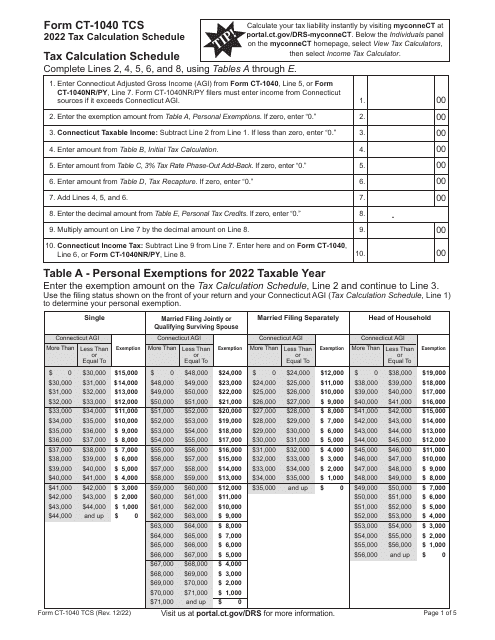

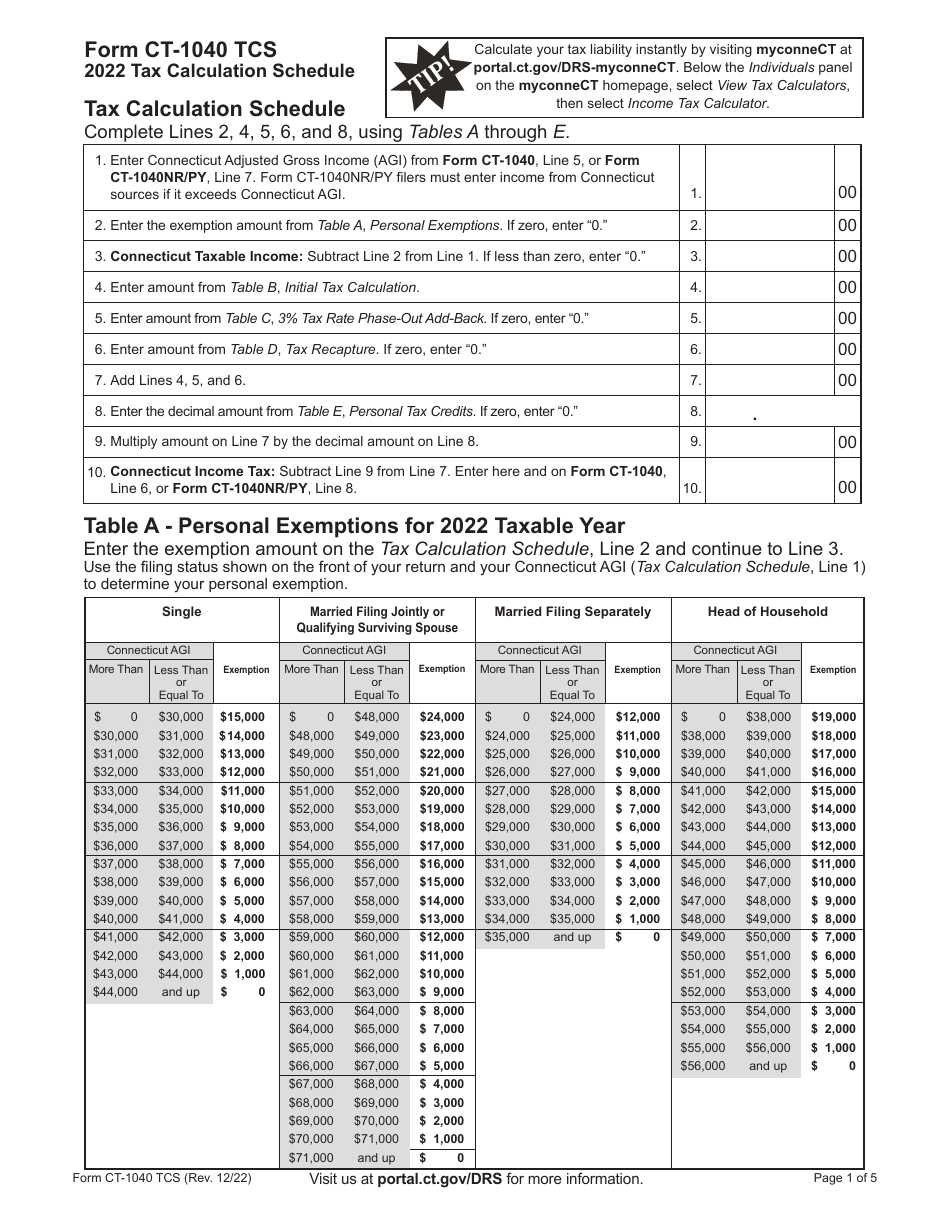

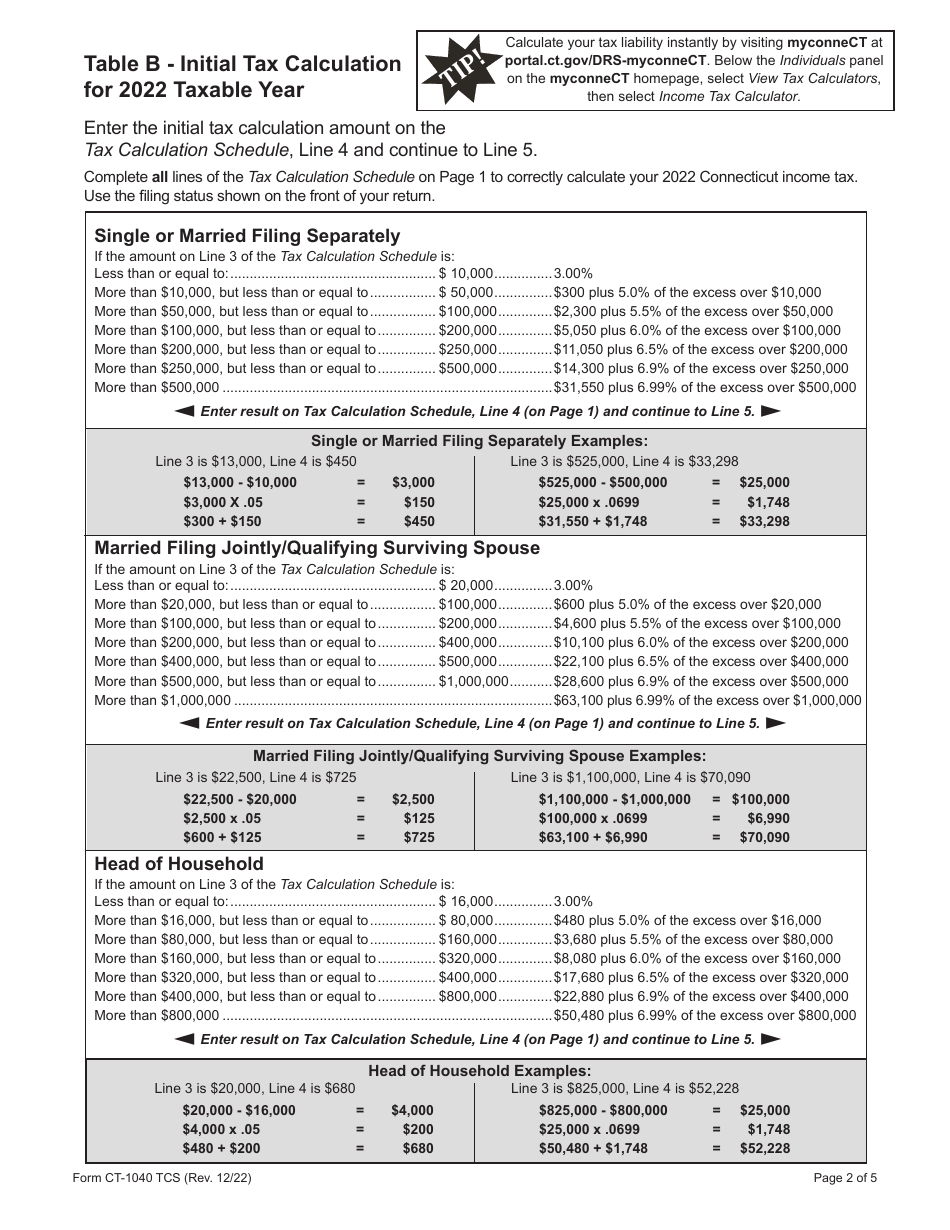

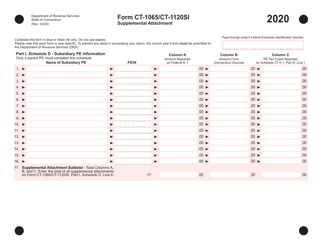

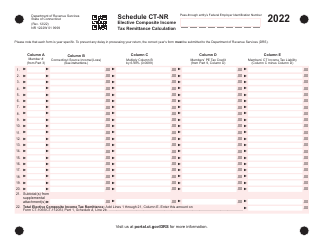

Form CT-1040 TCS Tax Calculation Schedule - Connecticut

What Is Form CT-1040 TCS?

This is a legal form that was released by the Connecticut Department of Revenue Services - a government authority operating within Connecticut. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CT-1040 TCS?

A: Form CT-1040 TCS is the Tax Calculation Schedule for Connecticut.

Q: What is the purpose of Form CT-1040 TCS?

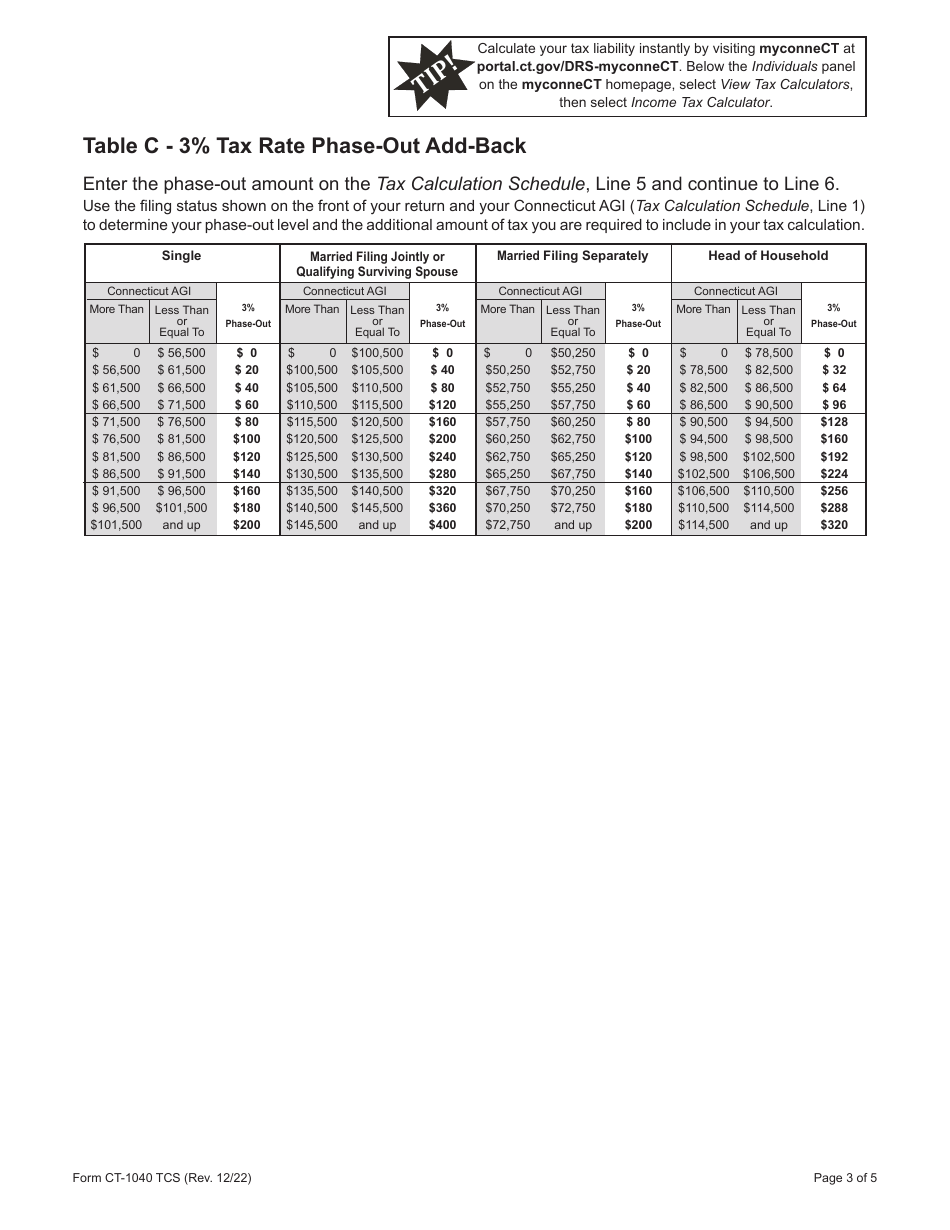

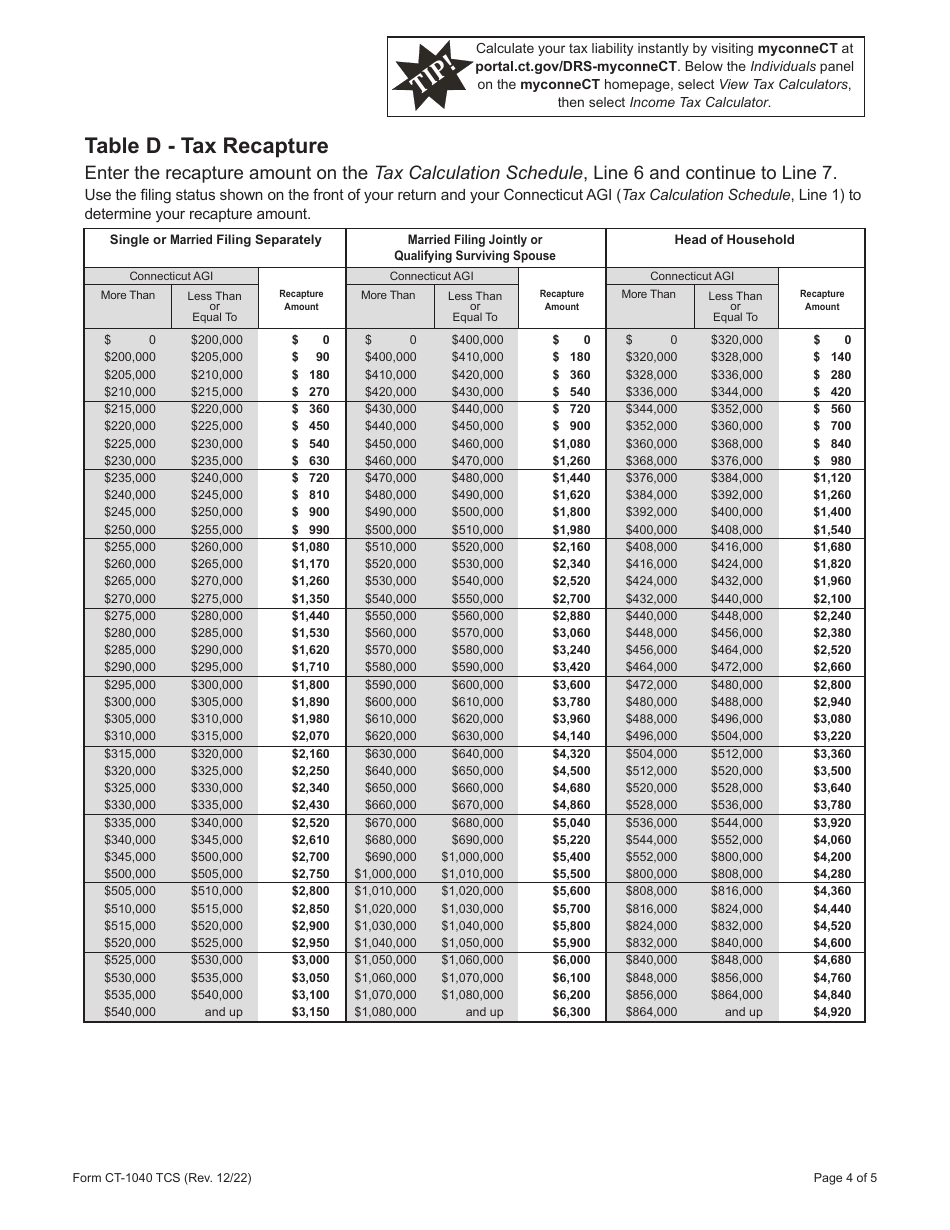

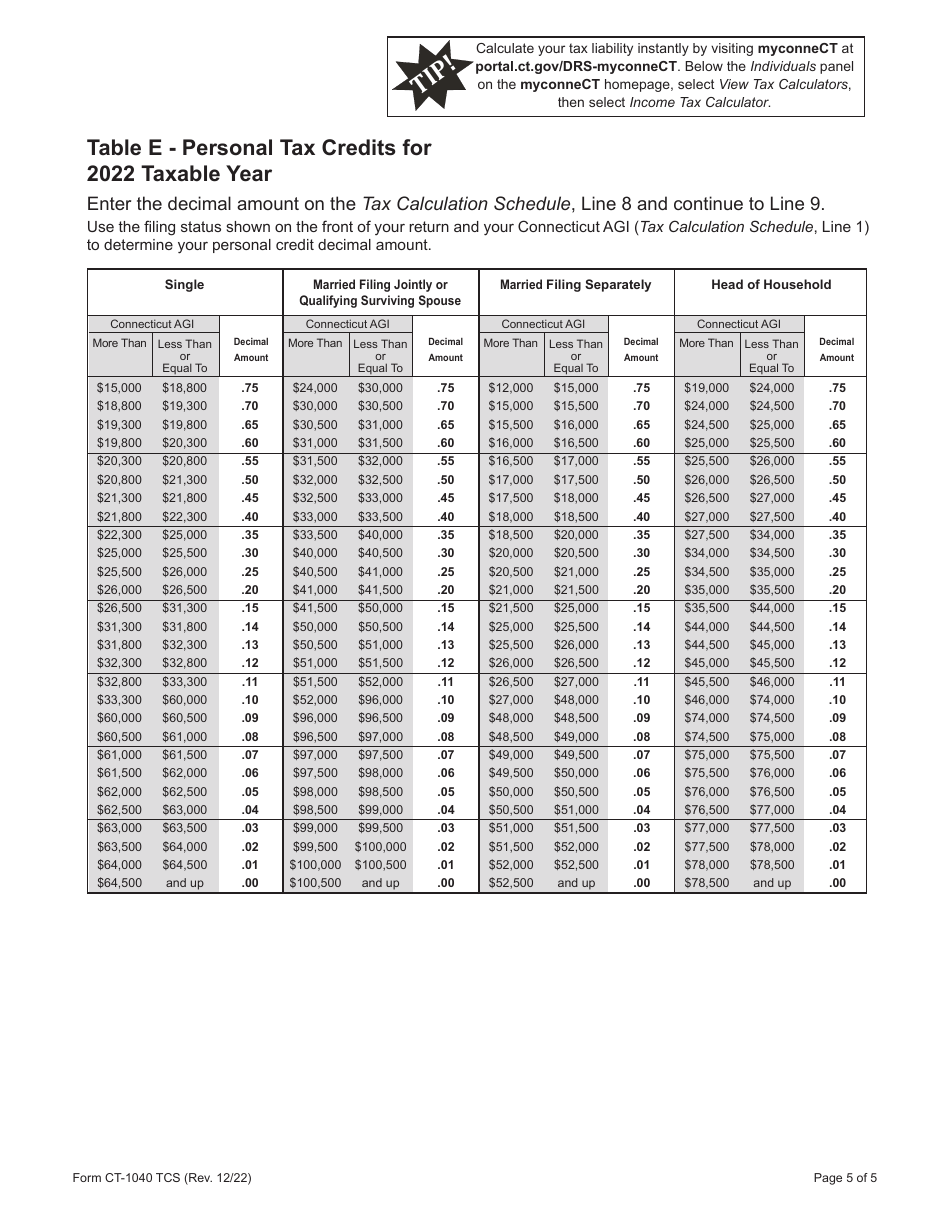

A: The purpose of Form CT-1040 TCS is to calculate the amount of tax owed by Connecticut residents.

Q: Who needs to file Form CT-1040 TCS?

A: Connecticut residents who are filing their state income tax return must file Form CT-1040 TCS.

Q: What information is required on Form CT-1040 TCS?

A: Form CT-1040 TCS requires information such as taxable income, deductions, and credits.

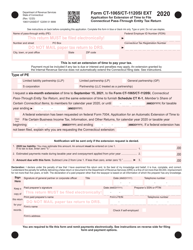

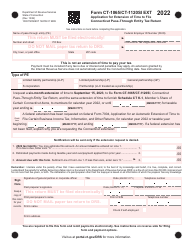

Q: When is Form CT-1040 TCS due?

A: Form CT-1040 TCS is typically due on April 15th, the same day as the federal income tax return.

Q: Is there a penalty for late filing of Form CT-1040 TCS?

A: Yes, there may be penalties for late filing of Form CT-1040 TCS. It is important to file your tax return on time to avoid any penalties or interest charges.

Q: Do I need to include any additional documentation with Form CT-1040 TCS?

A: You may need to include supporting documentation such as W-2 forms, 1099 forms, and schedules for deductions or credits.

Q: What do I do if I have questions about Form CT-1040 TCS?

A: If you have questions about Form CT-1040 TCS, you can contact the Connecticut Department of Revenue Services or seek assistance from a tax professional.

Form Details:

- Released on December 1, 2022;

- The latest edition provided by the Connecticut Department of Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-1040 TCS by clicking the link below or browse more documents and templates provided by the Connecticut Department of Revenue Services.