This version of the form is not currently in use and is provided for reference only. Download this version of

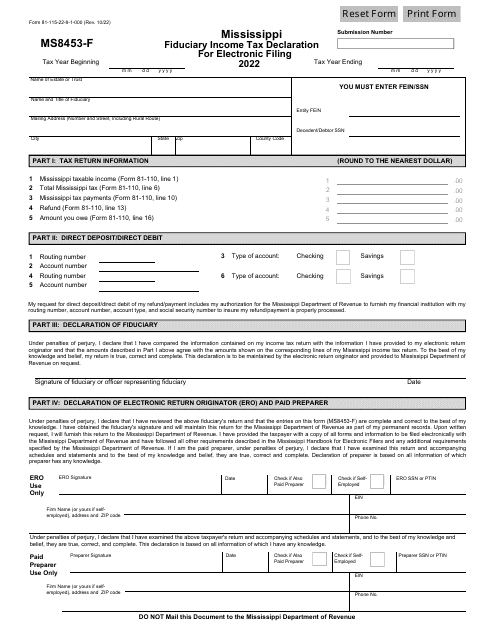

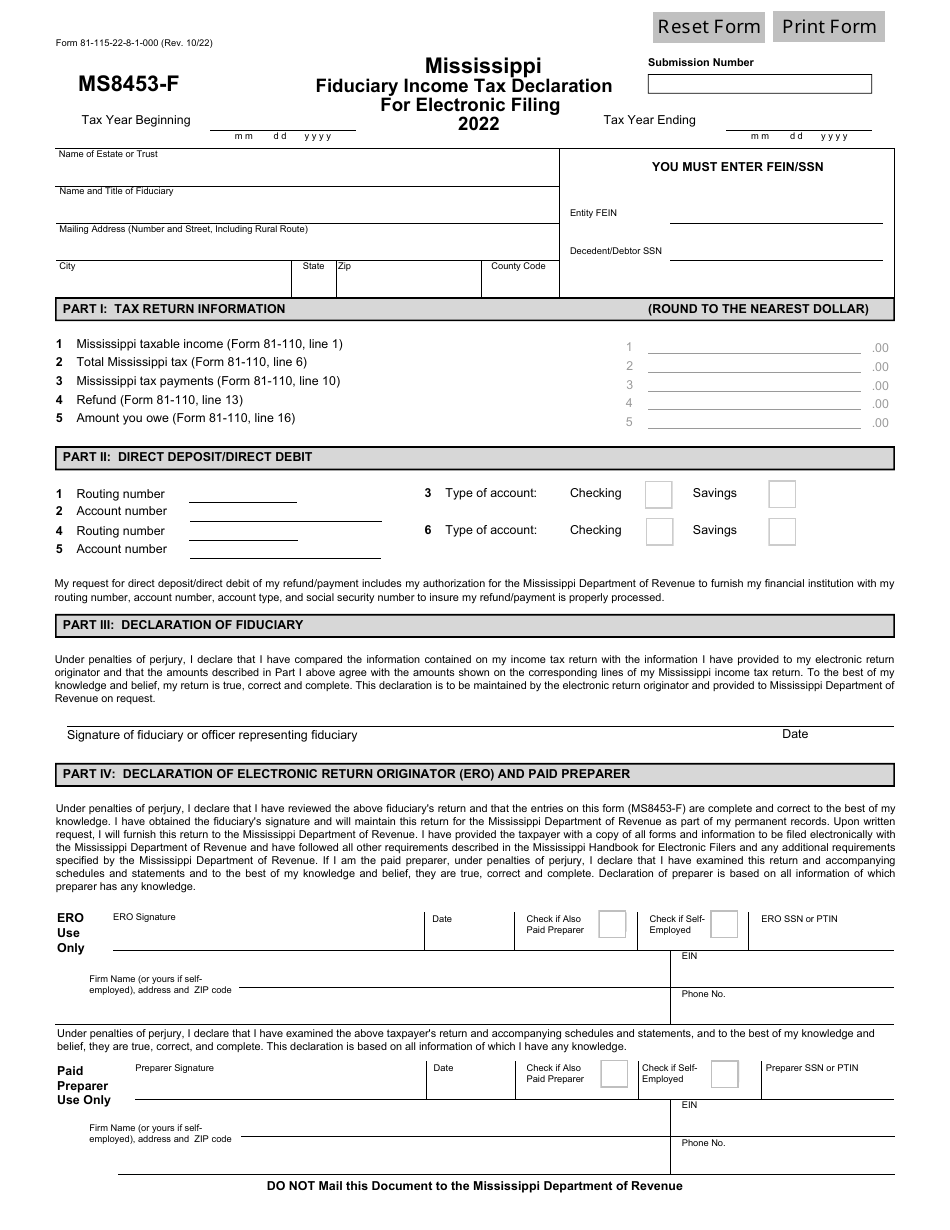

Form 81-115 (MS8453-F)

for the current year.

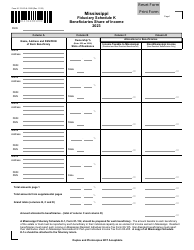

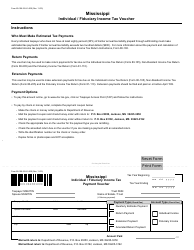

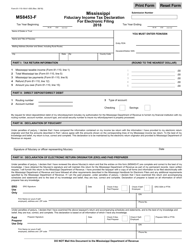

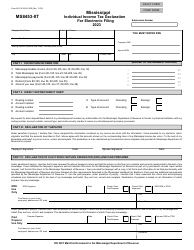

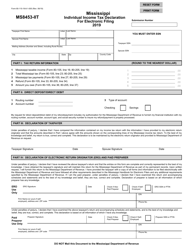

Form 81-115 (MS8453-F) Mississippi Fiduciary Income Tax Declaration for Electronic Filing - Mississippi

What Is Form 81-115 (MS8453-F)?

This is a legal form that was released by the Mississippi Department of Revenue - a government authority operating within Mississippi. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 81-115 (MS8453-F)?

A: Form 81-115 (MS8453-F) is the Mississippi Fiduciary Income Tax Declaration for Electronic Filing.

Q: Who needs to file Form 81-115 (MS8453-F)?

A: Individuals or entities with fiduciary income in Mississippi that are filing electronically need to file Form 81-115 (MS8453-F).

Q: What is fiduciary income?

A: Fiduciary income refers to income earned by a trustee, executor, or administrator of an estate or trust.

Q: Is Form 81-115 (MS8453-F) available for paper filing?

A: No, Form 81-115 (MS8453-F) is specifically for electronic filing. Paper filers should use the appropriate paper form.

Q: What information is required on Form 81-115 (MS8453-F)?

A: Form 81-115 (MS8453-F) requires information such as the fiduciary's name, address, federal identification number, and details of the income and deductions.

Q: What is the deadline for filing Form 81-115 (MS8453-F)?

A: The deadline for filing Form 81-115 (MS8453-F) is the same as the deadline for filing the fiduciary income tax return in Mississippi, which is typically due on April 15th.

Q: Are there any payment requirements associated with Form 81-115 (MS8453-F)?

A: Yes, if there is a balance due on the fiduciary income tax return, payment must be made by the filing deadline to avoid penalties and interest.

Q: Can I file Form 81-115 (MS8453-F) if I live outside of Mississippi?

A: Yes, you can file Form 81-115 (MS8453-F) even if you live outside of Mississippi, as long as you have fiduciary income in the state.

Q: Can I amend a previously filed Form 81-115 (MS8453-F)?

A: Yes, you can amend a previously filed Form 81-115 (MS8453-F) by filing a corrected version of the form.

Form Details:

- Released on October 1, 2022;

- The latest edition provided by the Mississippi Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 81-115 (MS8453-F) by clicking the link below or browse more documents and templates provided by the Mississippi Department of Revenue.