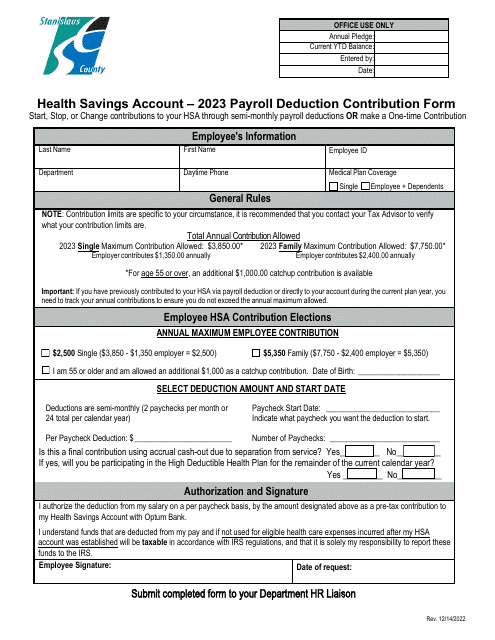

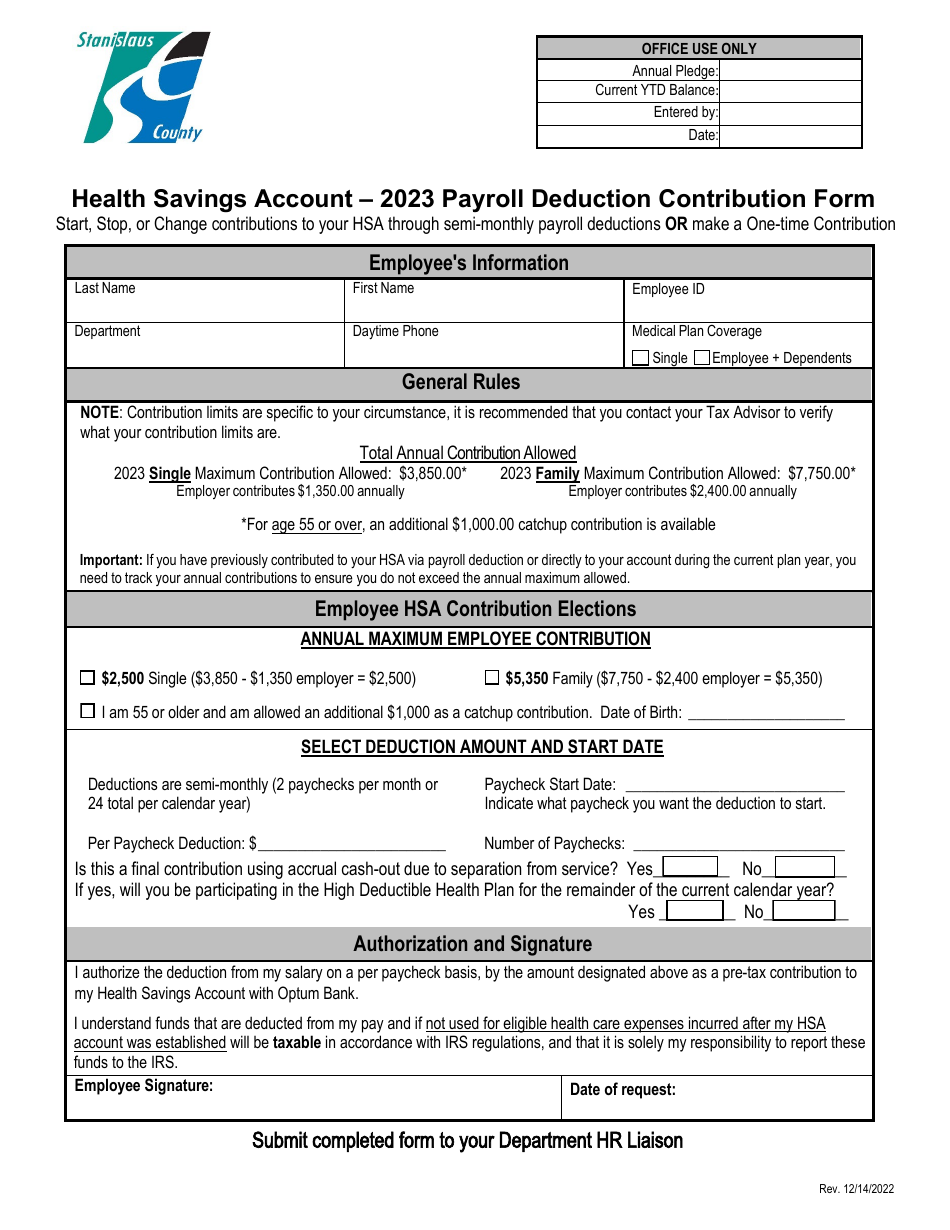

Health Savings Account - Payroll Deduction Contribution Form - Stanislaus County, California

Health Savings Account - Payroll Deduction Contribution Form is a legal document that was released by the Risk Management Service - Stanislaus County, California - a government authority operating within California. The form may be used strictly within Stanislaus County.

FAQ

Q: What is a Health Savings Account (HSA)?

A: A Health Savings Account (HSA) is a tax-advantaged medical savings account that allows you to save money for qualified medical expenses.

Q: Why would I want to contribute to a Health Savings Account?

A: Contributing to a Health Savings Account can lower your taxable income, provide potential tax-free growth, and allow you to save money specifically for medical expenses.

Q: Am I eligible to contribute to a Health Savings Account?

A: To be eligible to contribute to a Health Savings Account, you must have a high-deductible health insurance plan and not be enrolled in other health insurance coverage.

Q: What is the maximum contribution limit for a Health Savings Account?

A: The maximum contribution limit for an individual is $3,600 and for a family is $7,200 in 2021. However, these limits are subject to change.

Q: Are there any tax advantages to contributing to a Health Savings Account?

A: Yes, there are several tax advantages to contributing to a Health Savings Account. Contributions are tax-deductible, earnings are tax-free, and withdrawals for qualified medical expenses are tax-free.

Q: How do I contribute to a Health Savings Account?

A: You can contribute to a Health Savings Account through payroll deduction, similar to other workplace benefits.

Q: Do I need to enroll in a specific health insurance plan to have a Health Savings Account?

A: Yes, you need to have a high-deductible health insurance plan (HDHP) in order to be eligible for a Health Savings Account.

Q: Can I use the funds in my Health Savings Account for non-medical expenses?

A: While Health Savings Account funds are intended for qualified medical expenses, you can use the funds for non-medical expenses, but they will be subject to income tax and a 20% penalty if used before age 65.

Q: What happens to the funds in my Health Savings Account if I change jobs or retire?

A: The funds in your Health Savings Account are yours to keep, even if you change jobs or retire. You can continue to use the funds for qualified medical expenses or save them for future expenses.

Q: Can I invest the funds in my Health Savings Account?

A: Yes, many Health Savings Accounts offer investment options, allowing you to potentially grow your savings over time.

Form Details:

- Released on December 14, 2022;

- The latest edition currently provided by the Risk Management Service - Stanislaus County, California;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Risk Management Service - Stanislaus County, California.