This version of the form is not currently in use and is provided for reference only. Download this version of

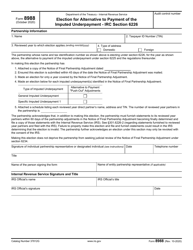

Form IA103 (41-172)

for the current year.

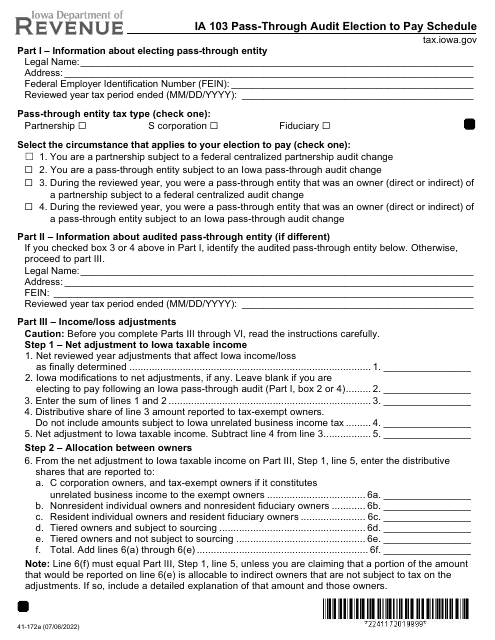

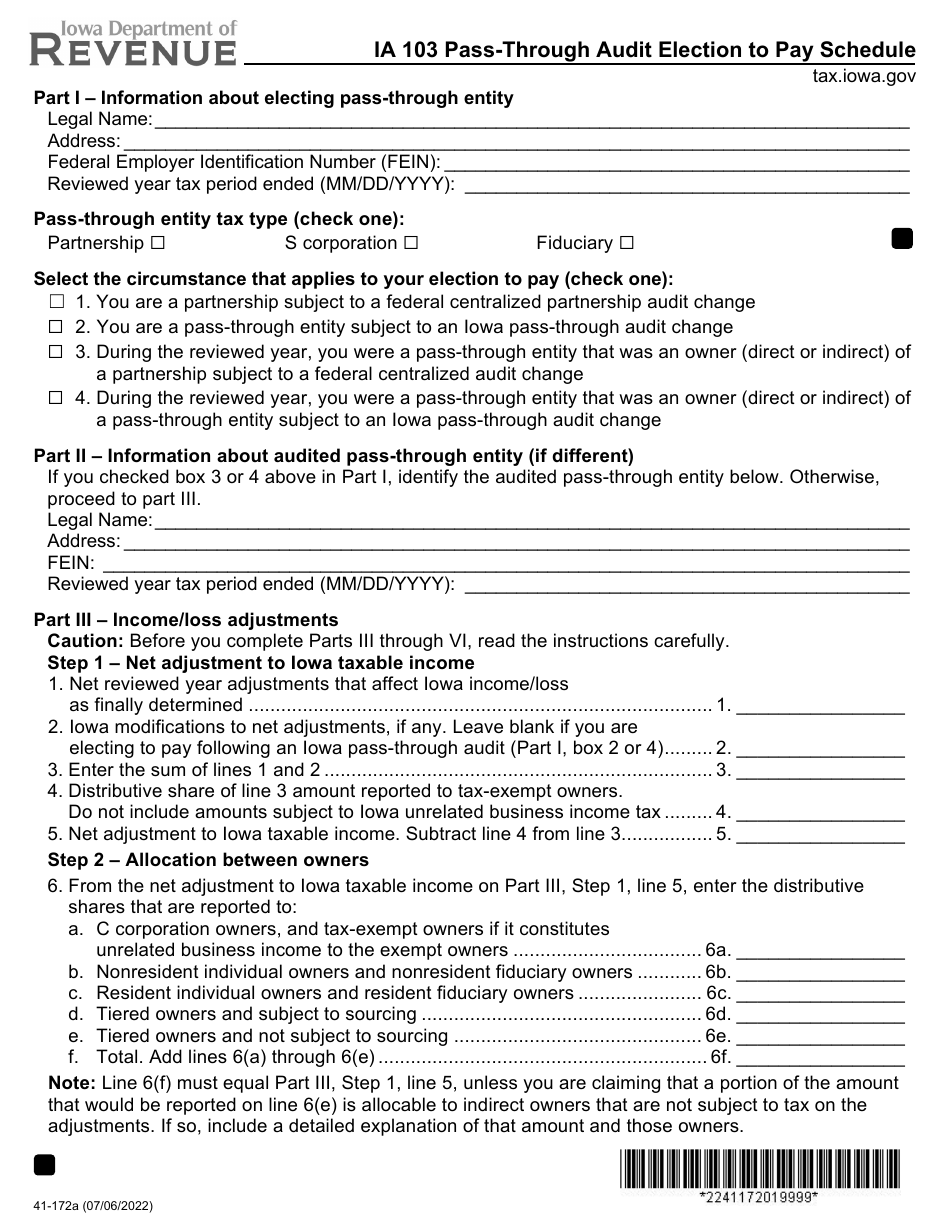

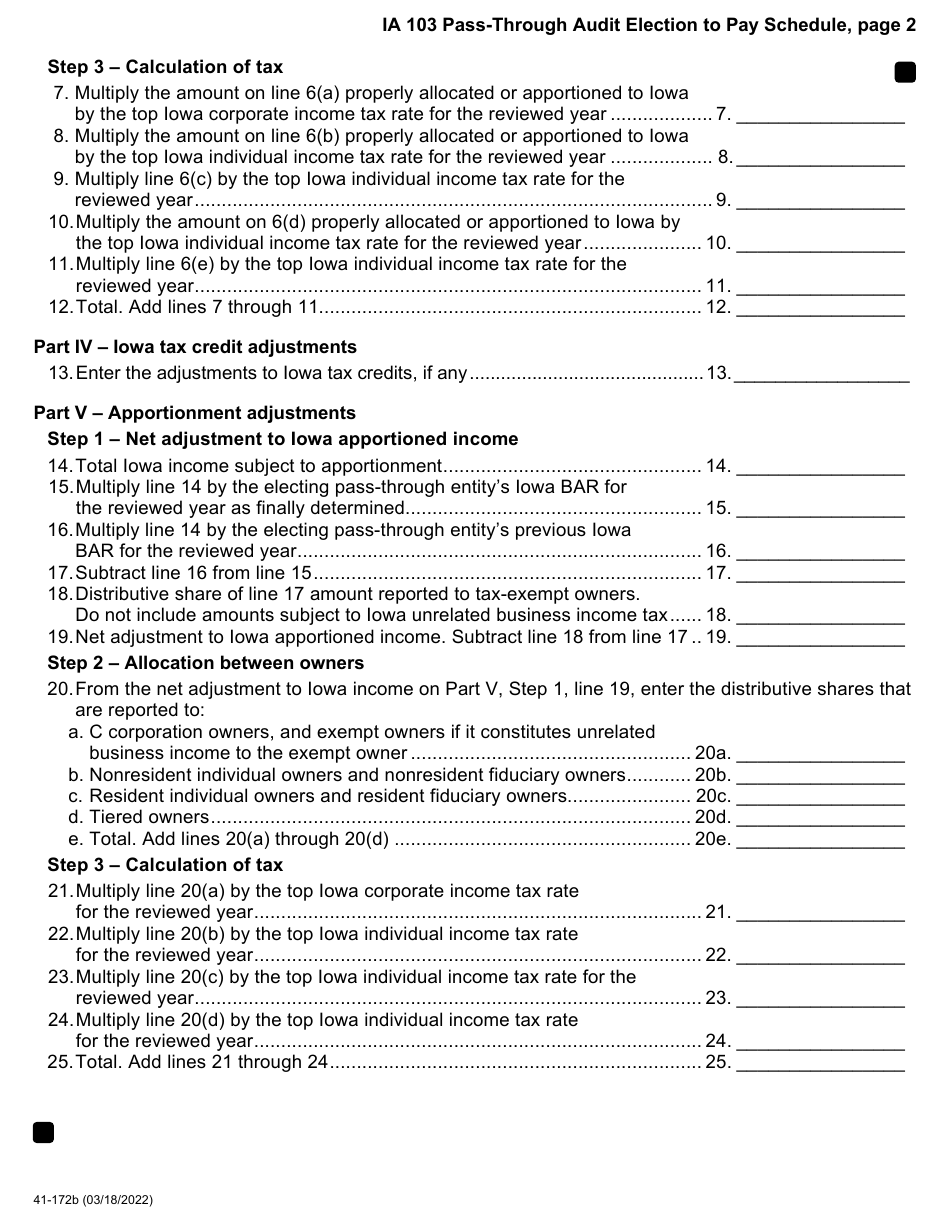

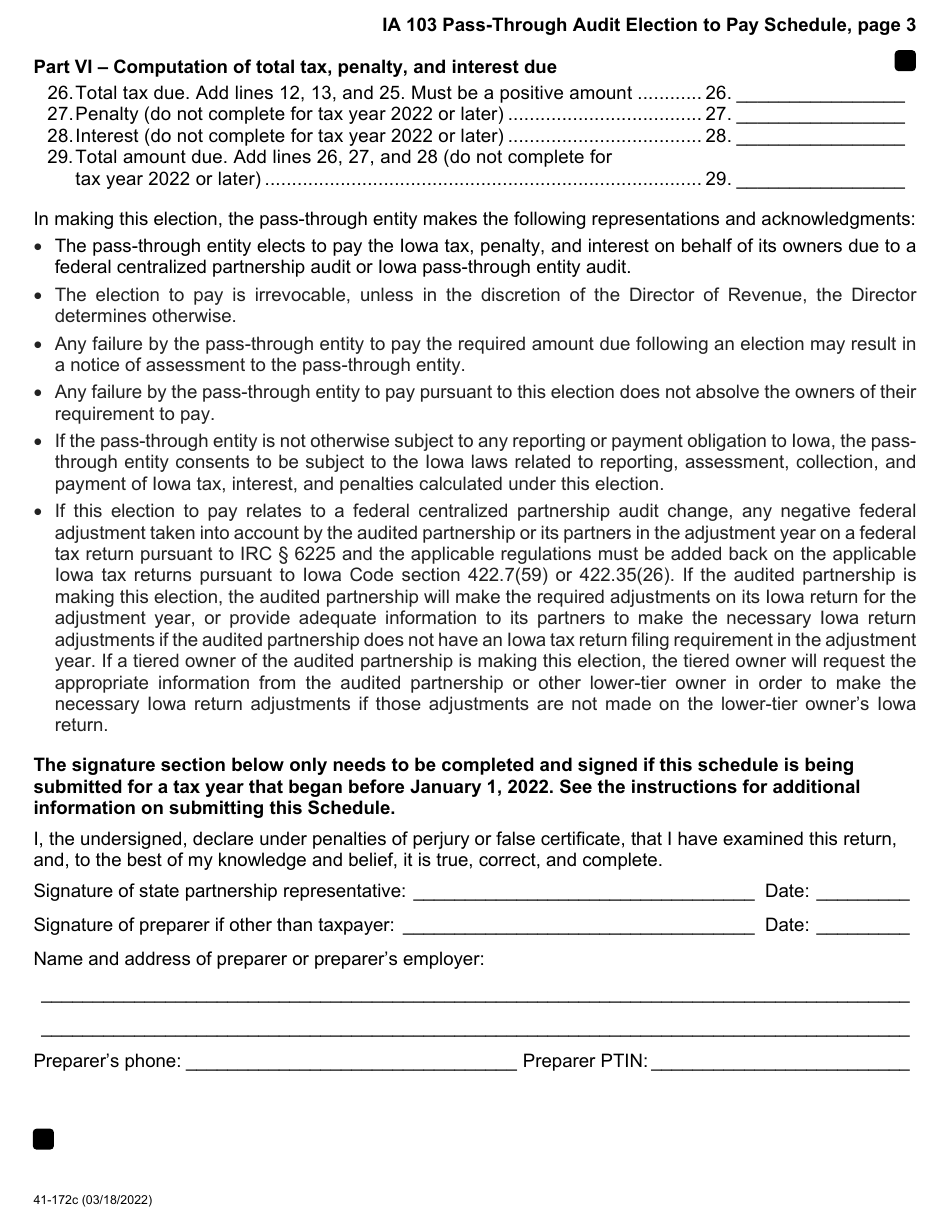

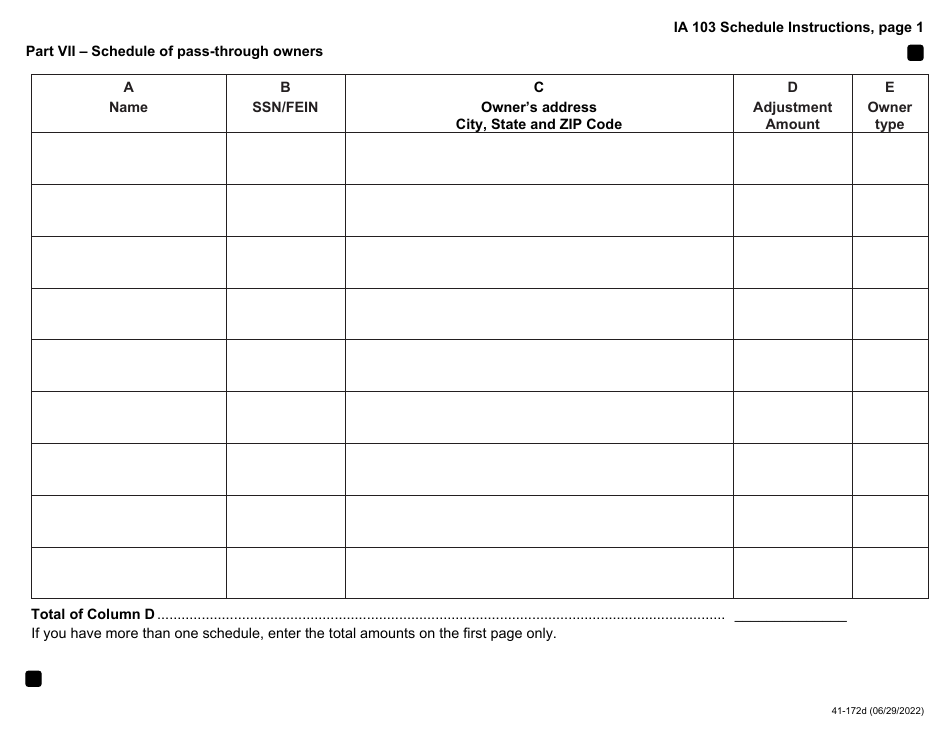

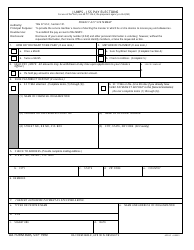

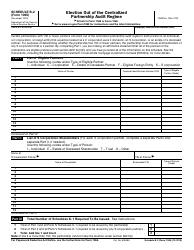

Form IA103 (41-172) Pass-Through Audit Election to Pay Schedule - Iowa

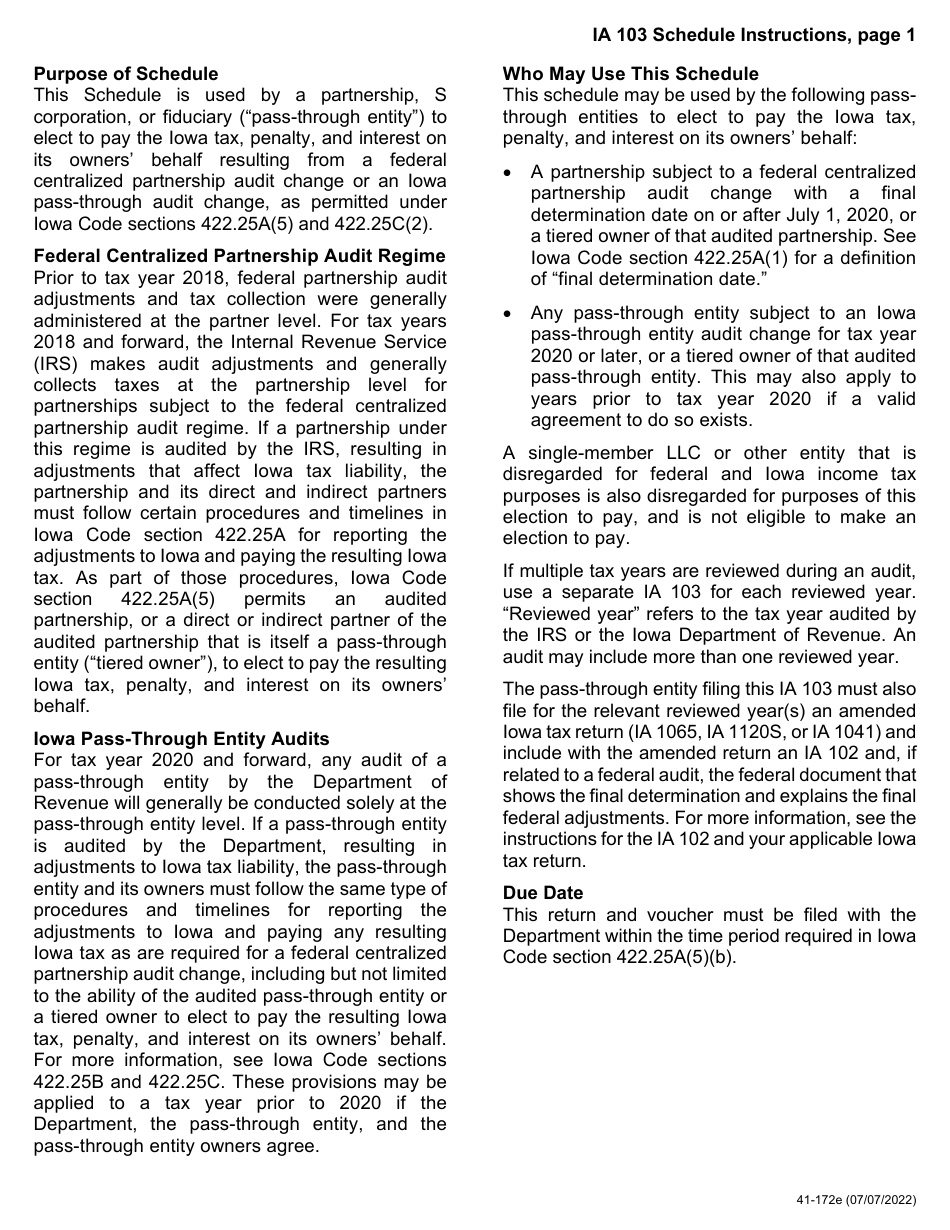

What Is Form IA103 (41-172)?

This is a legal form that was released by the Iowa Department of Revenue - a government authority operating within Iowa. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IA103?

A: Form IA103 is the Pass-Through Audit Election to Pay Schedule for Iowa.

Q: What is the purpose of Form IA103?

A: The purpose of Form IA103 is to elect to have a pass-through entity pay its composite tax liability.

Q: Who needs to file Form IA103?

A: Pass-through entities in Iowa that want to pay composite tax liability on behalf of their eligible nonresident members need to file Form IA103.

Q: What is a pass-through entity?

A: A pass-through entity is a type of business entity where the income is passed through to the owners or members, who then report it on their individual tax returns.

Q: What is composite tax liability?

A: Composite tax liability is the tax liability that is calculated and paid by a pass-through entity on behalf of its eligible nonresident members.

Q: What is the deadline for filing Form IA103?

A: Form IA103 should be filed by the due date of the pass-through entity's Iowa income tax return, which is generally the 15th day of the fourth month following the close of the tax year.

Form Details:

- Released on July 6, 2022;

- The latest edition provided by the Iowa Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IA103 (41-172) by clicking the link below or browse more documents and templates provided by the Iowa Department of Revenue.