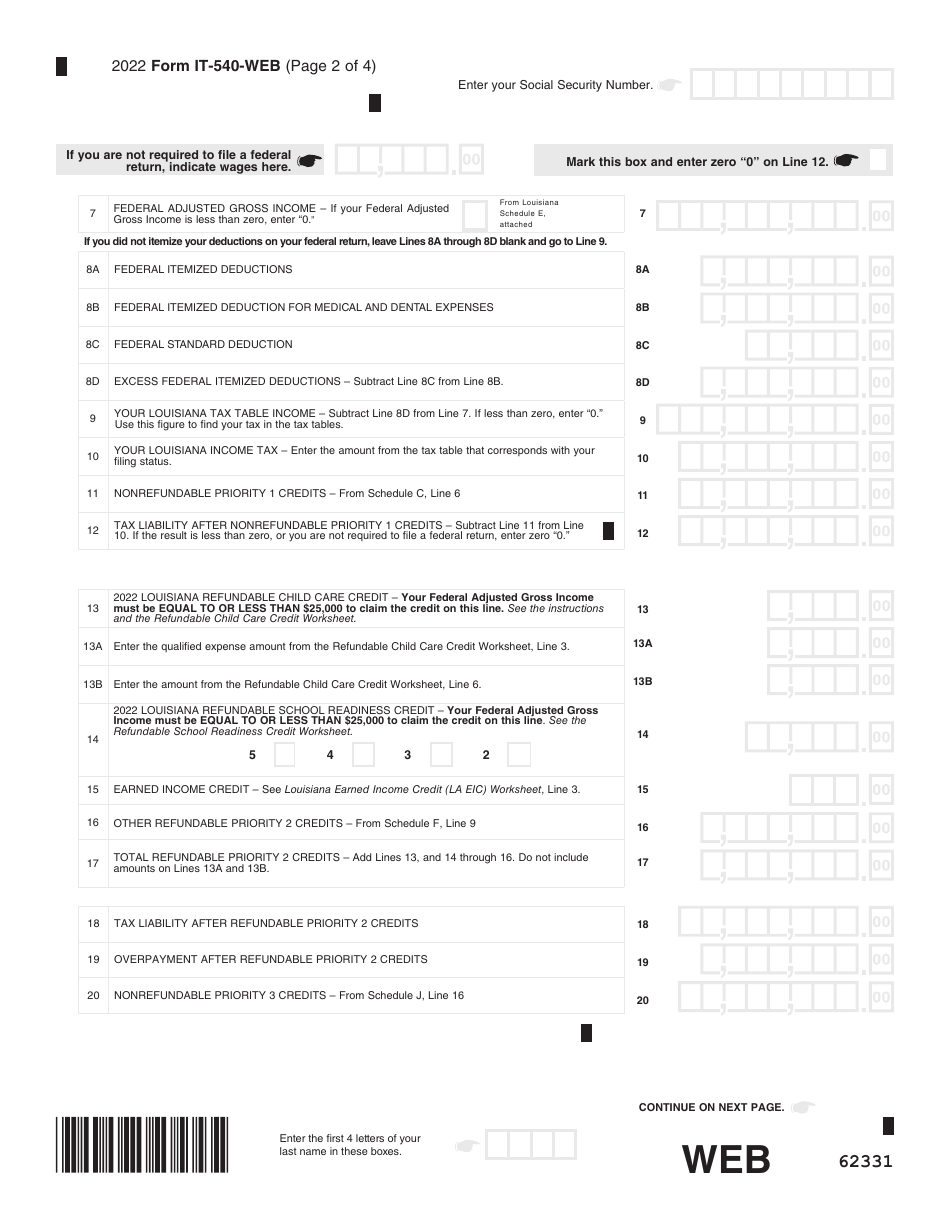

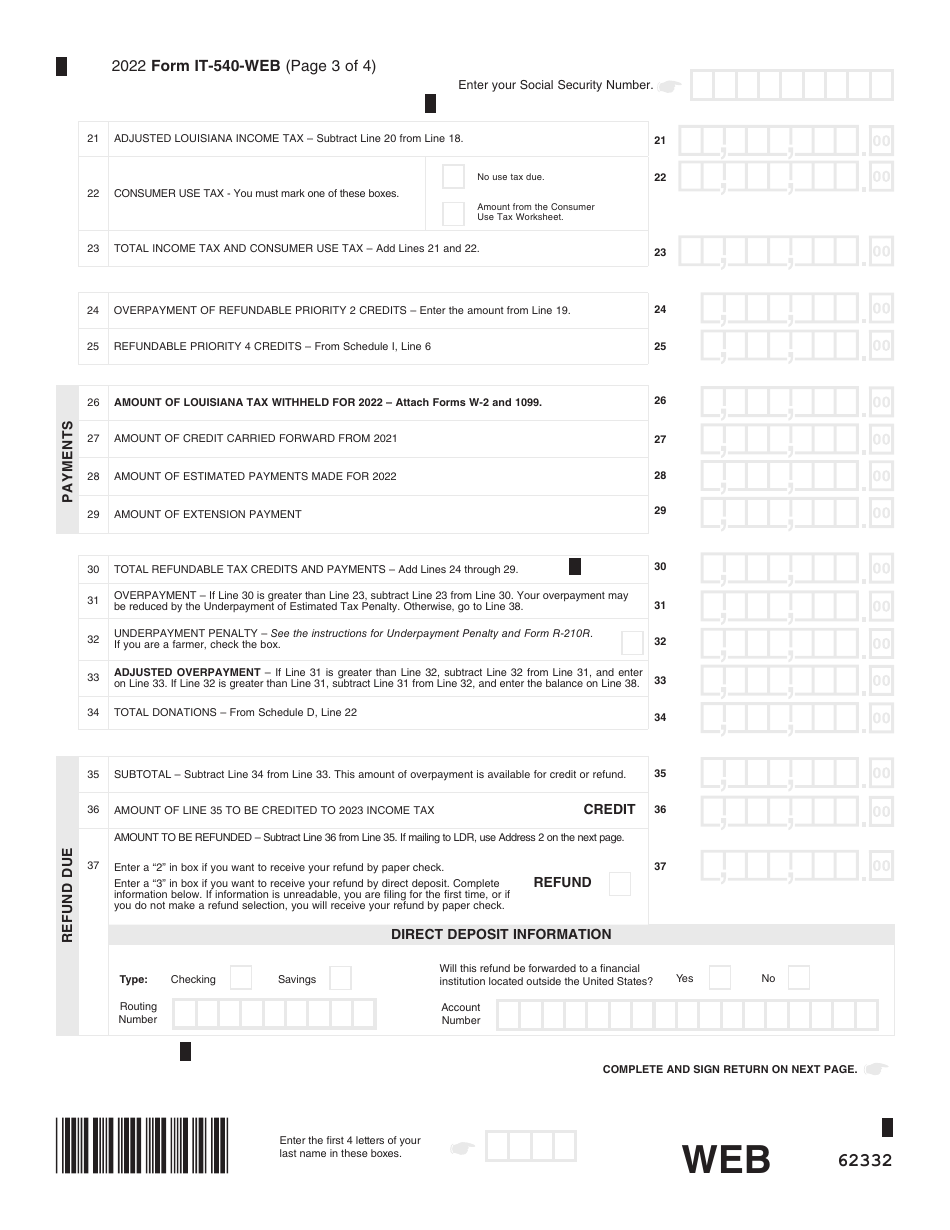

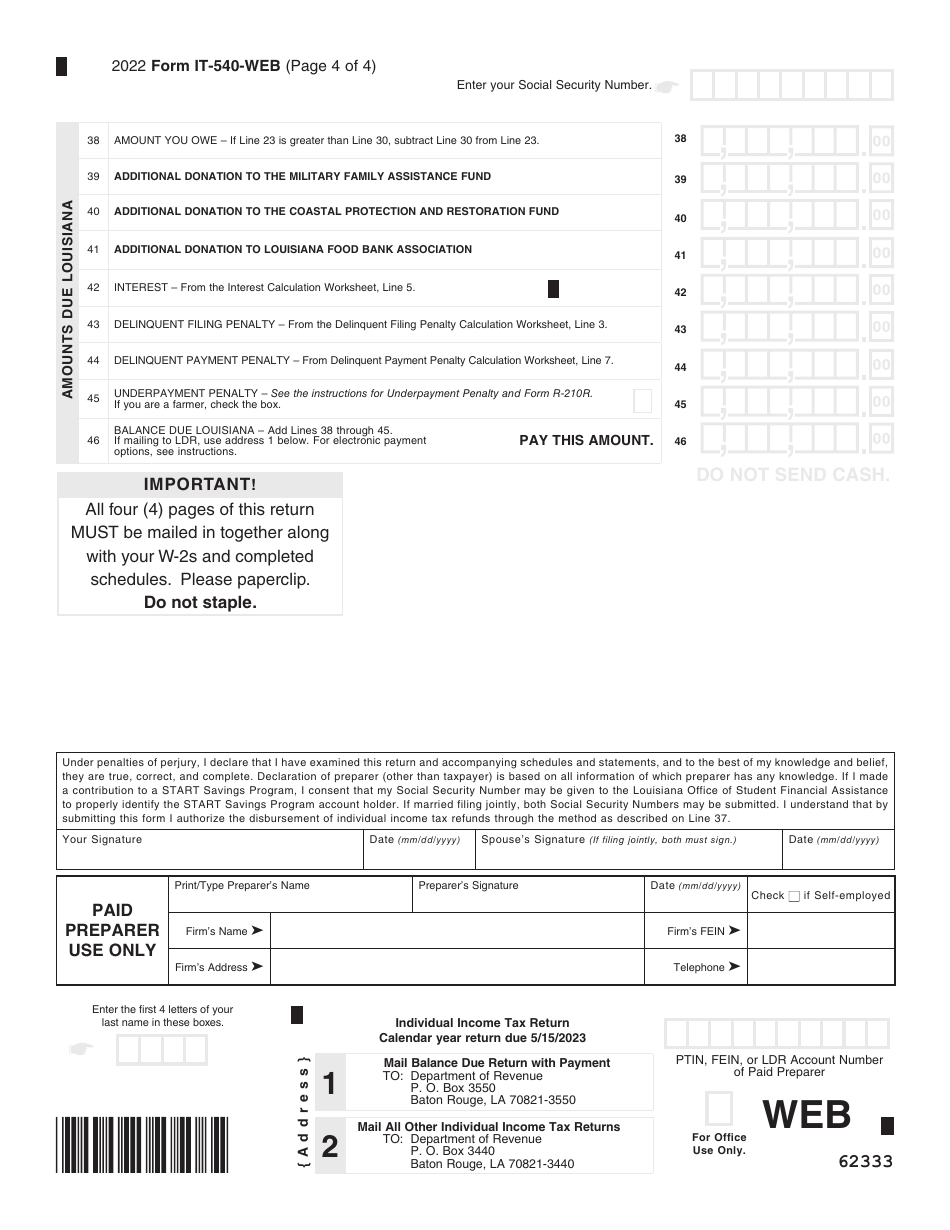

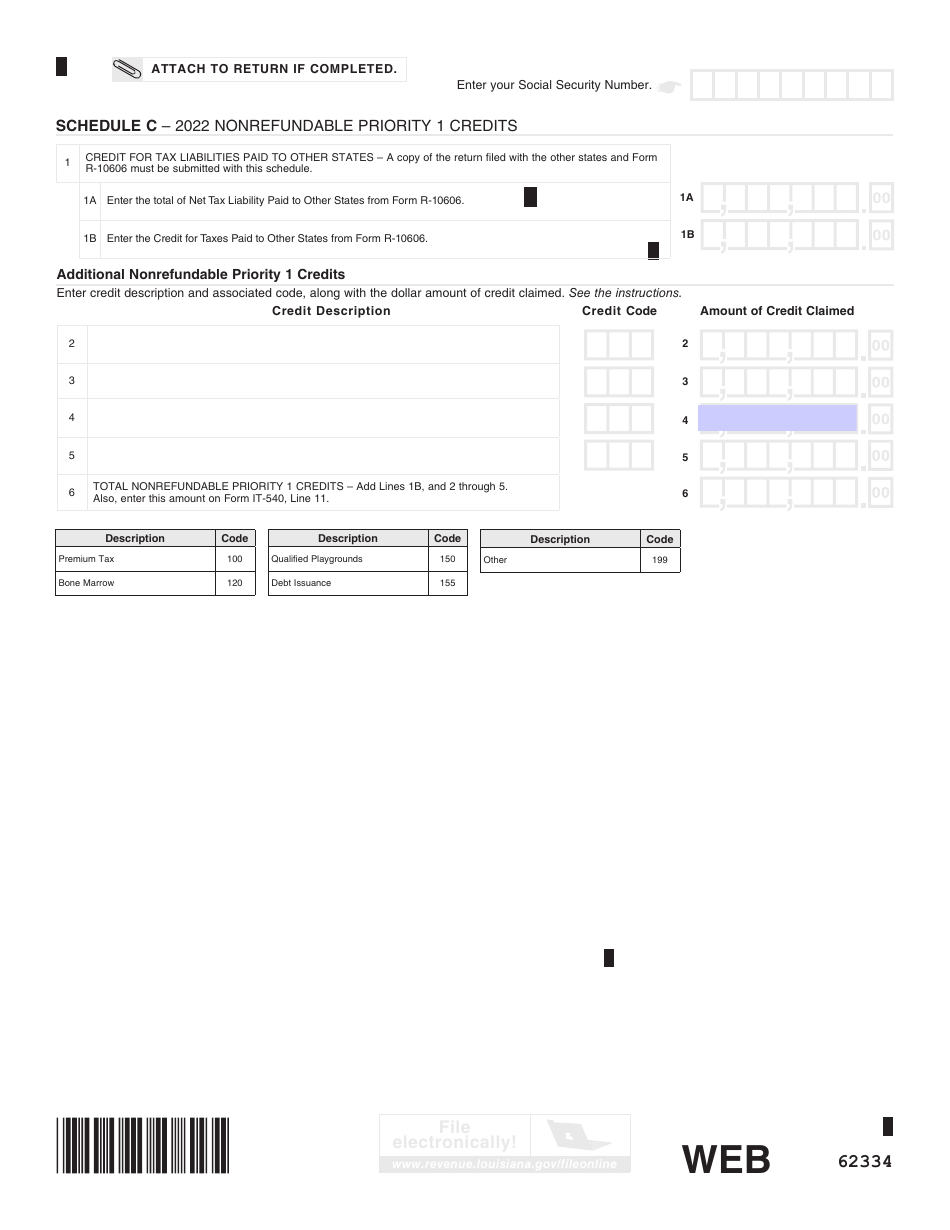

Form IT-540

for the current year.

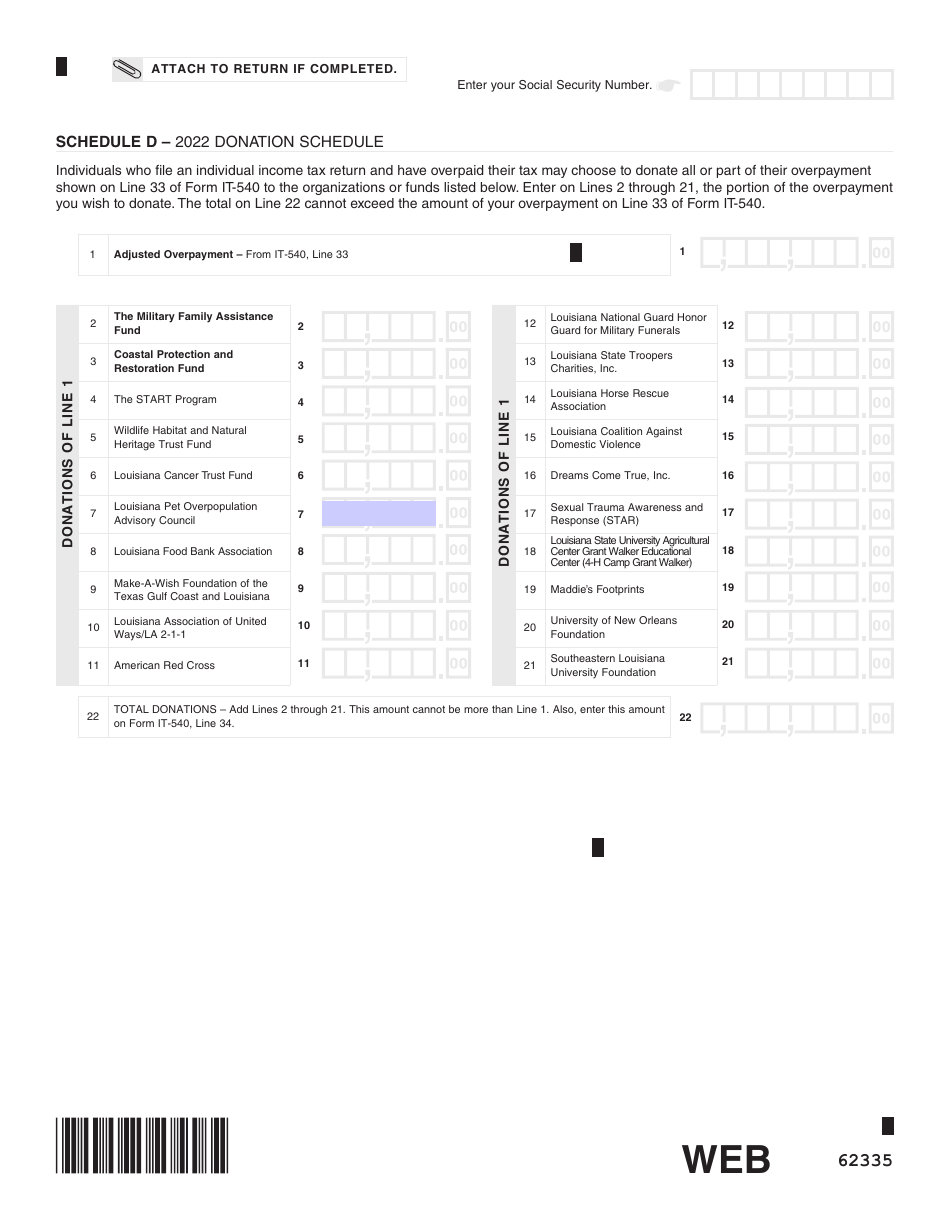

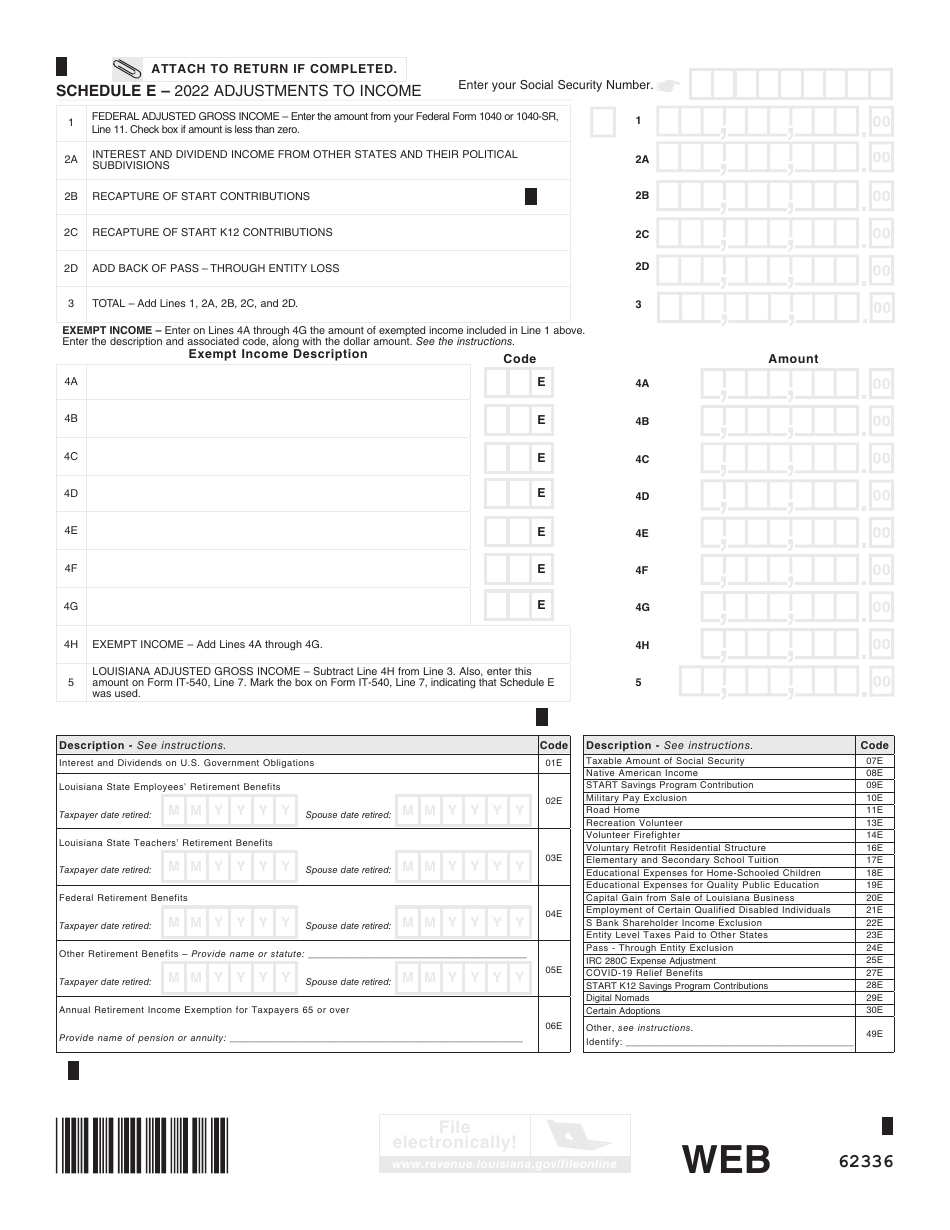

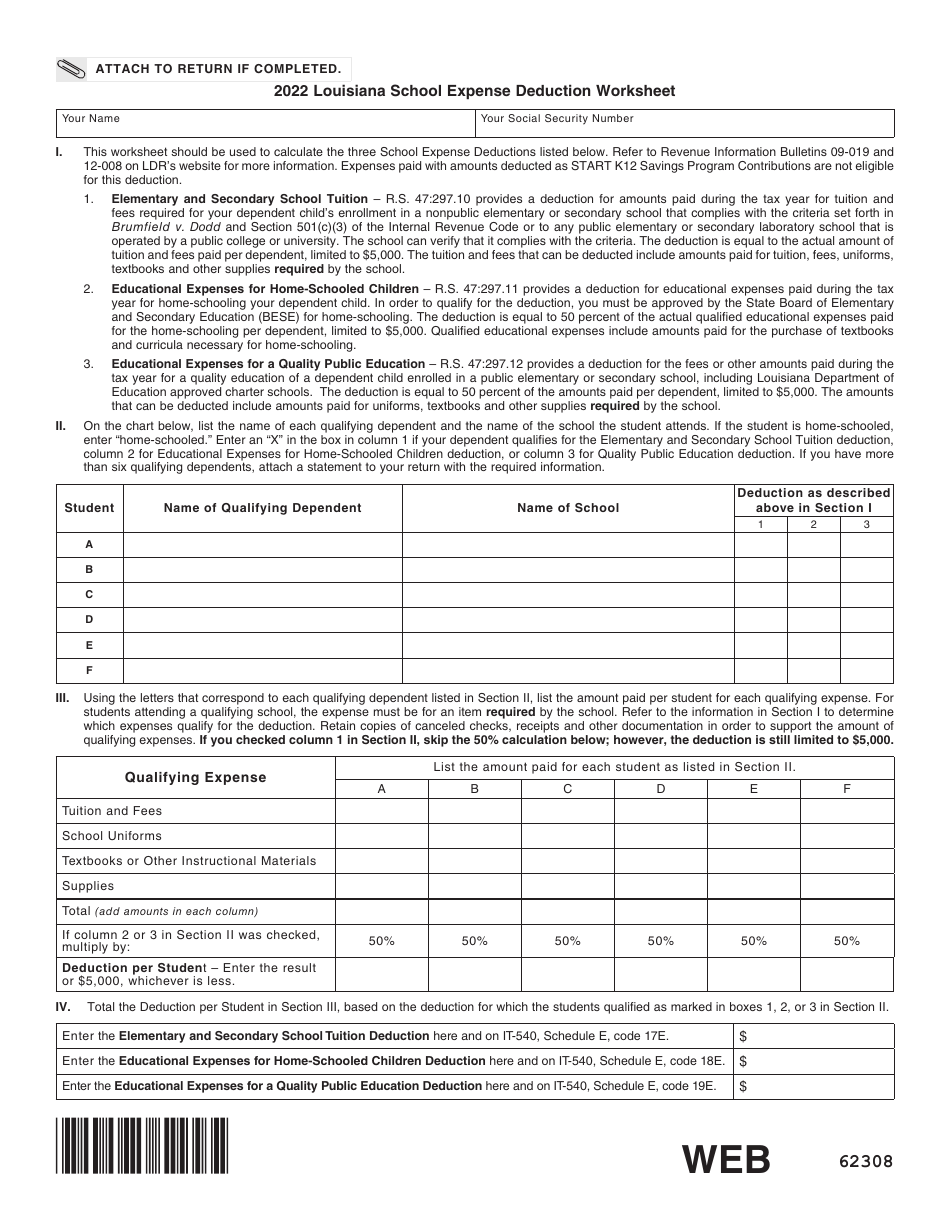

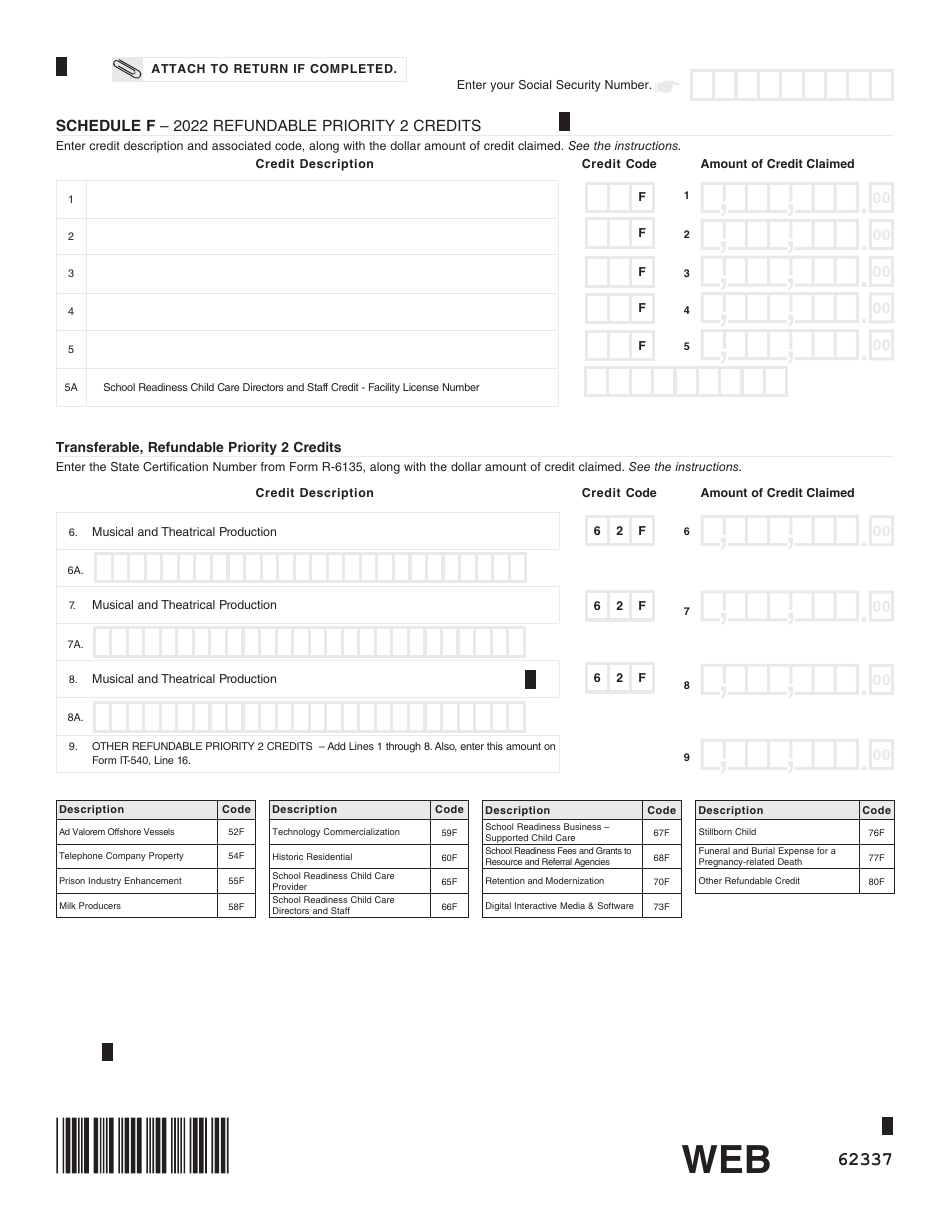

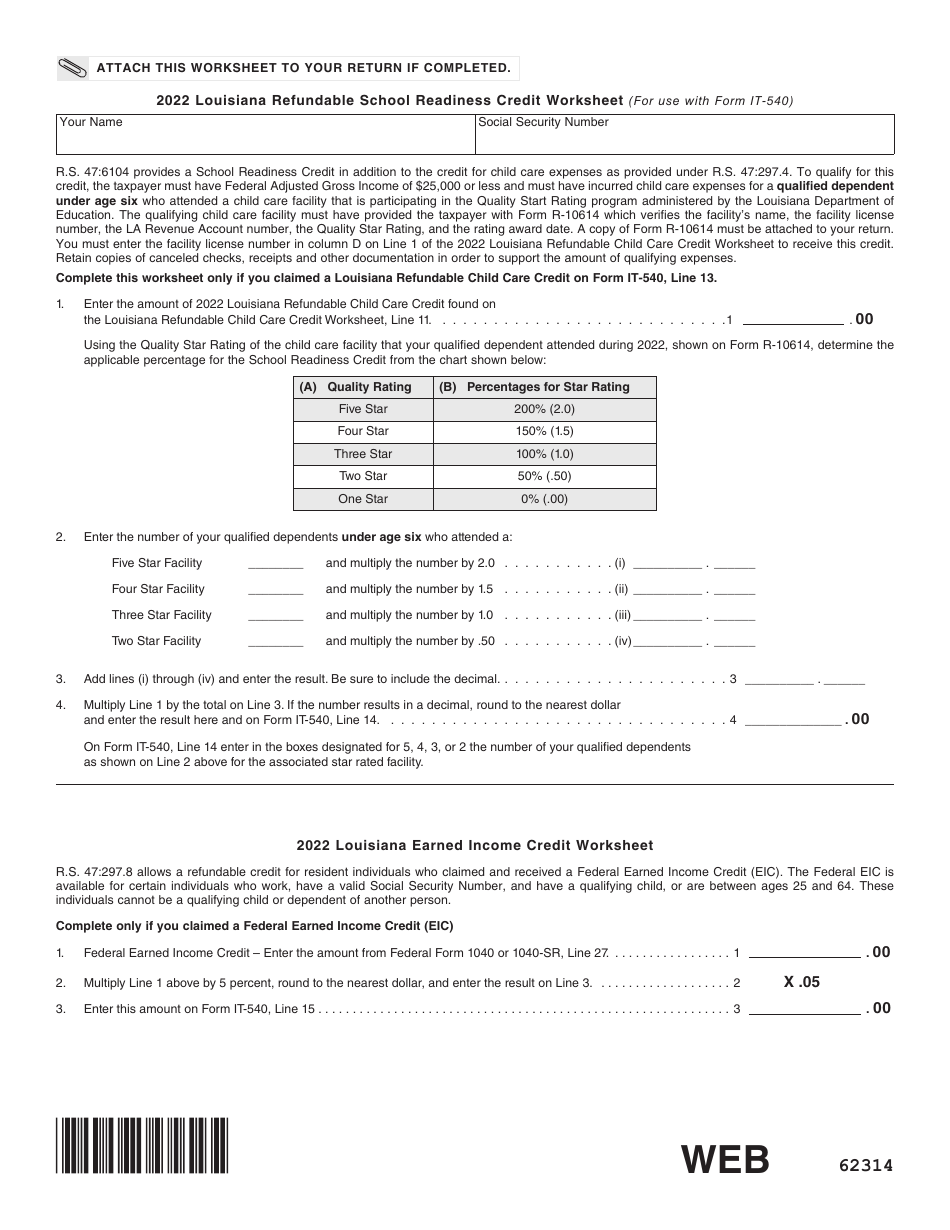

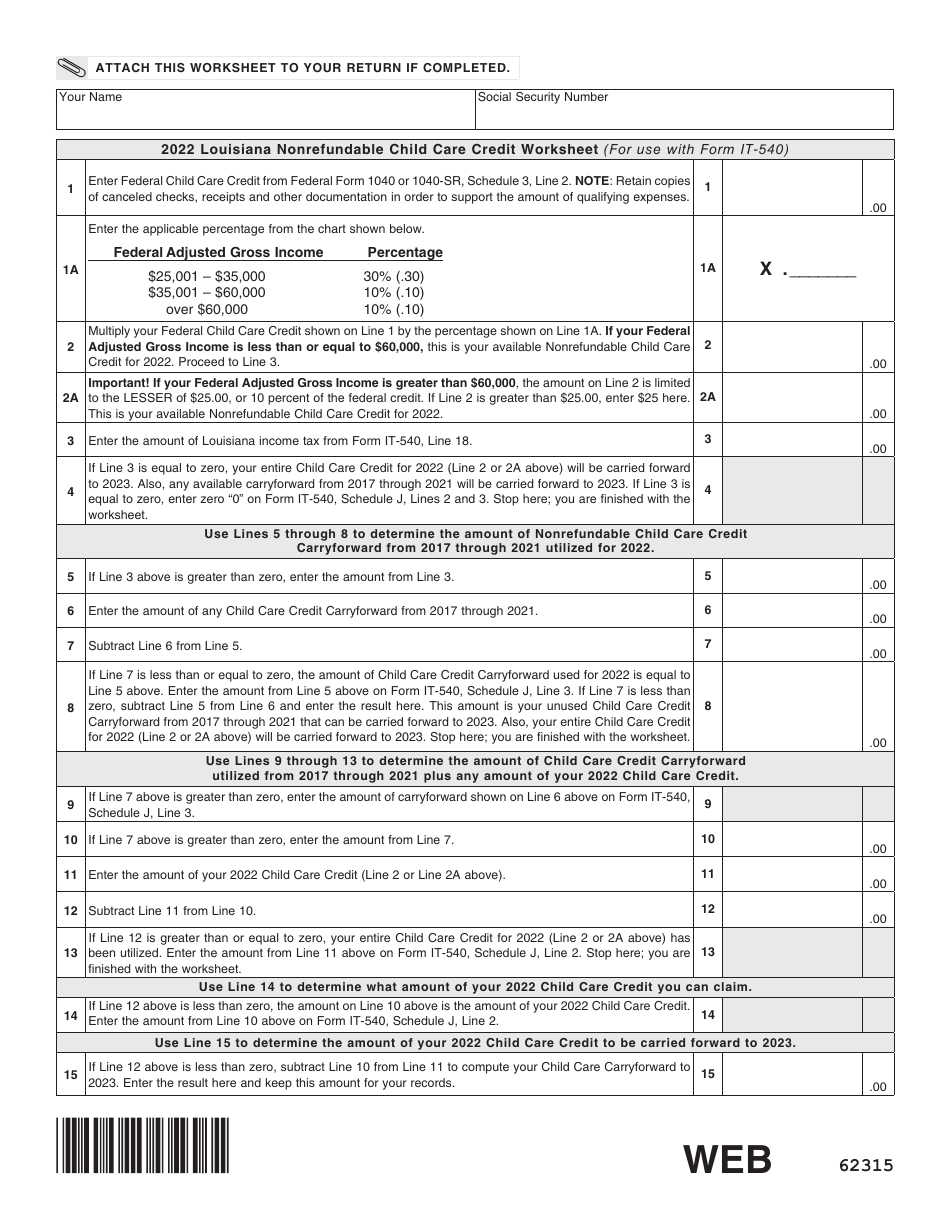

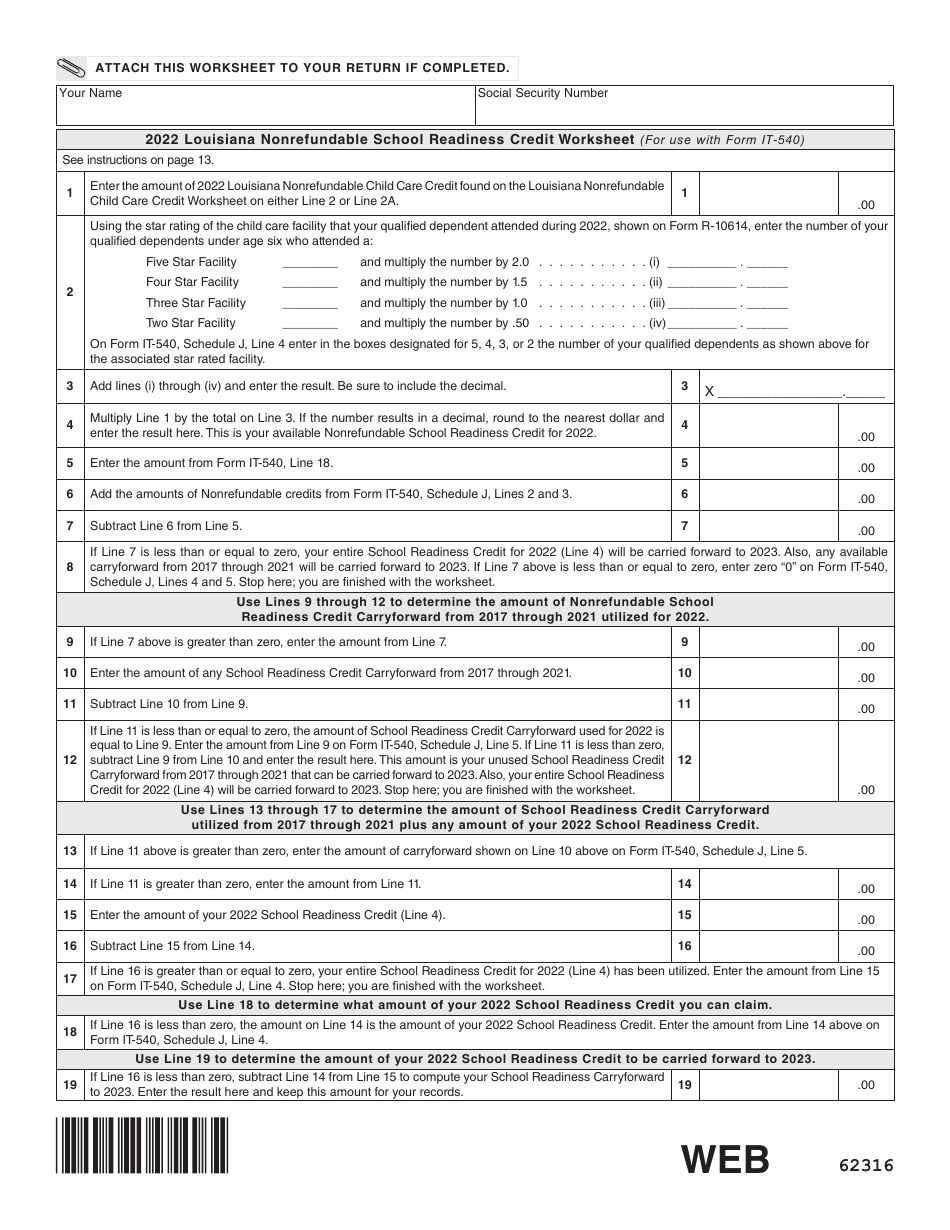

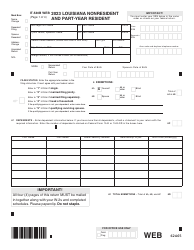

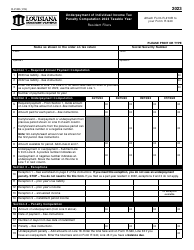

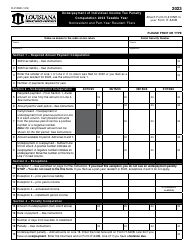

Form IT-540 Louisiana Resident Income Tax Return - Louisiana

What Is Form IT-540?

This is a legal form that was released by the Louisiana Department of Revenue - a government authority operating within Louisiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

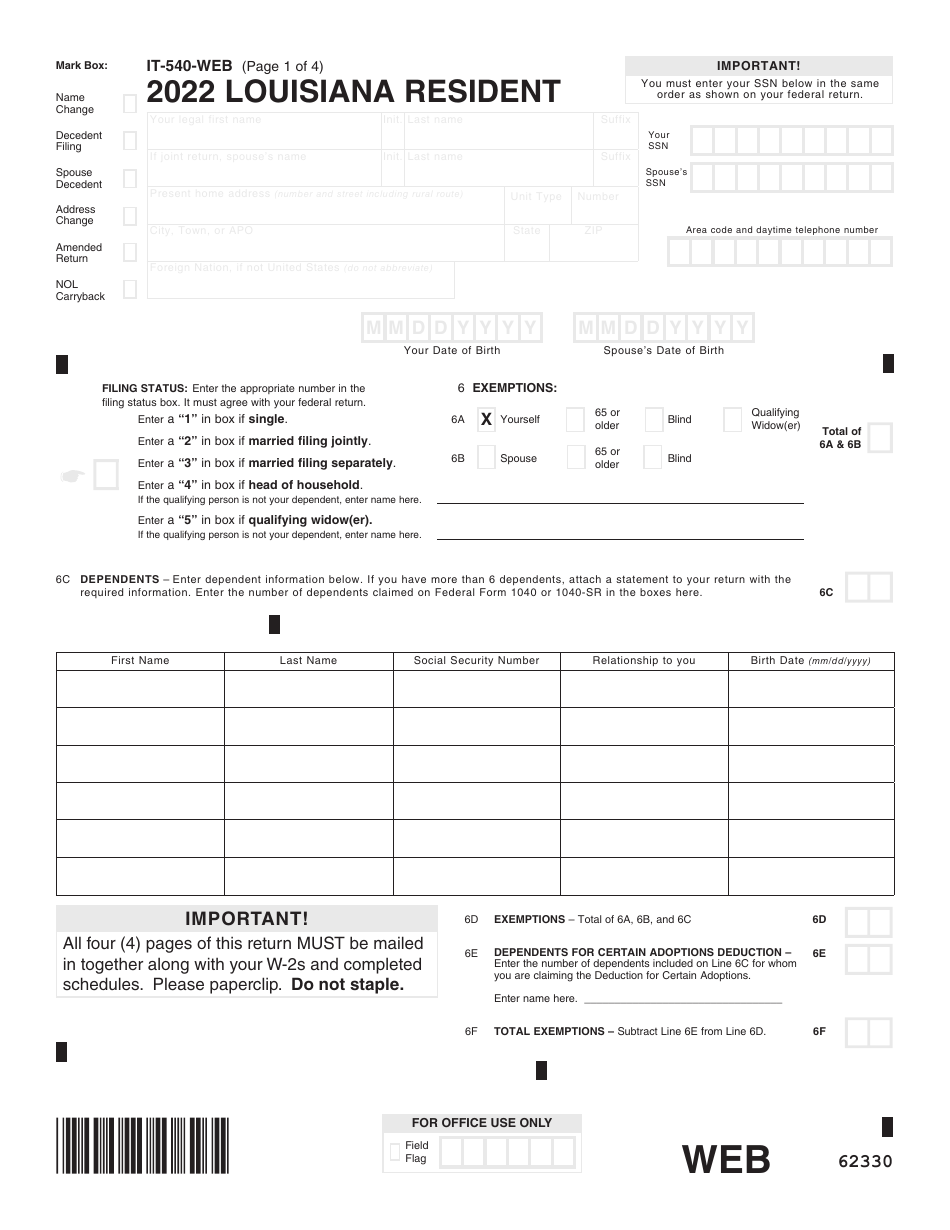

Q: What is Form IT-540?

A: Form IT-540 is the Louisiana Resident Income Tax Return.

Q: Who should file Form IT-540?

A: Louisiana residents who earned income in the state or have a filing requirement.

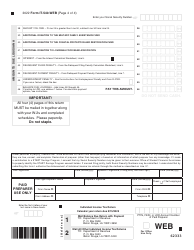

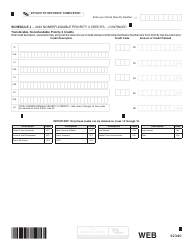

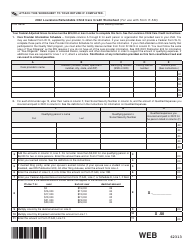

Q: What information is required to complete Form IT-540?

A: You will need details about your income, deductions, credits, and any taxes already paid.

Q: When is the deadline to file Form IT-540?

A: The deadline to file Form IT-540 is May 15th, or the next business day if it falls on a weekend or holiday.

Q: Are there any extensions available for filing Form IT-540?

A: Yes, you can request an automatic extension to file until November 15th by filling out Form R-2867.

Q: Do I need to include a payment with Form IT-540?

A: If you owe any taxes, you must include payment with your return.

Q: Can I e-file Form IT-540?

A: Yes, Louisiana supports electronic filing of Form IT-540.

Q: What if I made a mistake on my Form IT-540?

A: If you made a mistake, you can file an amended return using Form IT-540X.

Q: What happens if I don't file Form IT-540?

A: If you are required to file and fail to do so, you may face penalties and interest on any taxes owed.

Form Details:

- The latest edition provided by the Louisiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-540 by clicking the link below or browse more documents and templates provided by the Louisiana Department of Revenue.