This version of the form is not currently in use and is provided for reference only. Download this version of

Form 81-110

for the current year.

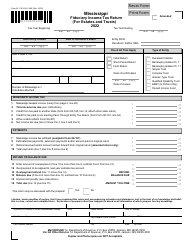

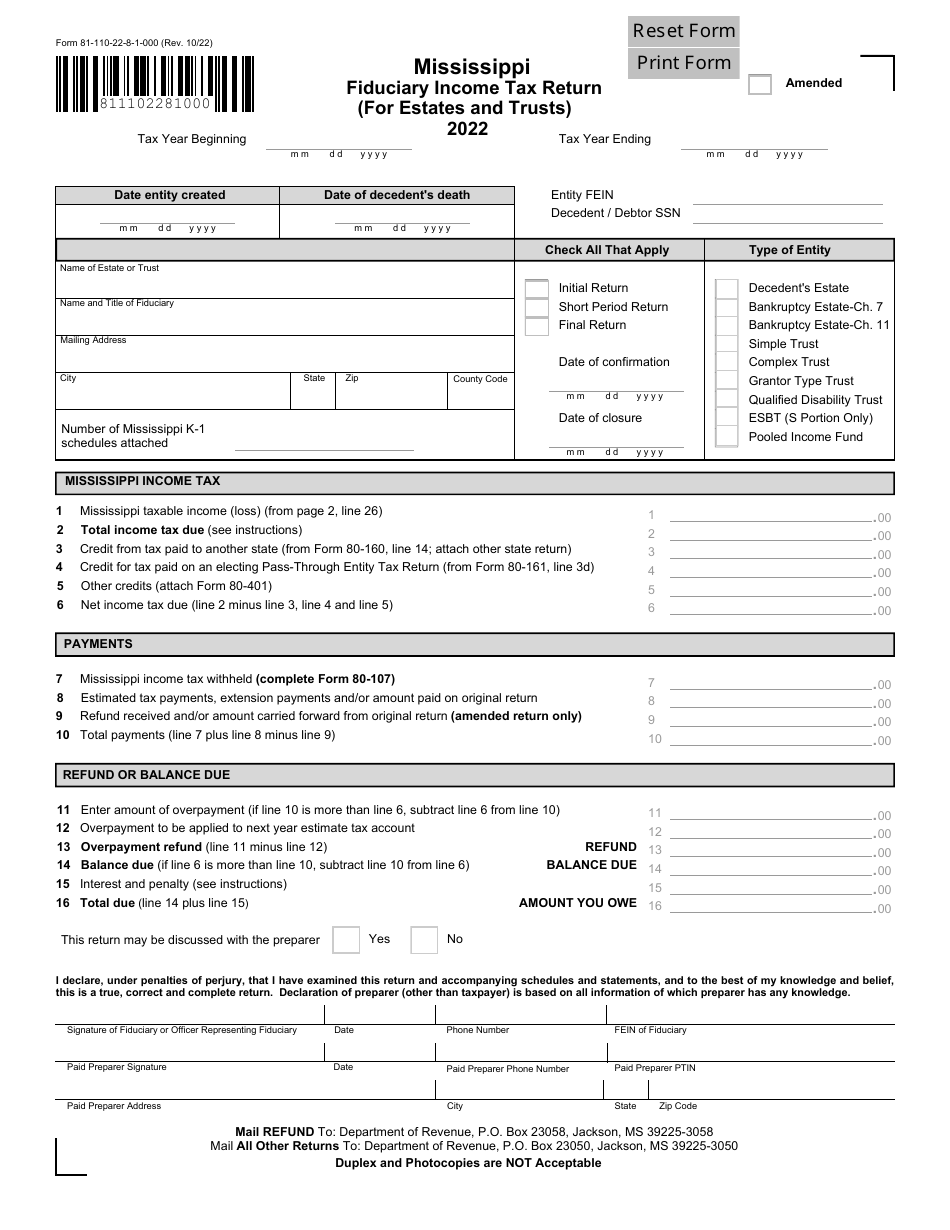

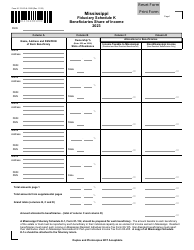

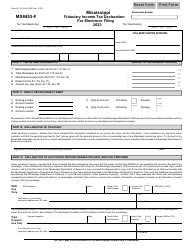

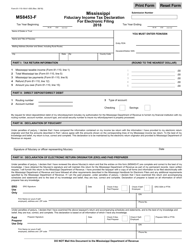

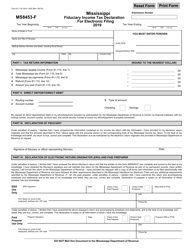

Form 81-110 Mississippi Fiduciary Income Tax Return (For Estates and Trusts) - Mississippi

What Is Form 81-110?

This is a legal form that was released by the Mississippi Department of Revenue - a government authority operating within Mississippi. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 81-110 Mississippi Fiduciary Income Tax Return?

A: Form 81-110 Mississippi Fiduciary Income Tax Return is a tax form used by estates and trusts in Mississippi to report their income and calculate their tax liability.

Q: Who needs to file Form 81-110 Mississippi Fiduciary Income Tax Return?

A: Estates and trusts that meet certain criteria, such as having income or assets in Mississippi, are required to file Form 81-110 Mississippi Fiduciary Income Tax Return.

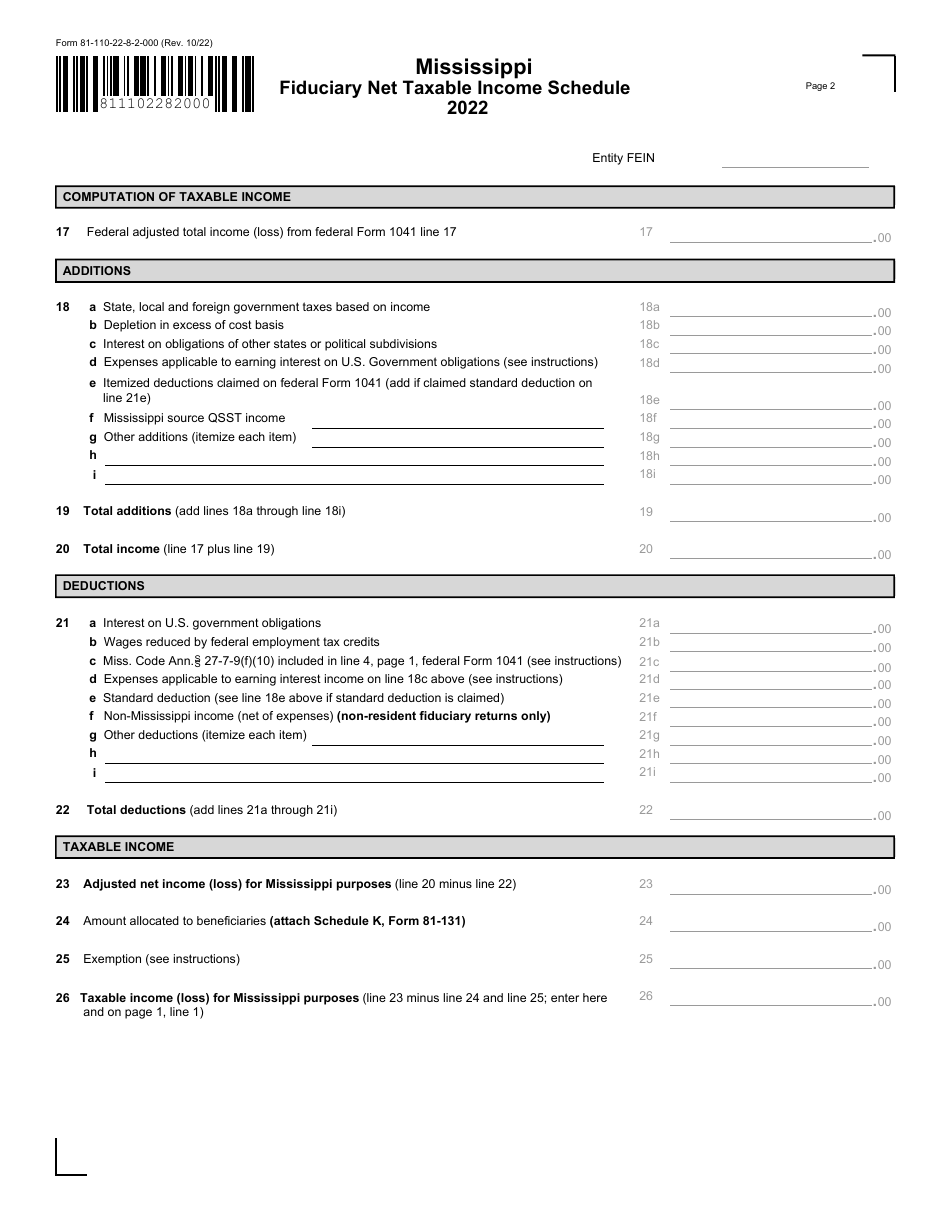

Q: What information do I need to complete Form 81-110 Mississippi Fiduciary Income Tax Return?

A: You will need to gather information about the estate or trust's income, expenses, deductions, and any credits or taxes paid.

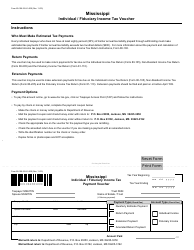

Q: When is the deadline to file Form 81-110 Mississippi Fiduciary Income Tax Return?

A: The deadline to file Form 81-110 Mississippi Fiduciary Income Tax Return is the same as the federal tax deadline, which is typically April 15th.

Q: Are there any penalties for late filing or non-filing of Form 81-110 Mississippi Fiduciary Income Tax Return?

A: Yes, there are penalties for late filing or non-filing of Form 81-110 Mississippi Fiduciary Income Tax Return, including interest charges and potential legal repercussions.

Q: Can I request an extension to file Form 81-110 Mississippi Fiduciary Income Tax Return?

A: Yes, you can request an extension to file Form 81-110 Mississippi Fiduciary Income Tax Return, but you must do so before the original deadline and pay any estimated tax due.

Q: How do I calculate the tax liability on Form 81-110 Mississippi Fiduciary Income Tax Return?

A: The tax liability on Form 81-110 Mississippi Fiduciary Income Tax Return is calculated by applying the appropriate tax rate to the taxable income of the estate or trust.

Form Details:

- Released on October 1, 2022;

- The latest edition provided by the Mississippi Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 81-110 by clicking the link below or browse more documents and templates provided by the Mississippi Department of Revenue.