This version of the form is not currently in use and is provided for reference only. Download this version of

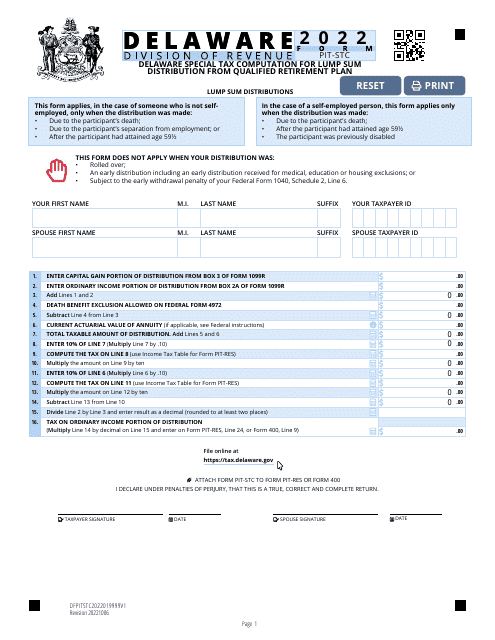

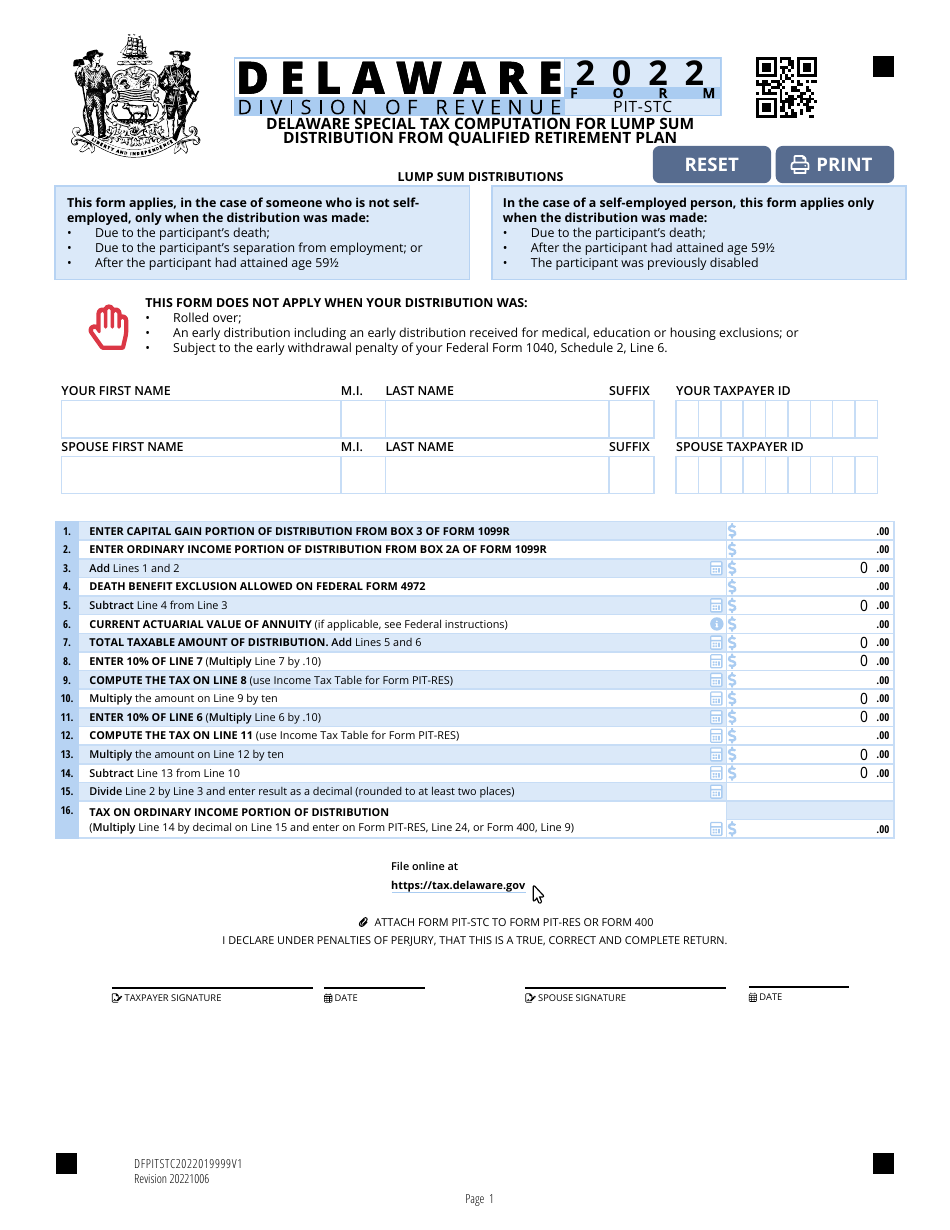

Form PIT-STC

for the current year.

Form PIT-STC Special Tax Computation for Lump Sum Distribution From Qualified Retirement Plan - Delaware

What Is Form PIT-STC?

This is a legal form that was released by the Delaware Department of Finance - Division of Revenue - a government authority operating within Delaware. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is a PIT-STC Special Tax Computation?

A: PIT-STC stands for Personal Income Tax - Special Tax Computation. It is a special tax calculation for lump sum distributions from qualified retirement plans.

Q: What is a lump sum distribution?

A: A lump sum distribution is a one-time payment from a retirement plan, usually received when leaving a job or retiring.

Q: What is a qualified retirement plan?

A: A qualified retirement plan is a retirement savings plan that meets certain requirements set by the Internal Revenue Service (IRS), such as a 401(k) or an Individual Retirement Account (IRA).

Q: Who needs to file a PIT-STC Special Tax Computation?

A: Individuals who receive a lump sum distribution from a qualified retirement plan and live in Delaware may need to file a PIT-STC Special Tax Computation.

Q: What information is required for the PIT-STC Special Tax Computation?

A: You will need to provide details about the lump sum distribution, including the amount received, the date of distribution, and any rollovers or transfers.

Q: Are there any special tax rates for lump sum distributions?

A: Yes, the PIT-STC Special Tax Computation uses a separate tax rate schedule specifically designed for lump sum distributions.

Q: Are there any deductions or exemptions available for lump sum distributions?

A: No, the PIT-STC Special Tax Computation does not allow for any deductions or exemptions.

Form Details:

- Released on October 6, 2022;

- The latest edition provided by the Delaware Department of Finance - Division of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PIT-STC by clicking the link below or browse more documents and templates provided by the Delaware Department of Finance - Division of Revenue.