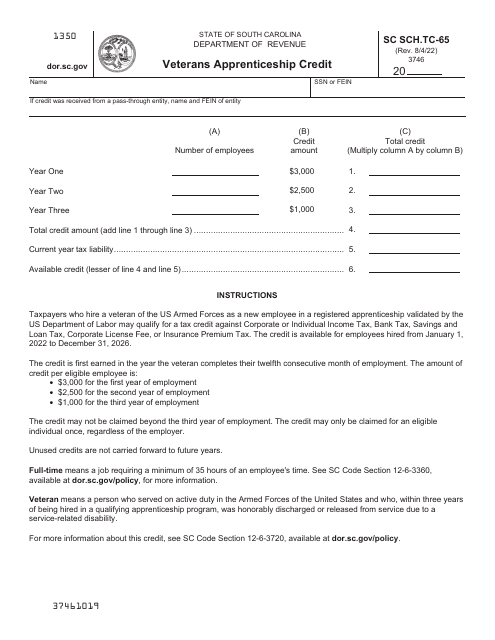

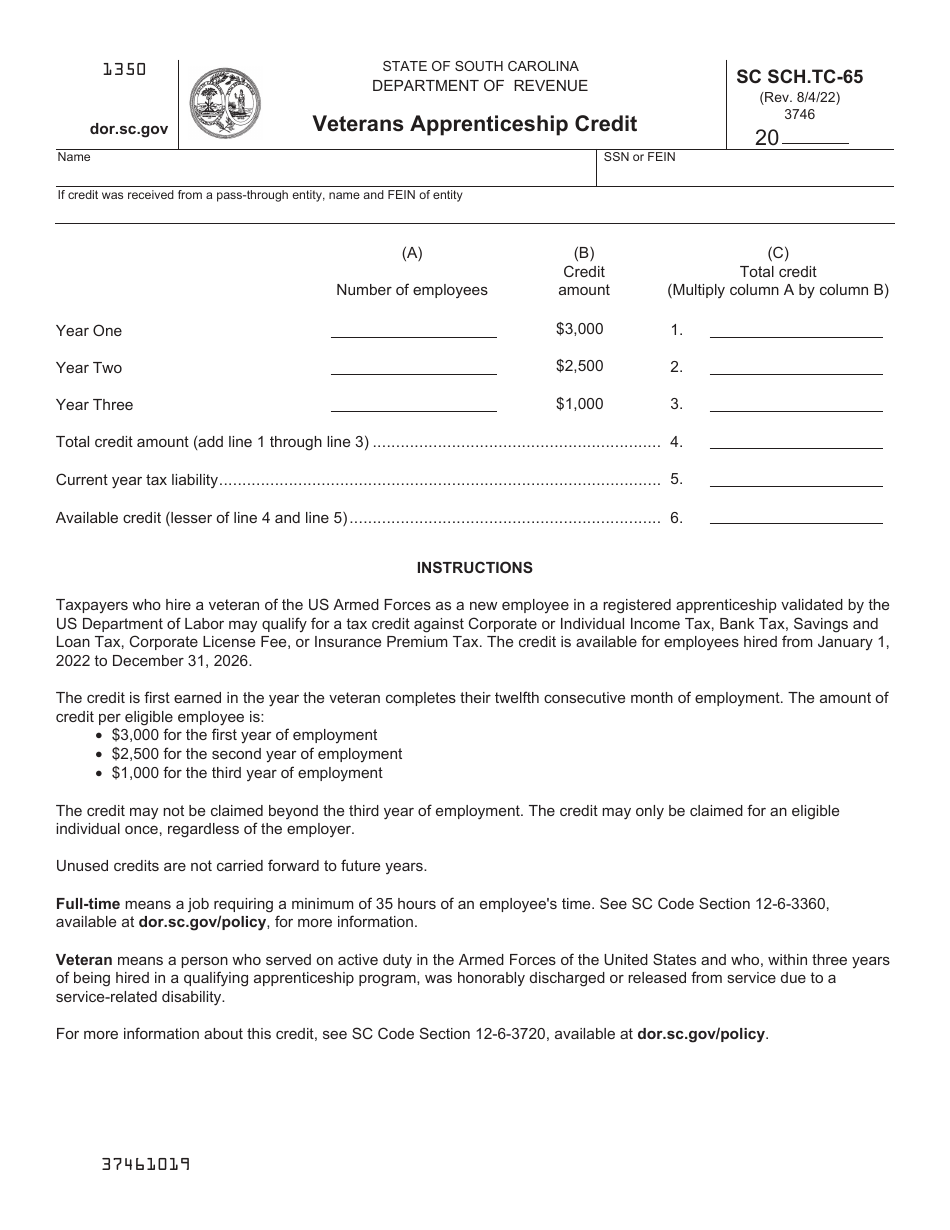

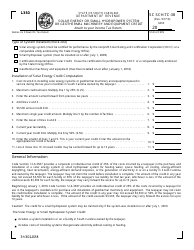

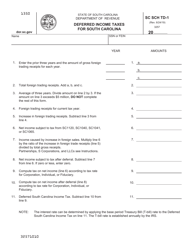

Form SC SCH.TC-65 Veterans Apprenticeship Credit - South Carolina

What Is Form SC SCH.TC-65?

This is a legal form that was released by the South Carolina Department of Revenue - a government authority operating within South Carolina. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

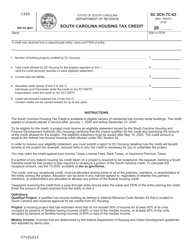

Q: What is the SC SCH.TC-65 Veterans Apprenticeship Credit?

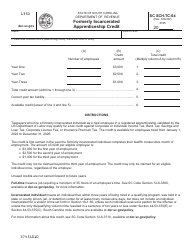

A: The SC SCH.TC-65 Veterans Apprenticeship Credit is a tax credit offered in South Carolina to businesses that hire eligible veterans as apprentices.

Q: Who is eligible for the SC SCH.TC-65 Veterans Apprenticeship Credit?

A: Eligible veterans who have served in the U.S. Armed Forces and have been honorably discharged or released from active duty within the past five years are eligible for the credit.

Q: How much is the SC SCH.TC-65 Veterans Apprenticeship Credit?

A: The credit is equal to 25% of the qualified wages paid to an eligible veteran apprentice, up to a maximum credit of $1,500 per apprentice per taxable year.

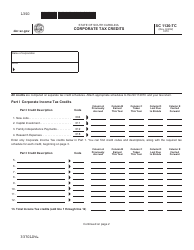

Q: How do businesses claim the SC SCH.TC-65 Veterans Apprenticeship Credit?

A: Businesses can claim the credit by completing Form SC SCH.TC-65 and attaching it to their South Carolina state tax return.

Q: Are there any additional requirements to claim the SC SCH.TC-65 Veterans Apprenticeship Credit?

A: Yes, businesses must obtain certification from the South Carolina Department of Employment and Workforce to verify that the veteran apprentice meets the eligibility criteria.

Form Details:

- Released on August 4, 2022;

- The latest edition provided by the South Carolina Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form SC SCH.TC-65 by clicking the link below or browse more documents and templates provided by the South Carolina Department of Revenue.