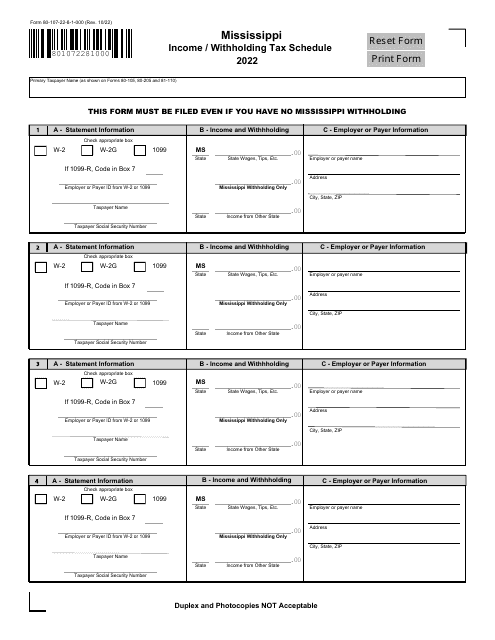

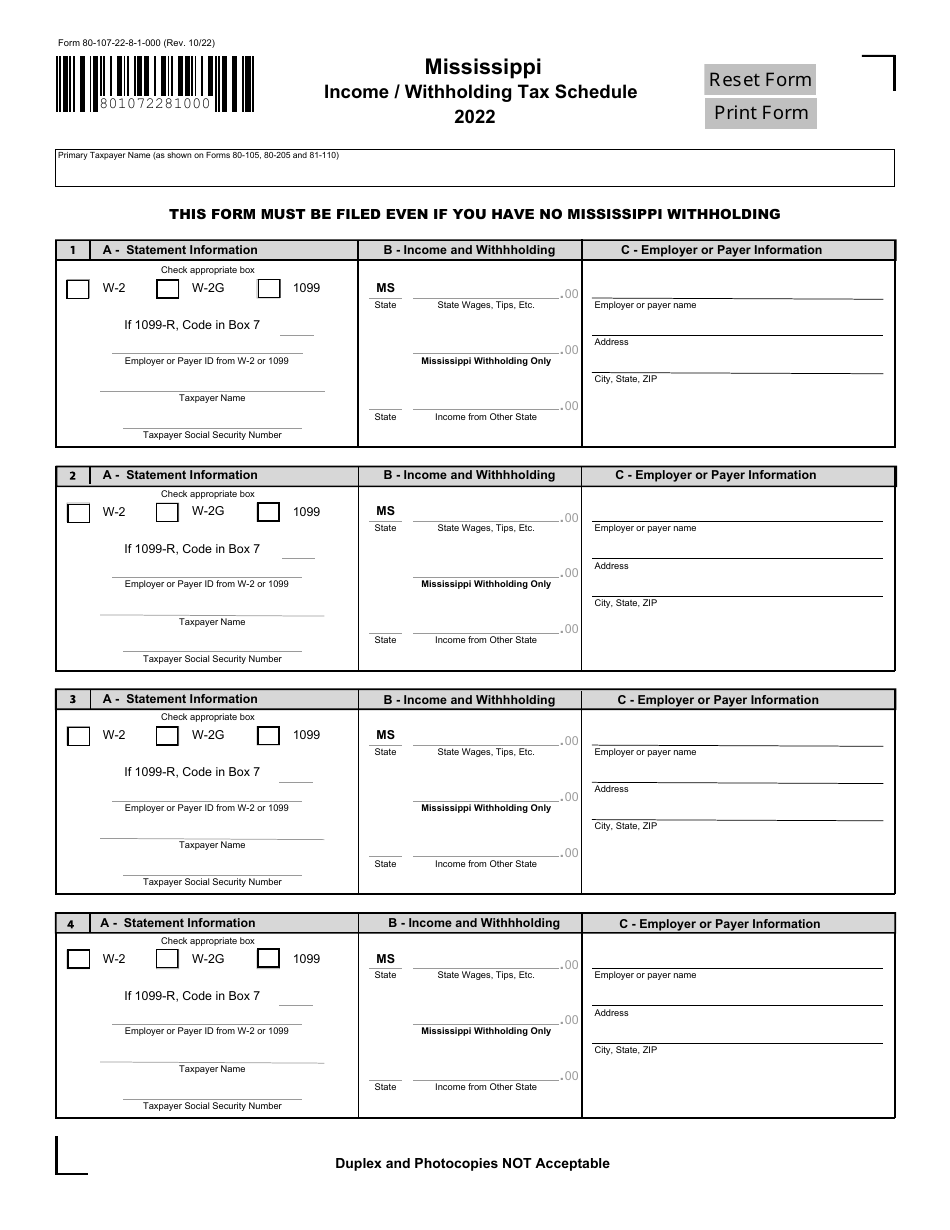

This version of the form is not currently in use and is provided for reference only. Download this version of

Form 80-107

for the current year.

Form 80-107 Mississippi Income / Withholding Tax Schedule - Mississippi

What Is Form 80-107?

This is a legal form that was released by the Mississippi Department of Revenue - a government authority operating within Mississippi. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 80-107?

A: Form 80-107 is the Mississippi Income/Withholding Tax Schedule.

Q: Who needs to file Form 80-107?

A: Residents of Mississippi who have state income tax liability and also have withholding from sources other than wages.

Q: What is the purpose of Form 80-107?

A: Form 80-107 is used to calculate and report the amount of Mississippi income tax liability and withholding from non-wage sources.

Q: When is the deadline to file Form 80-107?

A: The deadline to file Form 80-107 is the same as the deadline for filing your Mississippi income tax return, which is typically April 15th.

Q: Are there any penalties for not filing Form 80-107?

A: Yes, failure to file Form 80-107 or underpayment of Mississippi income tax may result in penalties and interest charges.

Q: Do I need to include any supporting documents with Form 80-107?

A: You may be required to attach copies of certain documents, such as W-2 forms or 1099s, depending on your individual circumstances.

Form Details:

- Released on October 1, 2022;

- The latest edition provided by the Mississippi Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 80-107 by clicking the link below or browse more documents and templates provided by the Mississippi Department of Revenue.