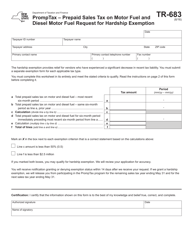

This version of the form is not currently in use and is provided for reference only. Download this version of

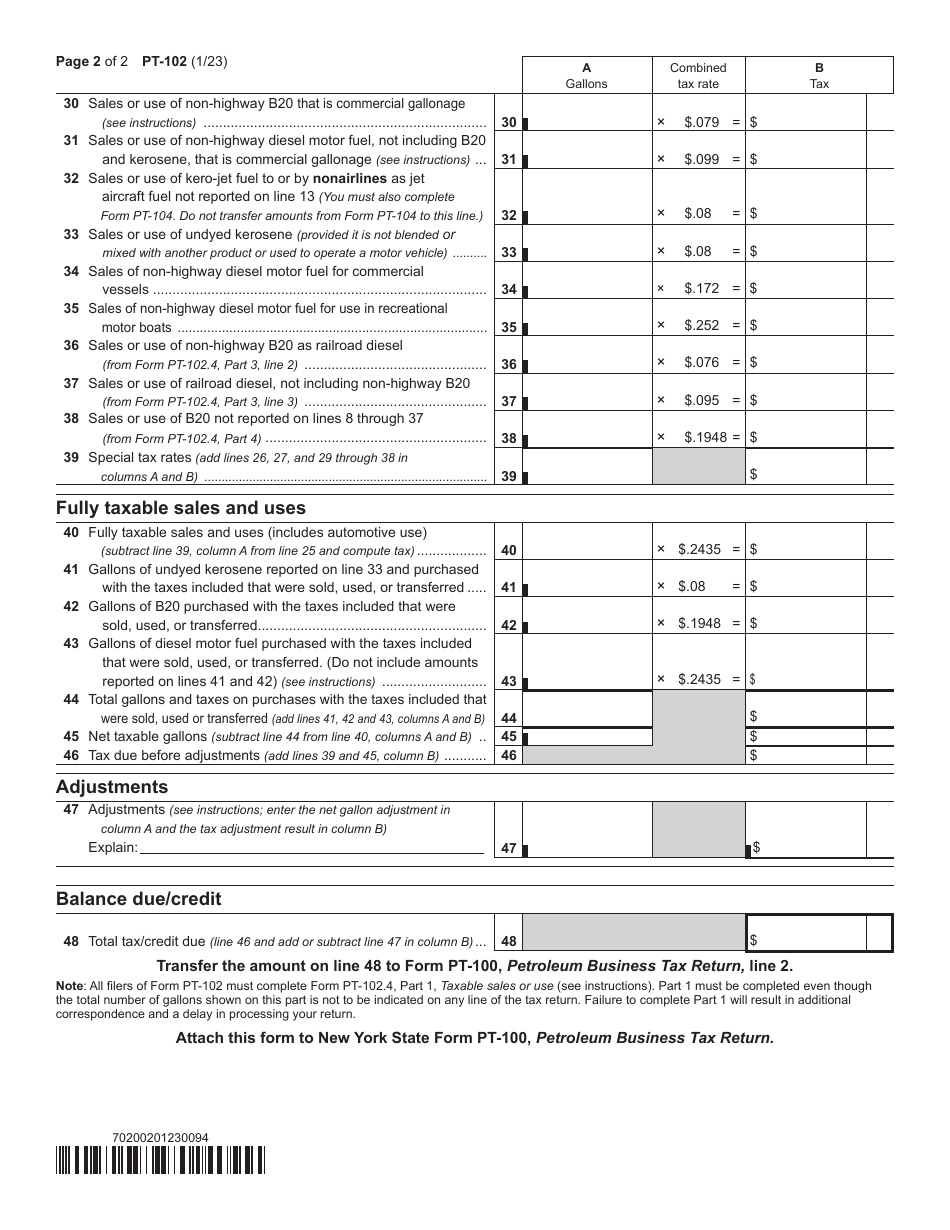

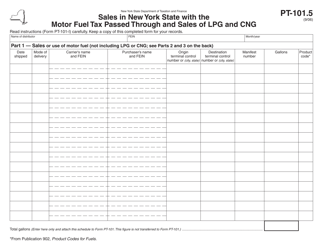

Form PT-102

for the current year.

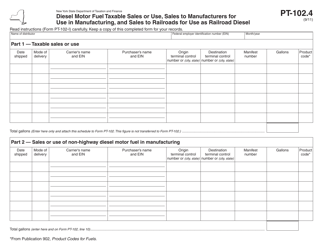

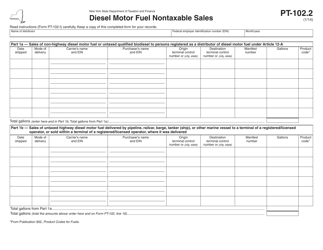

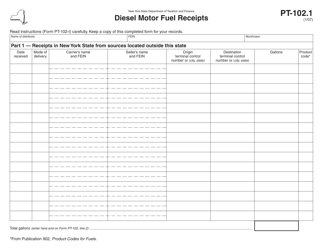

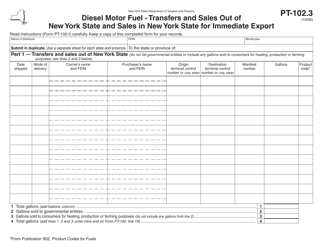

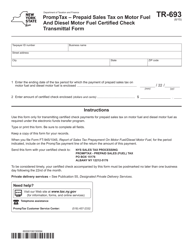

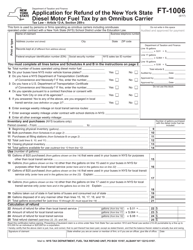

Form PT-102 Tax on Diesel Motor Fuel - New York

What Is Form PT-102?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PT-102?

A: Form PT-102 is a tax form used in New York to report and pay taxes on diesel motor fuel.

Q: Who needs to file Form PT-102?

A: Anyone who purchases and uses diesel motor fuel in New York is required to file Form PT-102 and pay the associated taxes.

Q: What information is required on Form PT-102?

A: Form PT-102 requires you to provide information such as your name, address, the quantity of diesel motor fuel purchased, and the amount of tax owed.

Q: When is Form PT-102 due?

A: Form PT-102 is due on a quarterly basis. The due dates are usually April 30th, July 31st, October 31st, and January 31st.

Q: Are there any penalties for late filing of Form PT-102?

A: Yes, if you fail to file Form PT-102 by the due date, you may be subject to penalties and interest on the unpaid tax amount.

Q: Can I claim a refund on Form PT-102?

A: Yes, if you overpaid your taxes, you can claim a refund by indicating the excess amount on Form PT-102.

Q: Are there any exemptions or credits available for diesel motor fuel taxes?

A: Yes, there are certain exemptions and credits available for diesel motor fuel taxes in New York. You should consult the instructions provided with Form PT-102 or contact the Department of Taxation and Finance for more information.

Form Details:

- Released on January 1, 2023;

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form PT-102 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.