This version of the form is not currently in use and is provided for reference only. Download this version of

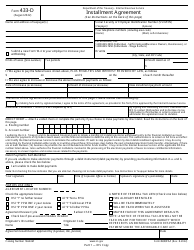

Form 71-661

for the current year.

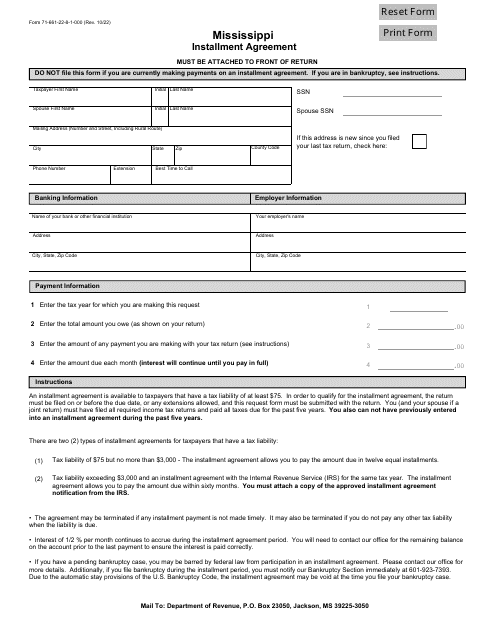

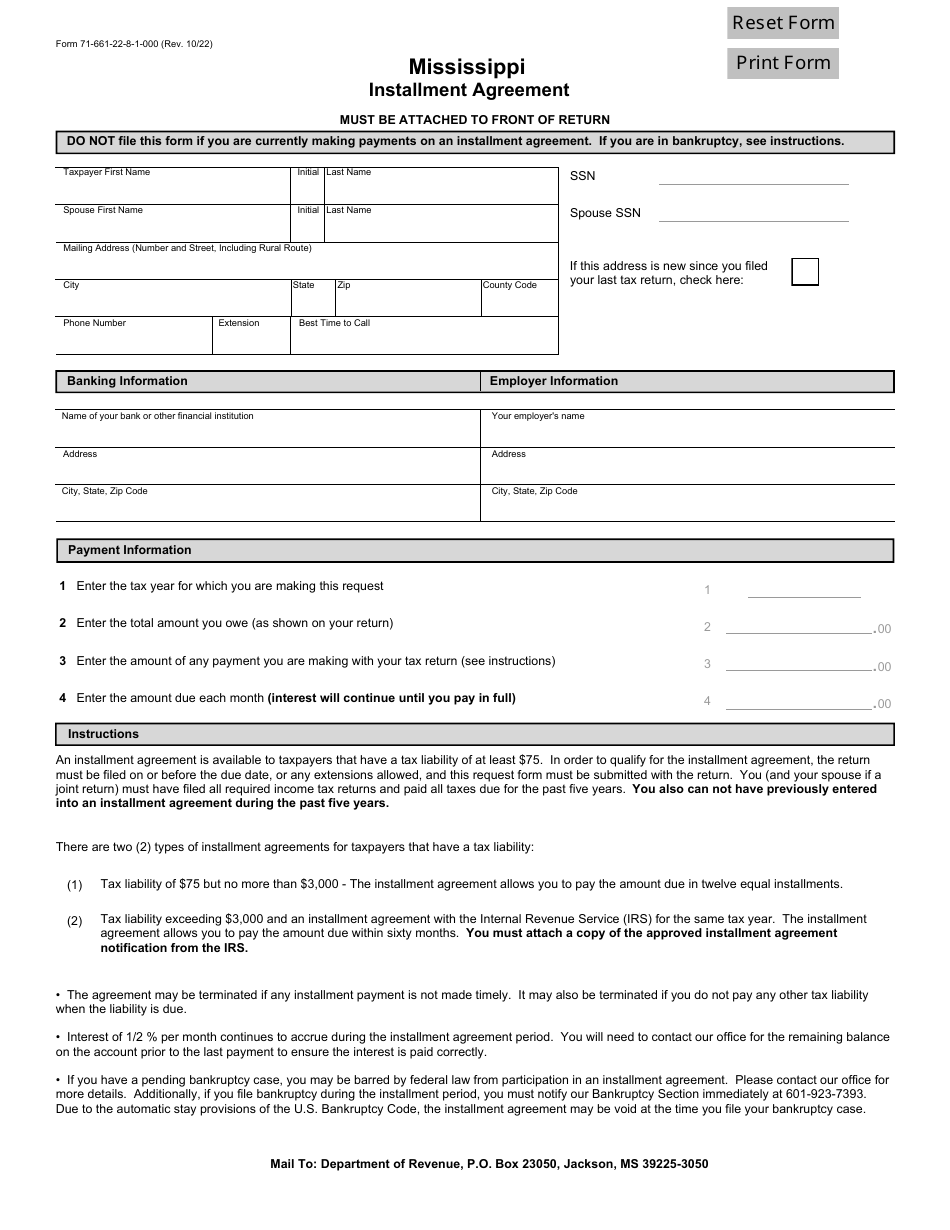

Form 71-661 Mississippi Installment Agreement - Mississippi

What Is Form 71-661?

This is a legal form that was released by the Mississippi Department of Revenue - a government authority operating within Mississippi. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

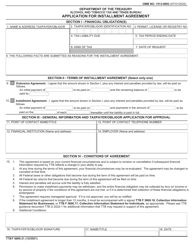

Q: What is Form 71-661?

A: Form 71-661 is the Mississippi Installment Agreement.

Q: What is the purpose of Form 71-661?

A: The purpose of Form 71-661 is to request a monthly installment plan for paying taxes owed to the state of Mississippi.

Q: Who can use Form 71-661?

A: Form 71-661 can be used by individuals, businesses, and other entities who owe taxes to the state of Mississippi.

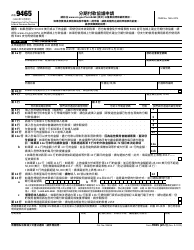

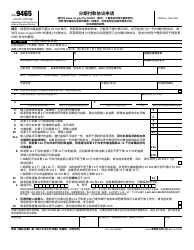

Q: What information is required on Form 71-661?

A: Form 71-661 requires information such as your name, contact information, tax period, total amount owed, proposed monthly payment amount, and bank account information for automatic withdrawals.

Q: Are there any fees associated with using Form 71-661?

A: No, there are no fees associated with submitting Form 71-661.

Q: How long does it take to process Form 71-661?

A: The processing time for Form 71-661 varies, but it generally takes about 30 to 45 days.

Q: Can I still receive a refund if I have an installment agreement?

A: No, refunds will be applied to any outstanding balance on your installment agreement.

Q: What happens if I miss a payment on my installment agreement?

A: If you miss a payment, you may be subject to penalties and interest. It is important to contact the Mississippi Department of Revenue to discuss your options.

Q: Can I pay off my installment agreement early?

A: Yes, you can pay off your installment agreement early by submitting the remaining balance in full.

Form Details:

- Released on October 1, 2022;

- The latest edition provided by the Mississippi Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 71-661 by clicking the link below or browse more documents and templates provided by the Mississippi Department of Revenue.