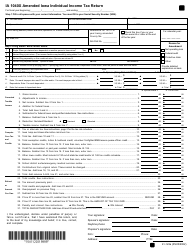

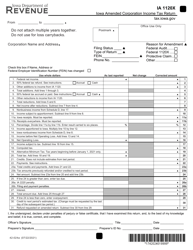

This version of the form is not currently in use and is provided for reference only. Download this version of

Form IA102 (41-171)

for the current year.

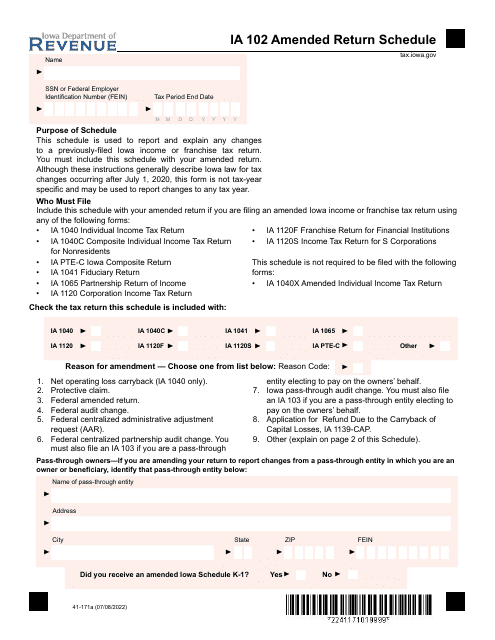

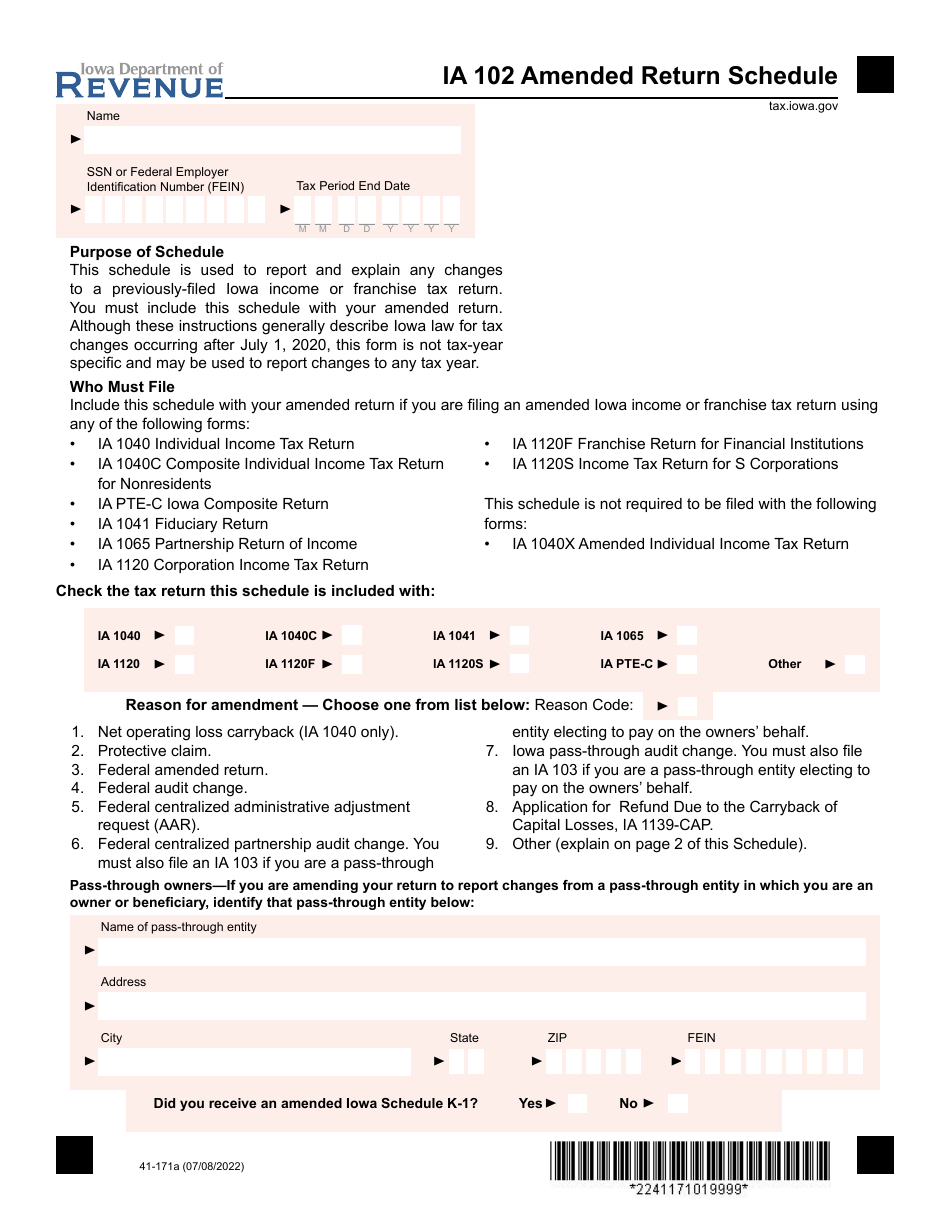

Form IA102 (41-171) Amended Return Schedule - Iowa

What Is Form IA102 (41-171)?

This is a legal form that was released by the Iowa Department of Revenue - a government authority operating within Iowa. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IA102?

A: Form IA102 is an Amended Return Schedule for Iowa.

Q: What is the purpose of Form IA102?

A: Form IA102 is used to amend a previously filed Iowa tax return.

Q: When should I use Form IA102?

A: You should use Form IA102 when you need to make changes or corrections to a previously filed Iowa tax return.

Q: Is Form IA102 for both individual and business taxpayers?

A: Yes, Form IA102 can be used by both individual and business taxpayers to amend their Iowa tax returns.

Q: Is there a deadline for filing Form IA102?

A: Yes, Form IA102 must be filed within three years from the original due date of the tax return or within one year from the date paid, whichever is later.

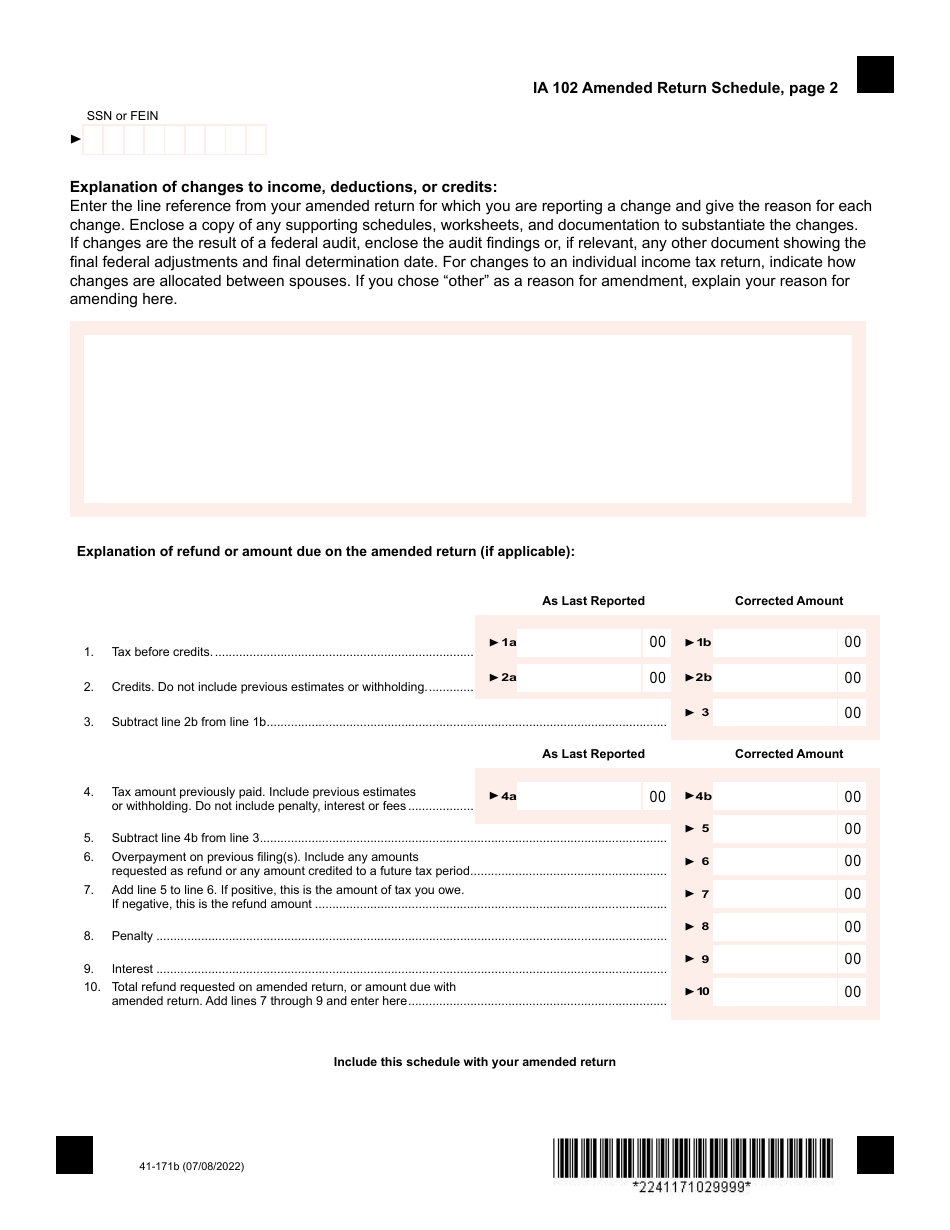

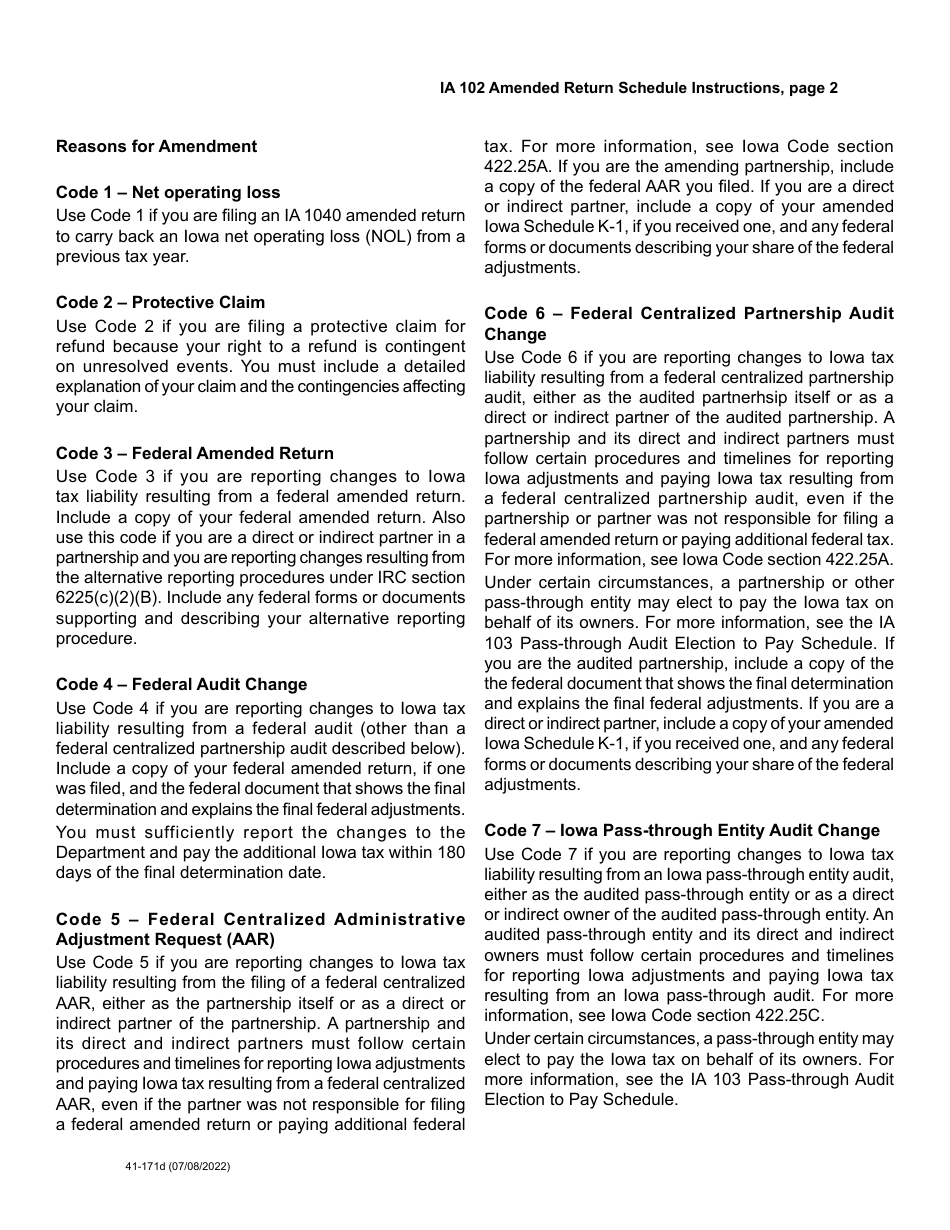

Q: What information do I need to provide on Form IA102?

A: You will need to provide your original tax return information, as well as the changes or corrections you are making.

Q: Are there any additional documents or attachments required with Form IA102?

A: It depends on the changes or corrections you are making. You may need to include supporting documents or explanations.

Q: Can I e-file Form IA102?

A: No, Form IA102 cannot be e-filed. It must be filed by mail.

Form Details:

- Released on July 8, 2022;

- The latest edition provided by the Iowa Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IA102 (41-171) by clicking the link below or browse more documents and templates provided by the Iowa Department of Revenue.