This version of the form is not currently in use and is provided for reference only. Download this version of

Form SSA-44

for the current year.

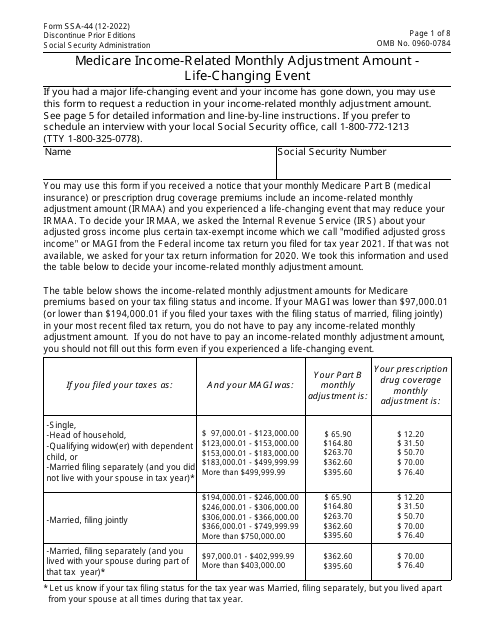

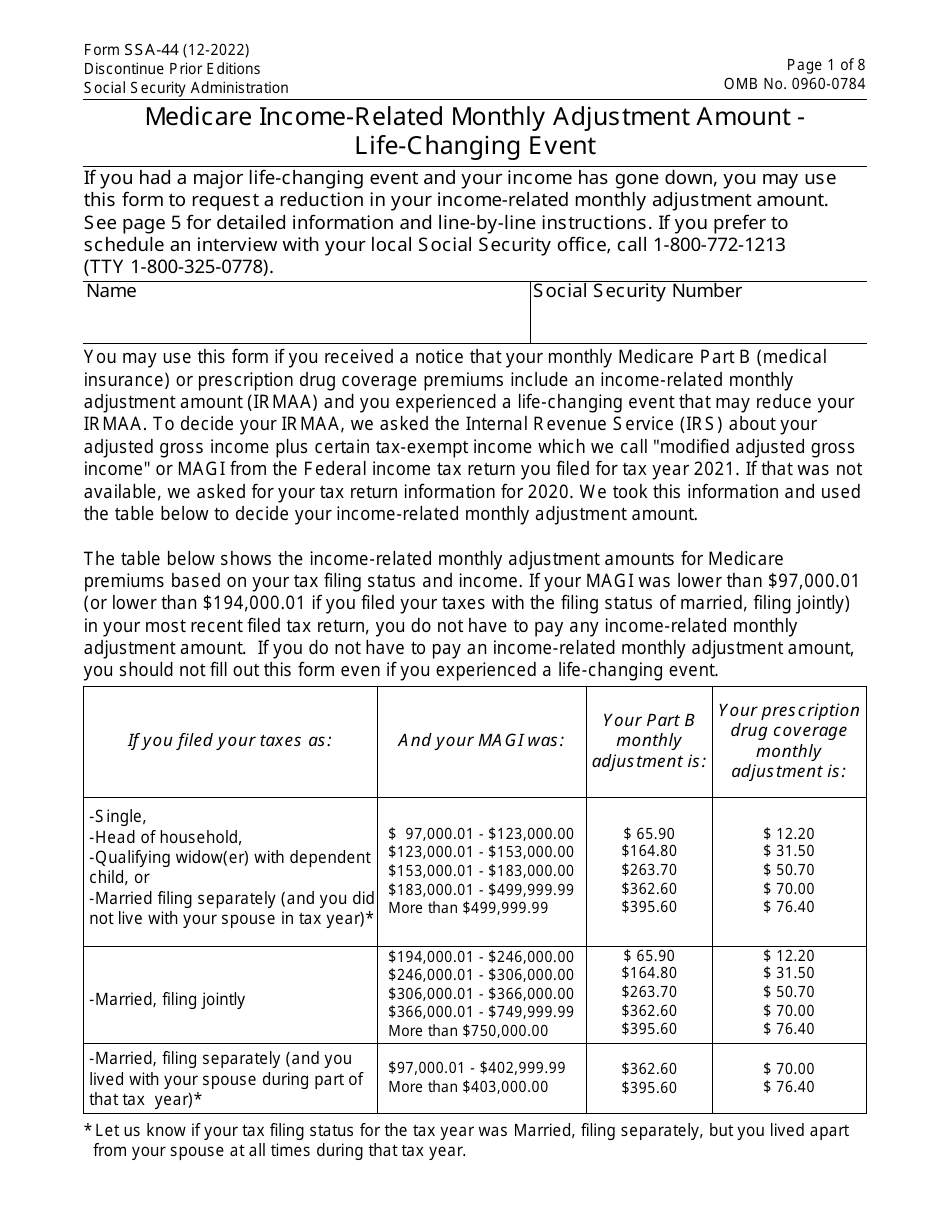

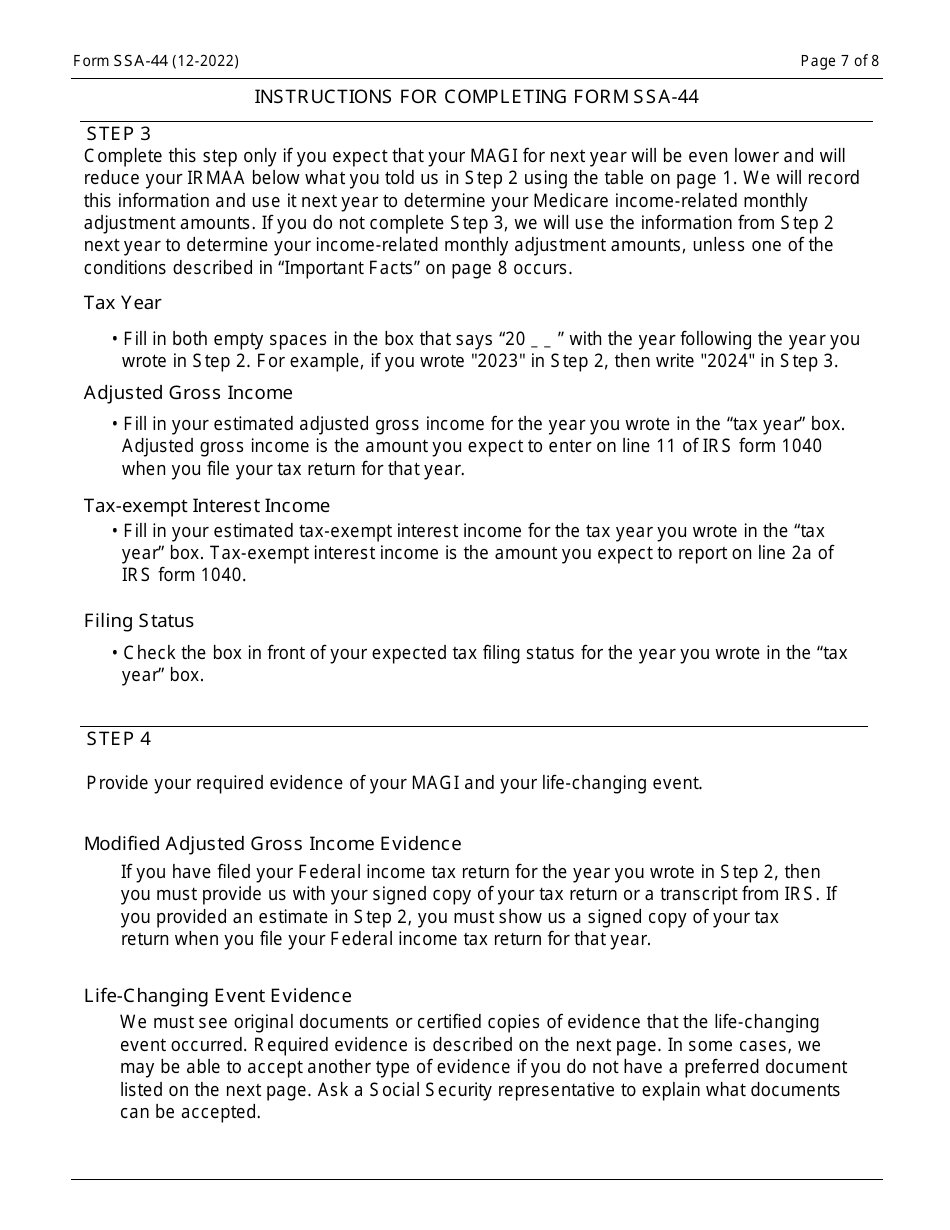

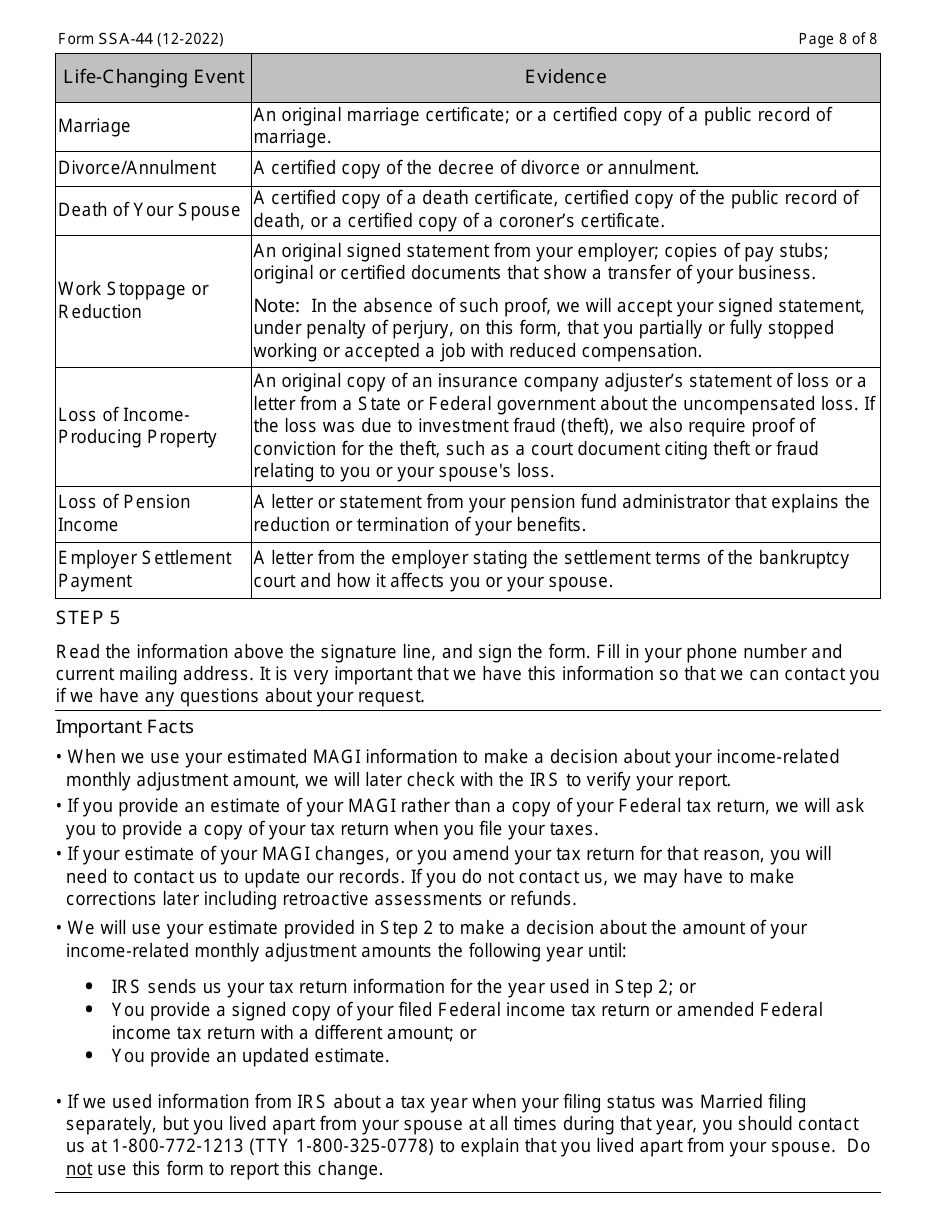

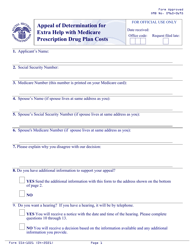

Form SSA-44 Medicare Income-Related Monthly Adjustment Amount - Life-Changing Event

What Is Form SSA-44?

This is a legal form that was released by the U.S. Social Security Administration on December 1, 2022 and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form SSA-44?

A: Form SSA-44 is a form used to apply for a Medicare Income-Related Monthly Adjustment Amount (IRMAA) based on a life-changing event.

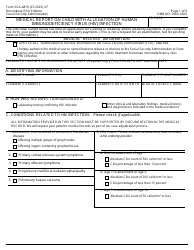

Q: What is the Medicare Income-Related Monthly Adjustment Amount (IRMAA)?

A: The Medicare Income-Related Monthly Adjustment Amount (IRMAA) is an additional amount that some people have to pay for their Medicare Part B and Part D premiums, based on their income.

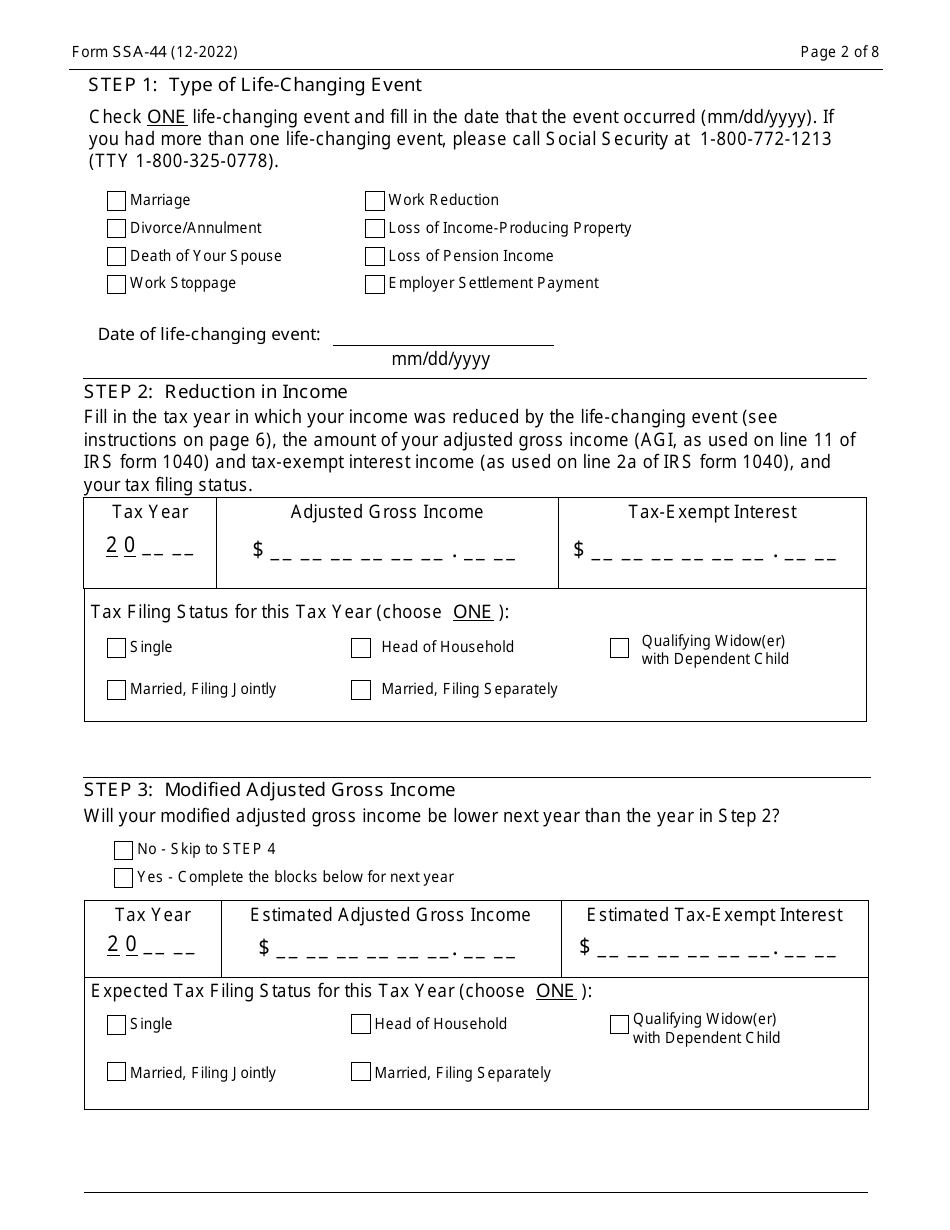

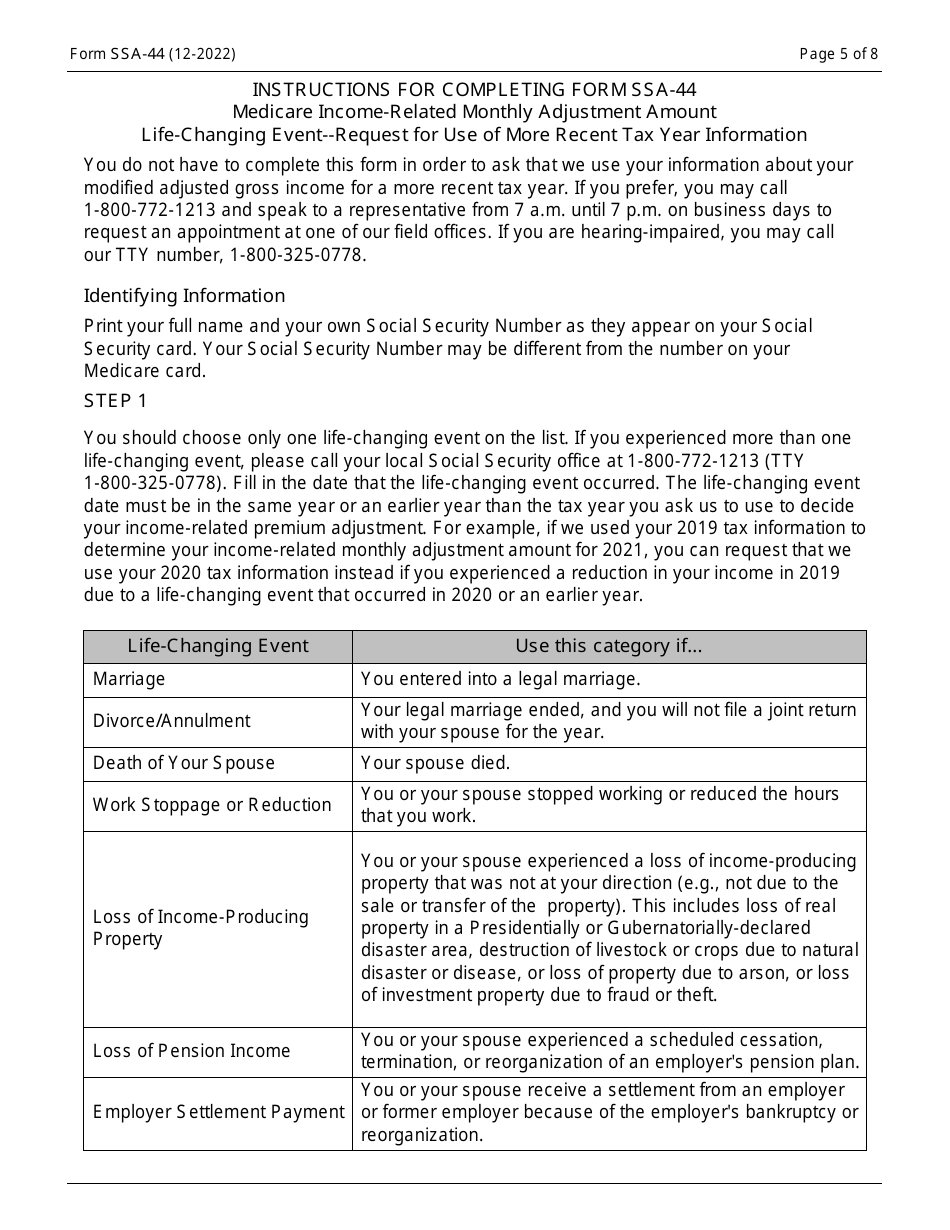

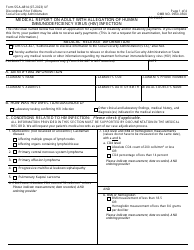

Q: What is a life-changing event?

A: A life-changing event is a specific event that may have caused a change in your income that could affect your IRMAA. Examples include marriage, divorce, death of a spouse, or reduction in work hours.

Q: Why would I need to fill out Form SSA-44?

A: You would need to fill out Form SSA-44 if you have experienced a life-changing event and want to request a reduction in your Medicare IRMAA.

Q: When should I submit Form SSA-44?

A: You should submit Form SSA-44 as soon as possible after your life-changing event and no later than 6 months after the end of the year in which the event occurred.

Q: What happens after I submit Form SSA-44?

A: After you submit Form SSA-44, the Social Security Administration will review your application and determine if you qualify for a reduction in your Medicare IRMAA.

Q: Can I appeal if my request for a reduction is denied?

A: Yes, if your request for a reduction in your Medicare IRMAA is denied, you have the right to appeal the decision.

Form Details:

- Released on December 1, 2022;

- The latest available edition released by the U.S. Social Security Administration;

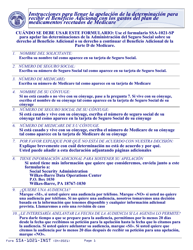

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form SSA-44 by clicking the link below or browse more documents and templates provided by the U.S. Social Security Administration.