This version of the form is not currently in use and is provided for reference only. Download this version of

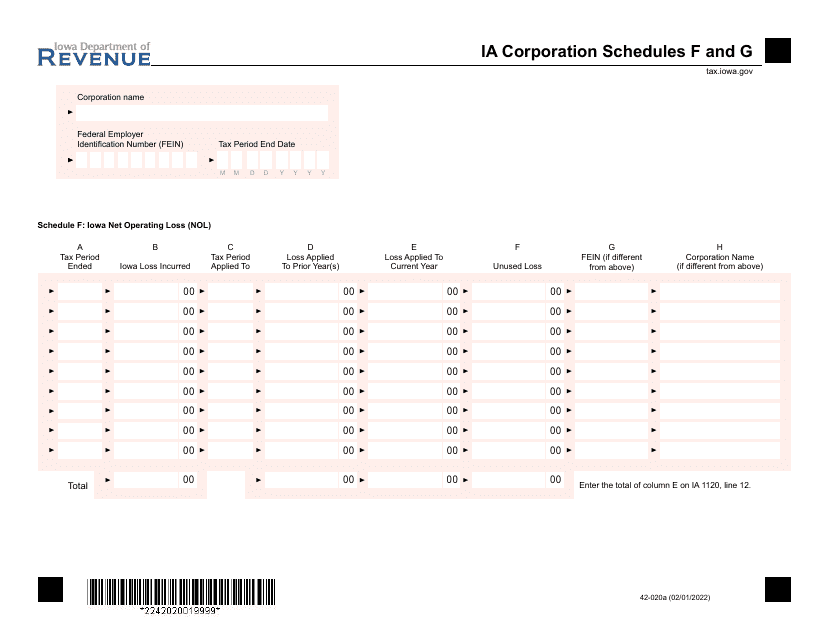

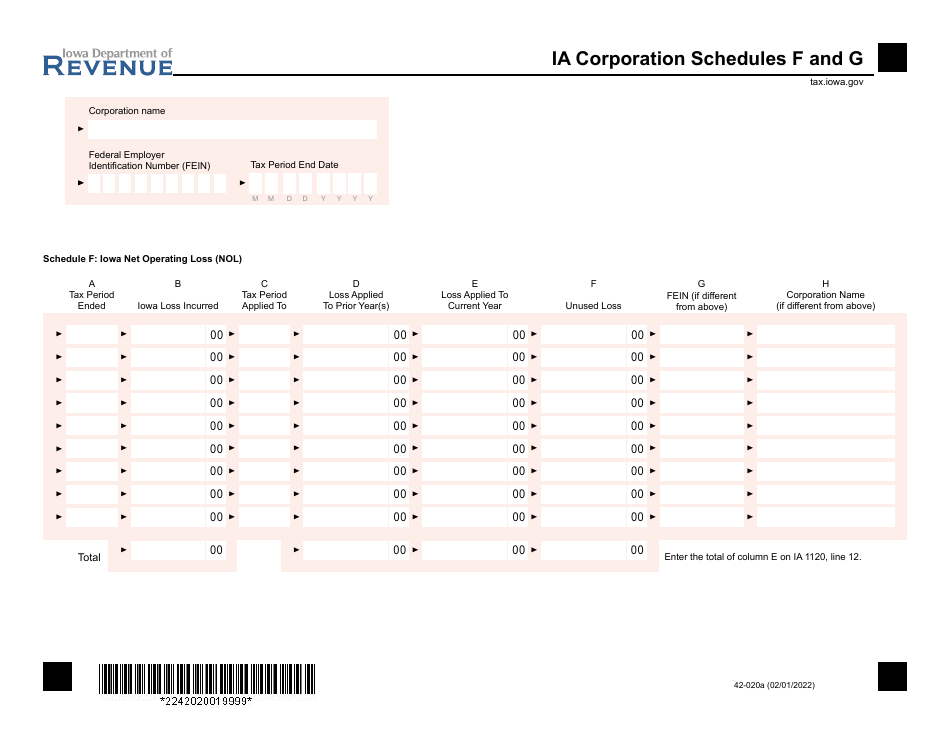

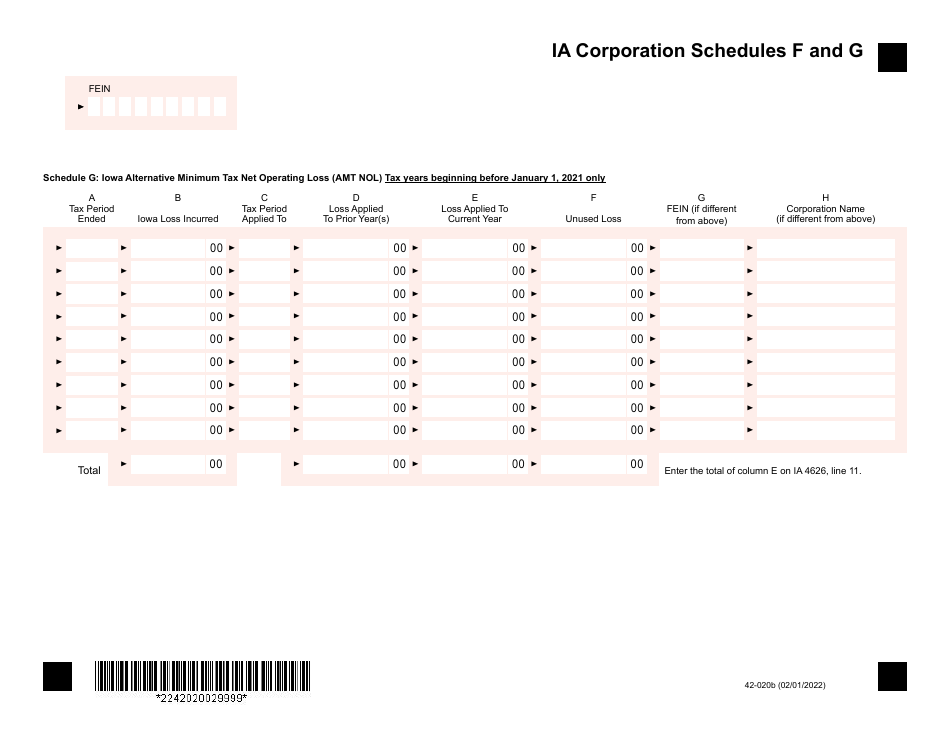

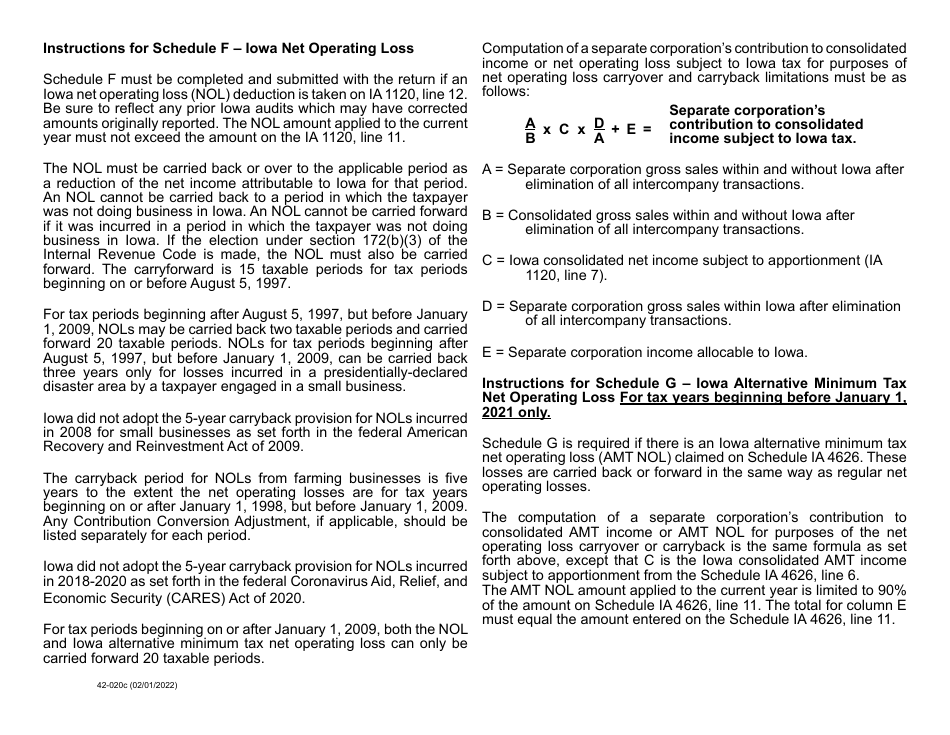

Form 42-020 Schedule F, G

for the current year.

Form 42-020 Schedule F, G Net Operating and Alternative Minimum Tax Loss Carryovers - Iowa

What Is Form 42-020 Schedule F, G?

This is a legal form that was released by the Iowa Department of Revenue - a government authority operating within Iowa. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 42-020 Schedule F, G?

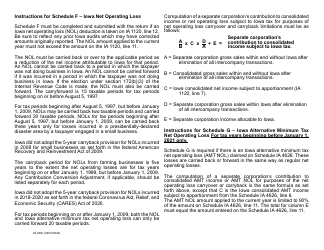

A: Form 42-020 Schedule F, G is a tax form used in Iowa to report Net Operating and Alternative Minimum Tax Loss Carryovers.

Q: What are Net Operating and Alternative Minimum Tax Loss Carryovers?

A: Net Operating and Alternative Minimum Tax Loss Carryovers are deductions that can be used to offset future taxable income in Iowa.

Q: Who needs to fill out Form 42-020 Schedule F, G?

A: Anyone who has Net Operating or Alternative Minimum Tax Loss Carryovers in Iowa needs to fill out this form.

Q: Is Form 42-020 Schedule F, G only applicable to individuals?

A: No, Form 42-020 Schedule F, G is applicable to both individuals and businesses in Iowa that have Net Operating or Alternative Minimum Tax Loss Carryovers.

Form Details:

- Released on February 1, 2022;

- The latest edition provided by the Iowa Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 42-020 Schedule F, G by clicking the link below or browse more documents and templates provided by the Iowa Department of Revenue.