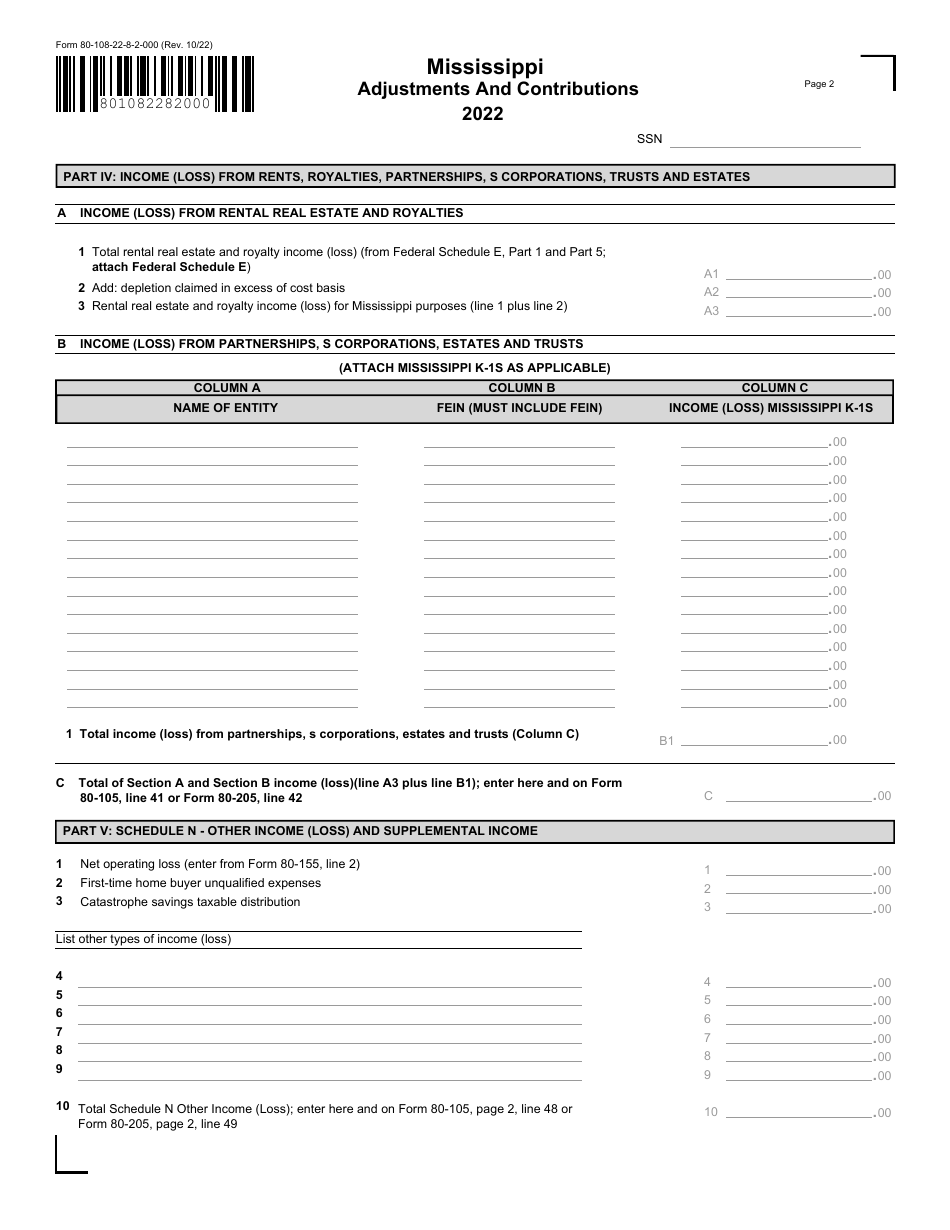

This version of the form is not currently in use and is provided for reference only. Download this version of

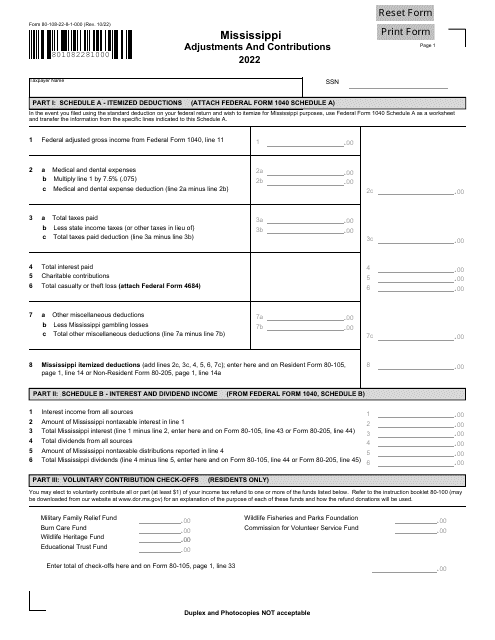

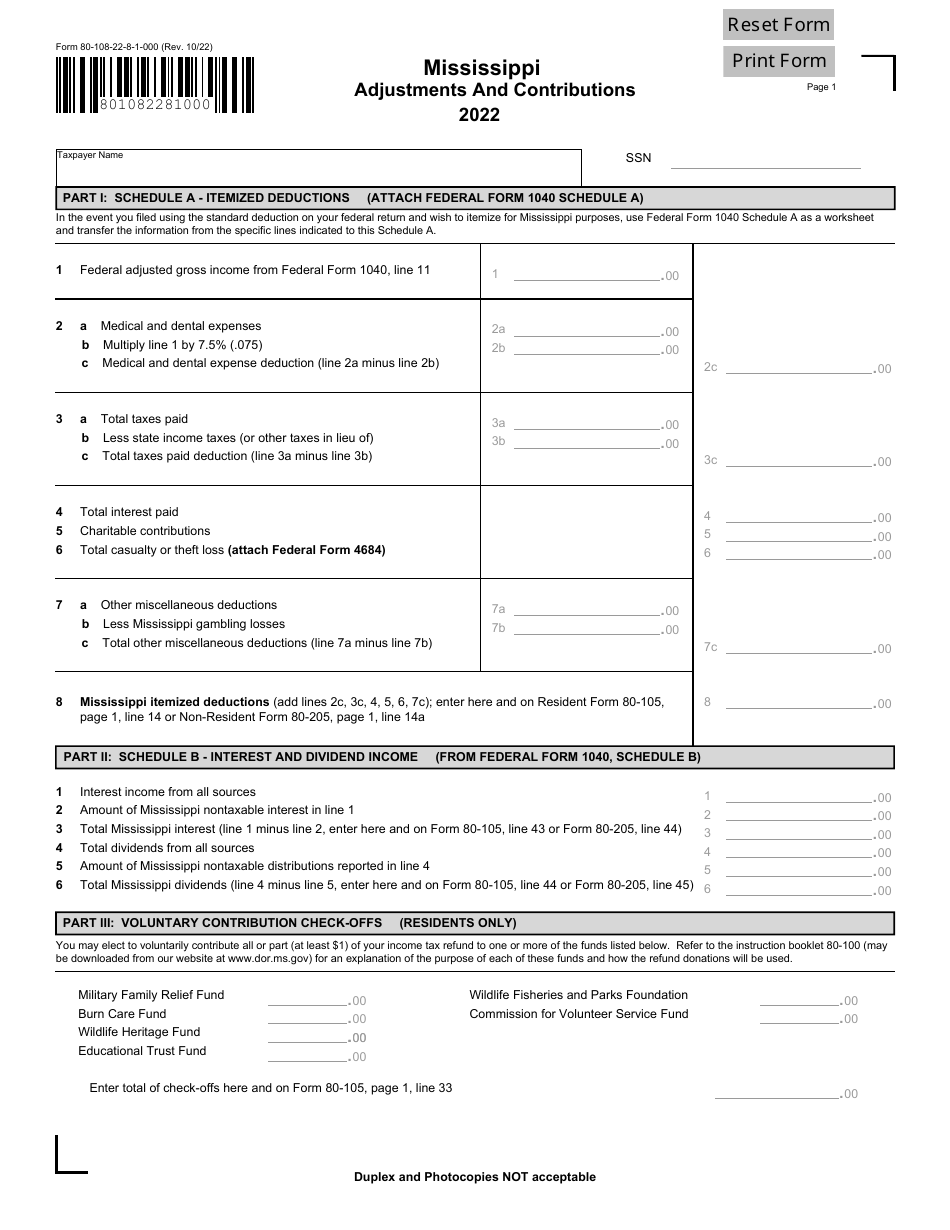

Form 80-108

for the current year.

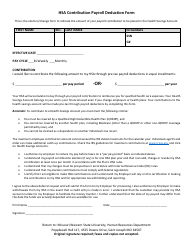

Form 80-108 Mississippi Adjustments and Contributions - Mississippi

What Is Form 80-108?

This is a legal form that was released by the Mississippi Department of Revenue - a government authority operating within Mississippi. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 80-108?

A: Form 80-108 is a tax form used in the state of Mississippi to report adjustments and contributions.

Q: Who needs to file Form 80-108?

A: Individuals who have made adjustments or contributions in Mississippi during the tax year need to file Form 80-108.

Q: What adjustments can be reported on Form 80-108?

A: Various adjustments related to Mississippi taxes can be reported on Form 80-108, such as deductions, exemptions, and credits.

Q: What contributions can be reported on Form 80-108?

A: Contributions made to certain Mississippi programs, such as the Mississippi Affordable College Savings (MACS) Program, can be reported on Form 80-108.

Q: When is the deadline for filing Form 80-108?

A: The deadline for filing Form 80-108 is typically April 15th, unless stated otherwise.

Q: Is Form 80-108 only for Mississippi residents?

A: No, Form 80-108 is for both Mississippi residents and non-residents who have made adjustments or contributions in Mississippi.

Q: Do I need to include supporting documents with Form 80-108?

A: It is recommended to include any supporting documents, such as receipts or statements, that validate the adjustments or contributions reported on Form 80-108.

Q: What should I do if I have questions about completing Form 80-108?

A: If you have any questions about completing Form 80-108, you can contact the Mississippi Department of Revenue for assistance.

Form Details:

- Released on October 1, 2022;

- The latest edition provided by the Mississippi Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 80-108 by clicking the link below or browse more documents and templates provided by the Mississippi Department of Revenue.