This version of the form is not currently in use and is provided for reference only. Download this version of

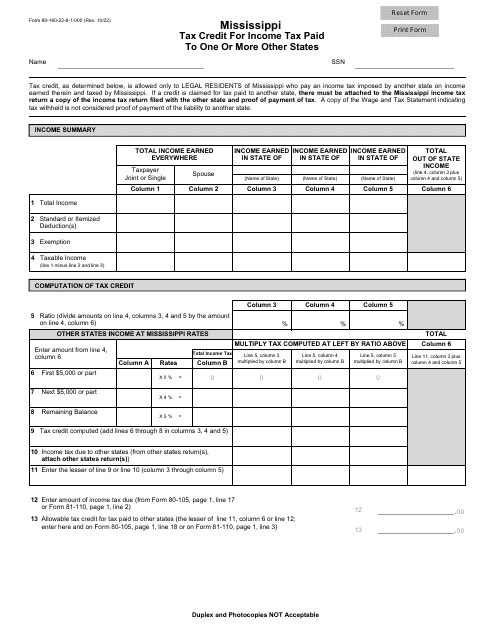

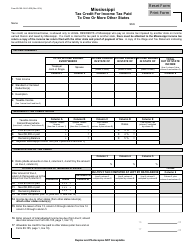

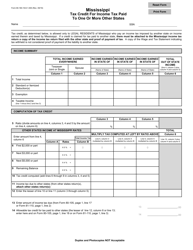

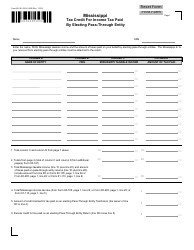

Form 80-160

for the current year.

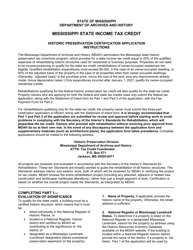

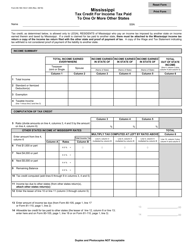

Form 80-160 Mississippi Tax Credit for Income Tax Paid to One or More Other States - Mississippi

What Is Form 80-160?

This is a legal form that was released by the Mississippi Department of Revenue - a government authority operating within Mississippi. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

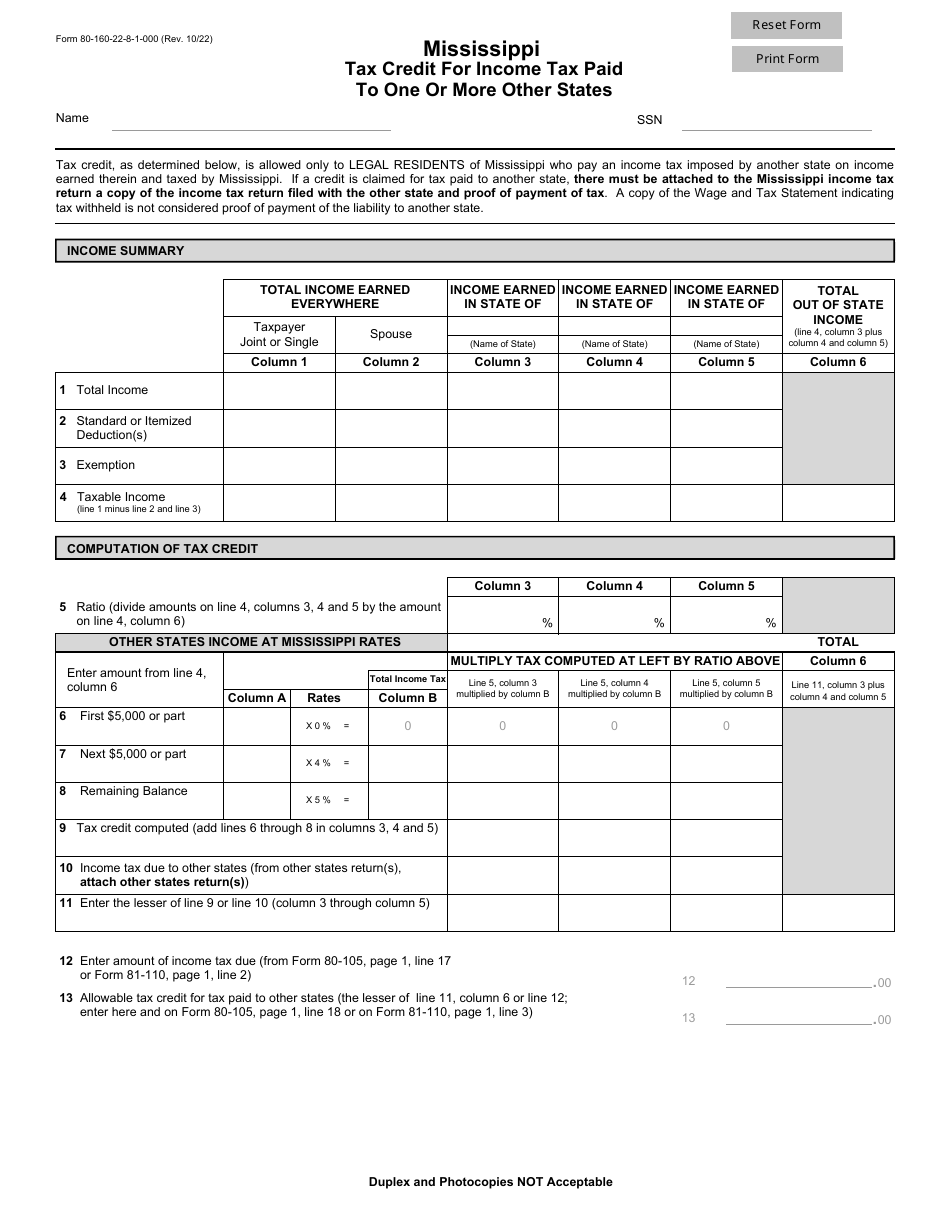

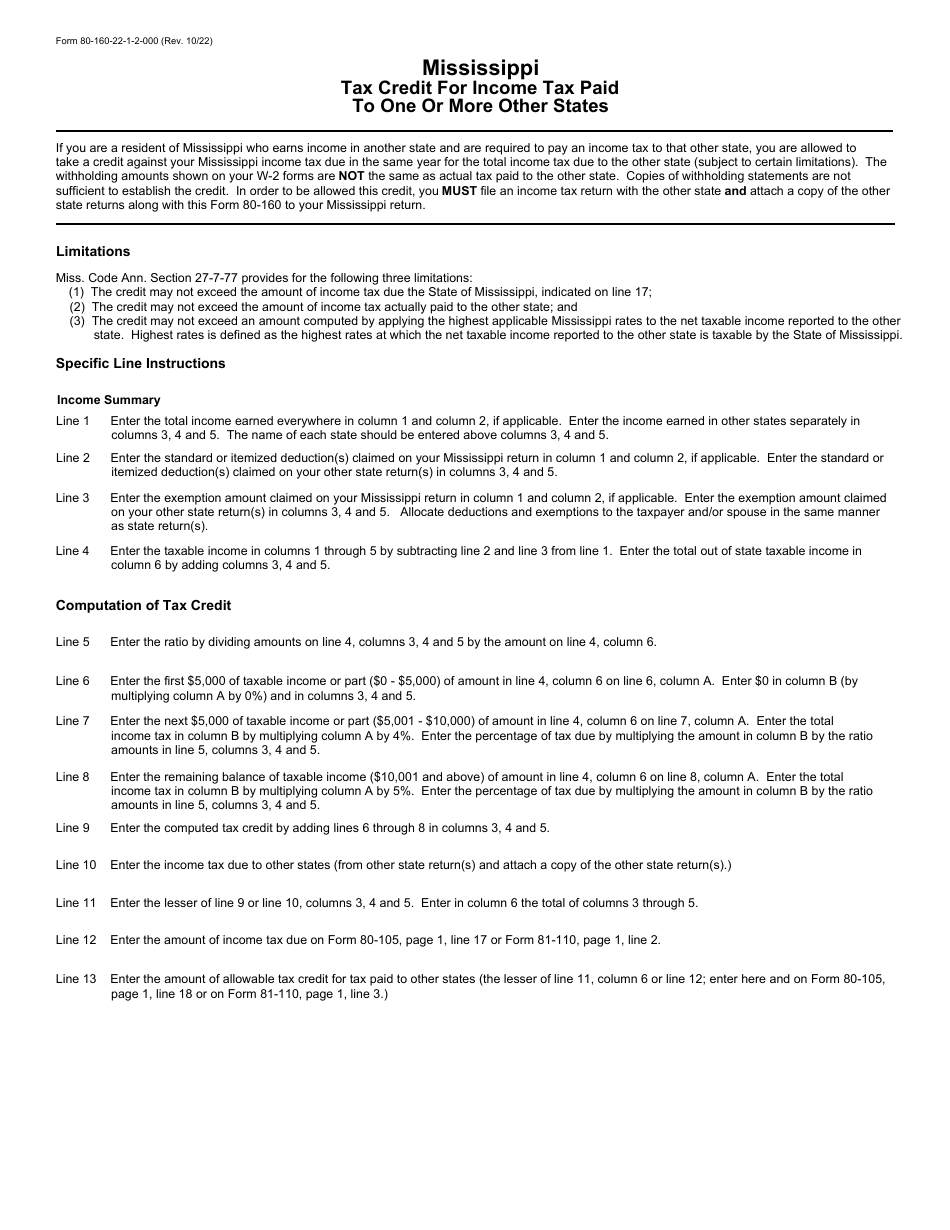

Q: What is Form 80-160?

A: Form 80-160 is the Mississippi Tax Credit for Income Tax Paid to One or More Other States.

Q: Who is eligible to use Form 80-160?

A: Mississippi residents who paid income tax to one or more other states are eligible to use Form 80-160.

Q: What is the purpose of Form 80-160?

A: The purpose of Form 80-160 is to claim a tax credit for income tax paid to one or more other states.

Q: What information is required on Form 80-160?

A: Form 80-160 requires information such as the amount of income tax paid to other states, the names of the states, and any other supporting documentation.

Q: When is Form 80-160 due?

A: Form 80-160 is due on the same date as your Mississippi income tax return, which is typically April 15th.

Q: Is there a fee to file Form 80-160?

A: No, there is no fee to file Form 80-160.

Q: What if I paid income tax to more than one state?

A: If you paid income tax to more than one state, you will need to complete a separate Form 80-160 for each state.

Q: Will I receive a refund for the tax credit claimed on Form 80-160?

A: The tax credit claimed on Form 80-160 may result in a refund or a reduction in the amount of tax owed, depending on your individual tax situation.

Form Details:

- Released on October 1, 2022;

- The latest edition provided by the Mississippi Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 80-160 by clicking the link below or browse more documents and templates provided by the Mississippi Department of Revenue.