This version of the form is not currently in use and is provided for reference only. Download this version of

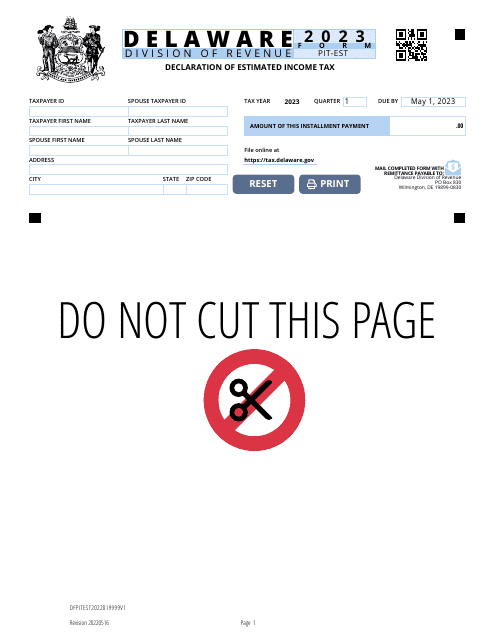

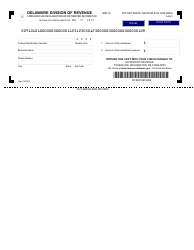

Form PIT-EST

for the current year.

Form PIT-EST Declaration of Estimated Income Tax - Delaware

What Is Form PIT-EST?

This is a legal form that was released by the Delaware Department of Finance - Division of Revenue - a government authority operating within Delaware. Check the official instructions before completing and submitting the form.

FAQ

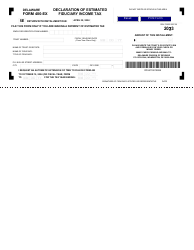

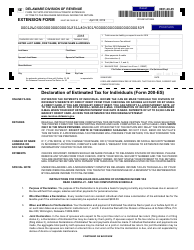

Q: What is the PIT-EST Declaration of Estimated Income Tax?

A: The PIT-EST Declaration is a form used by individuals to report and pay estimated income tax to the state of Delaware.

Q: Who needs to file the PIT-EST Declaration?

A: Individuals who expect to owe more than $400 in Delaware income tax for the current tax year are required to file the PIT-EST Declaration.

Q: When is the deadline to file the PIT-EST Declaration?

A: The PIT-EST Declaration must be filed and the first installment of estimated tax must be paid by April 30th of the current tax year.

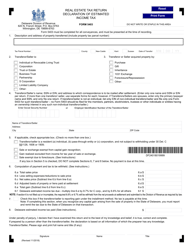

Q: How do I calculate the estimated tax amount?

A: You can use the worksheet provided in the PIT-EST Declaration form instructions to calculate your estimated tax amount based on your expected income, deductions, and credits.

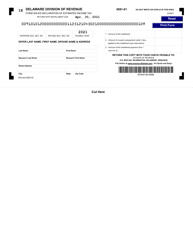

Q: What happens if I don't file the PIT-EST Declaration?

A: If you are required to file the PIT-EST Declaration and fail to do so, you may be subject to penalties and interest on any underpayment of estimated tax.

Q: Can I make changes to my PIT-EST Declaration after filing?

A: Yes, you can file an amended PIT-EST Declaration if there are changes to your income, deductions, or credits. However, any underpayment of estimated tax may still be subject to penalties and interest.

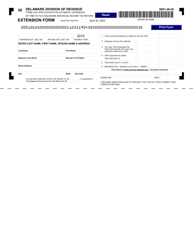

Form Details:

- Released on May 16, 2022;

- The latest edition provided by the Delaware Department of Finance - Division of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PIT-EST by clicking the link below or browse more documents and templates provided by the Delaware Department of Finance - Division of Revenue.