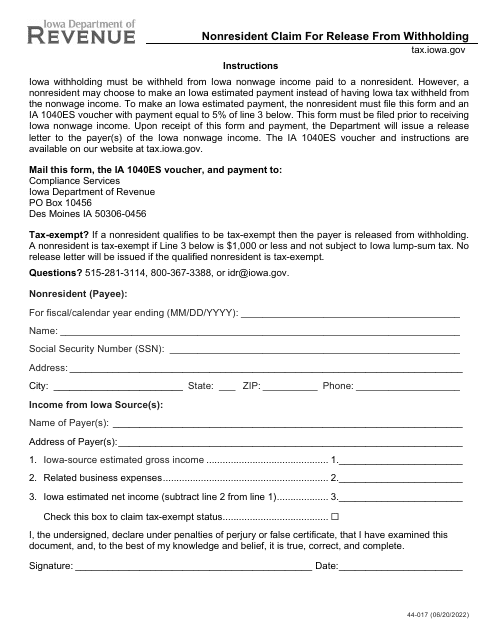

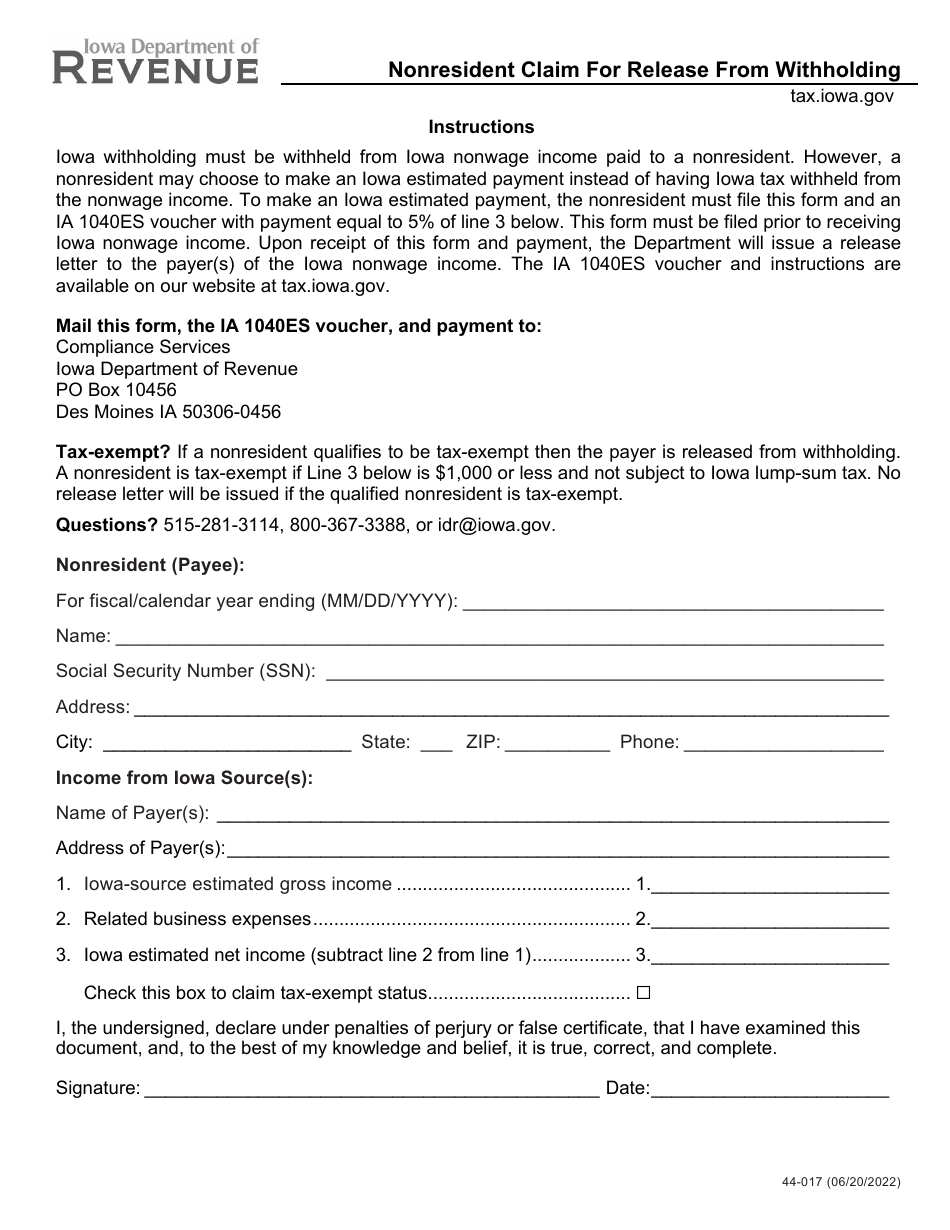

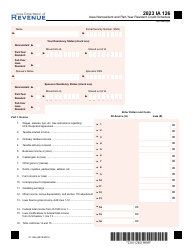

This version of the form is not currently in use and is provided for reference only. Download this version of

Form 44-017

for the current year.

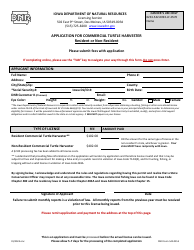

Form 44-017 Nonresident Claim for Release From Withholding - Iowa

What Is Form 44-017?

This is a legal form that was released by the Iowa Department of Revenue - a government authority operating within Iowa. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 44-017?

A: Form 44-017 is the Nonresident Claim for Release From Withholding form specific to Iowa.

Q: Who should use Form 44-017?

A: Nonresidents who want to claim release from withholding in Iowa should use Form 44-017.

Q: What is the purpose of Form 44-017?

A: The purpose of Form 44-017 is to claim exemption from income tax withholding on Iowa-source income for nonresidents.

Q: How do I fill out Form 44-017?

A: You need to fill out your personal information, provide your reasons for claiming release from withholding, and submit the form to the Iowa Department of Revenue.

Q: What supporting documents should be submitted with Form 44-017?

A: Supporting documents such as federal income tax returns and W-2 forms may be required to be submitted with Form 44-017.

Q: When should I file Form 44-017?

A: Form 44-017 should be filed as soon as possible to ensure timely processing of your claim for release from withholding.

Q: What happens after I submit Form 44-017?

A: The Iowa Department of Revenue will review your claim and notify you of their decision regarding your request for release from withholding.

Q: Can I file Form 44-017 electronically?

A: No, Form 44-017 cannot be filed electronically and must be submitted via mail or in person.

Q: What if I need help filling out Form 44-017?

A: If you need assistance with filling out Form 44-017, you can contact the Iowa Department of Revenue for guidance.

Form Details:

- Released on June 20, 2022;

- The latest edition provided by the Iowa Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 44-017 by clicking the link below or browse more documents and templates provided by the Iowa Department of Revenue.