This version of the form is not currently in use and is provided for reference only. Download this version of

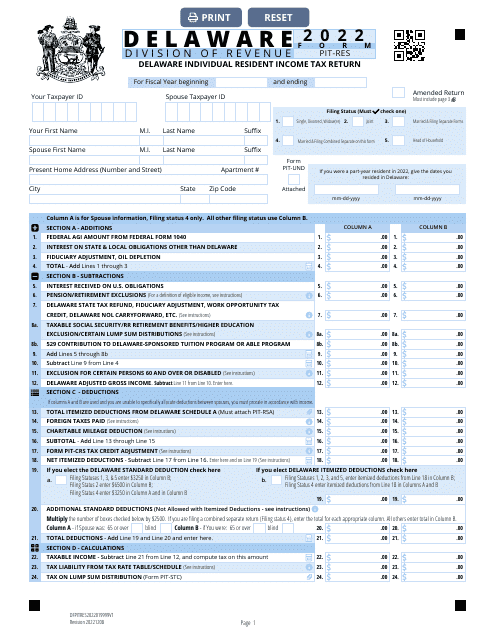

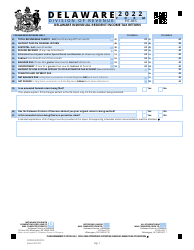

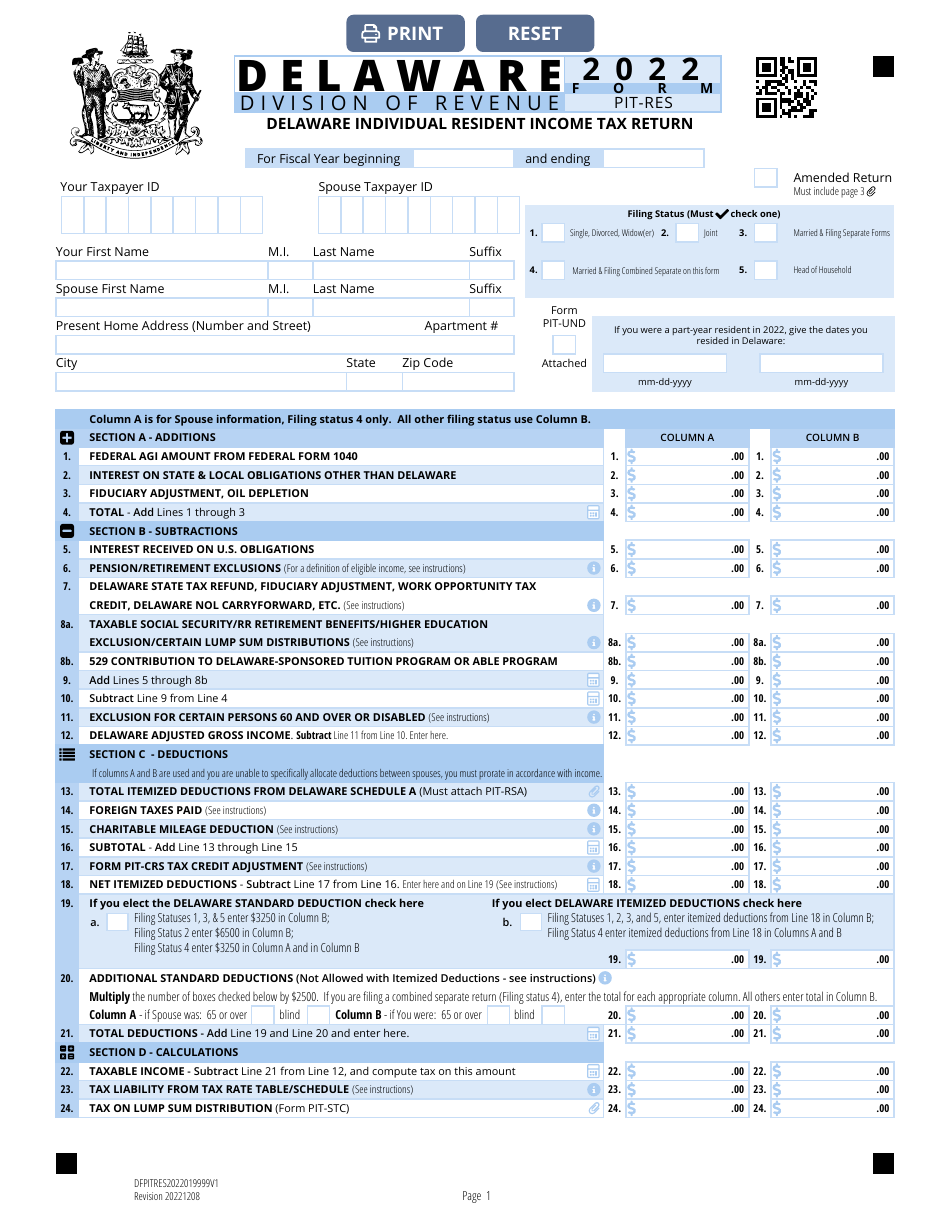

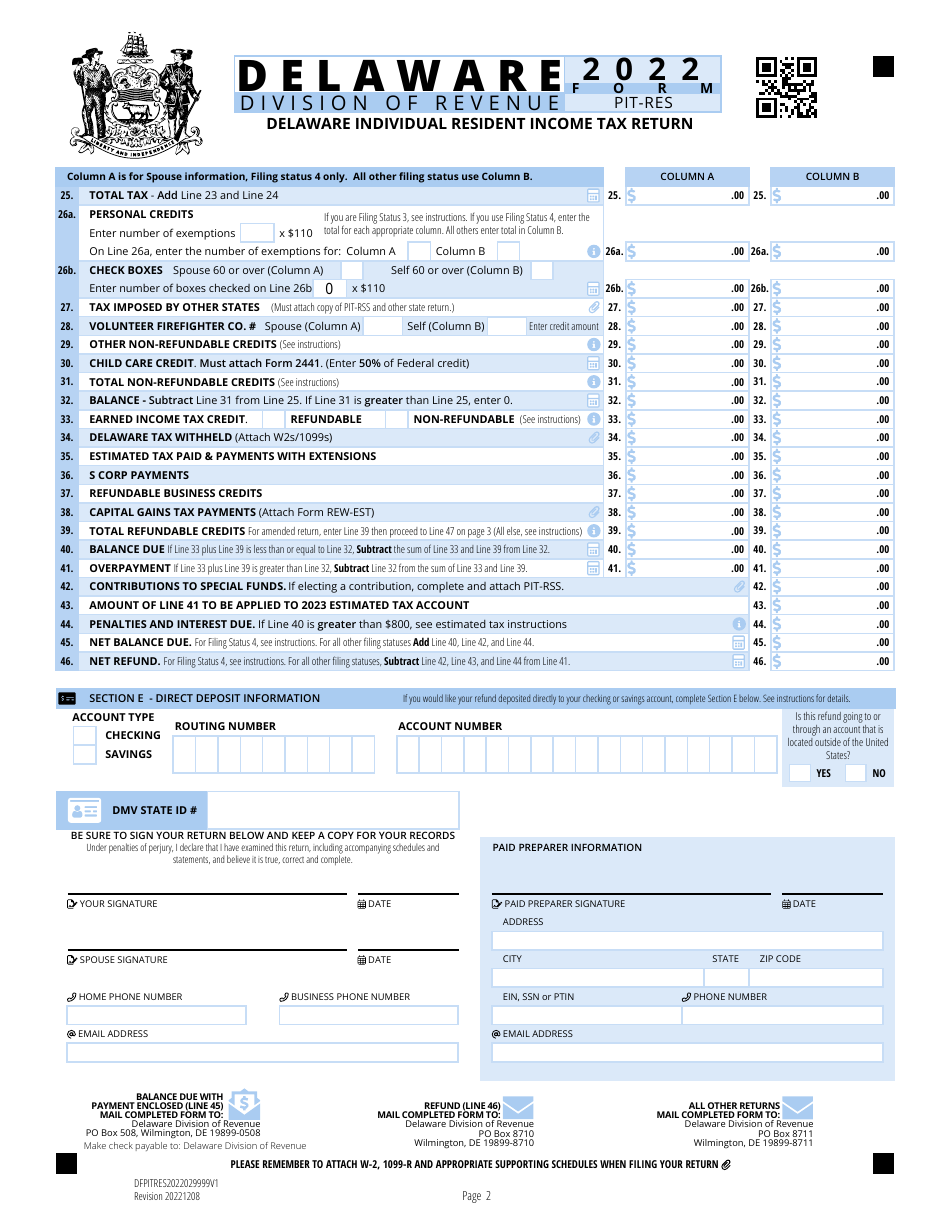

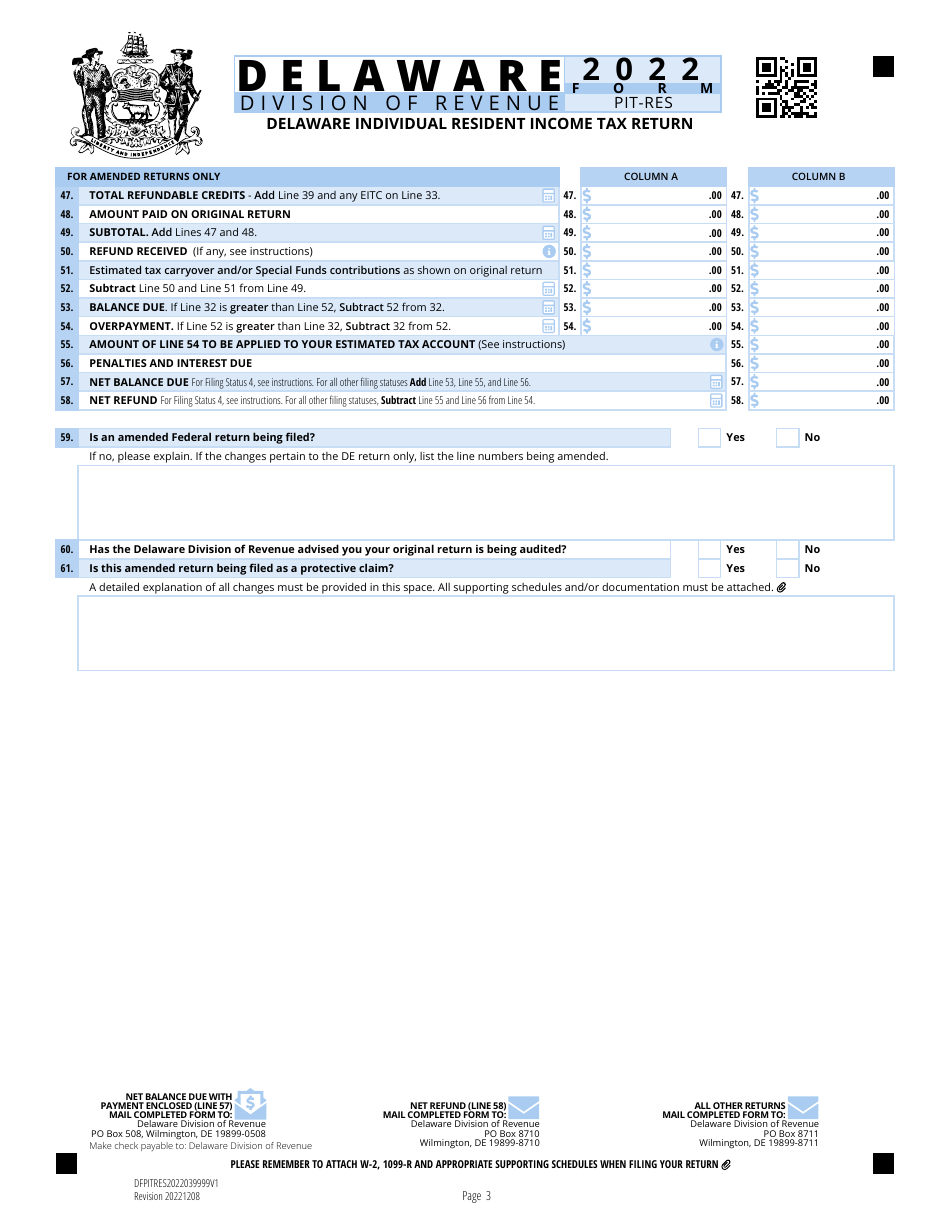

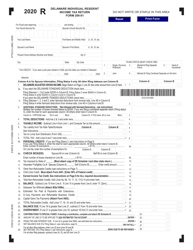

Form PIT-RES

for the current year.

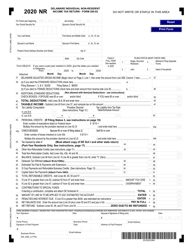

Form PIT-RES Delaware Individual Resident Income Tax Return - Delaware

What Is Form PIT-RES?

This is a legal form that was released by the Delaware Department of Finance - Division of Revenue - a government authority operating within Delaware. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PIT-RES?

A: Form PIT-RES is the Delaware Individual Resident Income Tax Return.

Q: Who needs to file Form PIT-RES?

A: Delaware residents who earned income during the tax year need to file Form PIT-RES.

Q: What income should be reported on Form PIT-RES?

A: All income earned by a Delaware resident, including wages, salaries, tips, self-employment income, and any other taxable income, should be reported on Form PIT-RES.

Q: When is the deadline to file Form PIT-RES?

A: The deadline to file Form PIT-RES is usually April 30th of each year.

Q: Are there any extensions available for filing Form PIT-RES?

A: Yes, taxpayers can request an extension to file Form PIT-RES, which will generally extend the deadline to October 15th.

Q: Are there any additional forms or schedules that need to be attached to Form PIT-RES?

A: Yes, depending on the taxpayer's specific circumstances, additional forms or schedules may need to be attached to Form PIT-RES to report certain types of income or claim certain deductions or credits.

Q: Is there a penalty for filing Form PIT-RES late?

A: Yes, there may be penalties and interest charged for filing Form PIT-RES late.

Q: Can Form PIT-RES be filed electronically?

A: Yes, taxpayers have the option to file Form PIT-RES electronically.

Form Details:

- Released on December 8, 2022;

- The latest edition provided by the Delaware Department of Finance - Division of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PIT-RES by clicking the link below or browse more documents and templates provided by the Delaware Department of Finance - Division of Revenue.