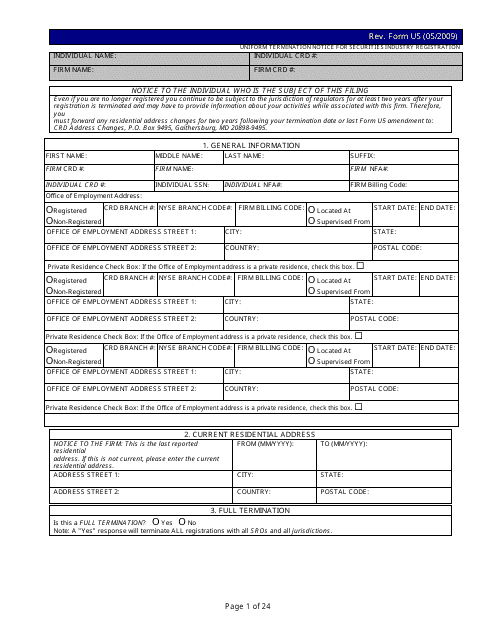

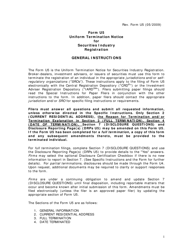

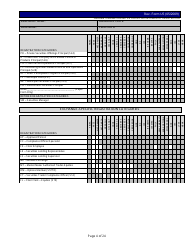

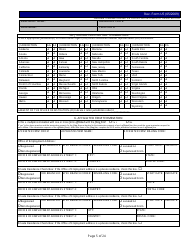

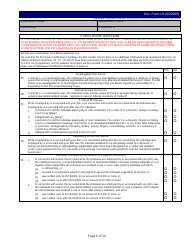

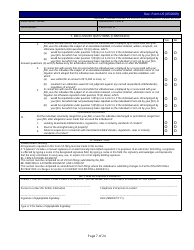

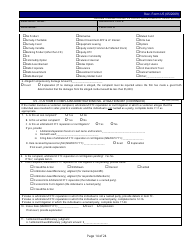

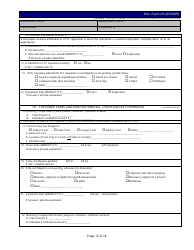

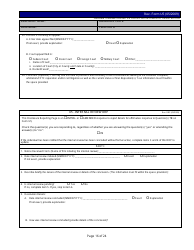

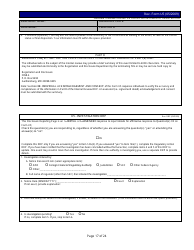

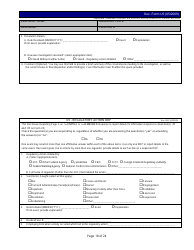

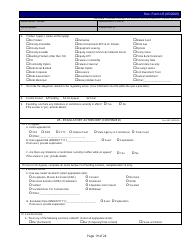

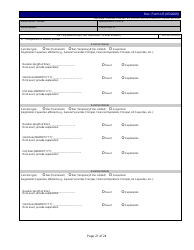

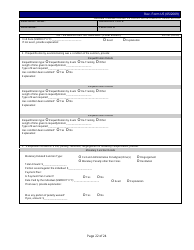

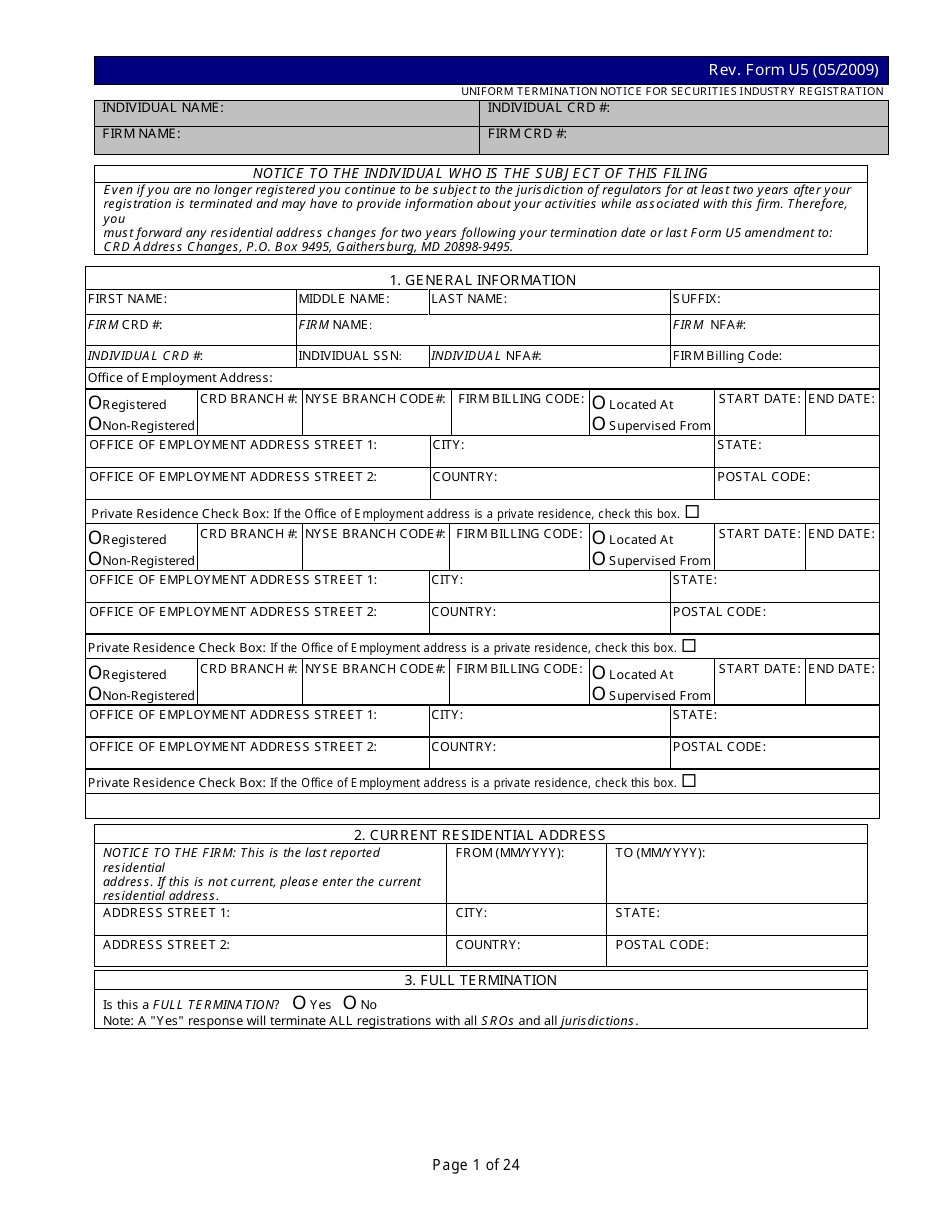

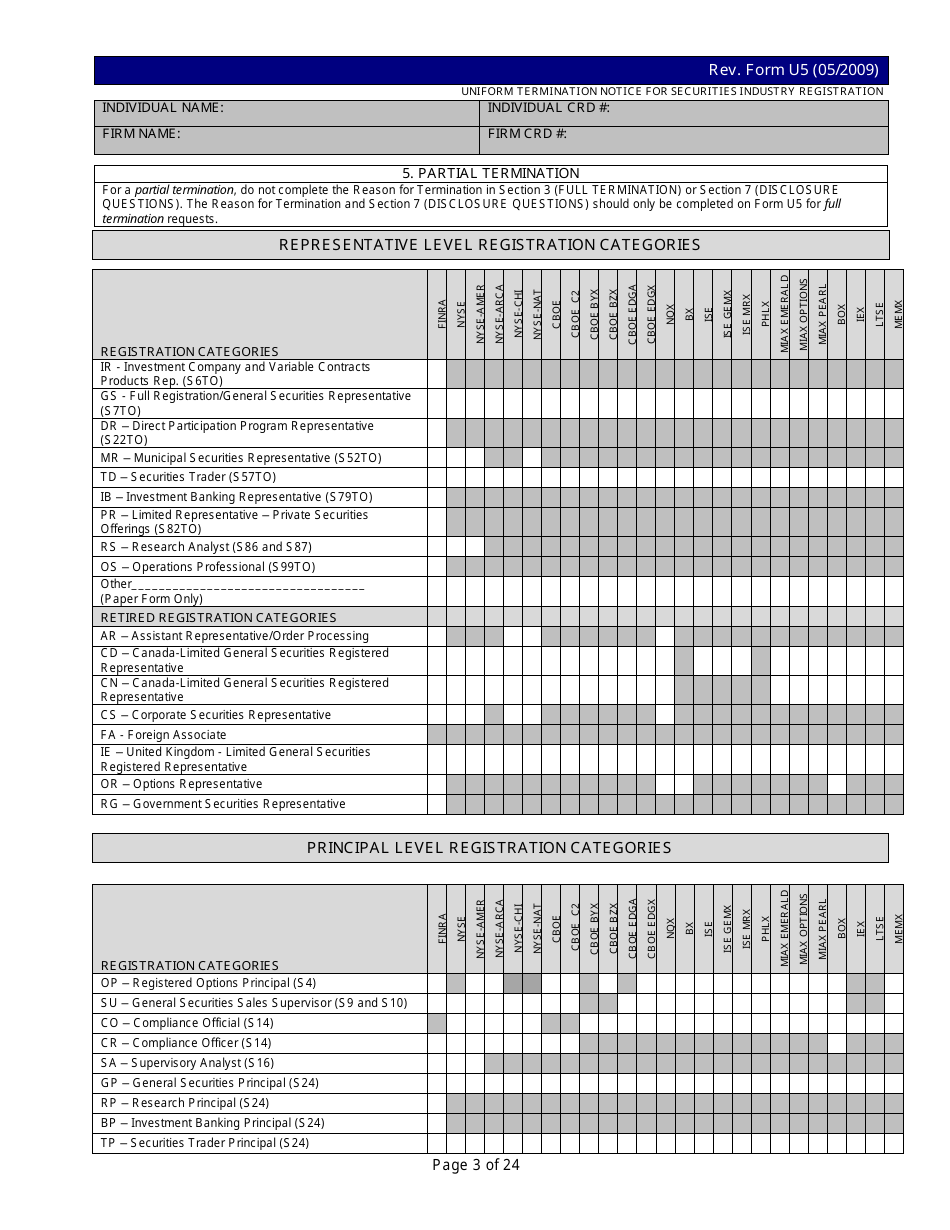

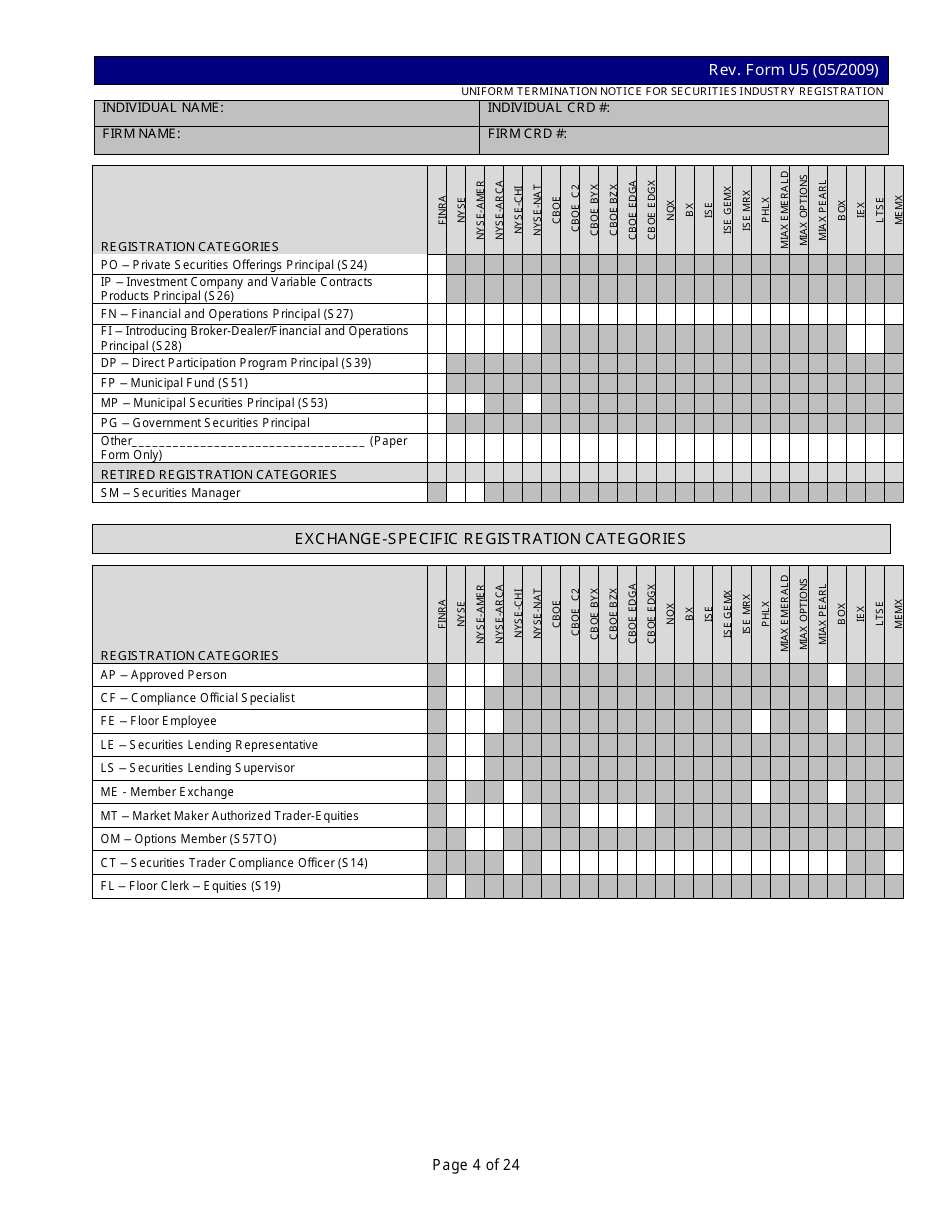

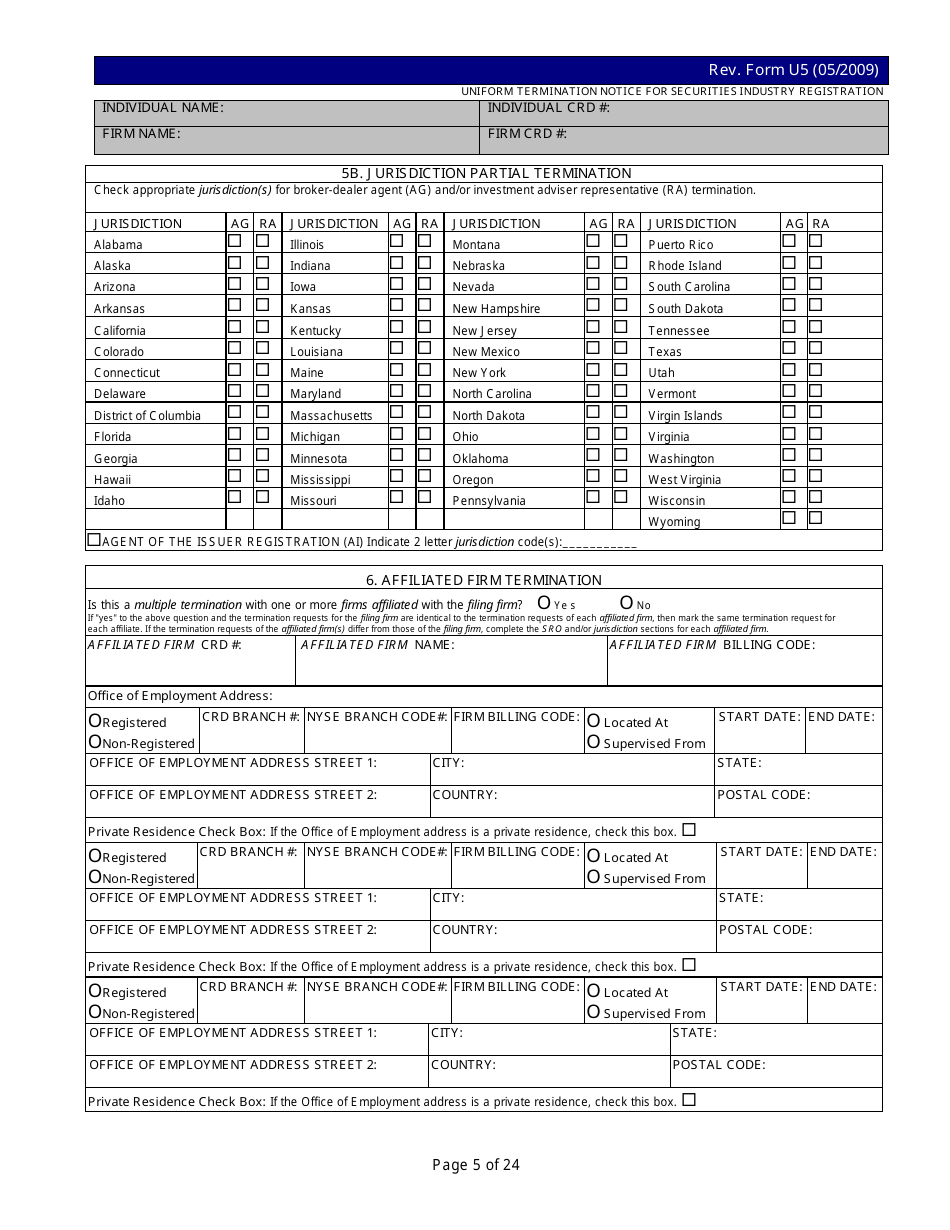

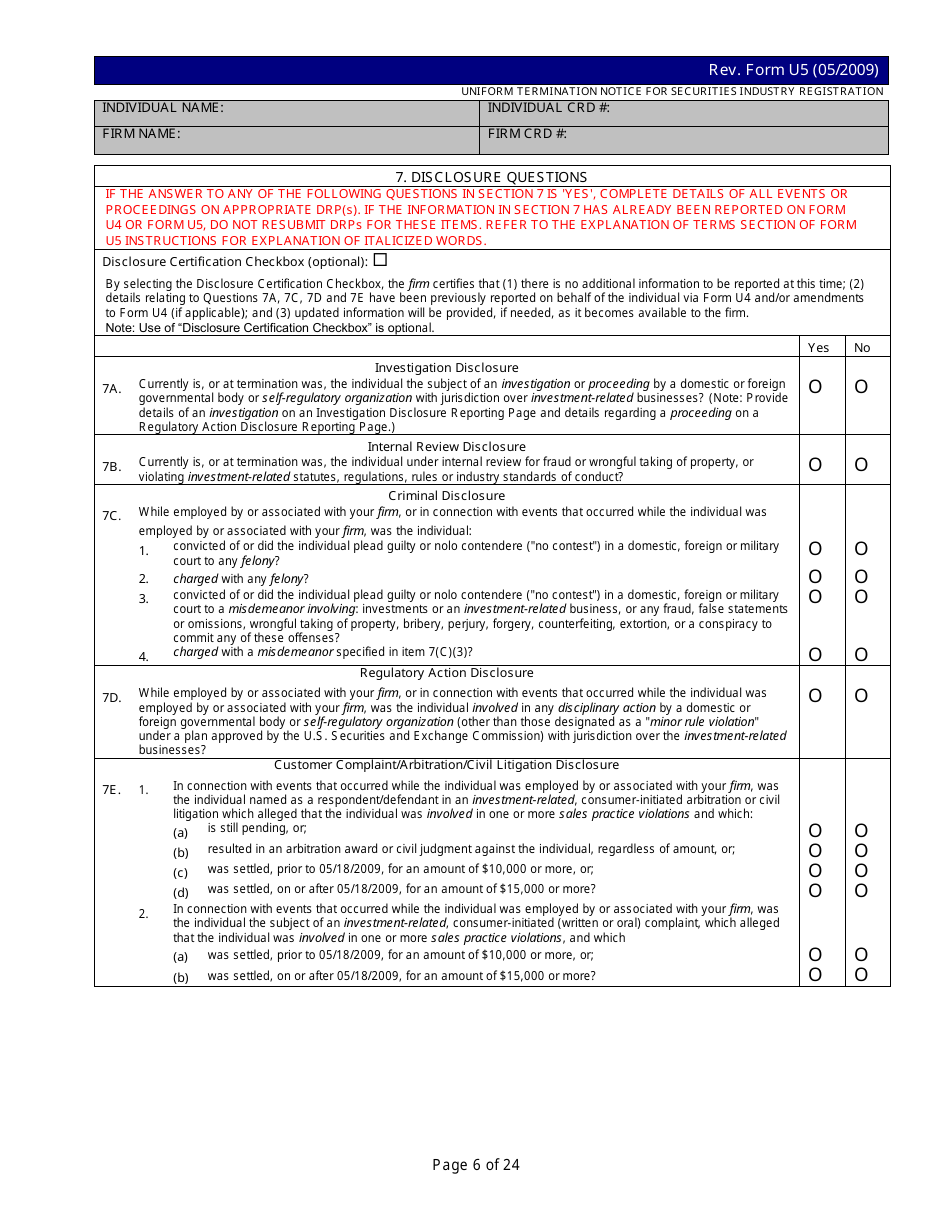

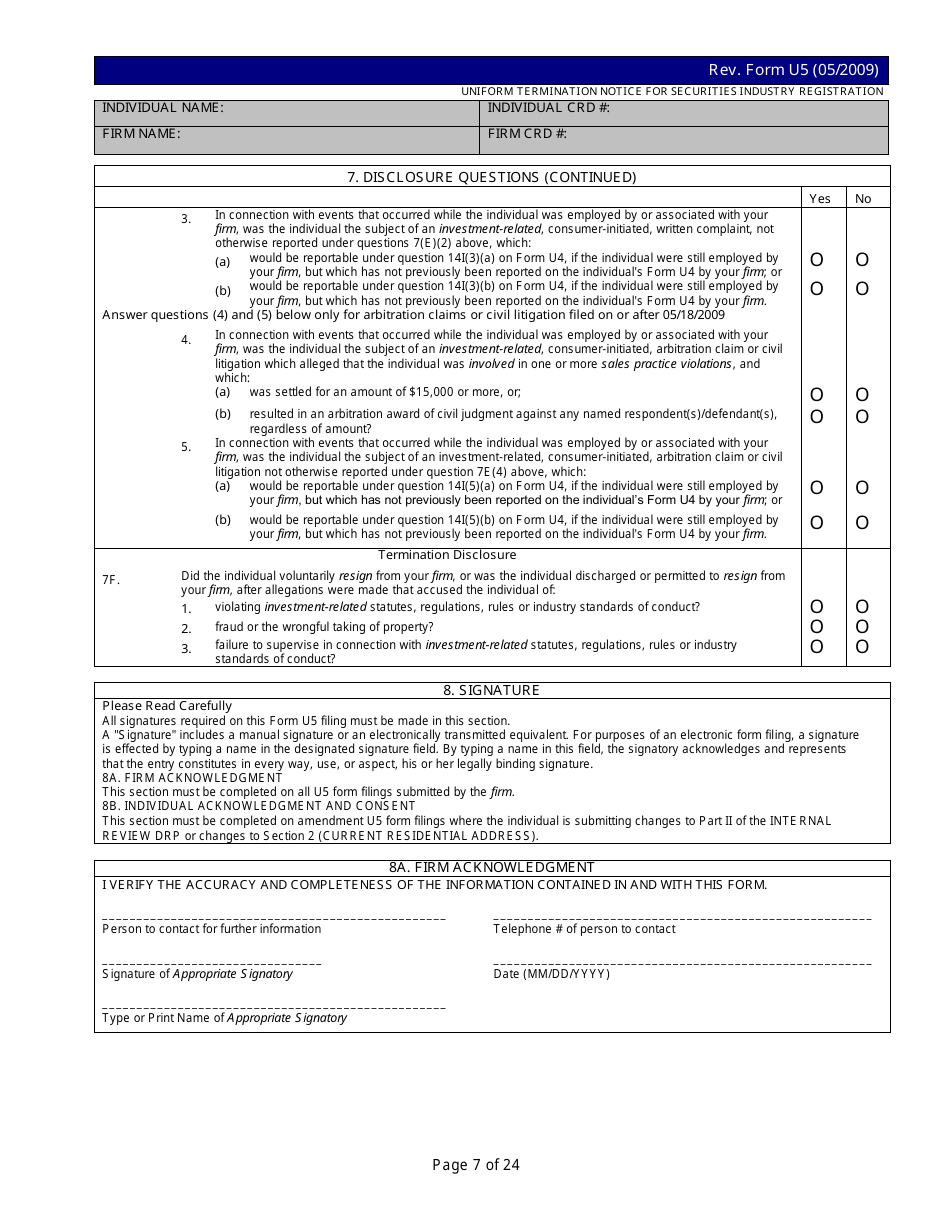

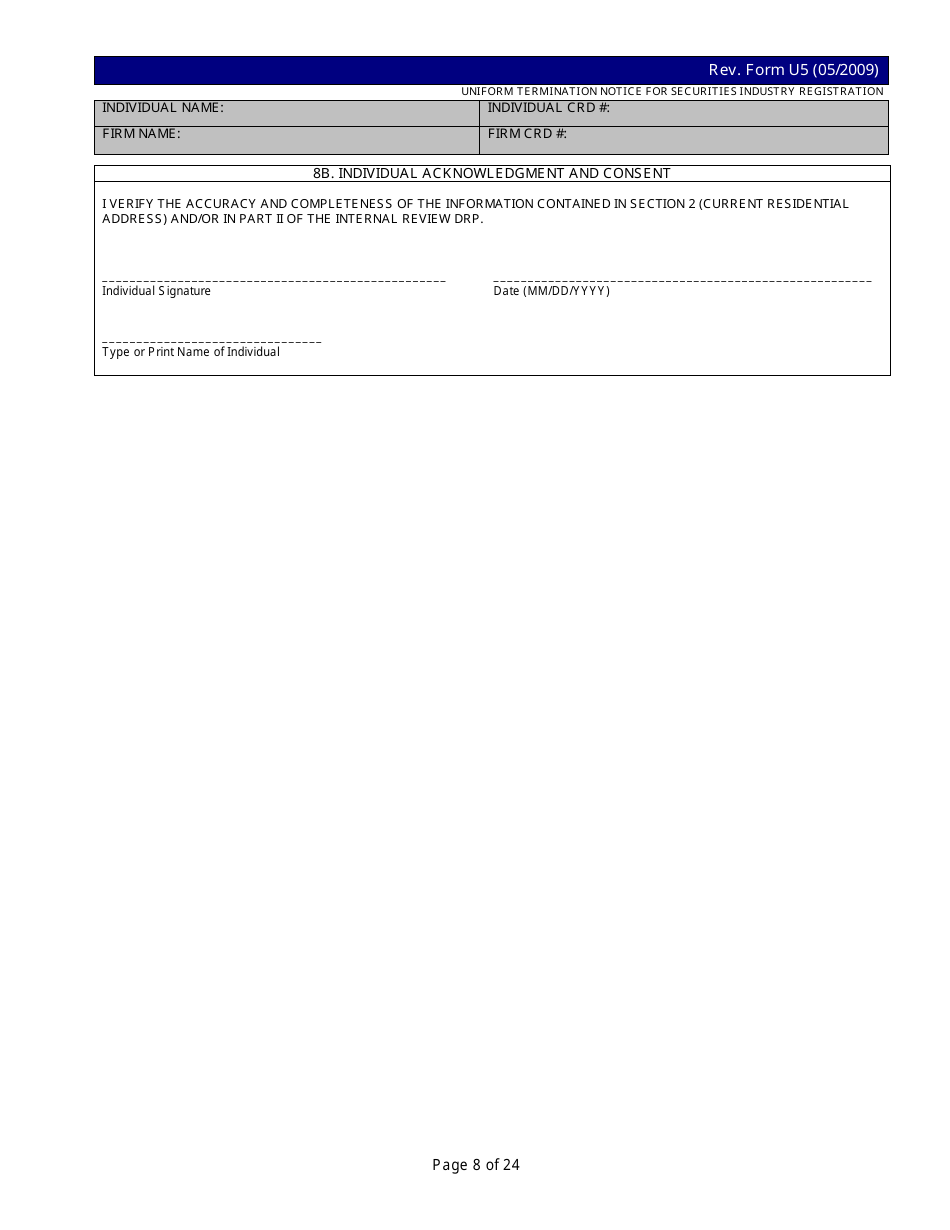

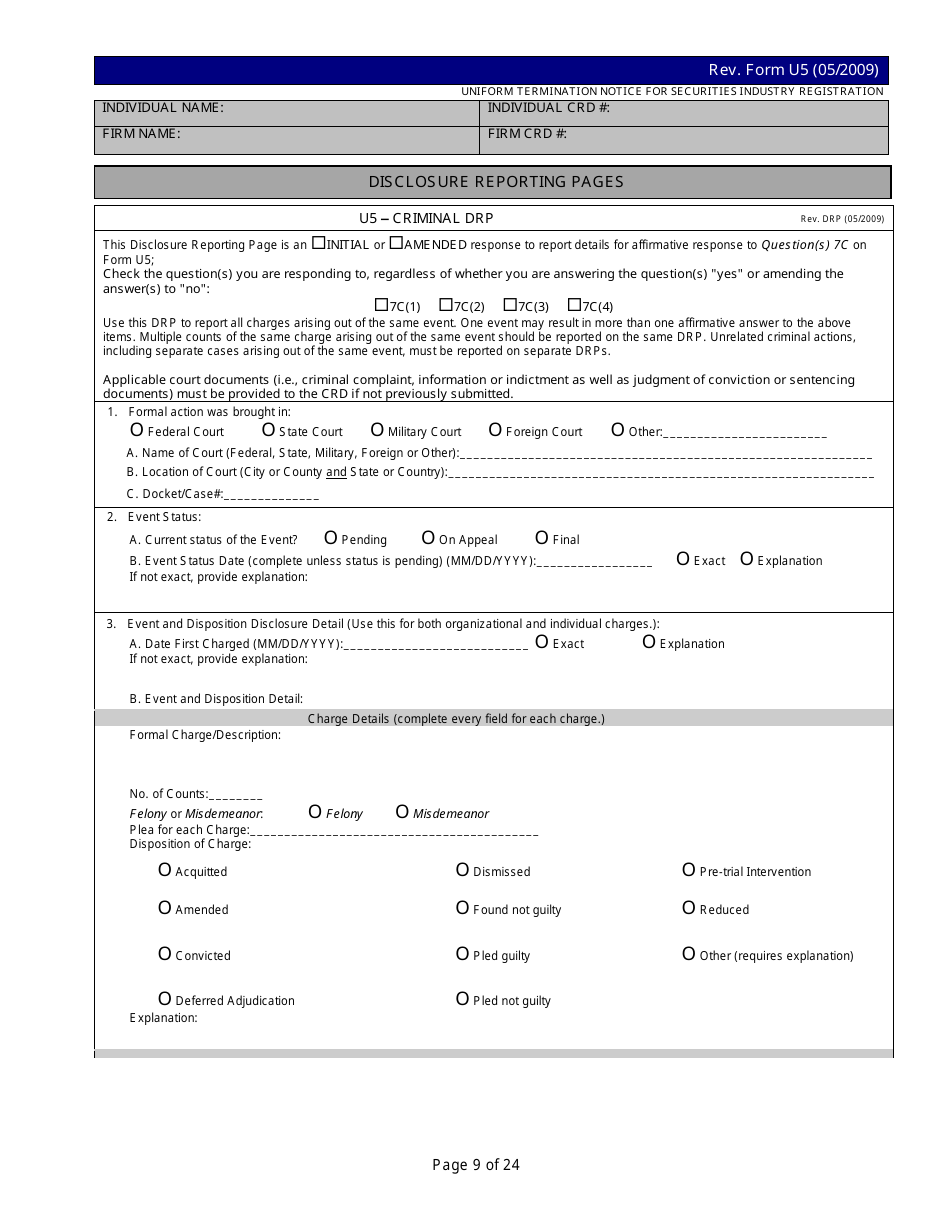

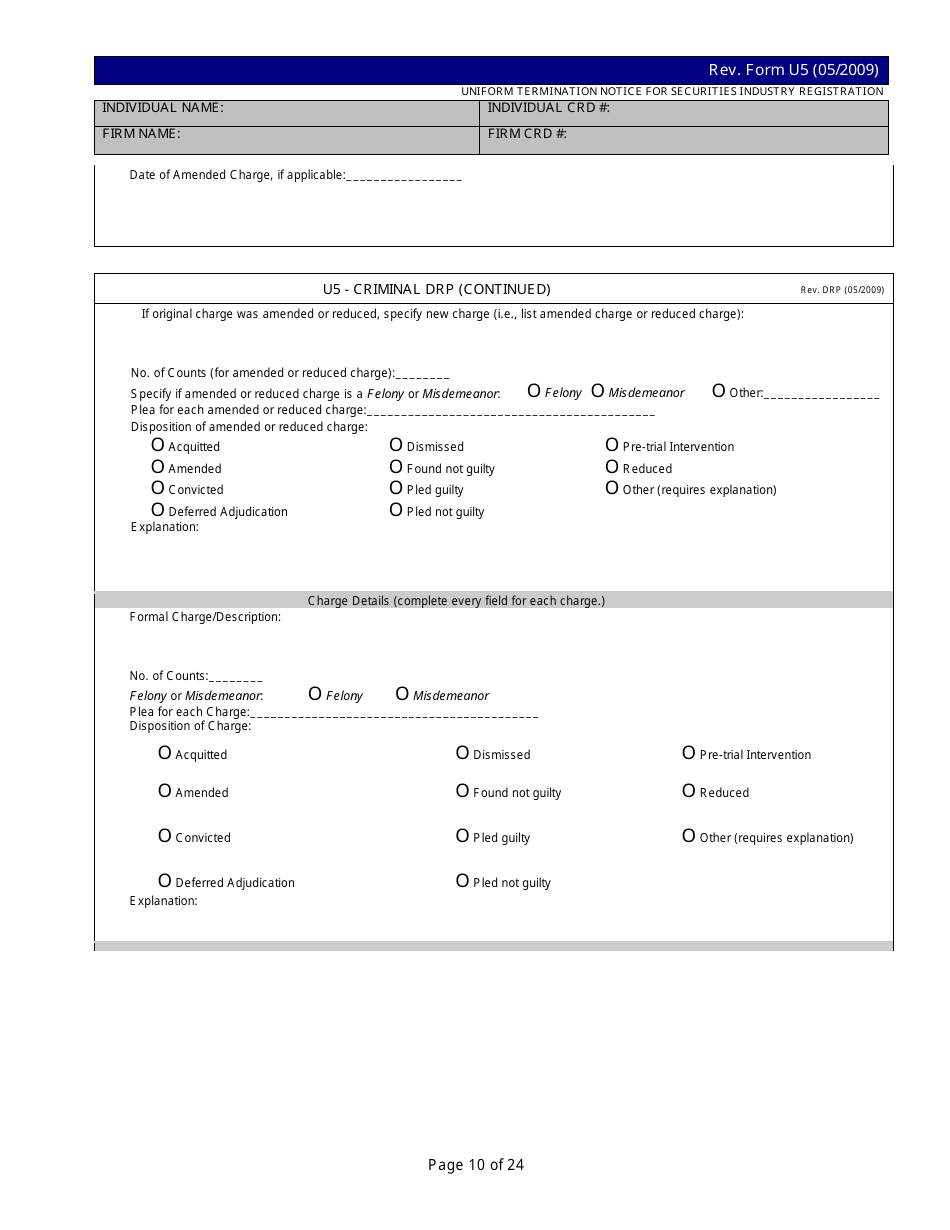

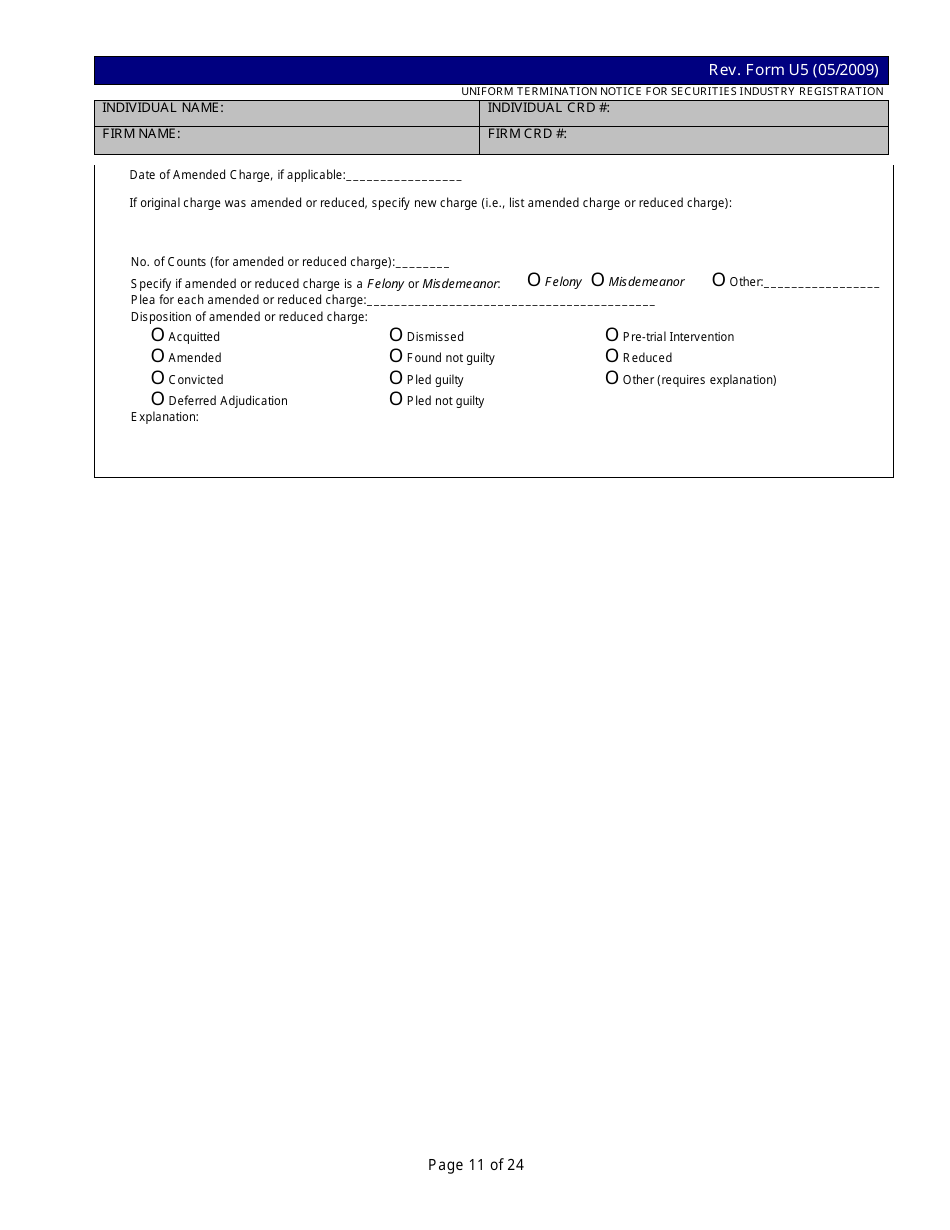

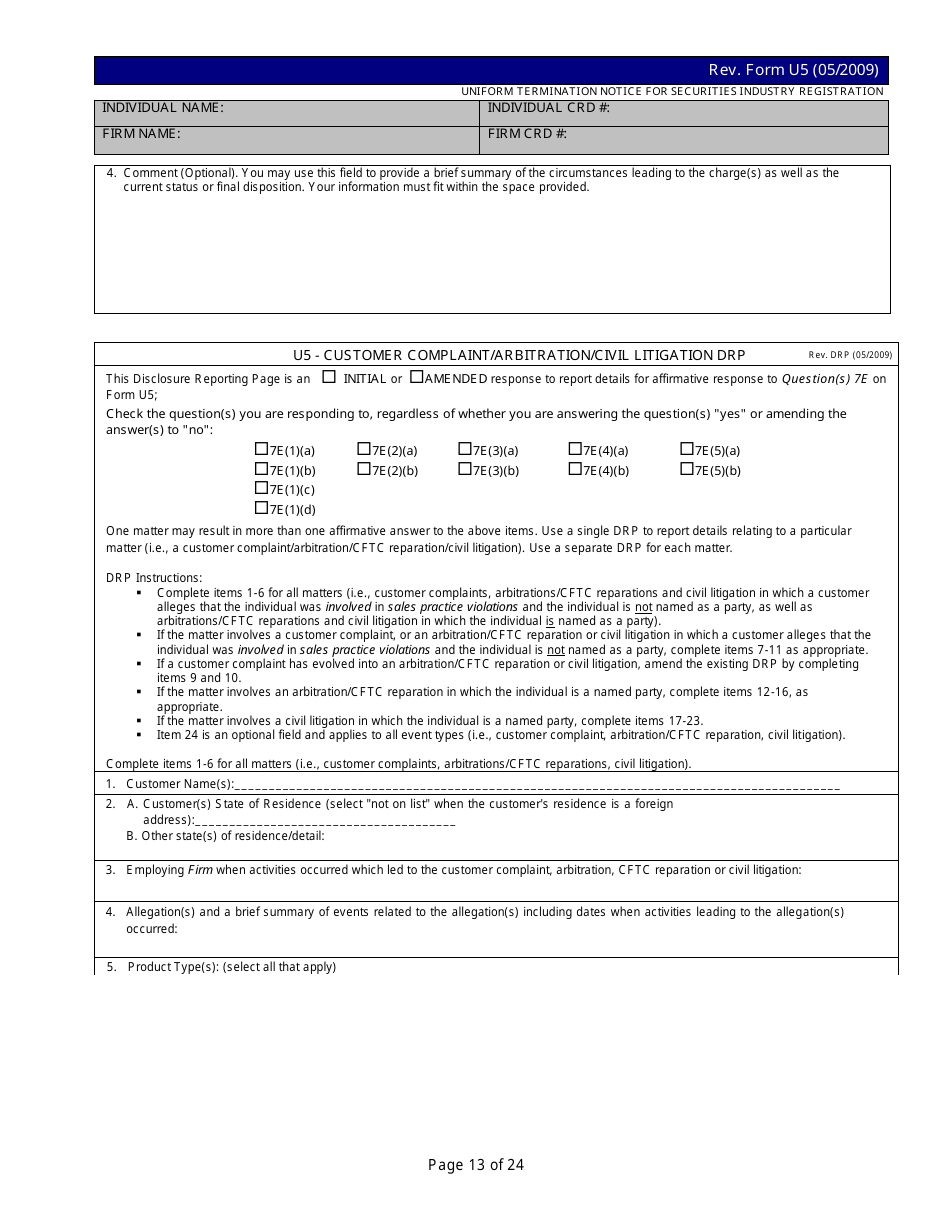

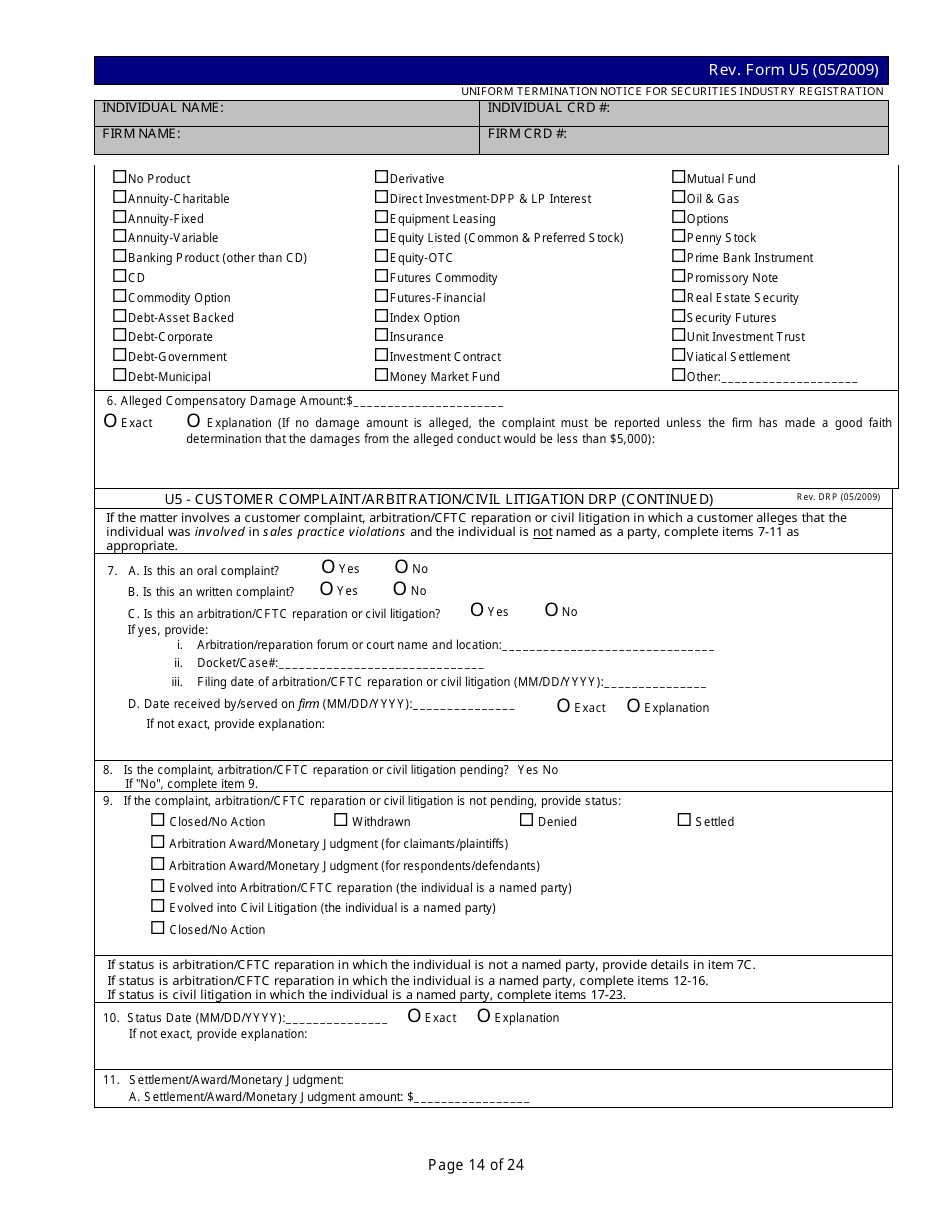

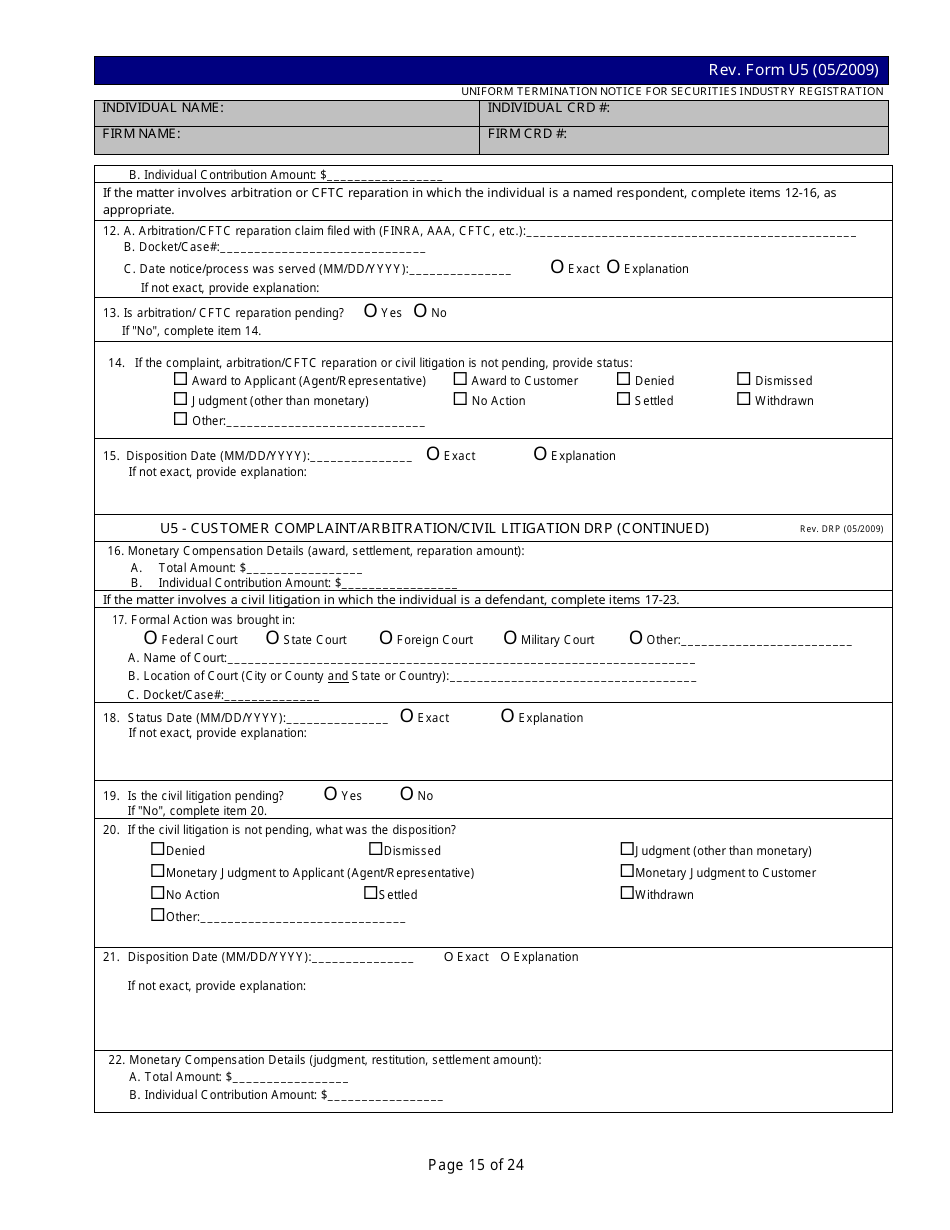

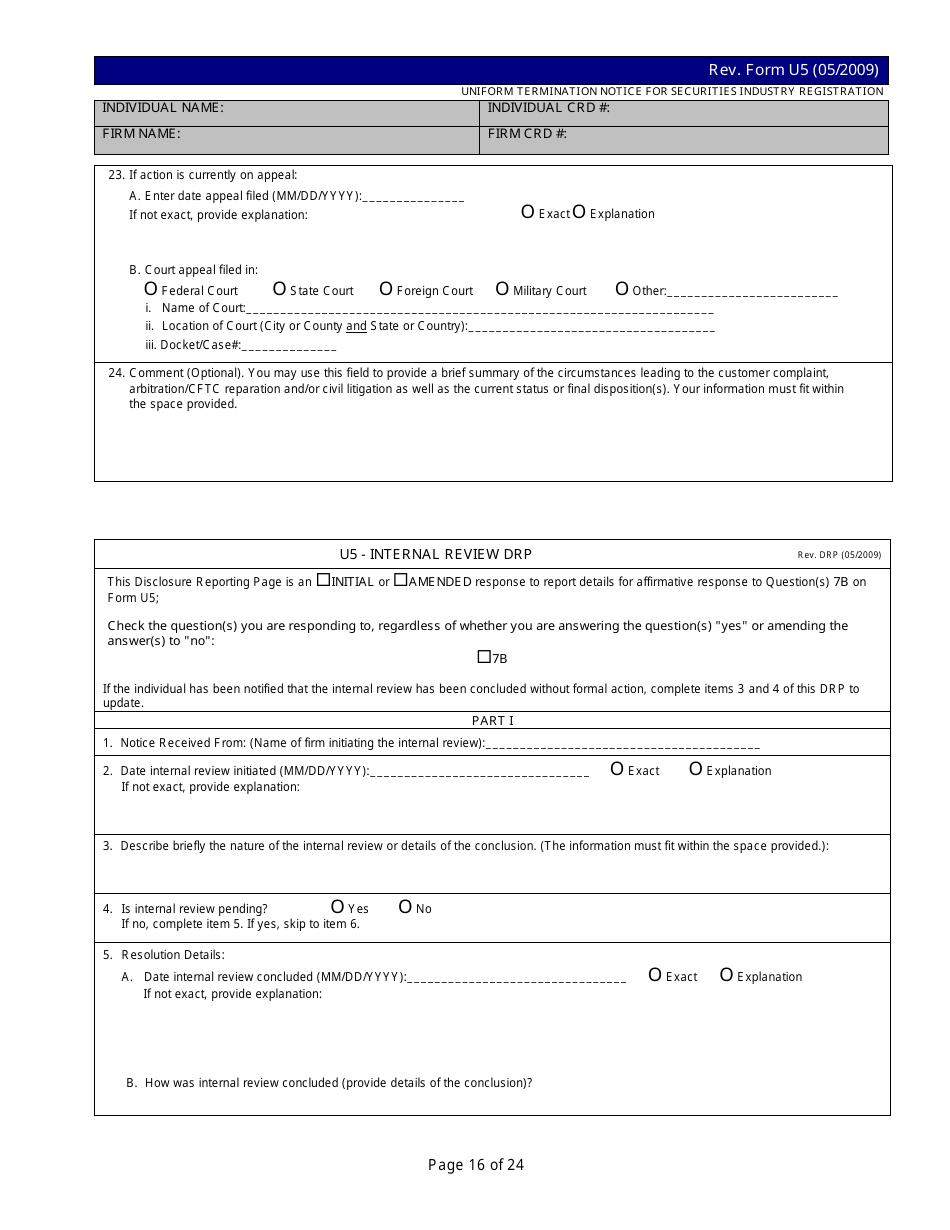

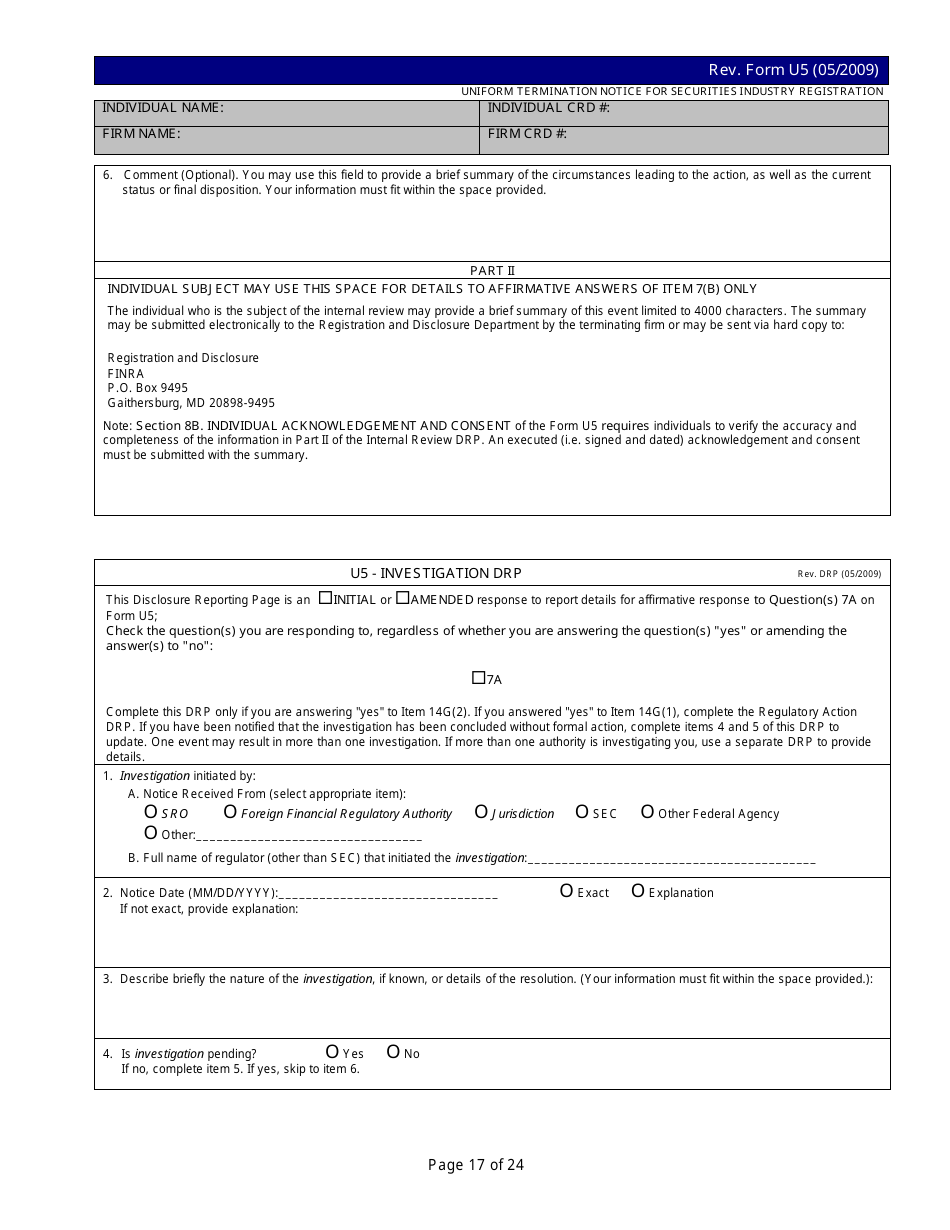

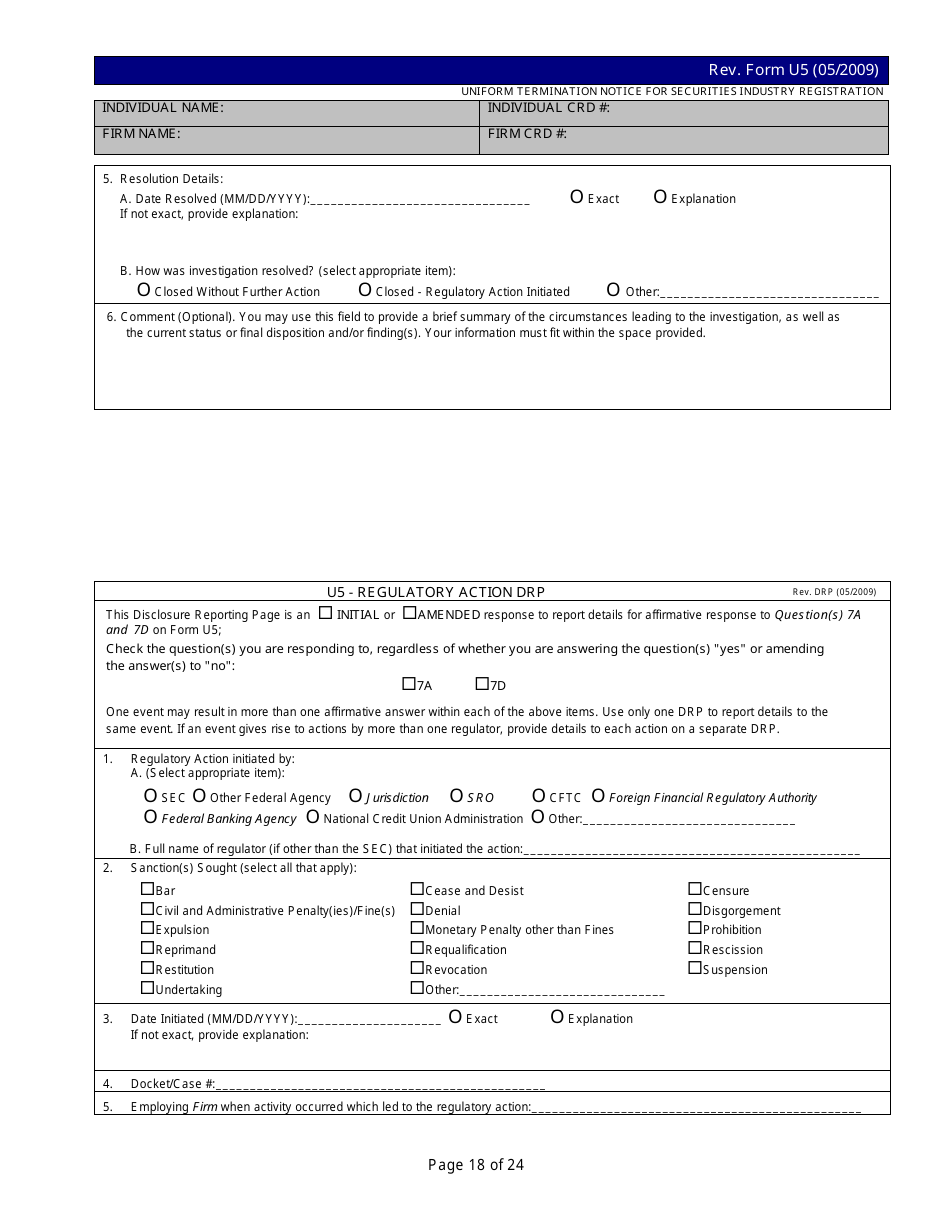

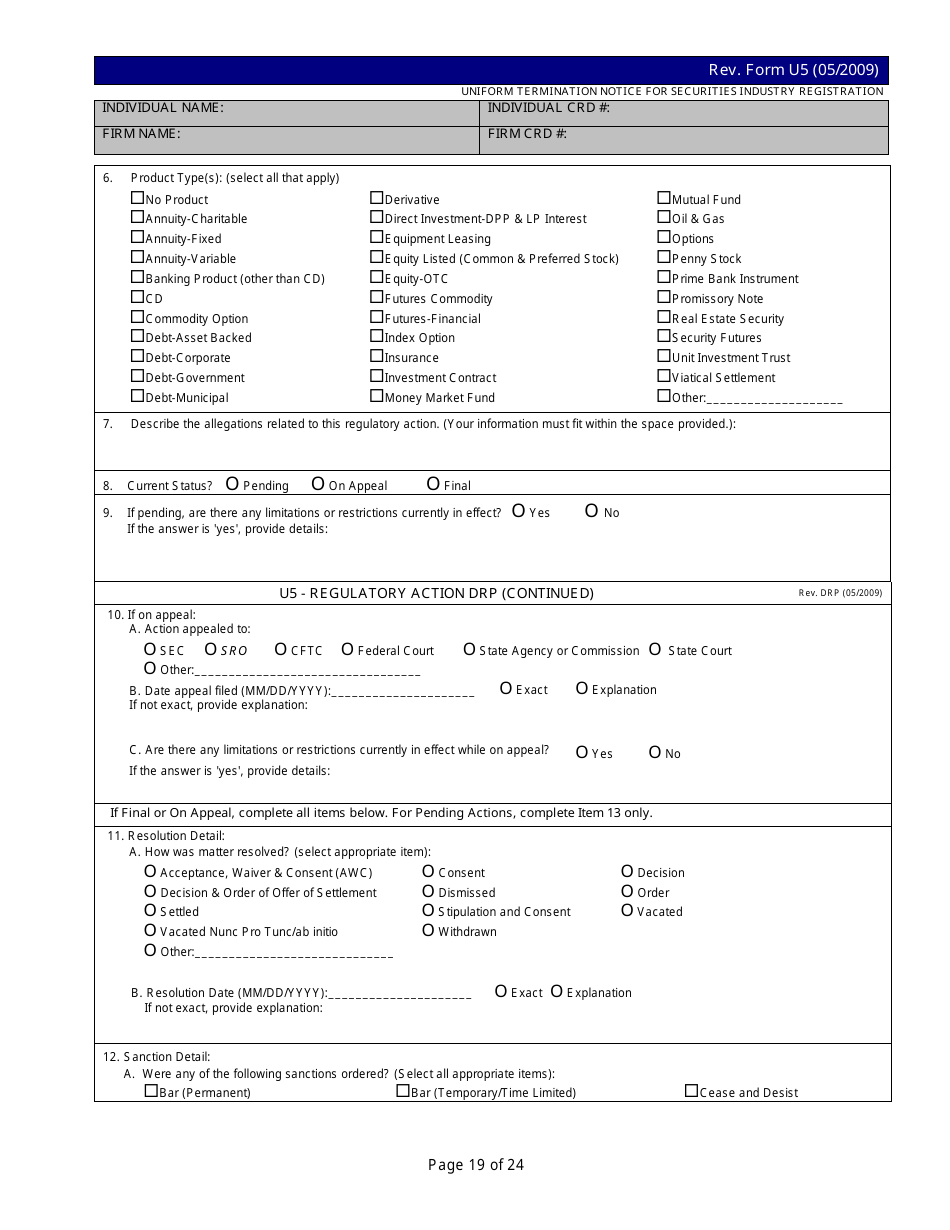

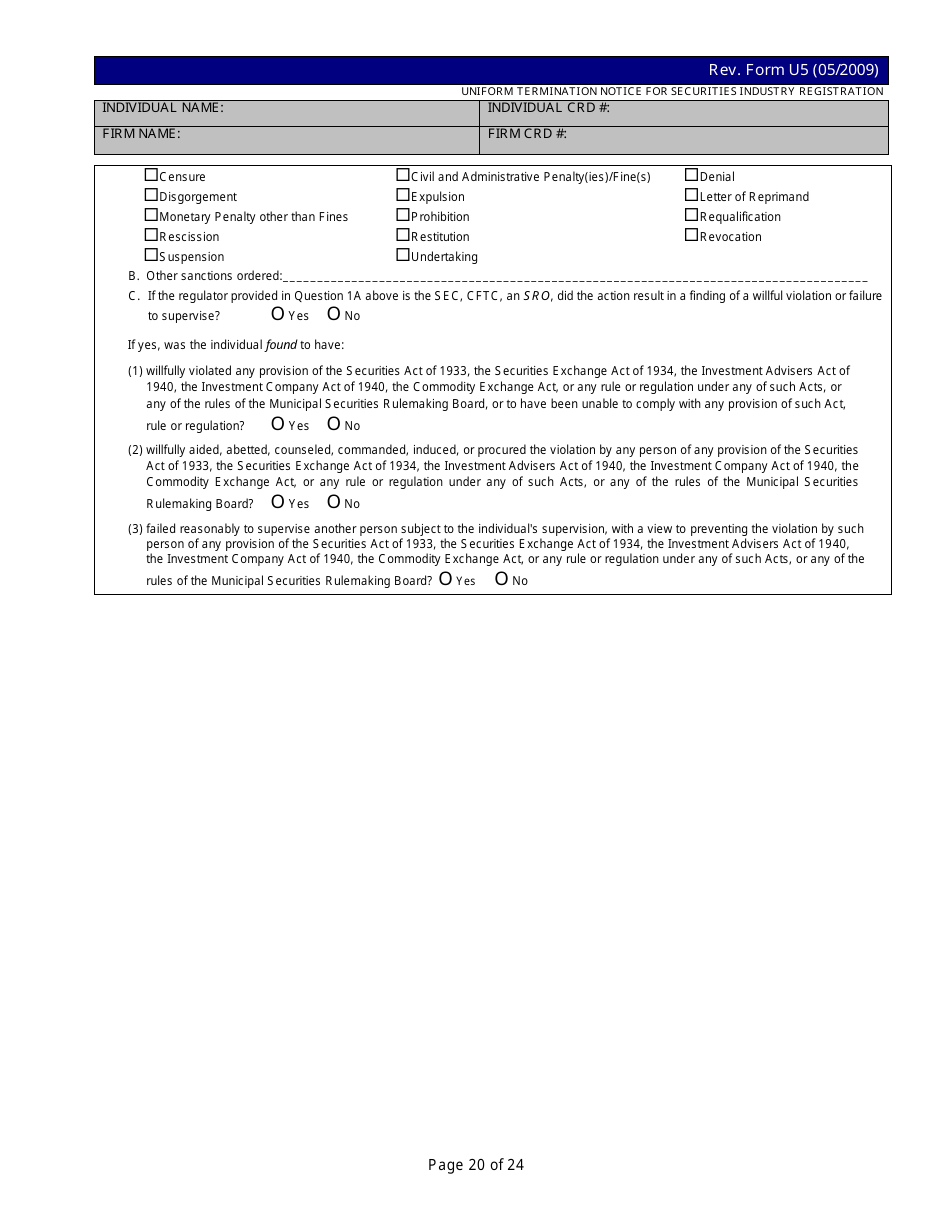

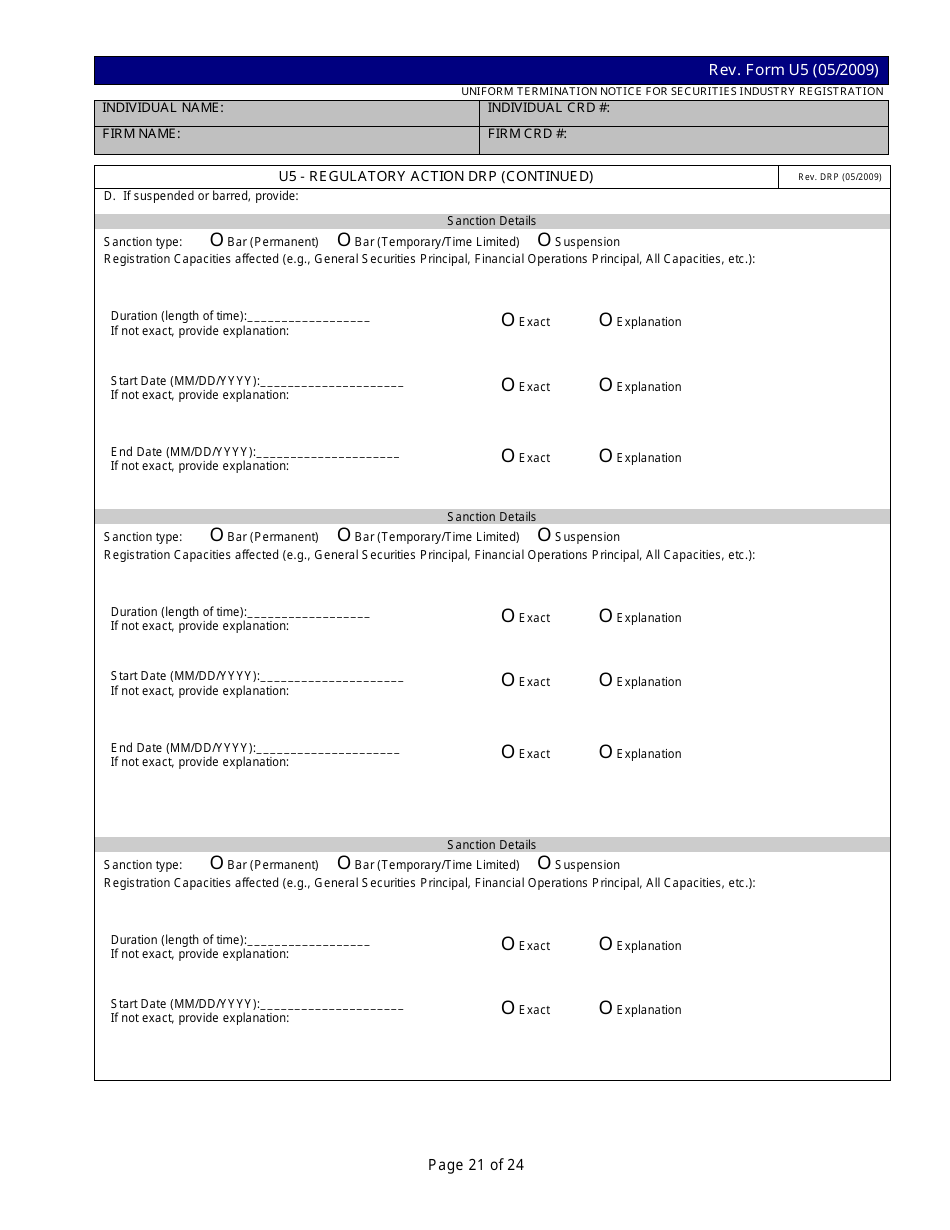

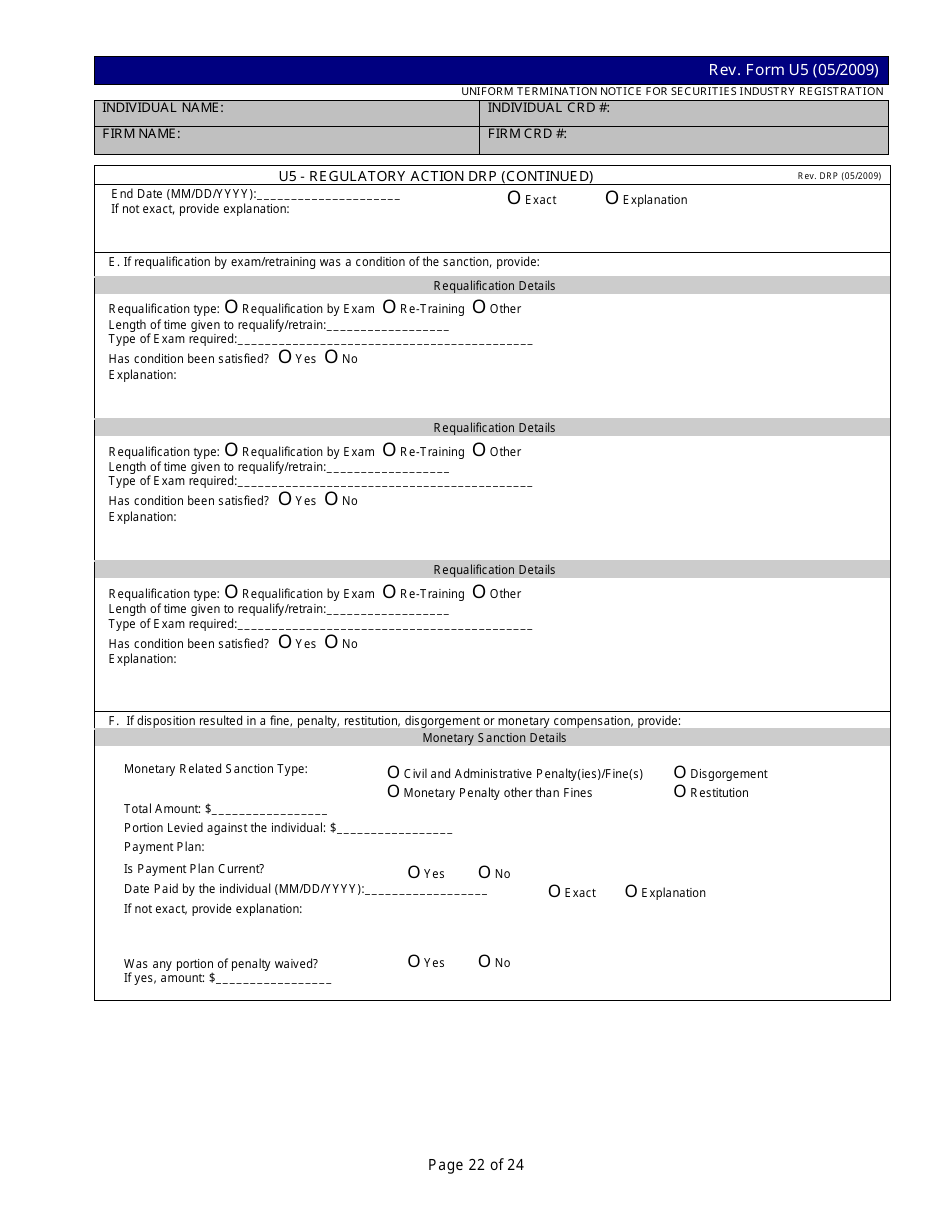

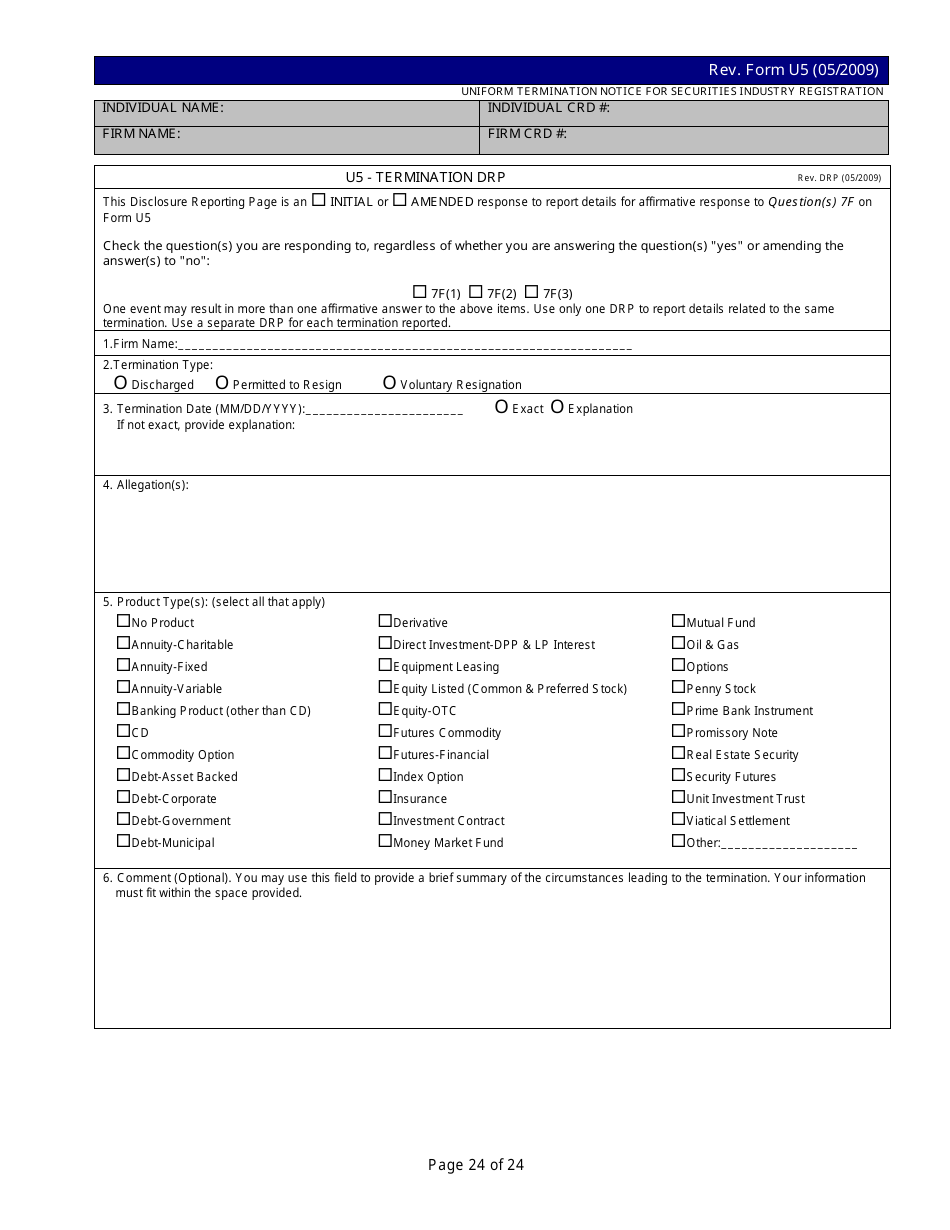

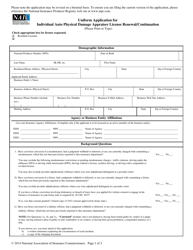

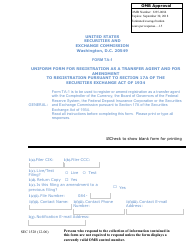

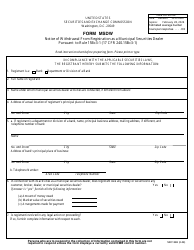

Form U5 Uniform Termination Notice for Securities Industry Registration

What Is Form U5?

This is a legal form that was released by the Financial Industry Regulatory Authority (FINRA) on May 1, 2009 and used country-wide. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form U5?

A: Form U5 is a Uniform Termination Notice for Securities Industry Registration.

Q: Who uses Form U5?

A: Form U5 is used by securities industry firms to report the termination of a registered individual.

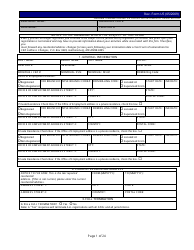

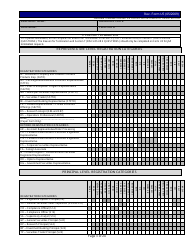

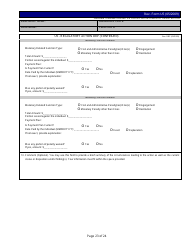

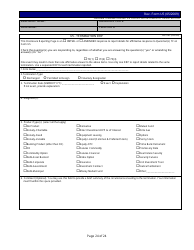

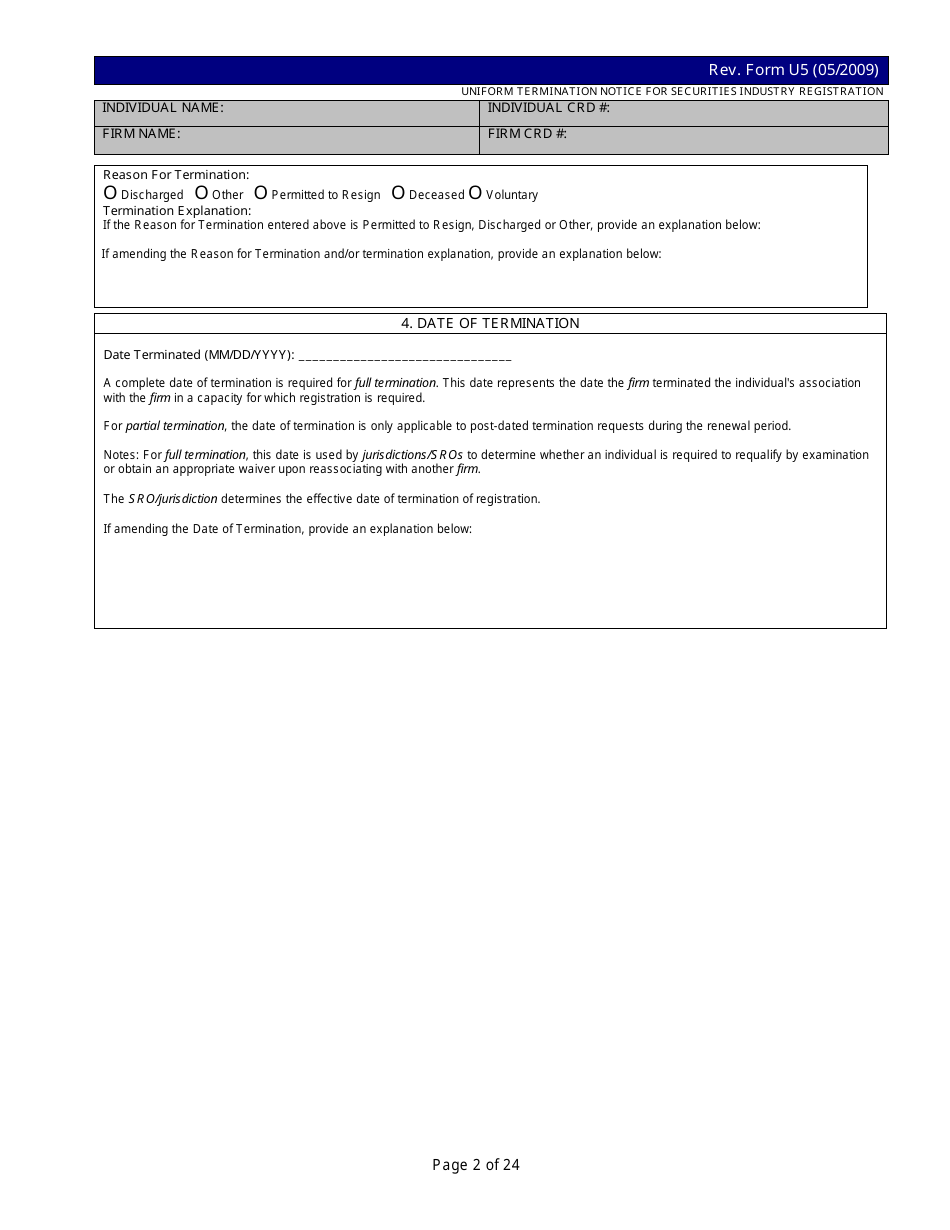

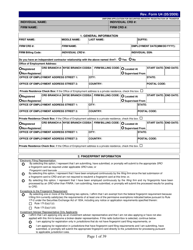

Q: What information is included in Form U5?

A: Form U5 includes information about the registered individual's termination, reason for termination, and any allegations or findings of misconduct.

Q: Why is Form U5 important?

A: Form U5 is important because it allows regulators and potential employers to track the employment history and conduct of registered individuals in the securities industry.

Q: How long does a firm have to file Form U5?

A: A firm must file Form U5 within 30 days of the termination or resignation of a registered individual.

Q: Can the registered individual provide a written statement in response to the information on Form U5?

A: Yes, the registered individual has the right to provide a written statement in response to the information on Form U5, which will be included in the record.

Q: Is Form U5 available to the public?

A: Yes, Form U5 is generally available to the public through the Central Registration Depository.

Q: Can a registered individual dispute the information on Form U5?

A: Yes, a registered individual can dispute the information on Form U5 and request a hearing to have the information removed or amended.

Q: What are the potential consequences of misconduct reported on Form U5?

A: The potential consequences of misconduct reported on Form U5 can include disciplinary action by regulatory authorities, damage to the individual's reputation, and difficulties in obtaining future employment in the securities industry.

Form Details:

- Released on May 1, 2009;

- The latest available edition released by the Financial Industry Regulatory Authority (FINRA);

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form U5 by clicking the link below or browse more documents and templates provided by the Financial Industry Regulatory Authority (FINRA).