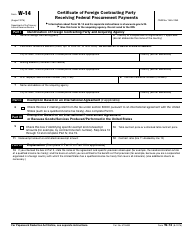

This version of the form is not currently in use and is provided for reference only. Download this version of

Form W-4MNP

for the current year.

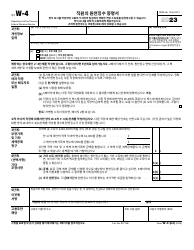

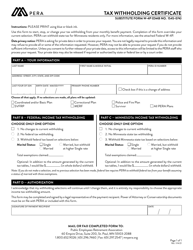

Form W-4MNP Minnesota Withholding Certificate for Pension or Annuity Payments - Minnesota

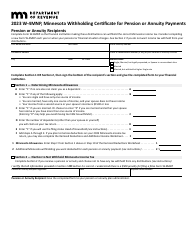

What Is Form W-4MNP?

This is a legal form that was released by the Minnesota Department of Revenue - a government authority operating within Minnesota. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form W-4MNP?

A: Form W-4MNP is the Minnesota Withholding Certificate for Pension or Annuity Payments specifically for residents of Minnesota.

Q: Who needs to file Form W-4MNP?

A: Residents of Minnesota who receive pension or annuity payments need to file Form W-4MNP.

Q: What is the purpose of Form W-4MNP?

A: The purpose of Form W-4MNP is to determine the correct amount of Minnesota state income tax to be withheld from pension or annuity payments.

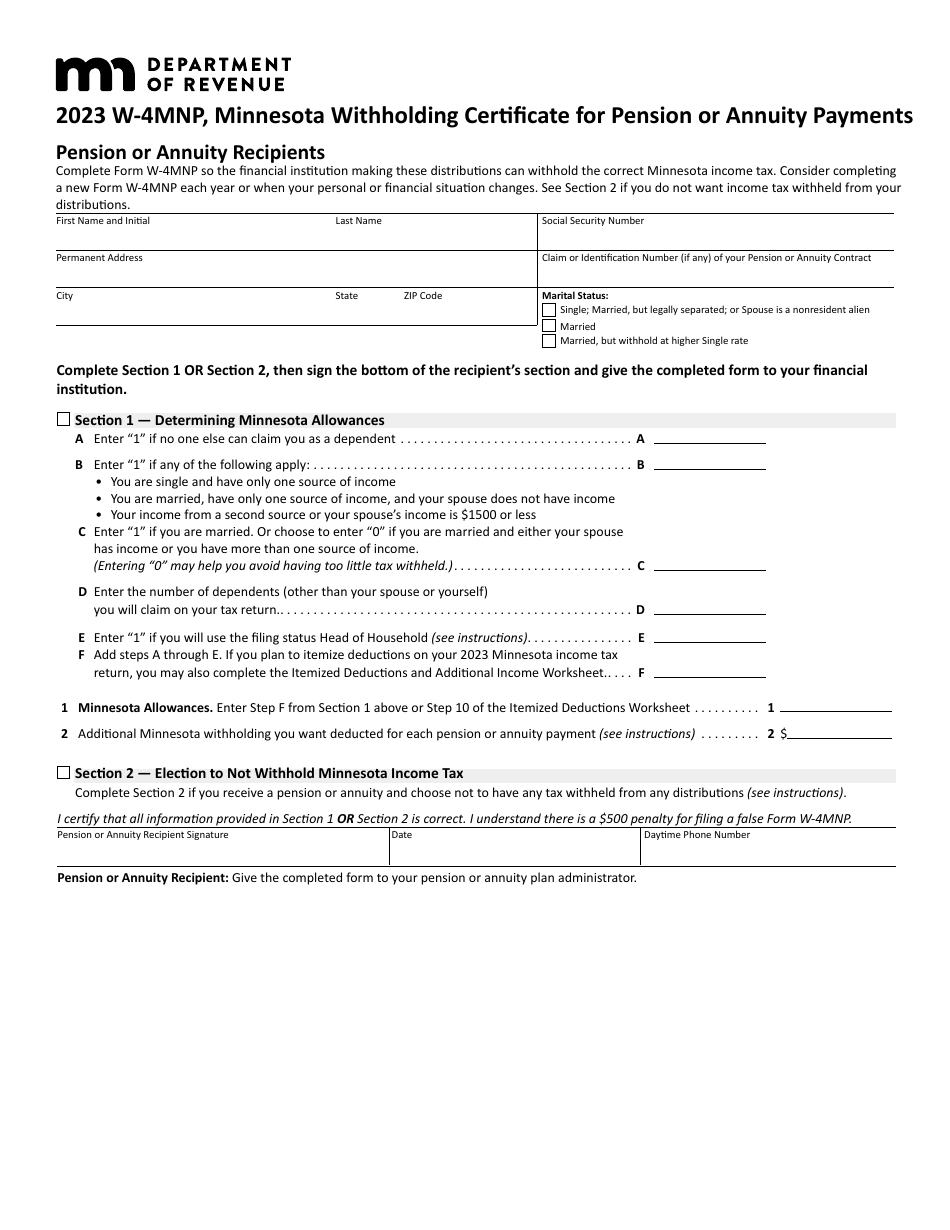

Q: Do I need to file Form W-4MNP every year?

A: No, you only need to file Form W-4MNP once unless your withholding allowances change or you want to update your withholding.

Q: When should I submit Form W-4MNP?

A: You should submit Form W-4MNP as soon as you start receiving pension or annuity payments.

Q: What happens if I don't file Form W-4MNP?

A: If you don't file Form W-4MNP, the payer of your pension or annuity will withhold federal income tax without considering any adjustments or exemptions you may be eligible for.

Q: Can I make changes to my Form W-4MNP?

A: Yes, you can make changes to your Form W-4MNP at any time by submitting a new form to the payer of your pension or annuity.

Q: Are there any penalties for incorrect withholding?

A: Yes, if you fail to provide accurate and complete information on Form W-4MNP, you may be subject to penalties for underreporting or underpaying your Minnesota state income tax.

Q: Can I claim exemption from withholding on Form W-4MNP?

A: Yes, you can claim exemption from withholding on Form W-4MNP if you meet certain criteria specified by the Minnesota Department of Revenue.

Form Details:

- The latest edition provided by the Minnesota Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form W-4MNP by clicking the link below or browse more documents and templates provided by the Minnesota Department of Revenue.