This version of the form is not currently in use and is provided for reference only. Download this version of

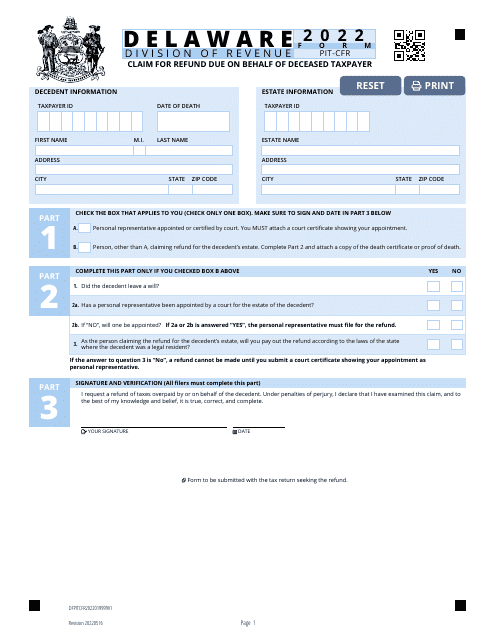

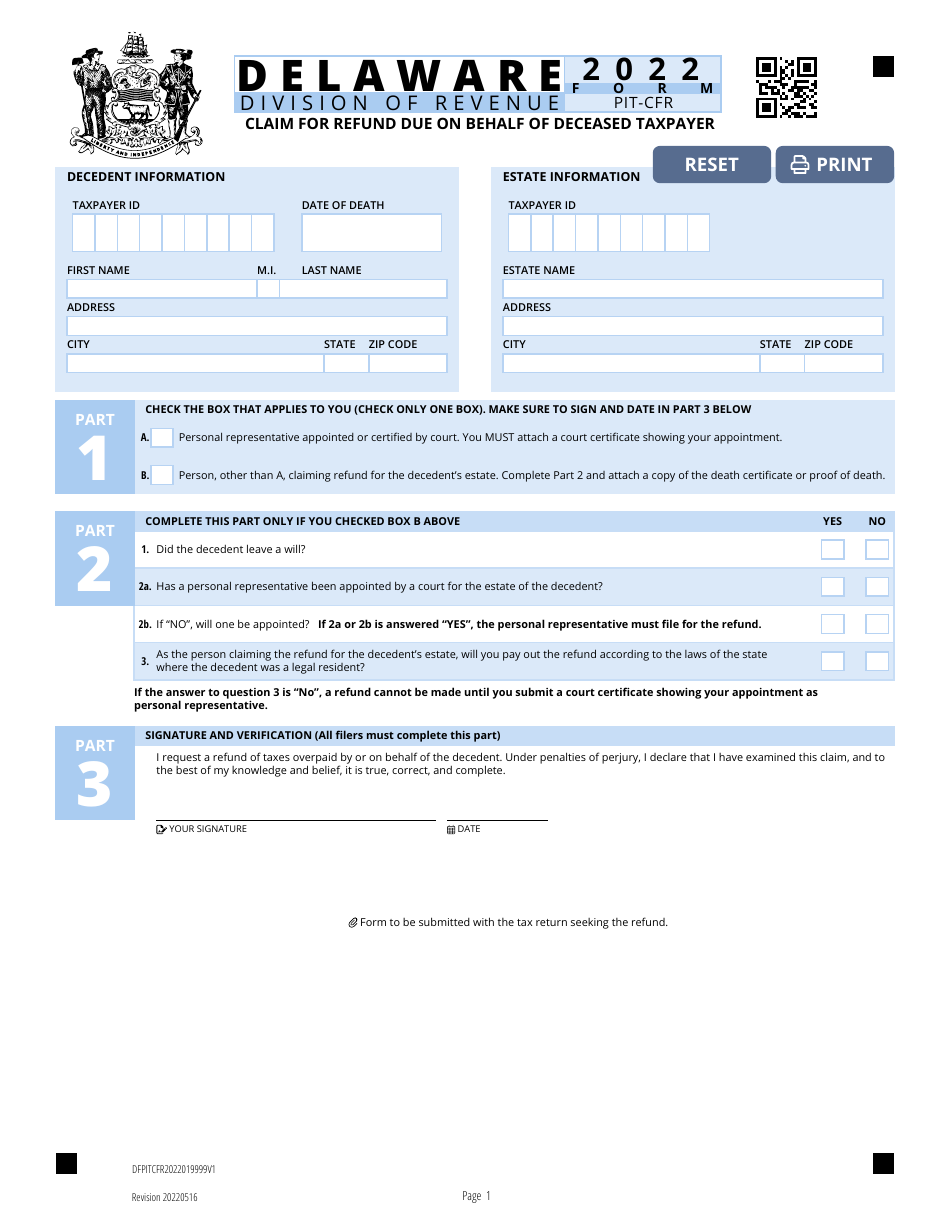

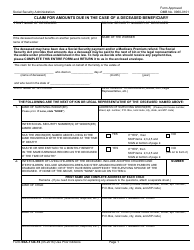

Form PIT-CFR

for the current year.

Form PIT-CFR Claim for Refund Due on Behalf of Deceased Taxpayer - Delaware

What Is Form PIT-CFR?

This is a legal form that was released by the Delaware Department of Finance - Division of Revenue - a government authority operating within Delaware. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the PIT-CFR claim for refund?

A: PIT-CFR is a claim for refund form for Delaware state taxes.

Q: How do I file a PIT-CFR claim for refund?

A: You can file a PIT-CFR claim for refund on behalf of a deceased taxpayer.

Q: What is the purpose of the PIT-CFR claim for refund?

A: The purpose of the PIT-CFR claim for refund is to request a refund of taxes paid by a deceased taxpayer.

Q: Who can file a PIT-CFR claim for refund?

A: You can file a PIT-CFR claim for refund on behalf of a deceased taxpayer.

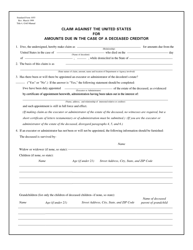

Form Details:

- Released on May 16, 2022;

- The latest edition provided by the Delaware Department of Finance - Division of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PIT-CFR by clicking the link below or browse more documents and templates provided by the Delaware Department of Finance - Division of Revenue.