This version of the form is not currently in use and is provided for reference only. Download this version of

Form M20001

for the current year.

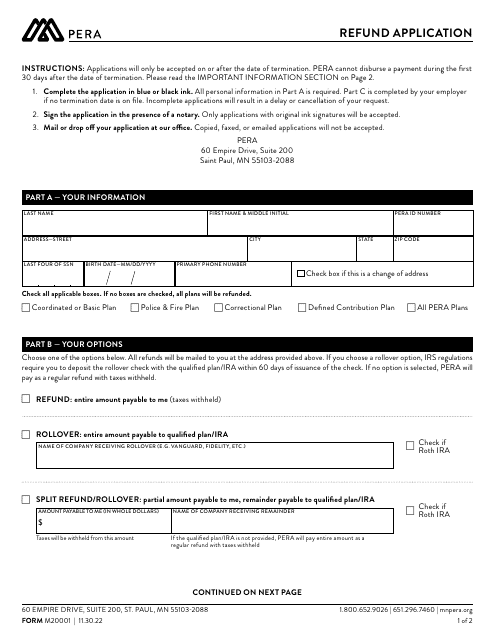

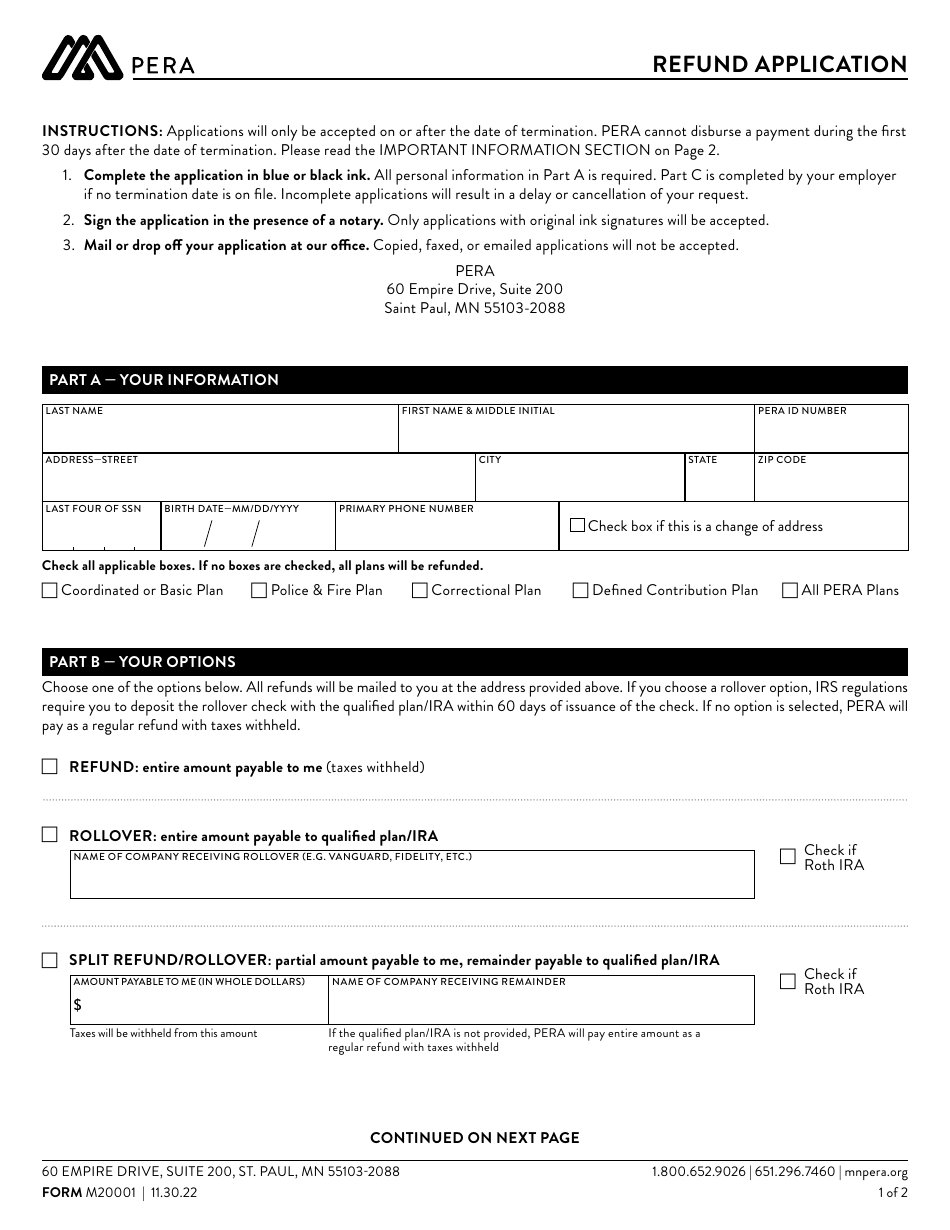

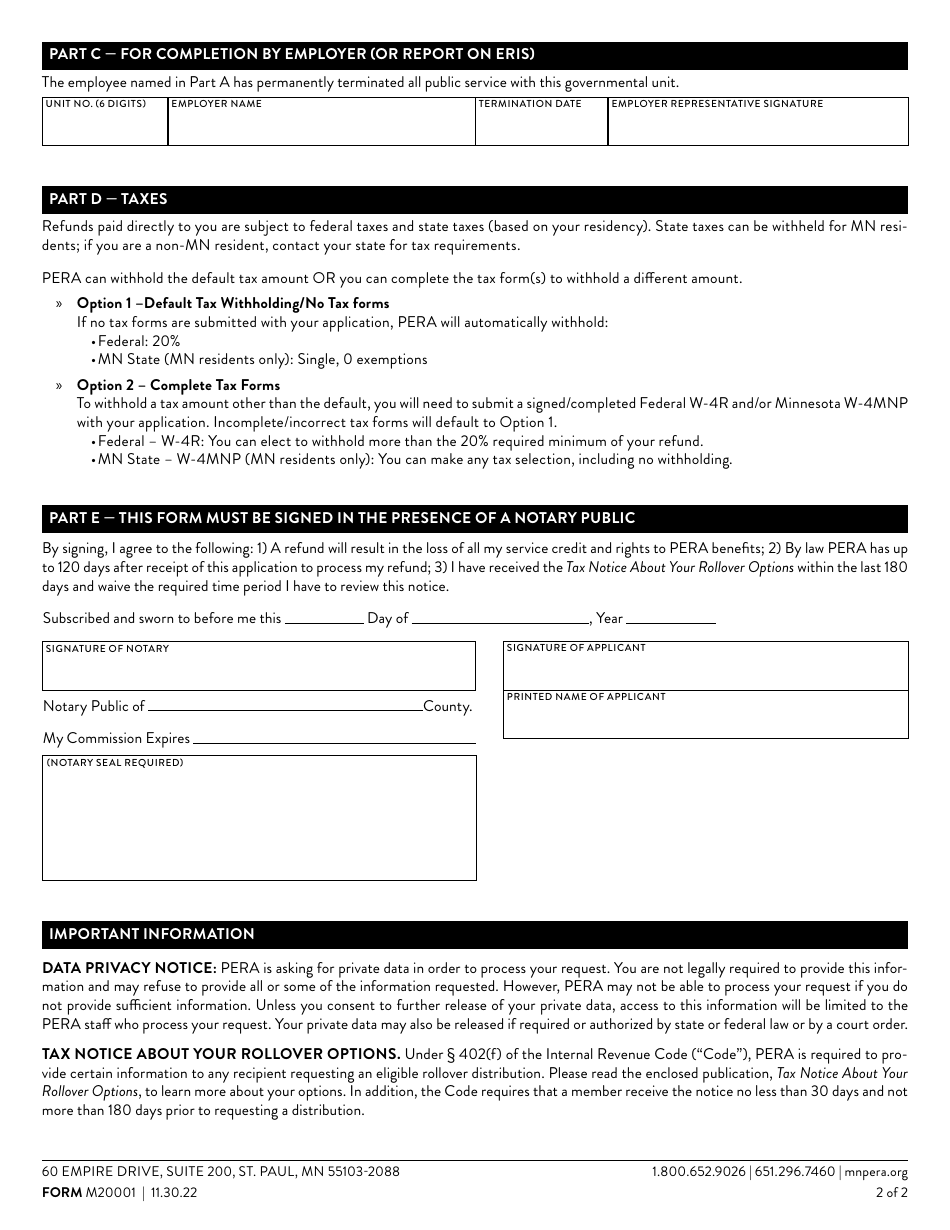

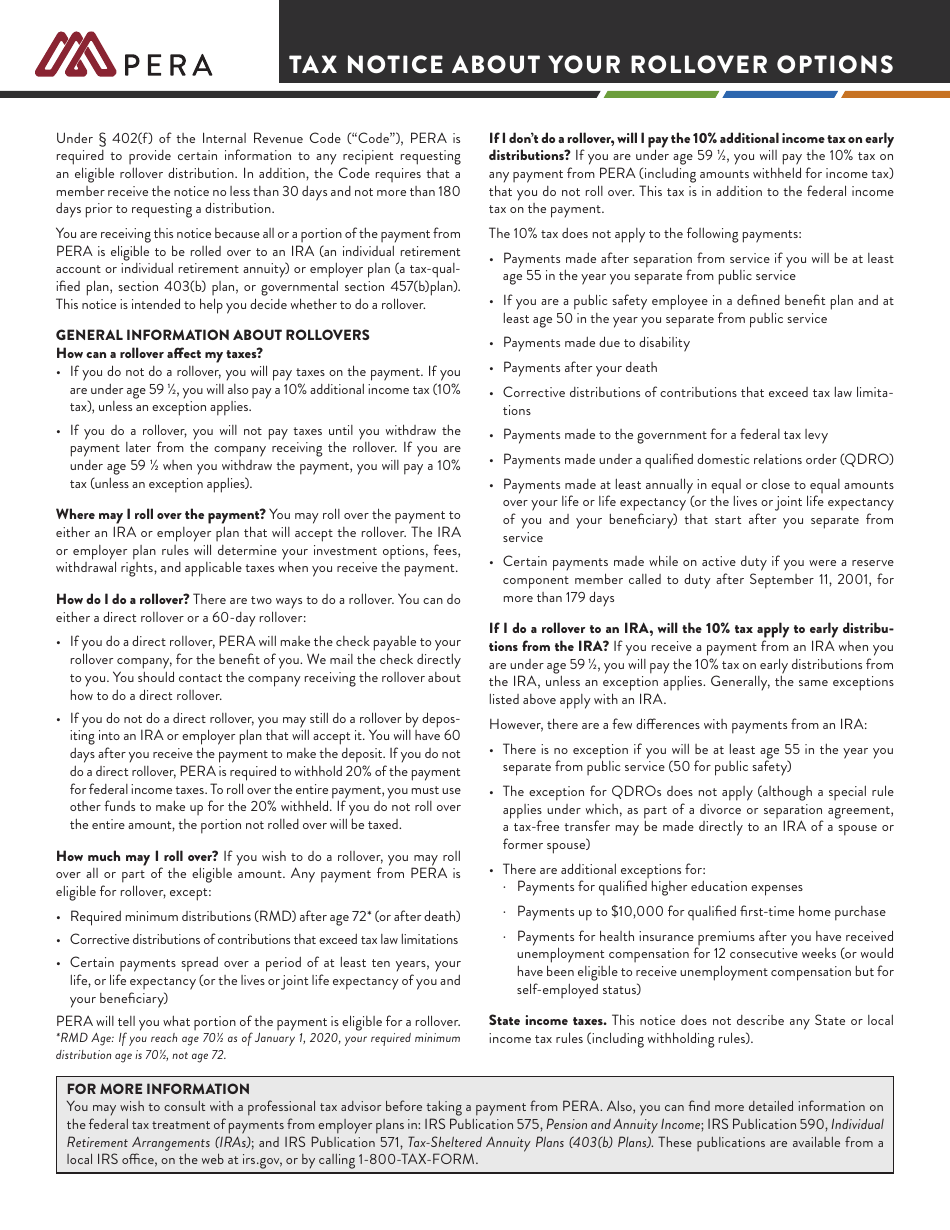

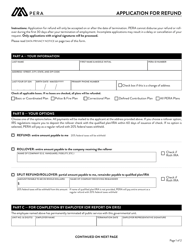

Form M20001 Refund Application - Minnesota

What Is Form M20001?

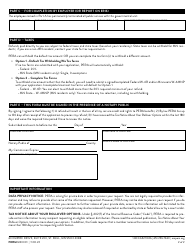

This is a legal form that was released by the Minnesota Public Employees Retirement Association - a government authority operating within Minnesota. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form M20001?

A: Form M20001 is a refund application for residents of Minnesota.

Q: Who can use Form M20001?

A: Residents of Minnesota can use Form M20001.

Q: What is the purpose of Form M20001?

A: Form M20001 is used to apply for a refund for certain taxes in Minnesota.

Q: What taxes can be refunded with Form M20001?

A: Form M20001 can be used to apply for refunds for income tax and property tax in Minnesota.

Q: Is there a deadline for submitting Form M20001?

A: Yes, the deadline for submitting Form M20001 is generally April 15th of the year following the tax year.

Q: Are there any eligibility requirements for using Form M20001?

A: Yes, there are certain eligibility requirements for using Form M20001. It is recommended to review the instructions included with the form or consult with a tax professional.

Q: Are there any fees associated with filing Form M20001?

A: No, there are no fees associated with filing Form M20001.

Q: How long does it take to process a refund application with Form M20001?

A: The processing time for a refund application with Form M20001 varies, but it generally takes several weeks to receive a refund.

Form Details:

- Released on November 30, 2022;

- The latest edition provided by the Minnesota Public Employees Retirement Association;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form M20001 by clicking the link below or browse more documents and templates provided by the Minnesota Public Employees Retirement Association.