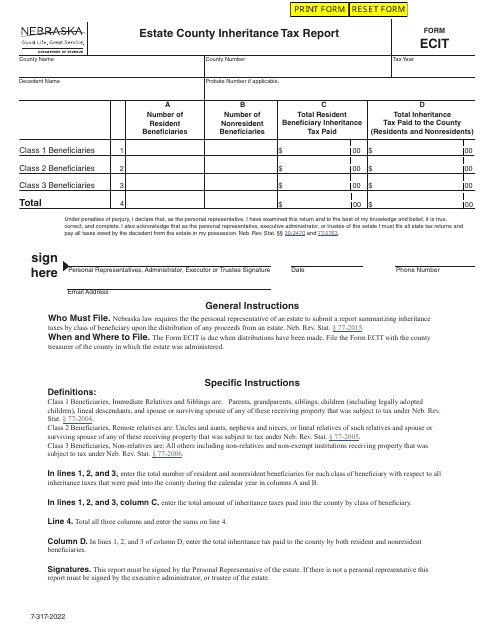

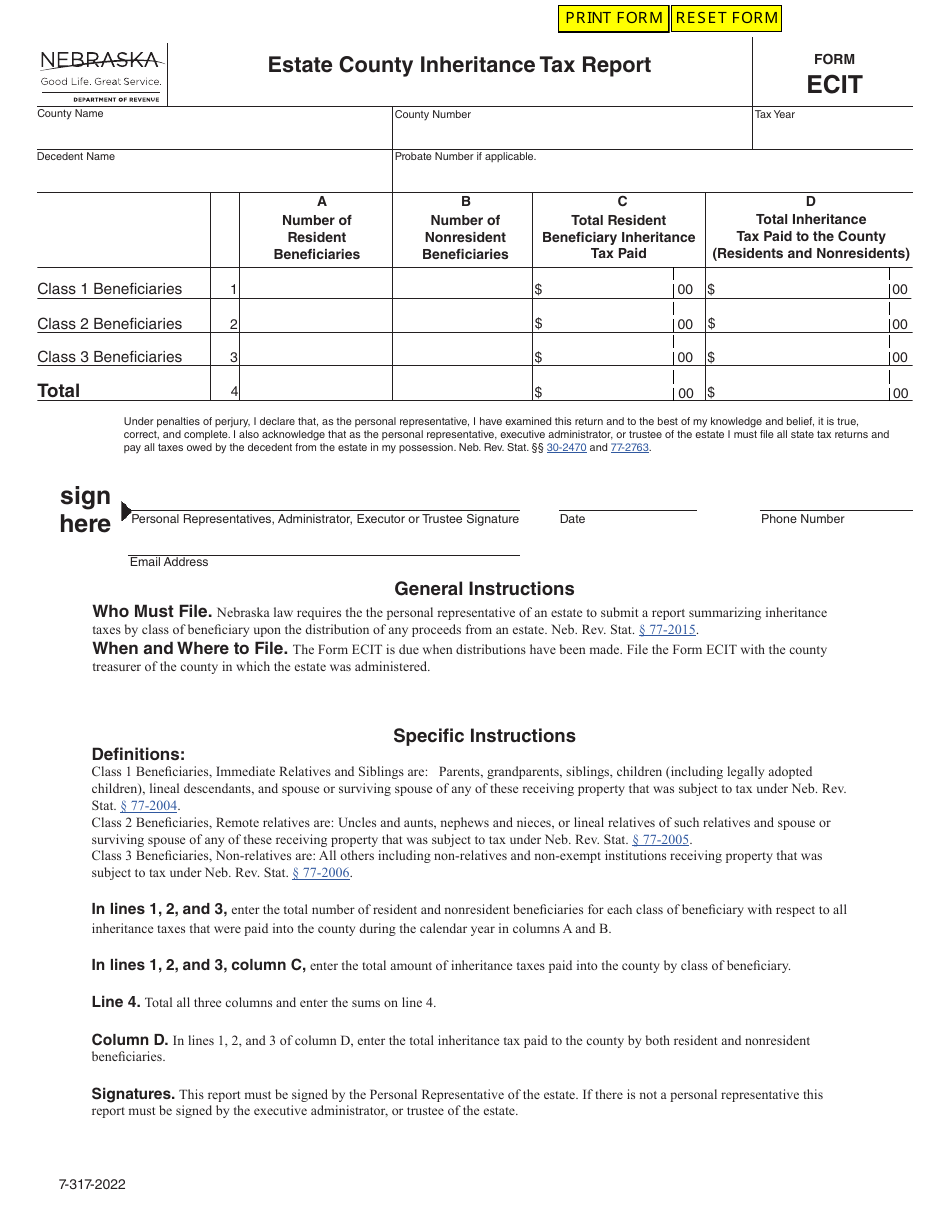

Form ECIT Estate County Inheritance Tax Report - Nebraska

What Is Form ECIT?

This is a legal form that was released by the Nebraska Department of Revenue - a government authority operating within Nebraska. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the ECIT Estate County Inheritance Tax Report?

A: The ECIT Estate County Inheritance Tax Report is a form used in Nebraska to report the estate and inheritance taxes.

Q: Who needs to file the ECIT Estate County Inheritance Tax Report?

A: The ECIT Estate County Inheritance Tax Report needs to be filed by the personal representative of a deceased person's estate.

Q: What is ECIT?

A: ECIT stands for Estate County Inheritance Tax, which is a tax imposed on the transfer of property after someone's death in Nebraska.

Q: What information is required on the ECIT Estate County Inheritance Tax Report?

A: The ECIT Estate County Inheritance Tax Report requires information about the deceased person's estate, including the value of assets and any outstanding debts.

Q: When is the deadline for filing the ECIT Estate County Inheritance Tax Report?

A: The deadline for filing the ECIT Estate County Inheritance Tax Report is nine months after the date of death.

Q: Are there any exemptions or deductions available for the ECIT?

A: Yes, there are exemptions and deductions available for the ECIT, such as a spousal exemption and deductions for funeral expenses.

Form Details:

- Released on January 1, 2022;

- The latest edition provided by the Nebraska Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form ECIT by clicking the link below or browse more documents and templates provided by the Nebraska Department of Revenue.