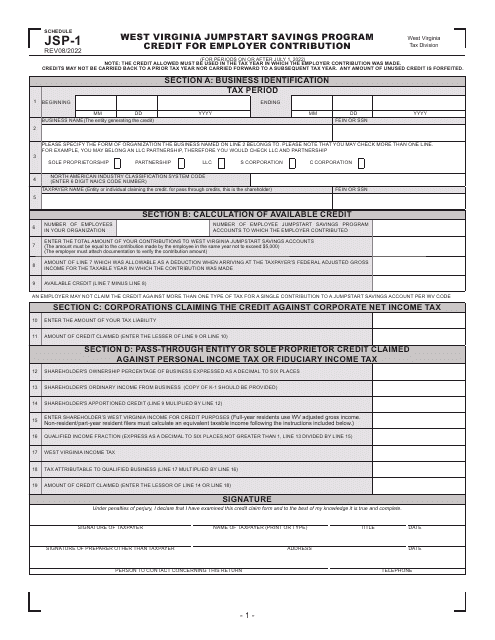

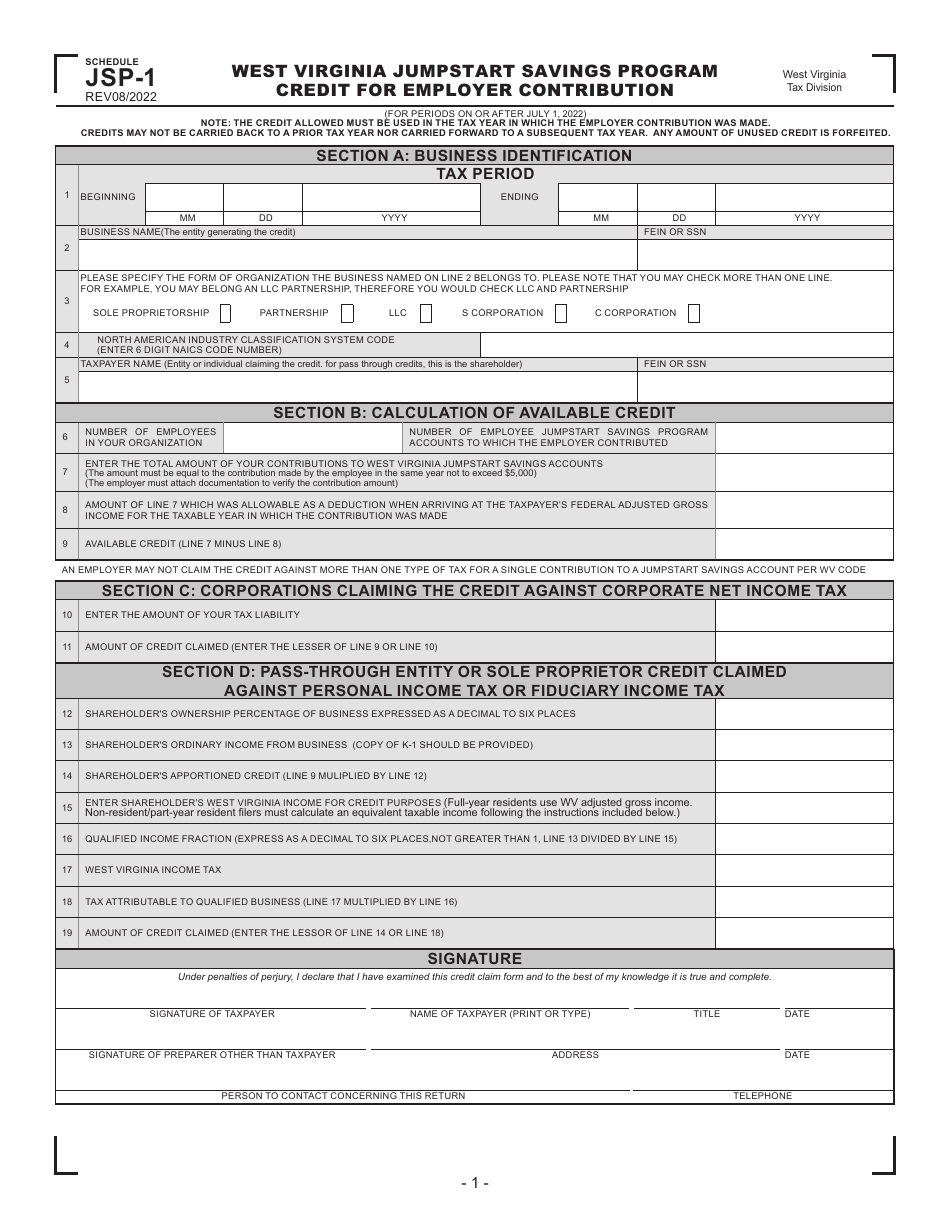

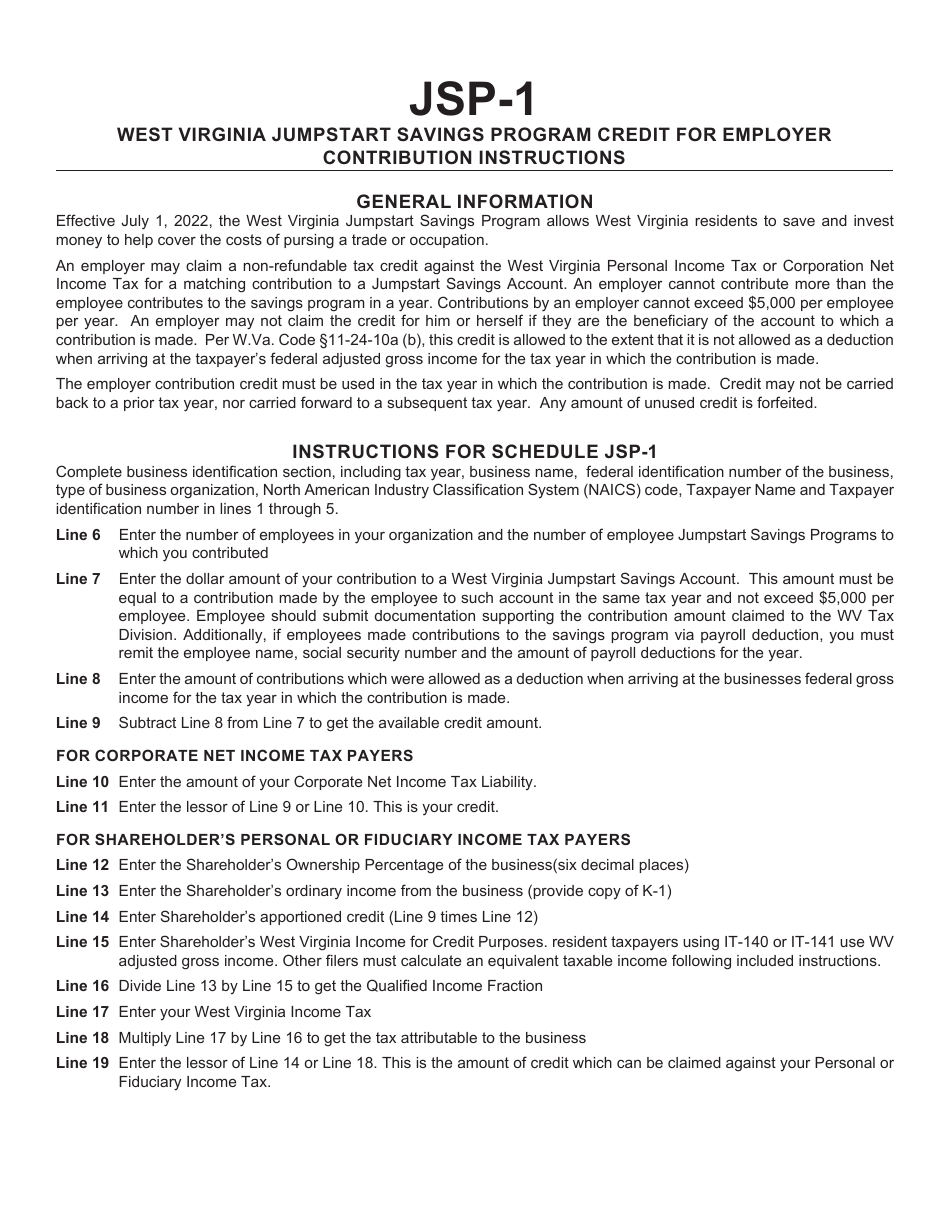

Schedule JSP-1 West Virginia Jumpstart Savings Program Credit for Employer Contribution - West Virginia

What Is Schedule JSP-1?

This is a legal form that was released by the West Virginia State Tax Department - a government authority operating within West Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Schedule JSP-1?

A: Schedule JSP-1 is a form for reporting employer contributions to the West Virginia Jumpstart Savings Program.

Q: What is the West Virginia Jumpstart Savings Program?

A: The West Virginia Jumpstart Savings Program is an initiative to promote savings for education and training expenses.

Q: What is the purpose of Schedule JSP-1?

A: The purpose of Schedule JSP-1 is to report employer contributions made to the West Virginia Jumpstart Savings Program.

Q: Who is required to file Schedule JSP-1?

A: Employers who make contributions to the West Virginia Jumpstart Savings Program are required to file Schedule JSP-1.

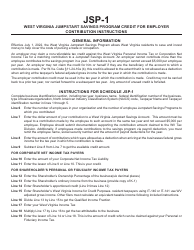

Q: What should be included in Schedule JSP-1?

A: Schedule JSP-1 should include the employer name, federal employer identification number (EIN), and the amount of contributions made to the West Virginia Jumpstart Savings Program.

Q: When should Schedule JSP-1 be filed?

A: Schedule JSP-1 must be filed annually by January 31st of the following year.

Q: Is there a penalty for not filing Schedule JSP-1?

A: Yes, there may be penalties for not filing Schedule JSP-1 or for filing it late. It is important to comply with the filing requirements to avoid penalties.

Form Details:

- Released on August 1, 2022;

- The latest edition provided by the West Virginia State Tax Department;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Schedule JSP-1 by clicking the link below or browse more documents and templates provided by the West Virginia State Tax Department.