This version of the form is not currently in use and is provided for reference only. Download this version of

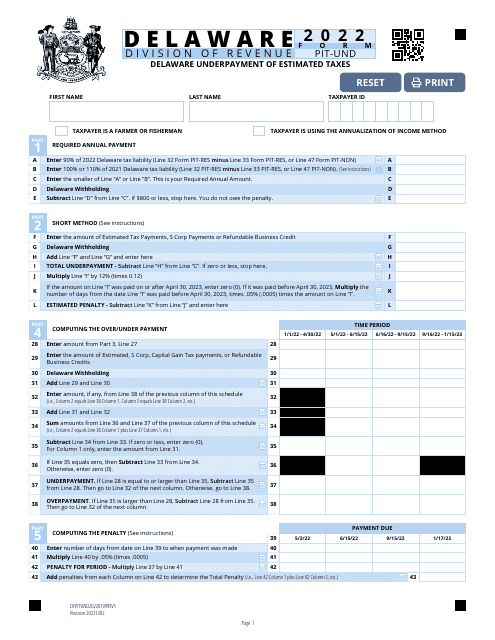

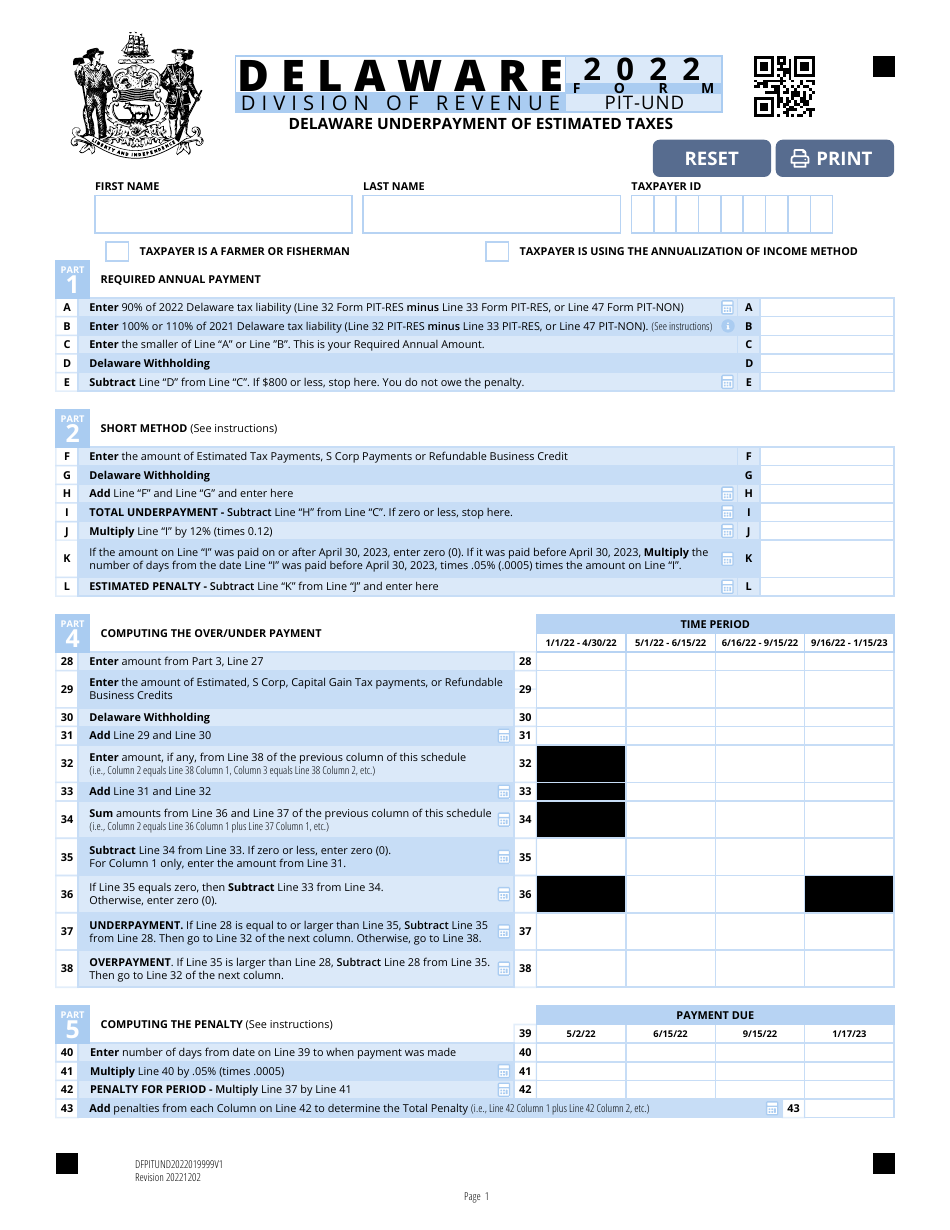

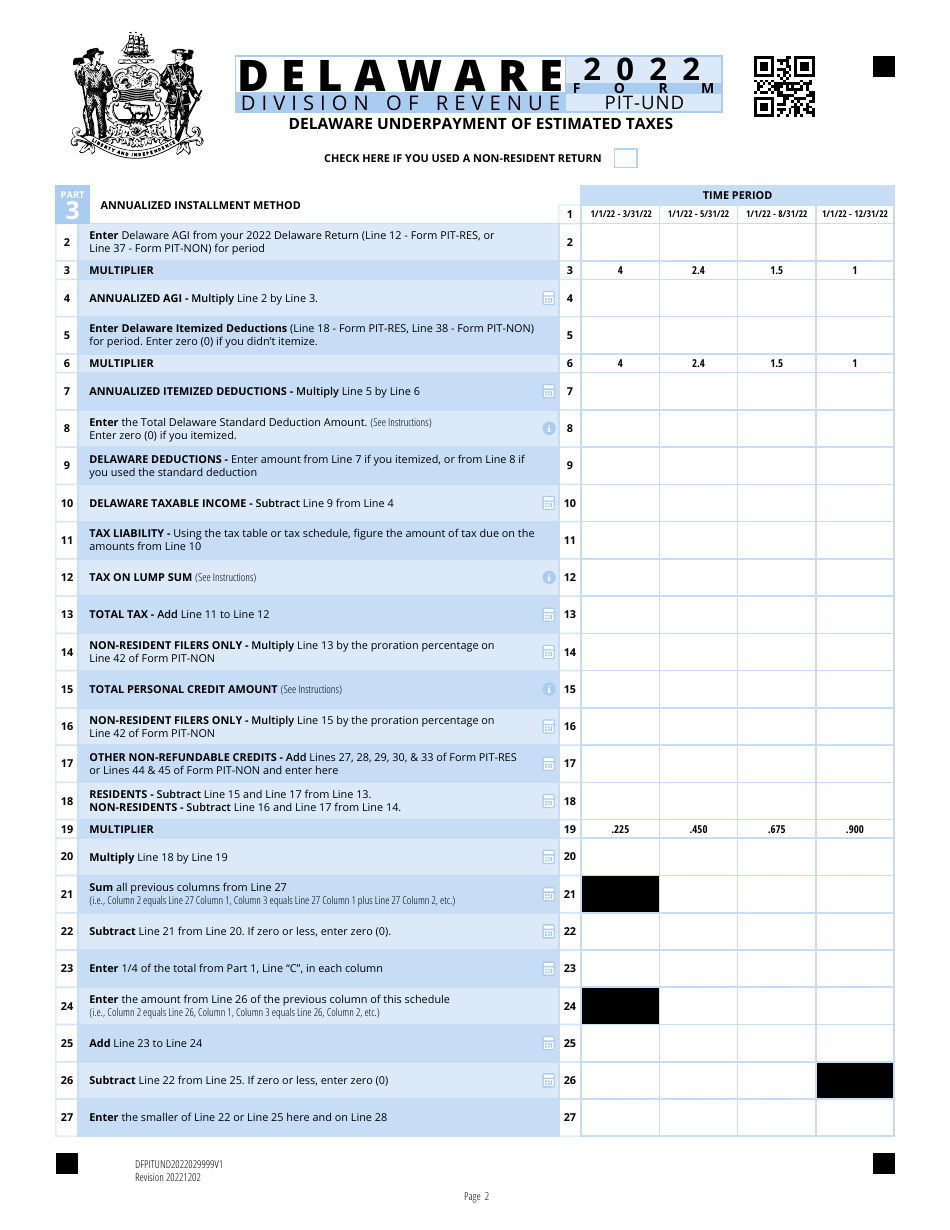

Form PIT-UND

for the current year.

Form PIT-UND Delaware Underpayment of Estimated Taxes - Delaware

What Is Form PIT-UND?

This is a legal form that was released by the Delaware Department of Finance - Division of Revenue - a government authority operating within Delaware. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PIT-UND?

A: Form PIT-UND is a tax form used in Delaware to report underpayment of estimated taxes.

Q: Who needs to file Form PIT-UND?

A: Individuals or businesses in Delaware who did not pay enough estimated taxes throughout the year may need to file Form PIT-UND.

Q: Why would someone need to file Form PIT-UND?

A: If an individual or business in Delaware did not pay enough estimated taxes during the year, they may owe additional taxes and need to file Form PIT-UND.

Q: When is Form PIT-UND due?

A: Form PIT-UND is typically due on the same day as the Delaware individual income tax return, which is April 30th.

Q: Can I e-file Form PIT-UND?

A: Yes, Delaware provides the option to e-file Form PIT-UND.

Q: What happens if I don't file Form PIT-UND?

A: If you are required to file Form PIT-UND and fail to do so, you may be subject to penalties and interest on the underpaid taxes.

Q: Can I amend a previously filed Form PIT-UND?

A: Yes, if you discover errors or need to make changes to a previously filed Form PIT-UND, you can file an amended form.

Q: Are there any exceptions to filing Form PIT-UND?

A: Yes, there are certain exceptions to filing Form PIT-UND, such as if you had no incometax liability in the previous year or if you meet one of the "safe harbor" criteria.

Form Details:

- Released on December 2, 2022;

- The latest edition provided by the Delaware Department of Finance - Division of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PIT-UND by clicking the link below or browse more documents and templates provided by the Delaware Department of Finance - Division of Revenue.