This version of the form is not currently in use and is provided for reference only. Download this version of

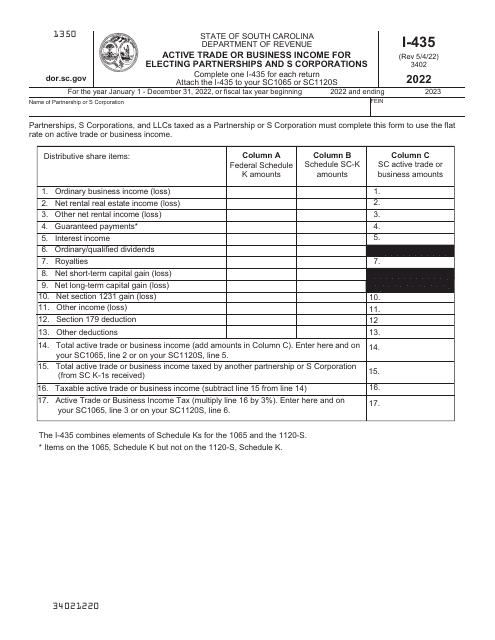

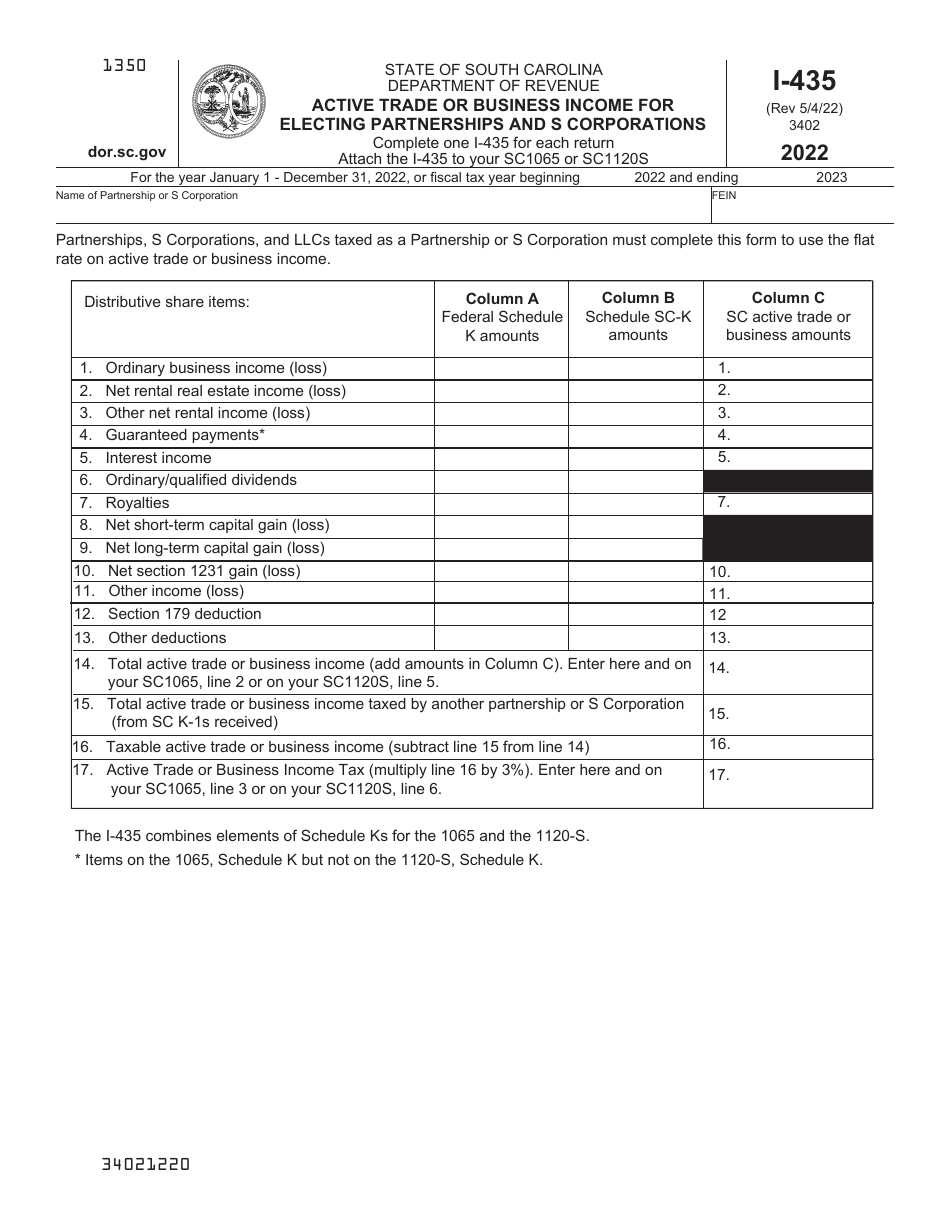

Form I-435

for the current year.

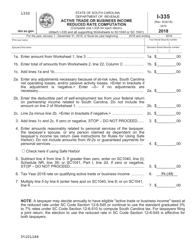

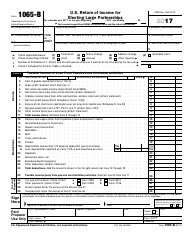

Form I-435 Active Trade or Business Income for Electing Partnerships and S Corporations - South Carolina

What Is Form I-435?

This is a legal form that was released by the South Carolina Department of Revenue - a government authority operating within South Carolina. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form I-435?

A: Form I-435 is a tax form used to report active trade or business income for electing partnerships and S corporations in South Carolina.

Q: Who needs to file Form I-435?

A: Partnerships and S corporations in South Carolina that elect to report active trade or business income need to file Form I-435.

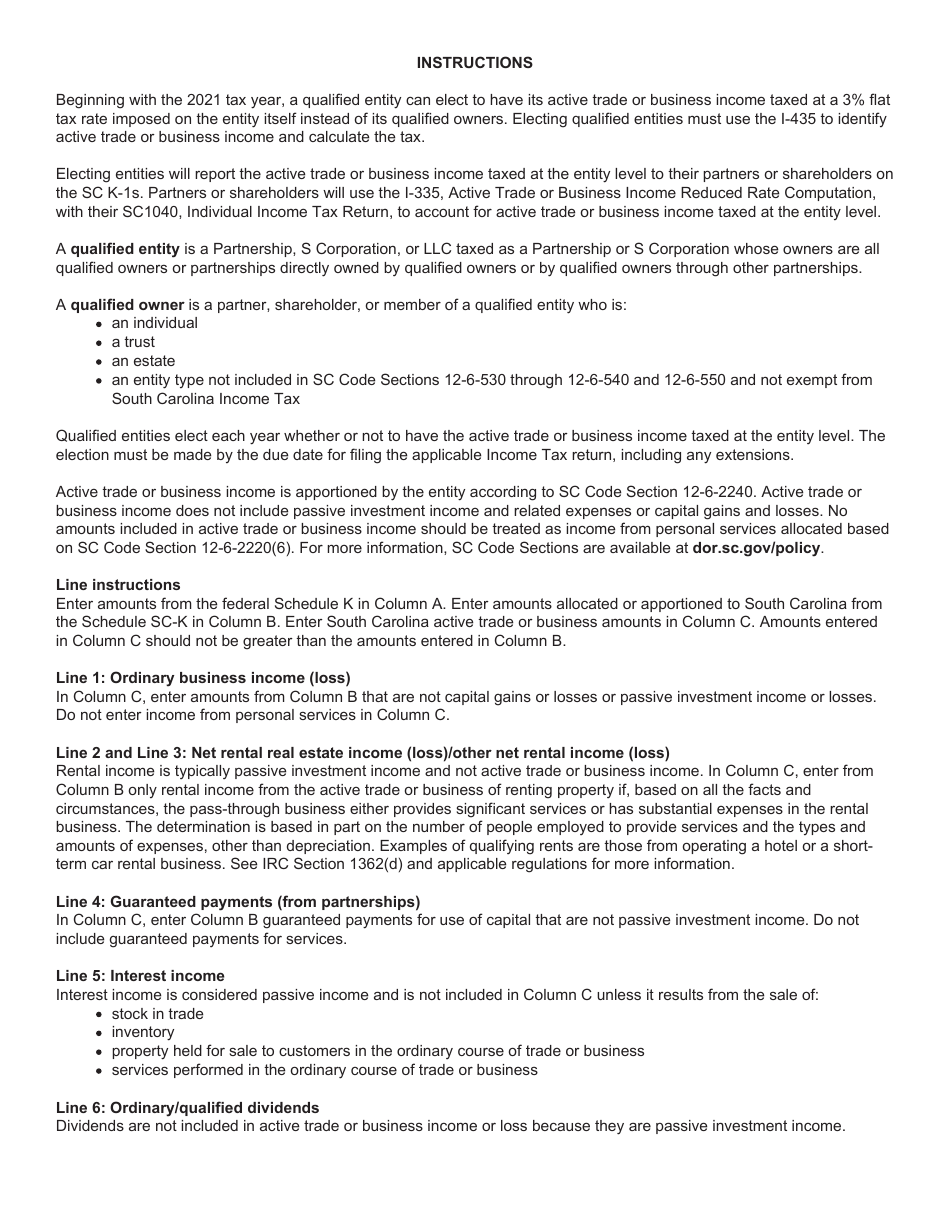

Q: What is considered active trade or business income?

A: Active trade or business income includes income from the regular operations of a business, such as sales of products or services.

Q: What is the purpose of filing Form I-435?

A: The purpose of filing Form I-435 is to calculate and report the active trade or business income for electing partnerships and S corporations in South Carolina.

Q: When is Form I-435 due?

A: Form I-435 is due on the 15th day of the fourth month following the end of the taxable year.

Q: Are there any filing fees for Form I-435?

A: There are no filing fees associated with Form I-435.

Q: What are the consequences of not filing Form I-435?

A: Not filing Form I-435 or filing it late may result in penalties, interest, and other consequences imposed by the South Carolina Department of Revenue.

Q: Are there any additional forms or schedules that need to be filed with Form I-435?

A: Depending on the specific circumstances, additional forms and schedules may need to be filed with Form I-435. It is recommended to consult the instructions provided with the form or seek professional tax advice.

Form Details:

- Released on May 4, 2022;

- The latest edition provided by the South Carolina Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form I-435 by clicking the link below or browse more documents and templates provided by the South Carolina Department of Revenue.