This version of the form is not currently in use and is provided for reference only. Download this version of

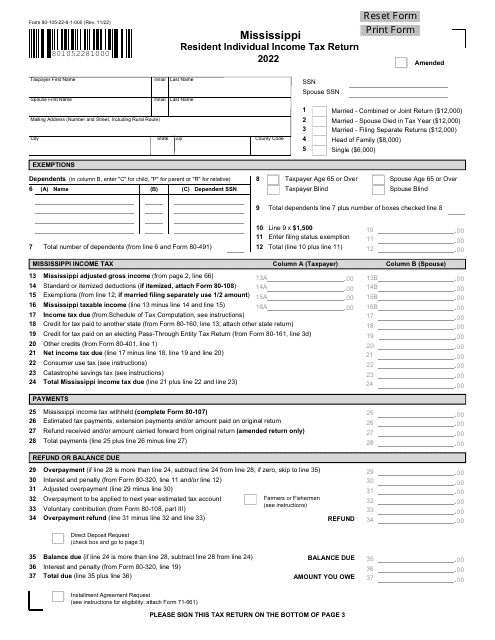

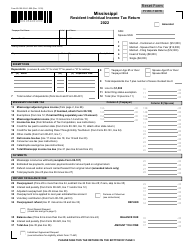

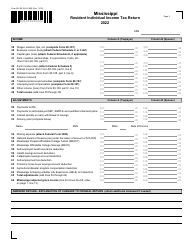

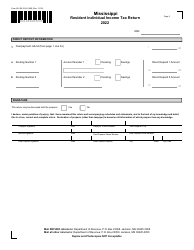

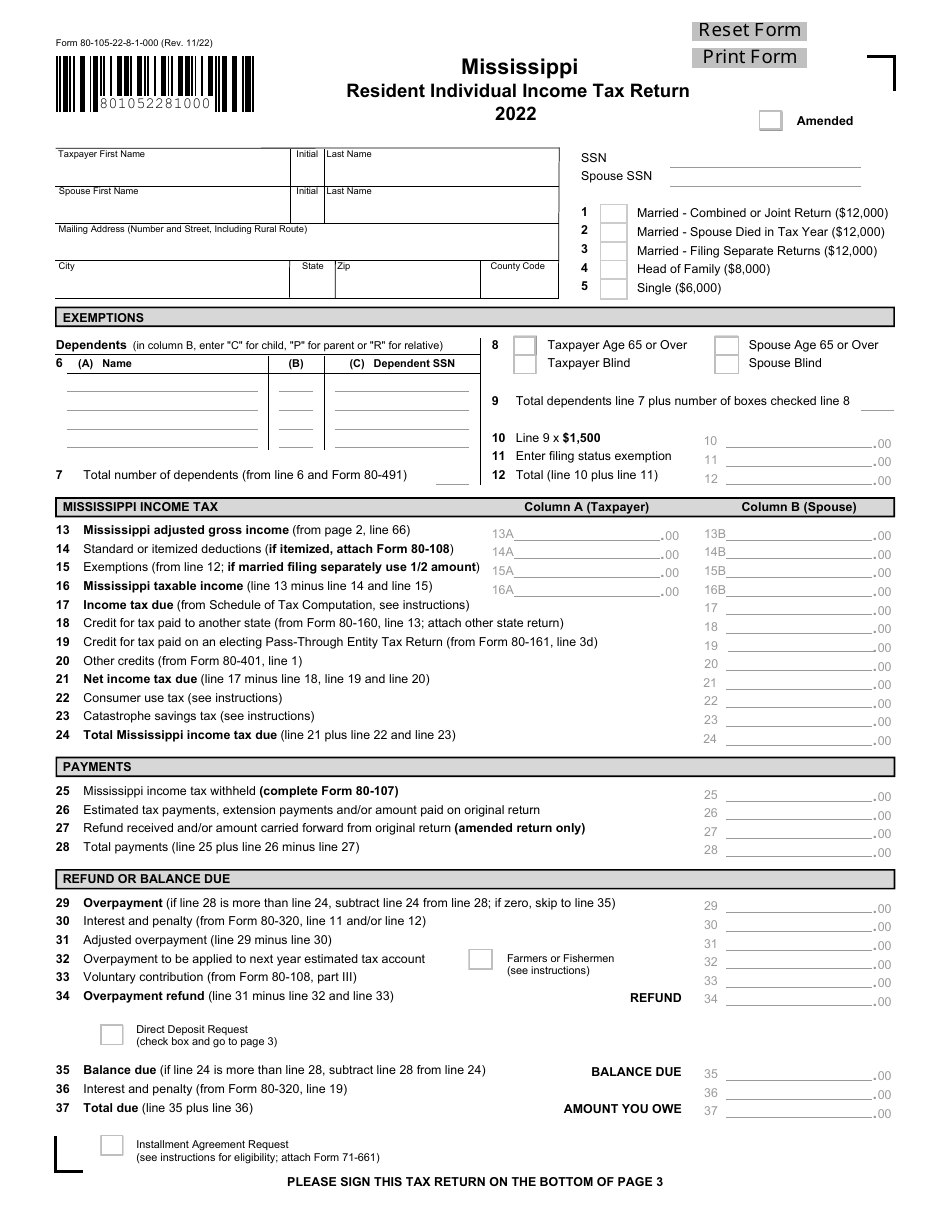

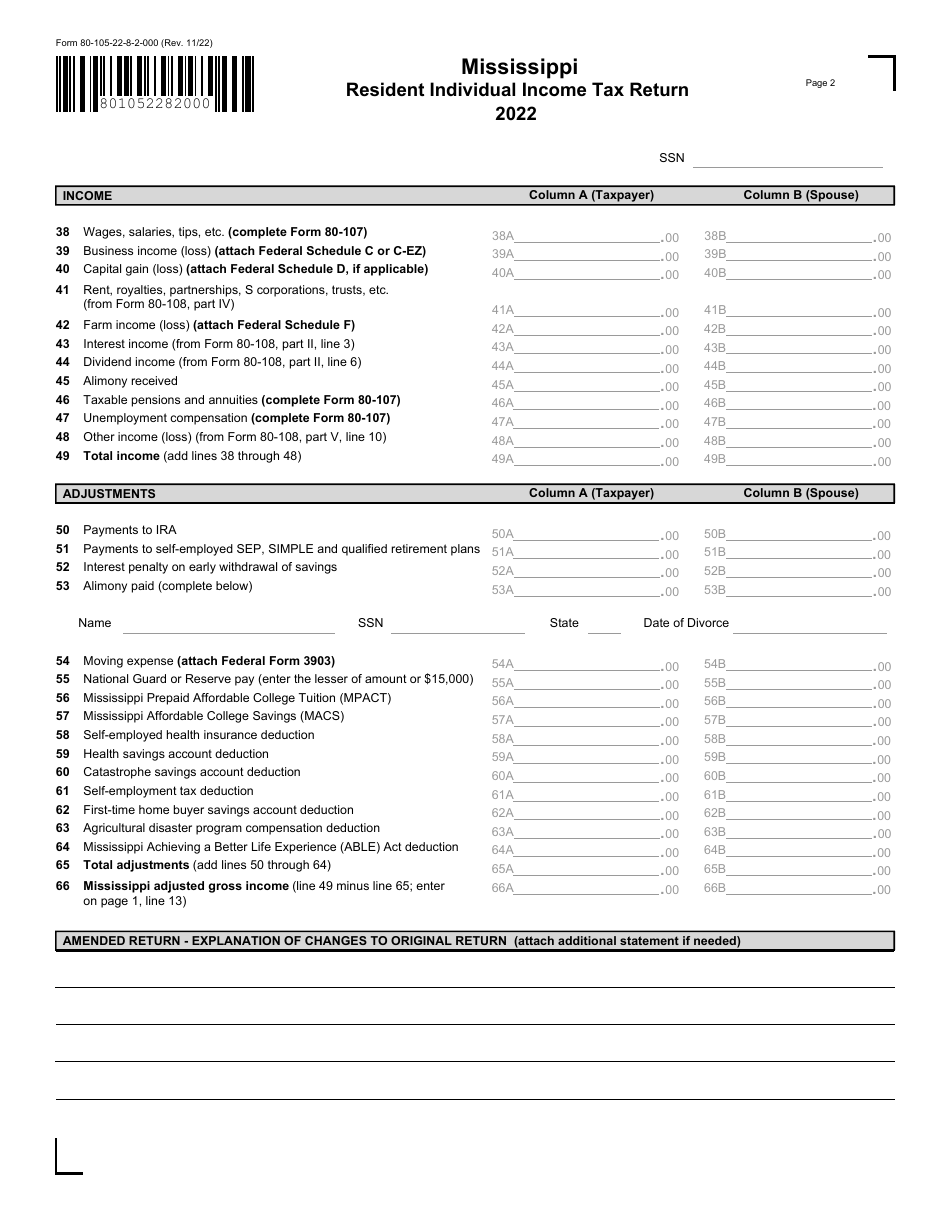

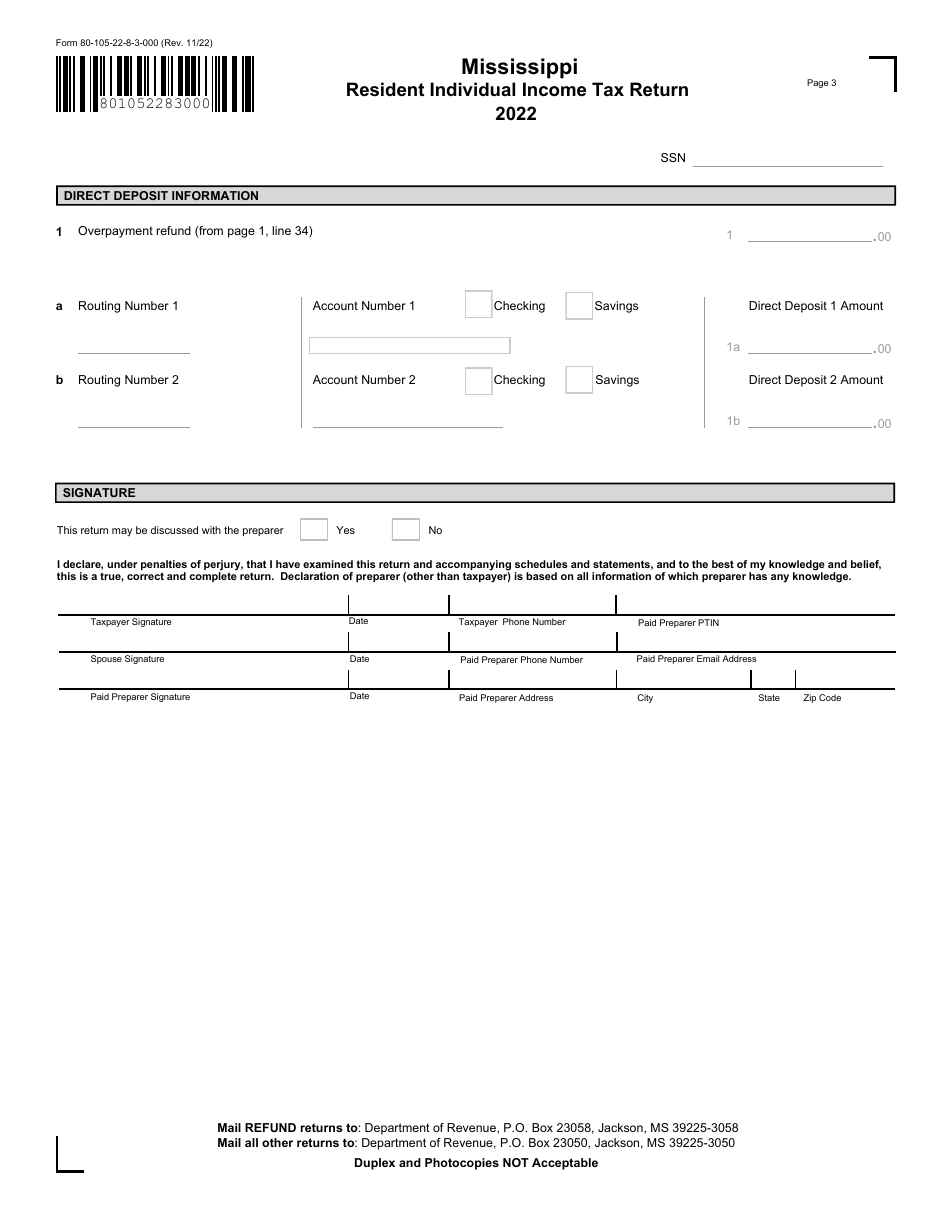

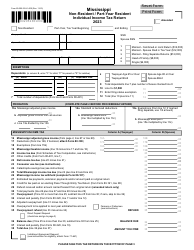

Form 80-105

for the current year.

Form 80-105 Mississippi Resident Individual Income Tax Return - Mississippi

What Is Form 80-105?

This is a legal form that was released by the Mississippi Department of Revenue - a government authority operating within Mississippi. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 80-105?

A: Form 80-105 is the Mississippi Resident Individual Income Tax Return.

Q: Who should file Form 80-105?

A: Mississippi residents who earned income during the tax year should file Form 80-105.

Q: What is the purpose of Form 80-105?

A: The purpose of Form 80-105 is to report your income, deductions, and tax liability to the state of Mississippi.

Q: When is the due date for Form 80-105?

A: Form 80-105 is due on or before April 15th of each year, or the next business day if April 15th falls on a weekend or holiday.

Q: What are some common attachments to Form 80-105?

A: Common attachments to Form 80-105 include W-2 forms, 1099 forms, and any other supporting documentation for income and deductions.

Q: Are there any specific requirements for filing Form 80-105?

A: Yes, you must be a resident of Mississippi and have income to report in order to file Form 80-105.

Q: Can I E-file Form 80-105?

A: Yes, you can E-file Form 80-105 using approved tax software or through a tax professional.

Q: What happens if I don't file Form 80-105?

A: If you are required to file Form 80-105 and fail to do so, you may face penalties and interest on any unpaid tax liability.

Form Details:

- Released on November 1, 2022;

- The latest edition provided by the Mississippi Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 80-105 by clicking the link below or browse more documents and templates provided by the Mississippi Department of Revenue.