This version of the form is not currently in use and is provided for reference only. Download this version of

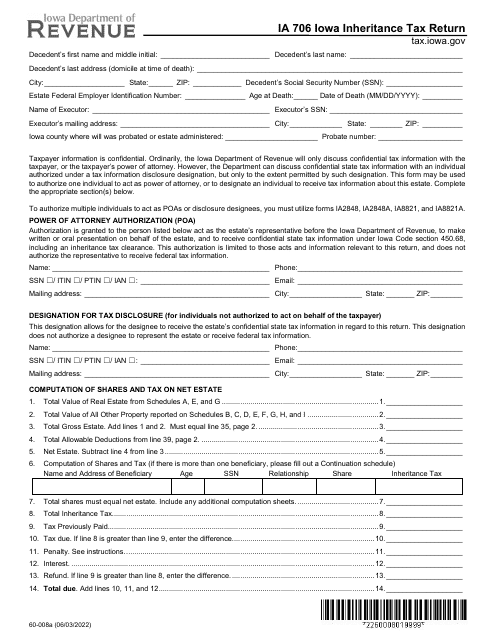

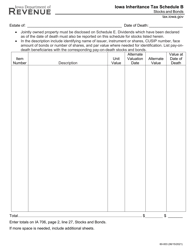

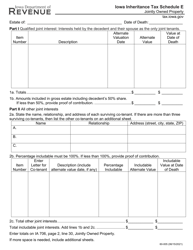

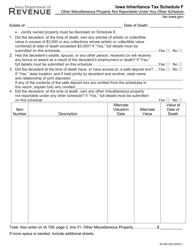

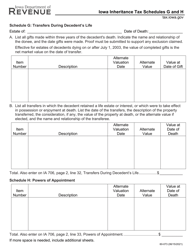

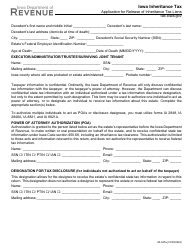

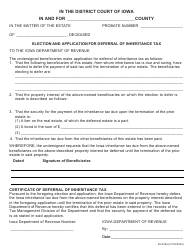

Form IA706 (60-008)

for the current year.

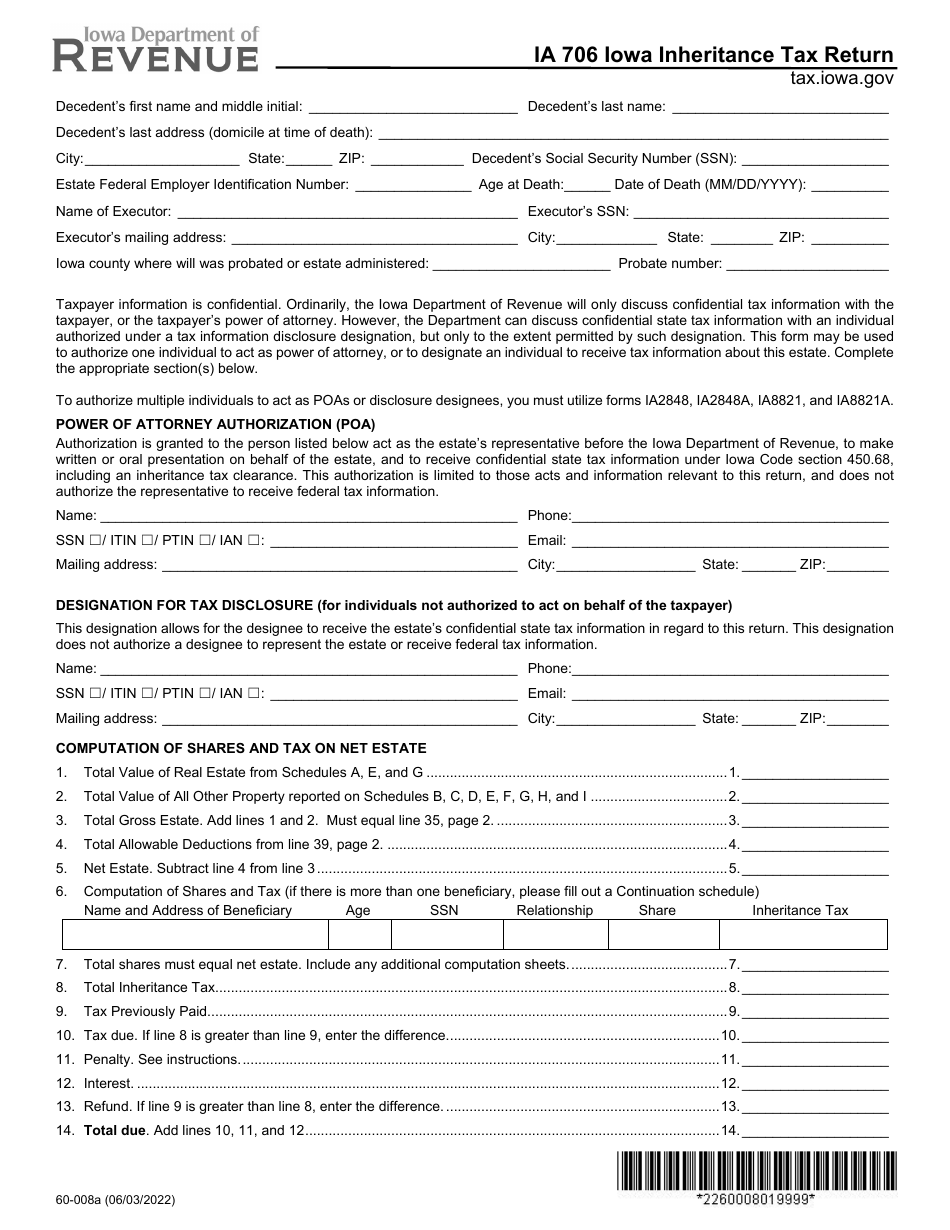

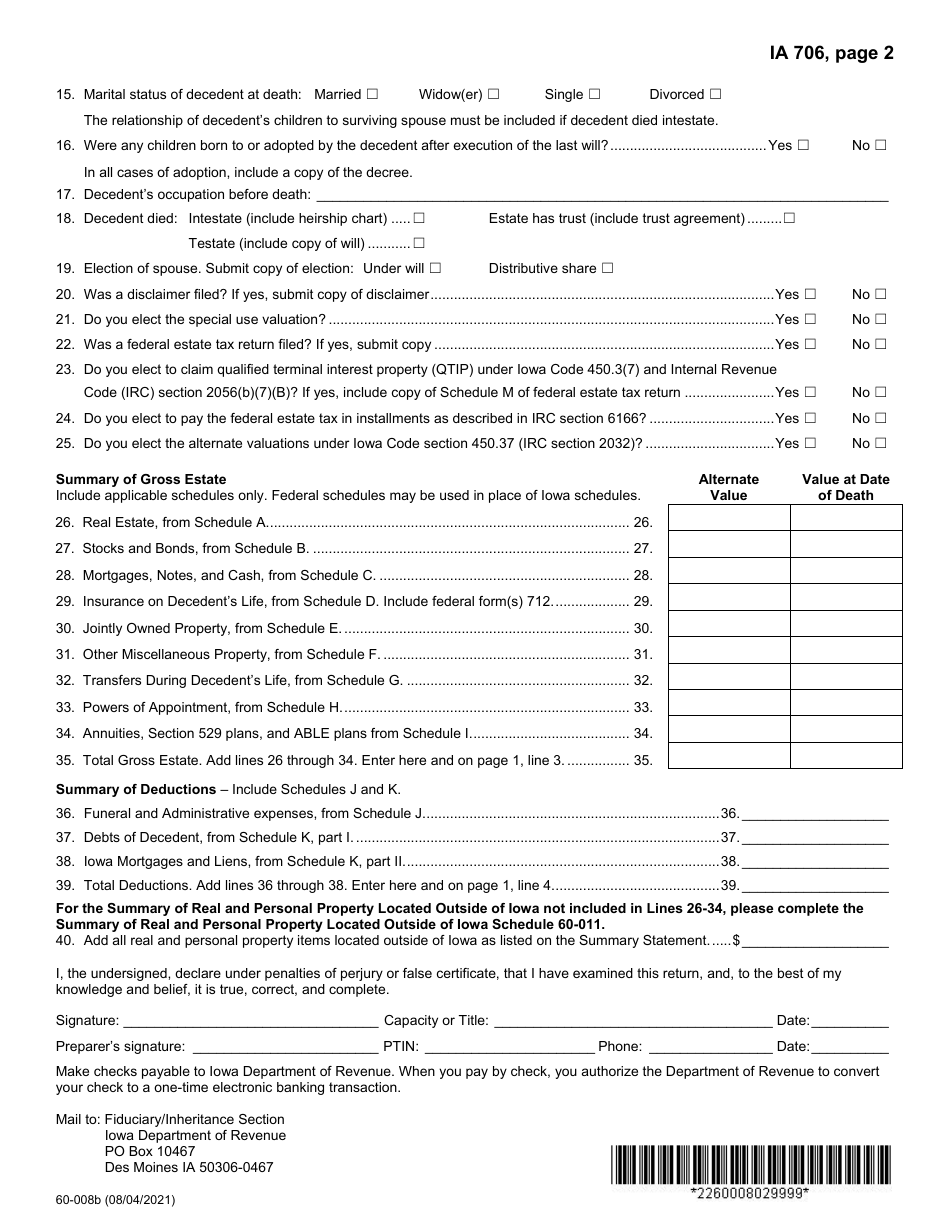

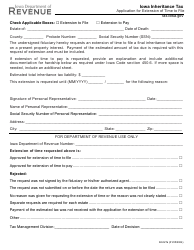

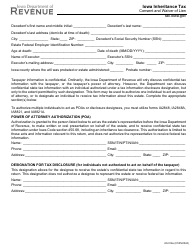

Form IA706 (60-008) Iowa Inheritance Tax Return - Iowa

What Is Form IA706 (60-008)?

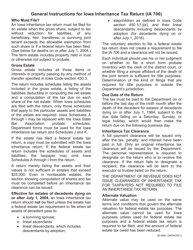

This is a legal form that was released by the Iowa Department of Revenue - a government authority operating within Iowa. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form IA706?

A: Form IA706 is the Iowa Inheritance Tax Return.

Q: Who needs to file Form IA706?

A: Individuals who are responsible for paying inheritance taxes in Iowa need to file Form IA706.

Q: What is the purpose of Form IA706?

A: The purpose of Form IA706 is to report and calculate the Iowa inheritance tax owed by the estate of a deceased person.

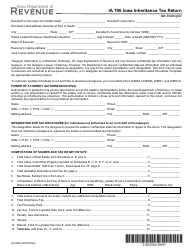

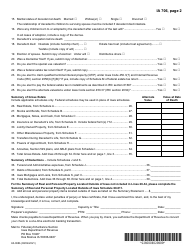

Q: What information is required on Form IA706?

A: Form IA706 requires information about the deceased person, the estate, and the beneficiaries. It also requires details on any exemptions or deductions that may apply.

Q: Can Form IA706 be filed electronically?

A: No, currently Form IA706 cannot be filed electronically. It must be filed by mail or in person.

Q: When is Form IA706 due?

A: Form IA706 is due within nine months of the date of death of the deceased person.

Q: Is there a penalty for late filing of Form IA706?

A: Yes, there is a penalty for late filing of Form IA706. The penalty is based on the amount of tax due and the number of months the return is late.

Form Details:

- Released on June 3, 2022;

- The latest edition provided by the Iowa Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IA706 (60-008) by clicking the link below or browse more documents and templates provided by the Iowa Department of Revenue.