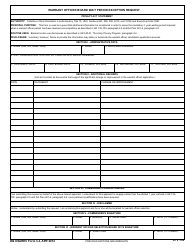

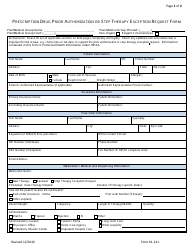

This version of the form is not currently in use and is provided for reference only. Download this version of

Form 78-641

for the current year.

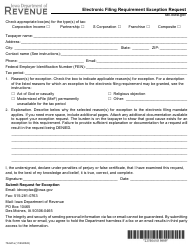

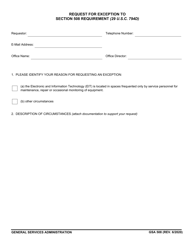

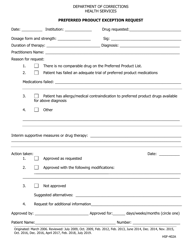

Form 78-641 Electronic Filing Requirement Exception Request - Iowa

What Is Form 78-641?

This is a legal form that was released by the Iowa Department of Revenue - a government authority operating within Iowa. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 78-641?

A: Form 78-641 is the Electronic Filing Requirement Exception Request form in Iowa.

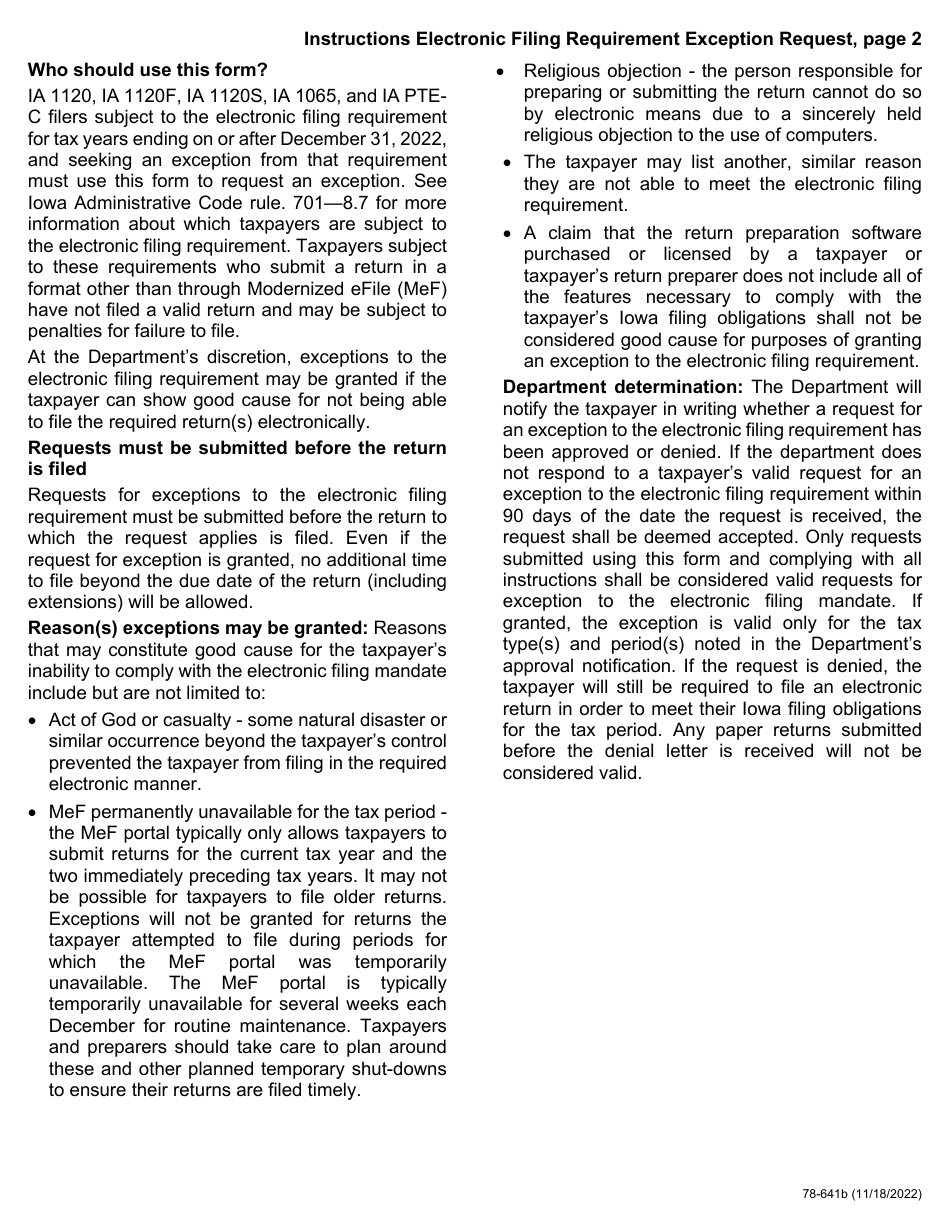

Q: Who needs to file Form 78-641?

A: Individuals or businesses in Iowa who are requesting an exception to the electronic filing requirement.

Q: Why would someone need to file Form 78-641?

A: An individual or business may need to file Form 78-641 if they are unable to file their tax return electronically due to certain circumstances.

Q: What should be included in the form?

A: The form should include the taxpayer's name, address, taxpayer identification number, reason for the exception request, and any supporting documentation.

Q: Is there a deadline for filing Form 78-641?

A: Yes, the form should be filed before the due date of the tax return.

Q: Is there a fee for filing Form 78-641?

A: No, there is no fee for filing Form 78-641.

Form Details:

- Released on November 29, 2022;

- The latest edition provided by the Iowa Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 78-641 by clicking the link below or browse more documents and templates provided by the Iowa Department of Revenue.